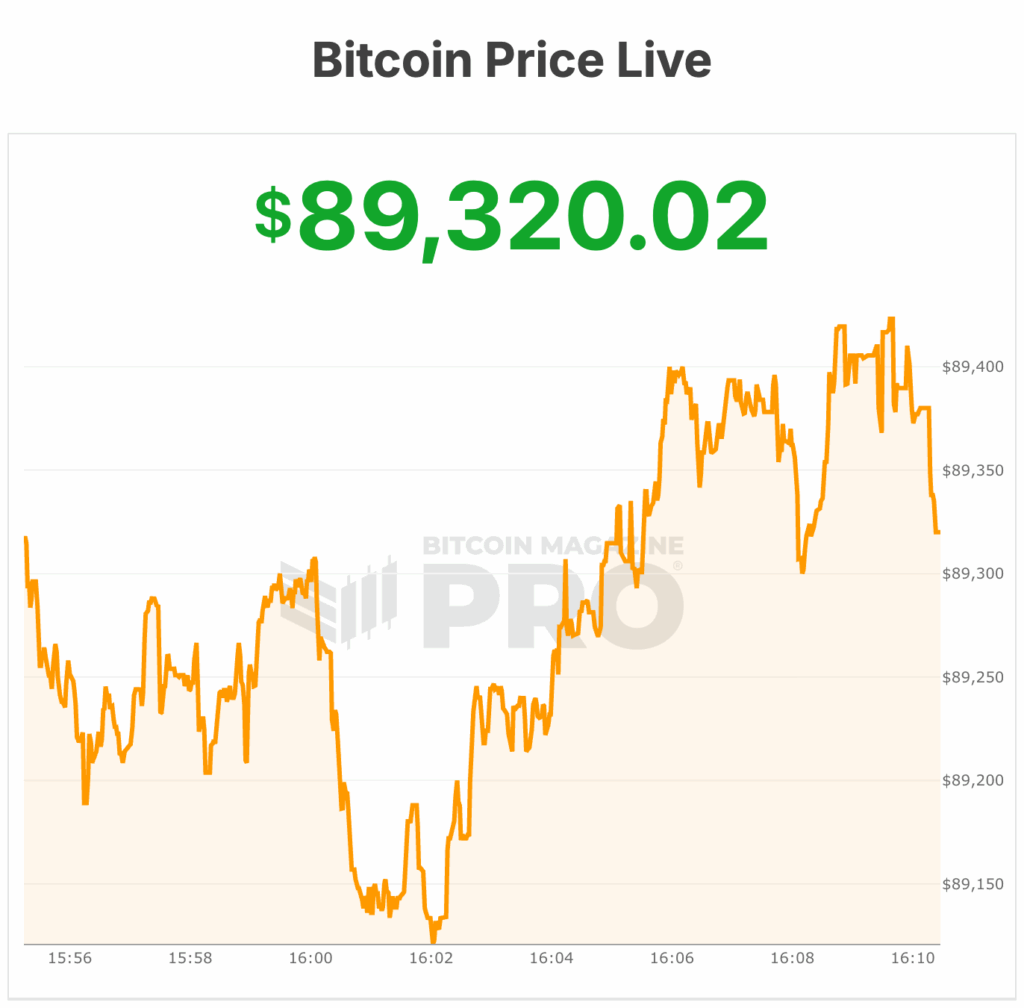

The bitcoin worth rallied sharply into the shut on Tuesday, surging above $89,400 after buying and selling as little as $87,100 earlier within the day, based on Bitcoin Journal Professional knowledge, as markets reacted to contemporary remarks from President Donald Trump on the U.S. economic system.

The late-day transfer got here as Trump, talking in Iowa, dismissed issues over the weakening U.S. greenback, telling supporters he was “not involved” about its decline and insisting the greenback was “doing nice.” The feedback triggered an instantaneous response throughout markets, with the greenback sliding additional and various shops of worth catching a bid.

Gold climbed to a brand new all-time excessive of $5,223 per ounce on the time of writing, underscoring rising demand for exhausting belongings amid mounting forex uncertainty.

The bitcoin worth appeared to profit from the identical macro tailwinds, reversing earlier warning that had dominated buying and selling following final weekend’s dip to $86,000.

The rally marks a notable shift in sentiment after bitcoin spent a lot of the previous 24 hours struggling to reclaim the $88,000 stage amid Federal Reserve uncertainty, ETF outflows, and lingering bearish technical stress.

Monday’s breakout above $89,000 suggests consumers are reasserting management within the close to time period, although markets stay extremely delicate to macro alerts because the Federal Reserve’s coverage determination looms later this week.

On the time of publication, Bitcoin worth traded at $89,320 right this moment, up 2% over the previous 24 hours, with $43 billion in day by day buying and selling quantity. The asset’s circulating provide stands at 19,981,268 BTC, out of a hard and fast 21 million most.

Bitcoin mining shares hovering together with bitcoin worth

Bitcoin miners which have pivoted towards synthetic intelligence and high-performance computing (HPC) infrastructure are roaring up close to 10% on Tuesday, as traders proceed to reward diversification past conventional mining revenues.

IREN ($IREN) and Cipher Mining ($CIFR) are every up greater than 13%, whereas Hut 8 ($HUT) and TeraWulf ($WULF) are posting positive aspects round 10%, extending a broader rally throughout the mining sector tied to AI-adjacent publicity.

The transfer comes as markets more and more view large-scale miners as energy and data-center performs quite than pure Bitcoin proxies, notably within the wake of tighter post-halving economics.

Firms like Cipher, IREN, Hut 8, and TeraWulf have spent the previous 12 months repositioning extra capability towards long-term AI and HPC internet hosting contracts, which provide steadier money flows and better margins than block rewards alone.