Identified for its scientific strategy to growth, robust educational foundations, and deal with scalability, Cardano has emerged as a number one blockchain platform. Because the crypto market is continually evolving and the blockchain’s total adoption is scaling new heights, the place of Cardano stays extremely important on this scene. On this article, we’ll check out Cardano’s long-term value prediction 2026 – 2030 primarily based on its intrinsic worth and its increasing array of use instances.

What’s Cardano (ADA)?

Cardano is the first-ever proof-of-stake blockchain based on peer-reviewed analysis and one which makes use of evidence-based strategies for growth. Cardano goals to offer an unmatched safety and sustainability to functions, methods, and societies.

The complete provide of Cardano is capped at 44 billion ADA. Because it makes use of a proof-of-stake mechanism for its blockchain, Cardano is an environmentally pleasant cryptocurrency.

The Historical past of Cardano (ADA)

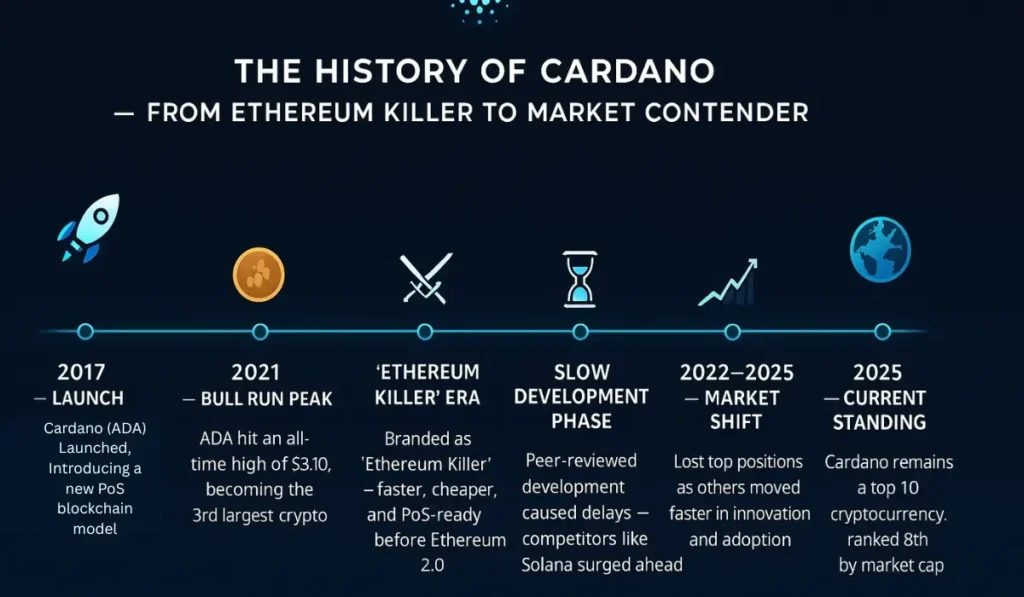

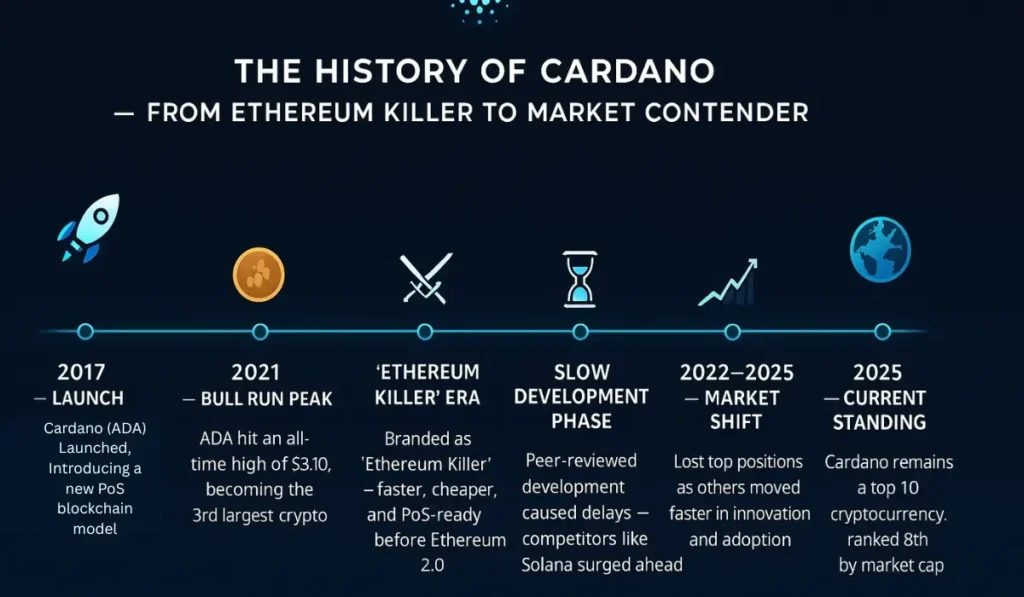

Cardano was launched in 2017. Since its arrival out there, it has proven excessive volatility. Cardano costs used to spike throughout bull runs of the market. In 2021, ADA reached its all-time excessive of $3.10.

AT its peak efficiency, Cardano was the third greatest cryptocurrency behind Bitcoin and Ethereum by market capitalization. Quickly, Cardano was branded because the Ethereum killer since Ethereum hadn’t but transitioned to a proof-of-stake mechanism, and it was sluggish and had excessive charges.

Cardano, then again, labored on a PoS, had low charges, and excessive speeds. These have been causes sufficient to be branded as an Ethereum killer, particularly when Cardano was focusing on the area that was dominated by Ethereum.

