Information exhibits the rebound in Bitcoin and different cryptocurrencies has punished the bears, triggering a large wave of brief liquidations.

Crypto Sector Has Simply Witnessed A Mass Liquidation Occasion

In keeping with information from CoinGlass, a considerable amount of liquidations have piled up on the cryptocurrency derivatives market. “Liquidation” refers back to the forceful shutdown that any open contract has to undergo if its losses exceed the brink outlined by its platform.

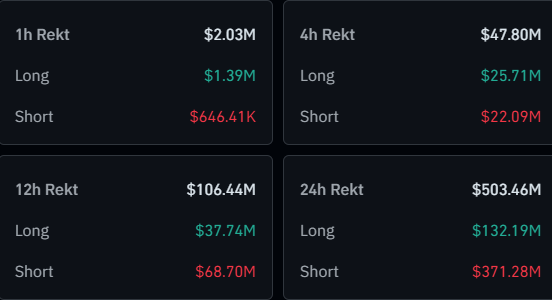

Under is a desk that exhibits the numbers associated to the newest liquidations out there.

As displayed, the cryptocurrency sector has seen a derivatives flush of over half a billion {dollars} in the course of the previous day. Out of those, 73.7% of the liquidations, equal to $371 million, got here from the brief traders alone.

The short-heavy mass liquidations have come as Bitcoin and firm have rebounded following the information of a ceasefire between Israel and Iran. Earlier, US strikes on Iranian nuclear amenities had induced a crash out there that ended up unleashing a flurry of lengthy liquidations. This time, it appears the bears have been those caught out as a substitute.

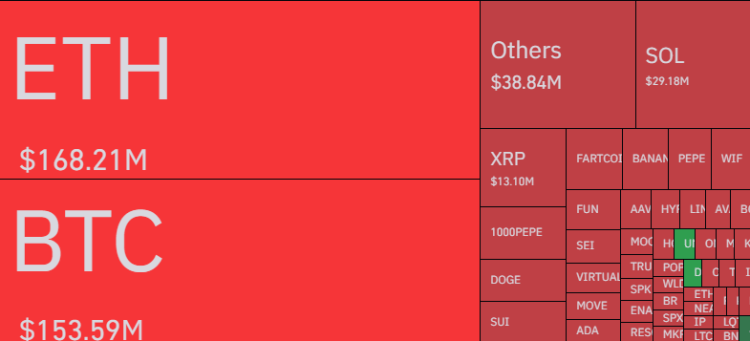

As typical, Bitcoin and Ethereum have topped the record of liquidations, however curiously, the latter ($168 million) has managed to outweigh the previous ($153 million), which is mostly not the case.

Ethereum observing the next quantity of liquidations might come right down to the truth that its worth has seen a bigger leap in the course of the previous day (7% vs 3.5%). It is also a sign of an elevated degree of speculative curiosity within the cryptocurrency.

Out of the altcoins, Solana and XRP have topped the charts with $29 million and $13 million in liquidations, respectively. Although clearly, these numbers are fairly small in comparison with the figures of the highest two titans, showcasing the sheer distinction in capital concerned.

In another information, Bitcoin taker purchase quantity has shot up on the cryptocurrency trade Bybit, as an analyst has identified in a CryptoQuant Quicktake submit.

Within the chart, the info of the Bitcoin Taker Purchase Promote Ratio is proven. This metric measures the ratio between the taker purchase and taker promote volumes for a given platform. Right here, the trade concerned is Bybit.

It could seem that the indicator has just lately seen a pointy spike above the 1 mark, an indication that lengthy quantity has began to sharply outpace the brief one. In keeping with the quant, spikes within the metric on Bybit have typically preceded a surge within the BTC worth.

BTC Worth

Following the restoration run over the past 24 hours, Bitcoin has returned to the $105,100 mark.