This indicator isn’t your normal transferring common crossover or RSI clone. It analyzes the mathematical chance of a worth breakout succeeding by evaluating three core parts:

- Historic breakout success price at related worth ranges over the previous 100-500 bars (configurable). If EUR/JPY has damaged above a sure resistance zone 12 occasions previously six months and sustained the transfer solely 4 occasions, the indicator elements that 33% success price into its calculation.

- Present volatility versus common volatility. Breakouts throughout excessive volatility intervals (ATR studying 20% above the 20-period common, as an illustration) have a tendency to indicate completely different success charges than breakouts throughout consolidation. The indicator compares real-time ATR in opposition to historic norms.

- Quantity affirmation metrics. Whereas MT5 foreign exchange charts present tick quantity moderately than precise transaction quantity, important will increase in tick quantity (above 150% of the 50-bar common) can point out institutional participation. The algorithm weighs this issue into chance calculations.

The output seems as a proportion displayed close to the value stage. A studying of “72%” means historic situations just like the present setup have resulted in profitable breakouts roughly 72% of the time. That’s not a assure—it’s a statistical edge.

How Merchants Apply This in Actual Market Situations

Let’s get sensible. In the course of the London session open on GBP/USD, worth approaches the 1.2850 resistance stage that’s rejected twice over the previous week. Right here’s how the indicator adjustments the decision-making course of:

- State of affairs 1: Value touches 1.2850, the indicator exhibits 38% chance. Most skilled merchants would wait. That sub-40% studying suggests situations don’t favor a sustained break—volatility could be too low, or the extent has confirmed too robust traditionally.

- State of affairs 2: Two hours later, the value returns to 1.2850, however now the indicator reads 68%. Volatility has picked up (seen on ATR), quantity is elevated, and the technical image has shifted. The dealer enters lengthy with a tighter stop-loss, understanding odds favor the commerce however nothing’s sure.

Right here’s what separates this from blind breakout buying and selling: place sizing adapts to chance. A forty five% studying may warrant a half-position with a wider cease. A 75% studying may justify a regular place dimension with regular threat parameters. The indicator doesn’t make the choice—it informs threat administration.

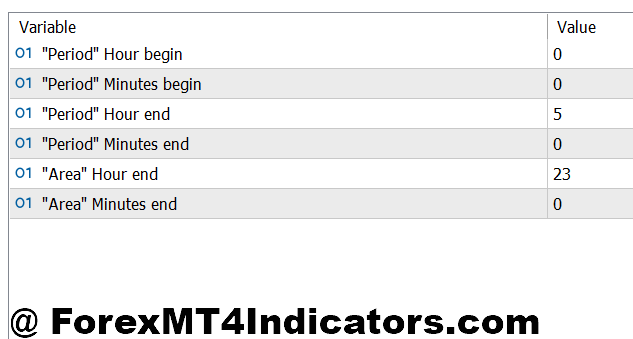

Customization Settings That Really Matter

The default parameters work for 4-hour and every day timeframes, however scalpers and swing merchants want completely different configurations. Three settings management the indicator’s habits:

Lookback Interval (default: 200 bars). This determines how a lot historic information the algorithm analyzes. Day merchants on 15-minute charts typically scale back this to 100 bars to maintain the dataset related to current worth motion. Swing merchants may prolong it to 500 bars for extra statistical significance. However right here’s the catch: longer intervals clean out the chance readings, which may lag throughout quickly altering market situations.

Volatility Multiplier (default: 1.5). This adjusts how closely ATR elements into calculations. Setting it to 2.0 makes the indicator extra conservative, requiring larger volatility earlier than upgrading breakout chance. Aggressive merchants drop it to 1.2, however that will increase false alerts throughout uneven markets.

Quantity Threshold (default: 150%). This units the tick quantity enhance required for affirmation. Pairs like USD/JPY throughout Tokyo hours may want solely 130% resulting from pure liquidity, whereas unique pairs may require 200% to filter out noise.

One dealer working this on AUD/NZD—a notoriously range-bound pair—discovered success by rising the lookback interval to 400 bars and elevating the amount threshold to 175%. The extra restrictive settings lowered sign frequency however improved win price from 52% to 64% over a three-month pattern.

The Sincere Evaluation: Benefits and Limitations

What works: The indicator excels at filtering out low-probability setups. In sideways markets the place breakout makes an attempt fail repeatedly, it retains merchants on the sidelines. That preservation of capital issues greater than most understand. One month of prevented losses can outweigh two months of modest beneficial properties.