Nevertheless, for the reason that spike in 2021, Cardano has fallen behind the competitors to different cash like Solana. A serious motive for this sluggish development was the peer-reviewed growth course of. This consumed plenty of time until deployment, and Solana overtook Cardano. After the competitors pushed Cardano to the again, as of 2025, Cardano is the quantity eighth cryptocurrency by market capitalization.

Cardano Value Prediction

The Cardano value prediction is a sophisticated journey as it’s affected by a mess of things that work in unison to determine the result.

By way of this text, we goal to foretell the long run value of Cardano on a long-term foundation by analysing the components that contribute to figuring out the worth.

If we take a look at Cardano’s value historical past, we see sharp spikes and main dips as properly. Nevertheless, an attention-grabbing reality is that regardless of the ups and downs, Cardano seems to be stabilizing itself. Even when at the moment second Cardano’s development appears to be mildly bullish, there’s a want for a better momentum to maintain this development. If Cardano can keep the help above $0.67, there’s a probability that it could actually rise to $0.7 or $0.74.

Then again, if the help breaks and Cardano falls beneath $0.64, the costs might consequently go decrease than $0.60.From the accessible info, it appears Cardano is on a cautious bullish path. The rationale behind this bullish rise may very well be that the market is regularly constructing momentum in the direction of extra buys.

In the intervening time, Cardano is providing a combined alternative for commerce. Whereas the scalability and use case of Cardano stay unquestioned, the risky nature of the foreign money is what upsets most buyers. Whether or not Cardano is an effective funding is a subject that’s typically debated. One of many main explanation why Cardano ever acquired to affix the highest three was due to its peculiar design that targeted on peer-reviewed growth. Nevertheless, it was the identical peer-reviewed growth that slowed its tempo.

So, to deal with the query, is Cardano a great funding? We should look past the technicalities of the blockchain and analyze the market information as properly. Cardano’s capacity to get well from its drop relies on market sentiment and adoption. With main updates and releases, as an example, the Hydra Layer-2 scaling, on the best way, there’s an elevated buzz round Cardano’s comeback. This might positively have an effect on the worth if investor sentiment turns into extra optimistic.

Cardano Value Prediction 2026 – 2030

| YEAR | LOW | AVERAGE | HIGH |

|---|---|---|---|

| 2026 | $1.31 | $1.35 | $1.61 |

| 2027 | $1.87 | $1.92 | $2.24 |

| 2028 | $2.94 | $3.02 | $3.36 |

| 2029 | $4.24 | $4.39 | $5.10 |

| 2030 | $5.38 | $5.57 | $6.50 |

Way forward for Cardano

Blockchains like Cardano have an intrinsic worth due to the know-how behind them. The companies they provide apply to real-world functions, and therefore Cardano has a future if it could actually deploy its blockchain to its full potential. The worth of Cardano rises when the blockchain turns into extra enticing to tasks and customers. Nevertheless, the worth of Cardano relies on components in addition to person attraction. That is courtesy of Cardano’s present market surroundings.

A coin deployed in the marketplace shall be topic to the market’s actions as properly. Whereas the technical advantages give such belongings an edge over their competitors, the technical superiority alone can not decide whether or not the worth will spike or not.

Nevertheless, we will look into the Execs and Cons of investing in Cardano.

Execs of Investing in Cardano

- Since Cardano has a capped provide, which has similarities to Bitcoin, costs can improve considerably primarily based on future demand.

- Cardano is a always evolving blockchain. This implies real-world use instances carry on getting added to the system, making it extra fascinating and offering it with intrinsic worth.

- One other side of the good thing about investing in Cardano is its partnership. Cardano has for the time being partnerships with the European Funding Financial institution and the Japan Financial institution for Worldwide Cooperation. Having ties with such monetary giants is a constructive signal in terms of a cryptocurrency.

- When one of many world’s most dominant powers, the USA, accepts a cryptocurrency as a strategic reserve, it’s a good signal of funding.

Cons of Investing in Cardano

- Gradual growth has been plaguing Cardano’s future. The peer-review course of is reasonably time-consuming. This was one of many main explanation why, regardless of being launched in 2017, it took Cardano 4 years to launch its good contract.

- The sluggish growth makes room for rivals to get forward and place themselves among the many potential buyers.

- The excessive volatility of Cardano makes it a nasty alternative for buyers on the lookout for short-term revenue.

Conclusion – Cardano Value Prediction

Like several risky asset, the correct prediction of costs shouldn’t be doable for Cardano. Nevertheless, by making use of business information, technical evaluation, and market sentiments, we will make knowledgeable selections. With cryptocurrencies, navigating the area of value is a sophisticated and precarious activity. One of the best ways to strategy this ever-shifting panorama is to be armed with data and data.

| Disclaimer: These crypto value forecasts are primarily based on predictive modeling and shouldn’t be thought of monetary recommendation. |

FAQs

Cardano is in fixed evolution; the technical nature of the blockchain speaks to a bigger group of builders and customers, so technically, its foreign money, ADA, should have a future.

No. Technical updates have confirmed to fail typically; in such cases, the extra risky an asset already is, the upper its volatility turns into.

Cardano’s delayed growth has price it among the main business partnerships that Solana was in a position to capitalize on; nonetheless, with loads of such institutional powers ready to enter the market, Cardano nonetheless has an opportunity to pose a risk to Solana and even overtake it.

Cardano makes use of a peer-to-peer overview mannequin for verifying the technical stability and validity of its tasks. It is a time-intensive course of and is the first motive why a number of of Cardano’s tasks acquired delayed.

A challenge or growth’s success doesn’t correspond to market success, as its real-world adoption is what’s going to decide its finality. A profitable challenge adopted by the worldwide market might imply Cardano’s monetary success and thereby rising costs of ADA.