BNB, the native token of BNB Chain, fell 1.7% over the previous 24-hour interval, rattled by rising market unease because the battle between Israel and Iran escalates and after U.S. President Donald Trump known as for the Nationwide Safety Council to organize within the state of affairs room.

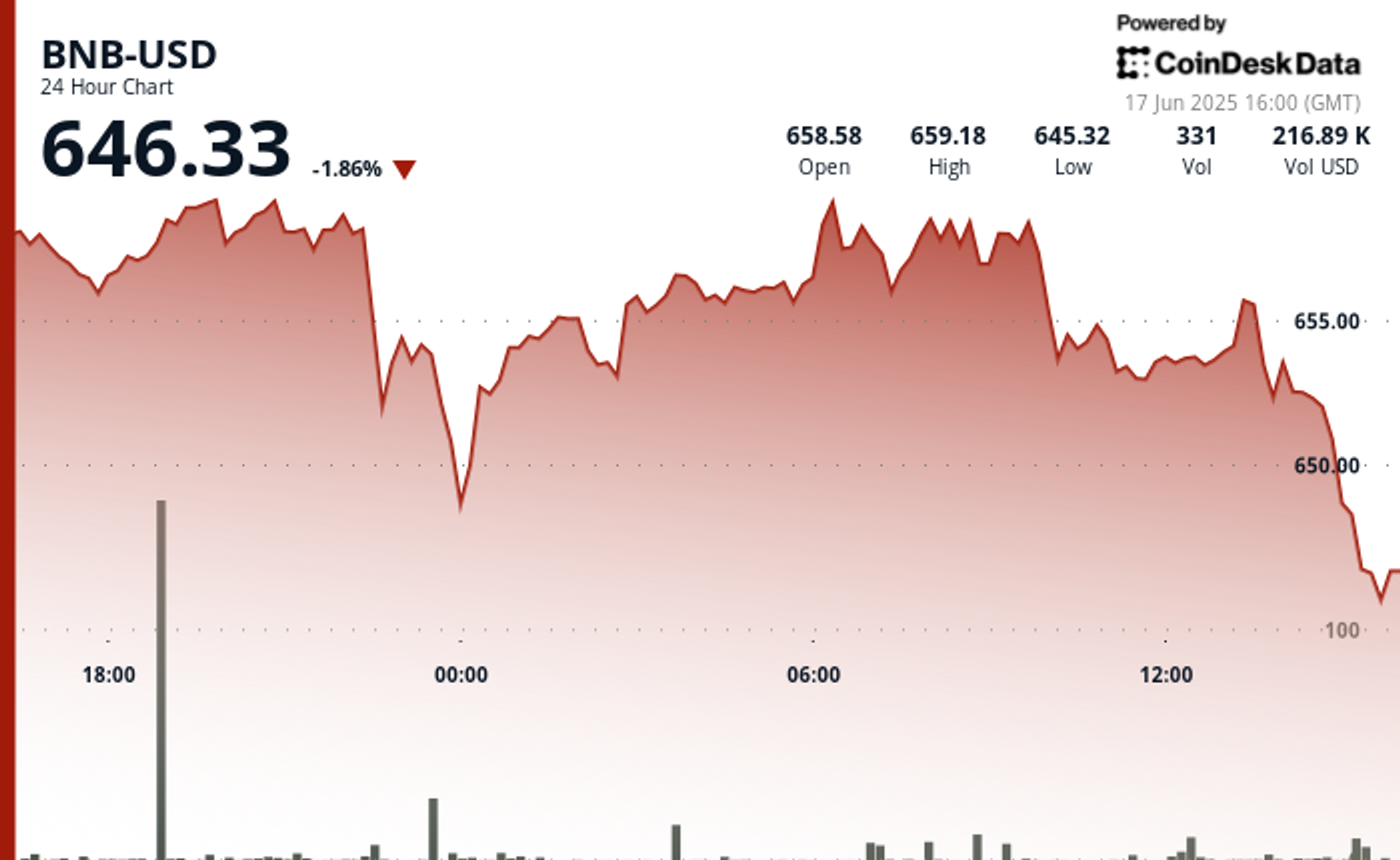

BNB swung between $659 and $646 in the course of the day, marking a decent however important buying and selling vary. The $647 stage has emerged as a assist line for the token, which now hovers under it, in line with CoinDesk Analysis’s technical evaluation knowledge.

Regardless of the turbulence, BNB Chain’s fundamentals stay robust.

It processed over $100 billion in decentralized alternate (DEX) quantity up to now month, and greater than $10 billion within the final 24 hours, in line with DeFiLlama.

Traders are actually eyeing Wednesday’s Federal Open Market Committee (FOMC) assembly for cues. Any indicators on rates of interest might affect liquidity, notably in risk-on property like crypto.

Additionally lingering within the background is VanEck’s pending BNB ETF utility, which was filed in Might. If authorized, it might open the door to higher institutional participation.

Technical Evaluation Overview

- Robust assist has shaped at $647, backed by a surge in quantity to 82,311 tokens, practically triple the 24-hour common, in line with CoinDesk Analysis’s technical evaluation knowledge.

- Resistance is entrenched between $658 and $659, an space the place the worth was rejected twice amid rising quantity.

- Hourly charts reveal a push to $655, adopted by a slight pullback to $652. This identifies an area resistance at $655.70-$655.80.

- Promoting stress intensified throughout downswings. BNB is presently consolidating under resistance with a bearish tilt, and additional draw back comes if sentiment stays weak.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.