The probability-based framework additionally removes emotion from entries. When the indicator exhibits 70%+ and your technical evaluation aligns, pulling the set off turns into simpler. Conversely, a 35% studying offers rational justification to cross on a setup, even when FOMO screams in any other case.

What doesn’t work: This software struggles throughout unprecedented market occasions. Brexit, COVID crash, Swiss franc depeg—these black swan moments invalidate historic chance. The indicator exhibits reasonable readings as a result of nothing within the historic dataset matches present situations. Merchants want discretion to override the software throughout apparent macro disruptions.

It additionally lags in the course of the first take a look at of latest assist or resistance ranges. If GBP/USD breaks above 1.3000 for the primary time in two years, the indicator has restricted historic information at that particular stage. Readings change into much less dependable till the extent is examined a number of occasions.

And right here’s the uncomfortable reality: even 80% chance means 1 in 5 trades fails. Merchants who anticipate certainty can be dissatisfied. This indicator improves odds; it doesn’t remove threat.

How It Compares to Commonplace Breakout Instruments

Conventional breakout indicators—Donchian Channels, Bollinger Bands, or easy assist/resistance breaks—sign when worth exceeds a stage. They’re binary: breakout detected, take the commerce. The Breakout Likelihood Indicator provides context.

Donchian Channels on a 4-hour EUR/USD chart may set off 8 breakout alerts in every week. The chance indicator may classify 3 of these as high-probability (65%+), 3 as reasonable (45-55%), and a couple of as low (under 40%). That filtering reduces overtrading and improves the standard of entries.

In comparison with volume-based breakout instruments just like the Quantity Breakout Indicator, this software is extra complete. Quantity indicators affirm breakouts after they happen, whereas chance calculations can anticipate which breakouts have higher statistical backing earlier than worth totally commits.

That stated, it shouldn’t exchange worth motion evaluation. Merchants nonetheless must determine consolidation zones, perceive market construction, and acknowledge candlestick patterns. The indicator is a decision-support software, not a standalone system.

