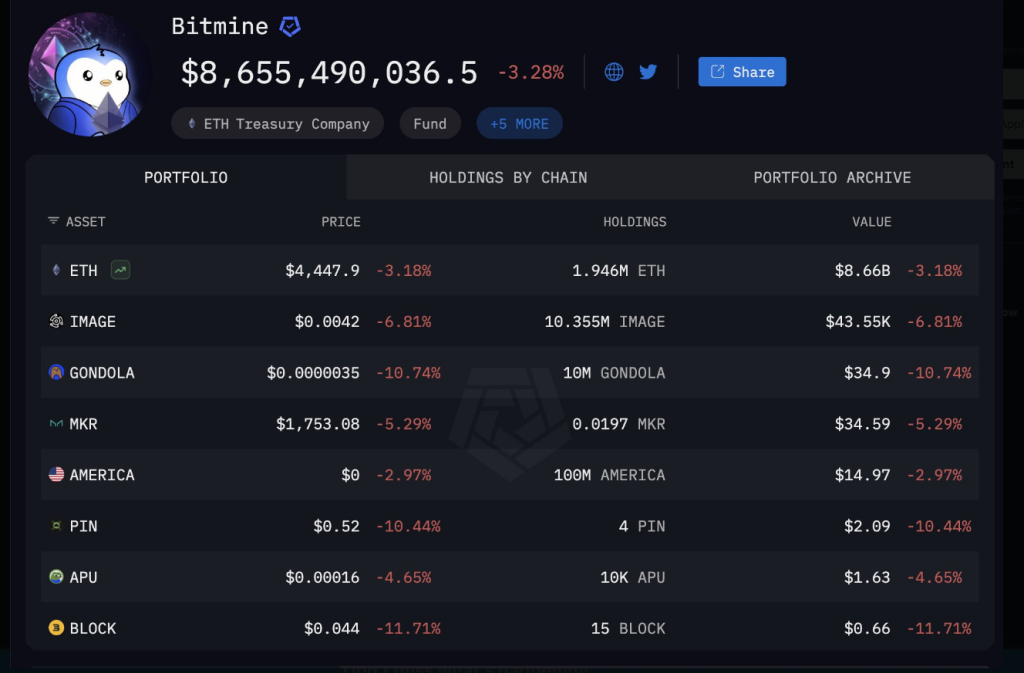

BitMine Immersion Applied sciences has added practically $70 million price of Ethereum to its holdings, pushing the corporate’s ETH stash to a worth close to $8.66 billion.

Associated Studying

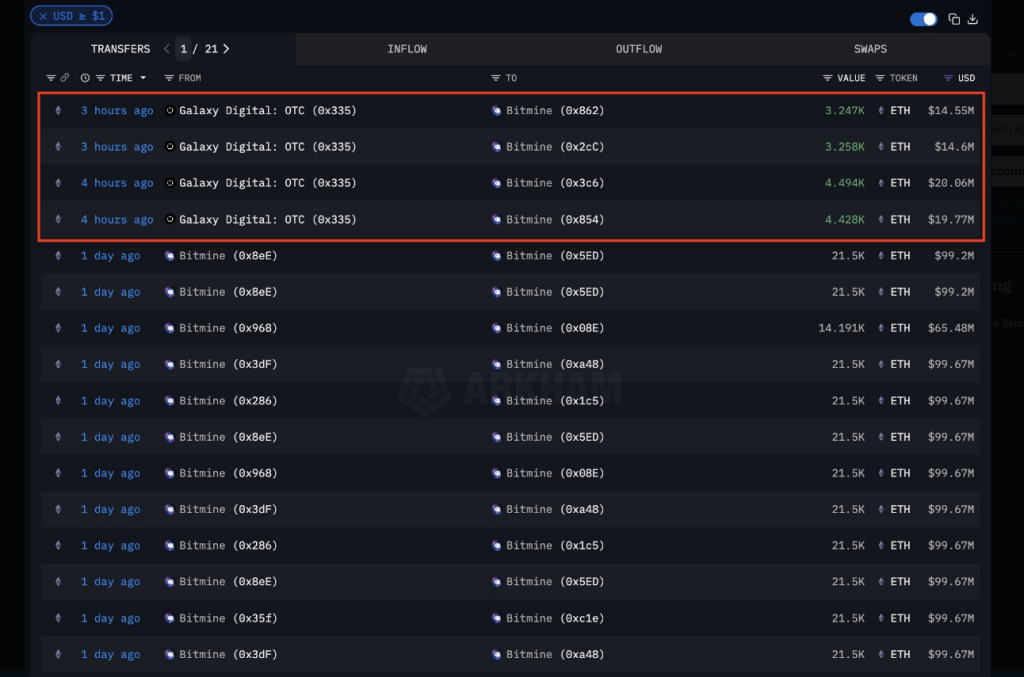

Based mostly on reviews, the purchases have been made via Galaxy Digital’s over-the-counter desk and arrived in a number of chunks somewhat than a single block.

Buy Damaged Into 4 Tranches

The current buys have been cut up into 4 settlements: 3,247 ETH ($14.50 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20 million), and 4,428 ETH ($19.75 million).

That totals about 15,427 ETH, which sums to roughly $69 million on the costs reported. Based on public trackers cited within the protection, these have been probably coordinated OTC trades designed to keep away from transferring the spot market.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine simply purchased one other $69M of ETH from Galaxy Digital. They now maintain $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

How A lot Of Ethereum Does BitMine Maintain

Stories have disclosed that BitMine now holds about 1.95 million ETH. That holding is valued at about $8.66 billion utilizing the identical pricing used within the protection.

Analysts monitoring company treasuries say that company and institutional ETH reserves collectively quantity to some % of circulating provide, and BitMine is listed among the many largest single holders.

The figures can look giant when put next with complete ETH provide, however the share relies on which provide measure is used — circulating, staked, or in any other case locked.

Market Mechanics Behind The Transfer

Shopping for giant quantities on OTC desks is widespread for public corporations and massive gamers. It reduces slippage and retains large orders off public order books.

The ETH right here moved with out apparent worth spikes. Some transfers have been seen on chain; the personal phrases of OTC trades normally stay confidential.

Based mostly on reviews citing blockchain trackers like Arkham, the on-chain flows matched the dimensions and timing described.

Threat, Accounting And Technique

Holding huge quantities of a unstable token carries actual dangers. A pointy fall in ETH would hit BitMine’s stability sheet. On the identical time, regular accumulation alerts a transparent strategic wager on future appreciation.

Market observers examine this method to different companies that maintain crypto as a part of their company treasury, and regulators and accountants will watch how such holdings are reported in quarterly filings.

Associated Studying

Company Accumulation Goes Massive

Some particulars stay unclear. Stories cite Arkham and Strategic Ether Reserve as the first sources, however OTC trades don’t reveal full pricing particulars and the precise phrases are sometimes personal.

As a result of these settlements occur off-exchange, public information present transfers however not each pricing particulars. Giant holders’ exercise tends to draw additional consideration when ETH strikes sharply up or down.

Based mostly on these numbers, the transfer is another signal of huge company accumulation of ETH.

Featured picture from Unsplash, chart from TradingView