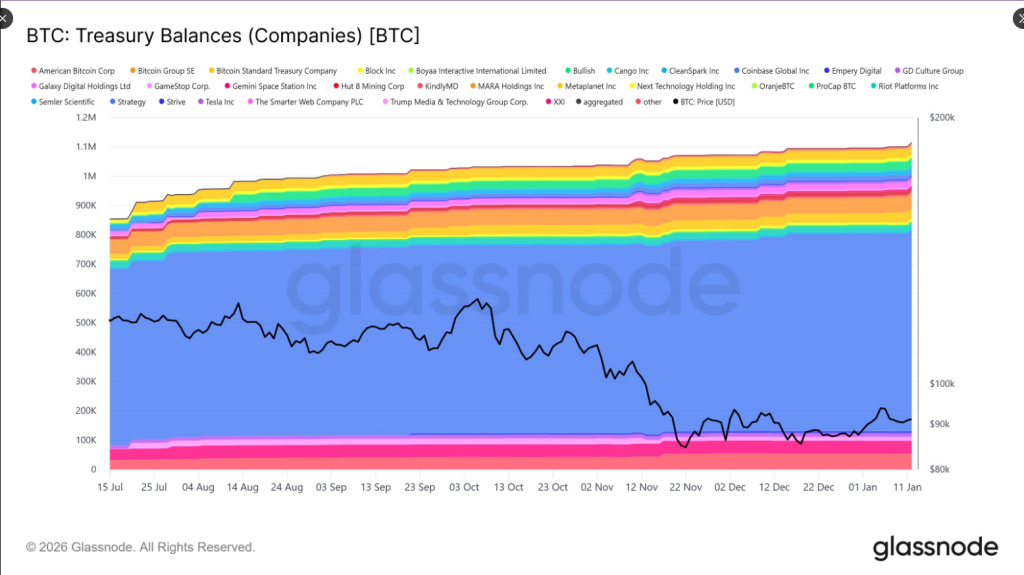

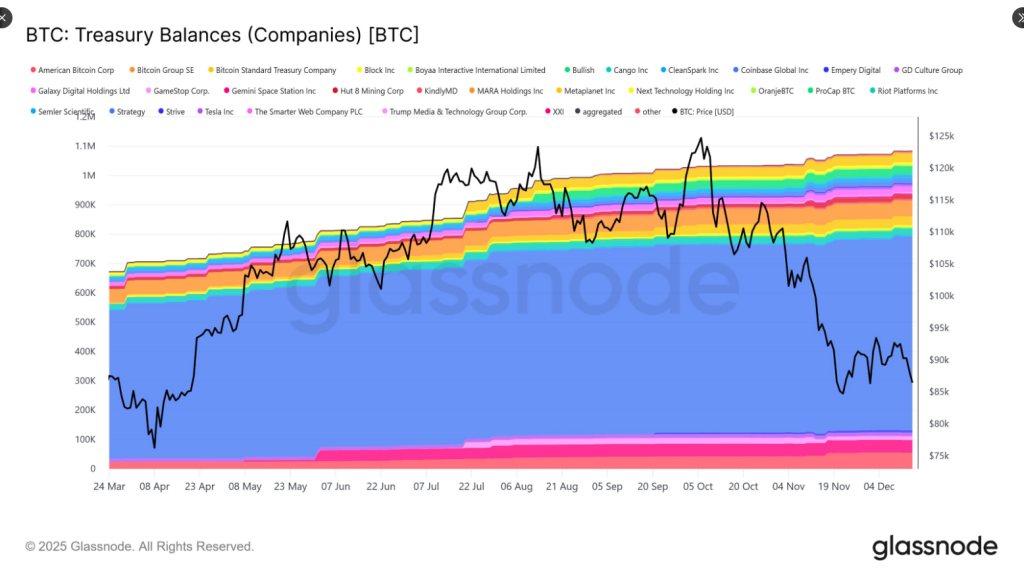

In accordance with on-chain knowledge, firms have piled into Bitcoin at a tempo that now outstrips new provide. Company treasuries held by private and non-private corporations rose from about 854,000 BTC to roughly 1.11 million BTC over the previous six months, a rise of round 260,000 BTC — roughly 43,000 BTC per 30 days.

This provides near $25 billion in worth to company steadiness sheets and factors to a rising urge for food amongst corporations for holding the coin, on-chain analytics supplier Glassnode disclosed, Tuesday.

Company Treasuries Swell

A single agency dominates that pile. Technique now controls the biggest share of company Bitcoin, holding 687,410 BTC after a recent purchase earlier this month. The corporate disclosed it acquired 13,627 BTC between January 5 and January 11, its largest buy since final July. Stories have highlighted how this focus means just a few huge patrons nonetheless form the company treasury image.

Over the previous 6 months, Bitcoin treasuries held by private and non-private firms have grown from ~854K BTC to ~1.11M BTC.

That’s a rise of ~260K BTC, or roughly ~43K BTC per 30 days, highlighting the regular enlargement of company balance-sheet publicity to Bitcoin.… https://t.co/hHXjcSDDj4 pic.twitter.com/oluVGO2bGD— glassnode (@glassnode) January 13, 2026

Smaller, however nonetheless vital company holders are seen on the listing. MARA Holdings, for instance, holds about 53,250 BTC. That makes it one of many largest company holders after Technique, and exhibits that miners and mining corporations are additionally selecting to maintain a bit of the coin they create.

ETF Demand May Tighten Provide

Change-traded funds are a part of the story. Spot Bitcoin ETFs within the US pulled in additional than $20 billion in flows throughout 2025, with some funds taking the biggest share of these inflows. Analysts say ETF shopping for can absorb recent provide and, if constant, may take away obtainable cash from the marketplace for lengthy durations. That dynamic has been flagged as one cause company accumulation might matter extra now than in previous cycles.

Miners Are Producing Much less Than Corporates Are Shopping for

Over the identical six months, miners are estimated to have created about 82,000 BTC. Which means company shopping for has outpaced mining issuance by roughly three to 1. In plain phrases: extra Bitcoin is being added to firm steadiness sheets than is popping out of the bottom, which tightens obtainable provide if patrons proceed to carry moderately than promote.

Value Motion And Macro Watch

Bitcoin has been buying and selling in a slender vary close to $92,000 forward of key US inflation figures, with the $90,000 stage seen as a psychological marker for merchants. Secure-haven curiosity has stayed agency amid geopolitical noise and questions on central financial institution coverage, leaving costs supported however range-bound. Quick-term strikes will possible mirror each ETF flows and whether or not current holders maintain promoting into demand.

Featured picture from Unsplash, chart from TradingView