Tom Lee—lengthy identified for bullish takes—says crypto costs could also be near their ground. In accordance with his feedback on TV, he sees indicators that purchasing strain might return if the financial and on-chain backdrop holds.

Associated Studying

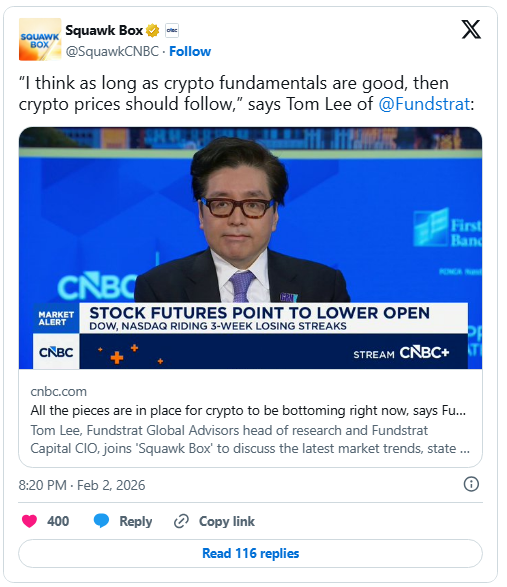

Throughout an interview on CNBC, Lee, Fundstrat’s head of analysis, mentioned the present market setup might enhance as fundamentals proceed to agency up.

That view sits alongside an enormous loss at his agency, which raises questions on how assured outdoors observers ought to be.

Market Strikes And Capital Flows

Stories say capital moved sharply into valuable metals as merchants sought cowl, and that stream drained cash away from crypto.

Gold and silver had run-ups that drew money. On the similar time, some market gamers have been already mild on borrowed positions. That blend left costs extra uncovered than many anticipated.

“I feel so long as crypto fundamentals are good, then crypto costs ought to comply with,” says Tom Lee of @Fundstrat:https://t.co/pldeBkwChZ

— Squawk Field (@SquawkCNBC) February 2, 2026

Massive Gross sales And Liquidations

About $2.56 billion in Bitcoin liquidations have been recorded in the course of the sharp swings this week, as merchants closed out positions and danger urge for food pale. Stories have disclosed that enormous sells pushed Bitcoin under key ranges, and it dipped beneath $78,000 for a spell.

BitMine, the agency tied to Lee, is reported to be sitting on roughly $6.95 billion in unrealized losses, a proven fact that complicates any narrative about impartial observers calling a backside.

Indicators That Might Mark A Flip

Stories observe an uptick in Ethereum lively accounts and rising work by massive monetary companies to construct merchandise on the community. These are the sorts of measures that, over time, are inclined to replicate deeper demand than short-term hypothesis.

A BitMine adviser has projected targets for Bitcoin and Ethereum—$77,000 and $2,400 respectively—and a few say these ranges might sign exhausted promoting if reached. However the market has been jittery, and numbers on the display can change quick.

Coverage Noise And Geopolitics Matter

Coverage strikes in Washington have been flagged as a supply of additional uncertainty. Some choices by regulators and lawmakers are seen as favoring sure companies or sectors, which provides to the uneven tone throughout danger belongings.

On prime of that, tensions within the Center East have pushed traders towards secure havens. When politics and geopolitics each push in the identical path, crypto tends to really feel that pull.

Associated Studying

Even when fundamentals look okay, timing is essential. Liquidity situations can tighten rapidly if sentiment turns, and that may make any rebound short-lived or shallow.

Stories say merchants are awaiting tapering in liquidations and clearer indicators that flows into metals have paused earlier than they are going to step again in with confidence.

There’s a case that the worst promoting has occurred. There may be additionally a case that costs can fall additional if a shock hits.

Featured picture from DALL-E, chart from TradingView