Resilient funding portfolios take extra than simply tossing collectively a number of shares from completely different sectors. True defensiveness comes from intentionally specializing in components which have traditionally held up properly throughout market crashes and financial downturns.

In my case, meaning prioritizing low-volatility shares and ultra-short-term bonds. In case your objective is to guard capital whereas nonetheless incomes modest development and earnings, I’ve bought a three-exchange-traded fund (ETF) portfolio in thoughts that matches a $50,000 allocation completely.

The inventory aspect

We’re placing 80% of the portfolio into shares. Which may sound excessive for a defensive setup, however in the event you’re nonetheless years or many years from retirement, equities stay your greatest guess for long-term development. The important thing is selecting the correct form of shares—ones which can be constructed to final when markets get tough.

To try this, we’re beginning with two low-volatility ETFs: BMO Low Volatility US Fairness ETF (TSX:ZLU) at 50%, and BMO Low Volatility Canadian Fairness ETF (TSX:ZLB) at 30%.

Each ETFs use a rules-based technique to display screen for shares with low beta, which is a measure of how a lot a inventory strikes relative to the broader market. A beta of 1 means a inventory tends to maneuver in sync with the market. A beta beneath one means it tends to maneuver much less, which is right for preserving capital throughout pullbacks.

Now, ZLU and ZLB don’t simply search for secure value motion. Additionally they skew towards defensive sectors like utilities, healthcare, and shopper staples. These are industries that promote issues folks want, it doesn’t matter what the financial system’s doing, making their revenues and inventory costs much less delicate to financial cycles.

Additionally they throw off respectable earnings. ZLU presently yields 1.98% and ZLB yields 2.13%, providing regular money circulate alongside stability.

The bond aspect

The remaining 20% of the portfolio goes into bonds, however not simply any bonds. We noticed in 2022 what occurs when rates of interest rise sharply: long-term bonds can get hammered. And if a recession hits, lower-rated company bonds can drop simply as laborious as shares. That’s why I’m choosing BMO Extremely Quick-Time period Bond ETF (TSX:ZST).

This ETF focuses on debt with both a maturity or reset date throughout the subsequent yr, which helps protect it from rate of interest swings. It primarily holds investment-grade company bonds, however may embody authorities debt, floating-rate notes, high-yield bonds, and even most popular shares.

The important thing level: 100% of the portfolio is funding grade, with over half (54%) rated A. Which means these are high-quality issuers with low credit score danger, precisely what you need for the secure aspect of your portfolio.

ZST can also be low cost, with a 0.17% expense ratio, and it pays month-to-month distributions. The present yield is 2.94%, which is definitely increased than the Financial institution of Canada’s coverage rate of interest of two.75%, a pleasant bonus for buyers on the lookout for regular earnings with out reaching for danger.

Placing it collectively

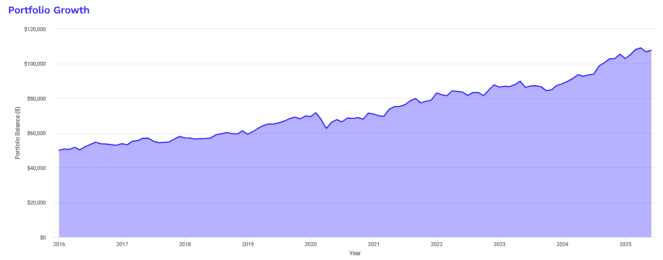

Should you had invested $50,000 into this easy three-ETF portfolio again in 2016, by mid-2025, you’d be sitting on about $107,600 earlier than taxes. That’s greater than doubling your cash in underneath a decade, with an 8.48% annualized return.

Importantly, this wasn’t finished by swinging for the fences. The portfolio stored issues secure. The worst yr (2022) was solely a 2.12% loss, and even in the course of the COVID-19 crash, it was down simply 12.66% from its peak. For comparability, many stock-only portfolios misplaced 30% or extra throughout that point.

The Sharpe ratio of 0.84 and Sortino ratio of 1.38 imply that, relative to how a lot danger was taken, the returns had been strong. These ratios let you know that you simply’re getting an excellent bang to your buck when it comes to risk-adjusted efficiency.

In plain English: this portfolio grew steadily, didn’t panic in a crash, and delivered outcomes that may make most buyers fairly pleased, particularly in the event you worth peace of thoughts.