Commerce with Breakout Likelihood MT5 Indicator

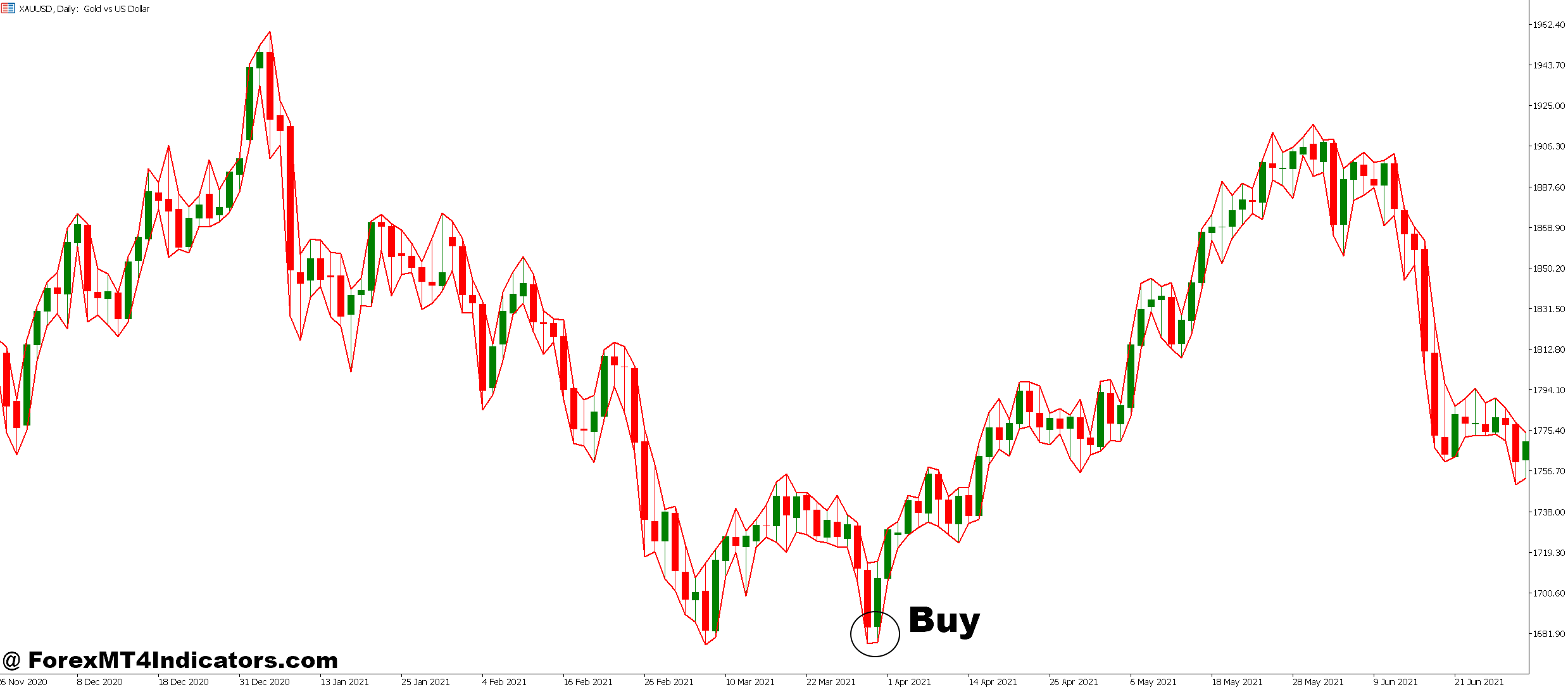

Purchase Entry

- Anticipate 65%+ chance studying – Solely enter lengthy positions when the indicator exhibits a minimal 65% breakout chance at resistance ranges on EUR/USD or GBP/USD 4-hour charts to filter out weak setups.

- Verify with quantity spike – Enter when tick quantity exceeds 150% of the 50-bar common alongside a excessive chance studying, signaling institutional participation moderately than retail noise.

- Enter on candle shut above resistance – Don’t soar the gun; watch for the 1-hour or 4-hour candle to totally shut 5-10 pips above the resistance stage earlier than executing the purchase order.

- Set stop-loss under the breakout stage – Place stops 15-20 pips under the damaged resistance (now assist) on EUR/USD, or 25-30 pips on GBP/USD to account for larger volatility.

- Keep away from entries under 50% chance – Skip the commerce solely if the indicator exhibits lower than 50%, even when worth motion appears to be like bullish; historic information suggests these fail greater than they succeed.

- Scale place dimension with chance – Danger 1% of account on 65-70% readings, enhance to 1.5% on 75%+ readings, however by no means exceed 2% no matter indicator confidence.

- Test ATR earlier than entry – Solely take the sign if the present ATR is not less than 20% above the 20-period common, indicating ample volatility to maintain the breakout transfer.

- Keep away from buying and selling throughout low liquidity – Skip breakout alerts in the course of the Asian session on EUR pairs or half-hour earlier than main information releases when fake-outs are most typical.

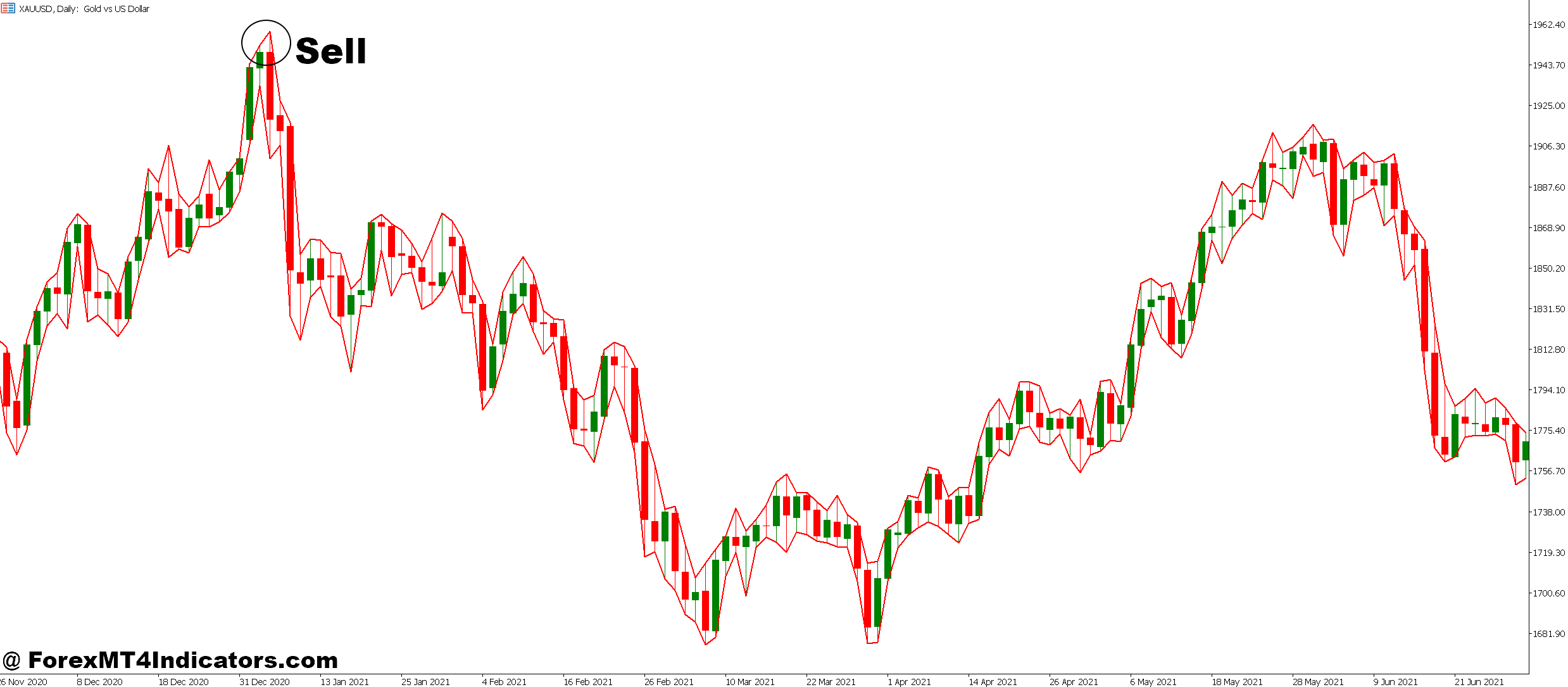

Promote Entry

- Enter at 65%+ chance on assist breaks – Take brief positions solely when the indicator confirms a minimal 65% chance that the assist breakdown will maintain on every day or 4-hour timeframes.

- Anticipate candle shut under assist – Don’t promote prematurely; affirm the 4-hour candle closes 5-10 pips under assist stage with the chance studying staying elevated all through the candle formation.

- Confirm with declining quantity on retests – Enter shorts when worth retests the damaged assist as new resistance however fails to draw robust quantity (under 120% of common), exhibiting weak shopping for curiosity.

- Place stop-loss above breakdown level – Set stops 20-25 pips above the damaged assist stage on EUR/USD, or 30-35 pips on GBP/USD to outlive regular retest volatility.

- Skip entries throughout uptrends – Ignore even 70%+ chance promote alerts when worth is above the 200-period transferring common on the every day chart; counter-trend breakdowns fail incessantly.

- Scale back place dimension on marginal readings – Danger solely 0.5-0.75% of account when chance exhibits 60-65%, and keep away from promoting solely under 60% no matter how bearish the value appears to be like.

- Verify with RSI under 50 – Add confluence by checking that 14-period RSI has crossed under 50 earlier than coming into, filtering out breakdowns that happen throughout momentary pullbacks in uptrends.

- Keep away from shorting into assist clusters – Don’t take promote alerts when one other main assist stage sits 30-50 pips under the present breakdown level; the following stage typically absorbs promoting stress rapidly.

Conclusion

The Breakout Likelihood MT5 Indicator shifts breakout buying and selling from guesswork to calculated threat. It received’t make unhealthy trades good, and it received’t catch each successful transfer. What it does is assist merchants keep away from the vast majority of low-quality breakout makes an attempt that drain accounts slowly over time.

Profitable implementation requires backtesting in your most popular pairs and timeframes. What works for EUR/USD might not work for GBP/JPY. What succeeds on every day charts may fail on 5-minute charts. The indicator offers information; merchants present technique, self-discipline, and threat administration.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and previous efficiency doesn’t guarantee future outcomes. This software will increase the chance of success, however chance isn’t certainty. Use applicable place sizing, keep strict stop-losses, and by no means threat capital you’ll be able to’t afford to lose.

For merchants severe about breakout buying and selling, this indicator deserves consideration, not as a holy grail, however as yet one more edge in a market the place each benefit counts.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90