Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is as soon as once more within the highlight, however for all of the improper causes. The favored meme coin has skilled large promoting stress over the previous few days, pushed by heightened world tensions and ongoing macroeconomic uncertainty. On Monday, DOGE set a recent native low round $0.129, additional confirming the downtrend that has been constructing over the previous few weeks.

Associated Studying

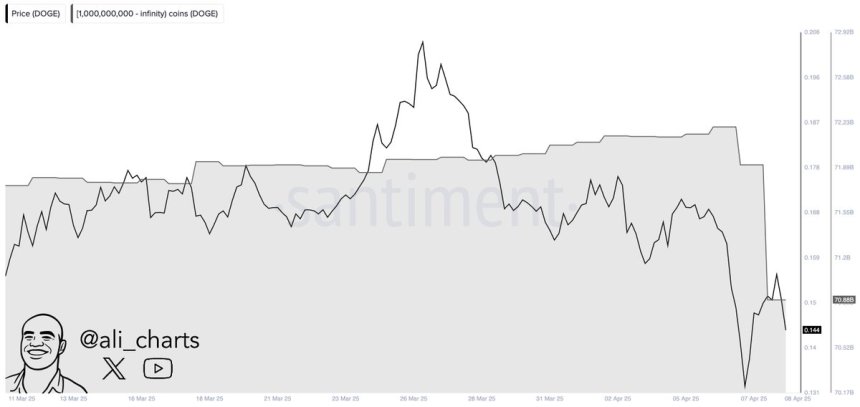

The market sentiment round Dogecoin has shortly shifted from cautious optimism to defensive positioning, as buyers react to a risk-off atmosphere affecting each conventional and crypto markets. Including gasoline to the bearish fireplace, knowledge from Santiment reveals that Dogecoin whales have offered greater than 1.32 billion DOGE prior to now 48 hours alone — a transfer that raises questions on broader market confidence.

Is that this large selloff a part of a strategic rebalancing from giant holders, or is it an indication of panic promoting amid deepening volatility? What’s sure is that DOGE is getting into a crucial section. If consumers fail to step in quickly, the trail of least resistance might be decrease. As whales exit and costs falter, the approaching days might outline whether or not Dogecoin stabilizes — or spirals additional.

Dogecoin Slides Additional As Whale Selloff Alerts Deepening Bear Pattern

Dogecoin has now misplaced greater than 70% of its worth since December, with no clear indicators of a restoration in sight. The meme coin, as soon as an emblem of bullish enthusiasm and retail hypothesis, is now main the decline within the altcoin area as market circumstances worsen. Rising macroeconomic uncertainty continues to weigh closely on danger belongings, and meme cash like Dogecoin have been probably the most affected.

The stress isn’t simply coming from throughout the crypto market. Broader monetary instability — significantly triggered by escalating world tensions — is accelerating the selloff. U.S. President Donald Trump’s newest spherical of aggressive tariffs and China’s retaliatory stance have stoked fears of a full-blown commerce warfare. As world markets reel from this uncertainty, buyers are pulling again from speculative belongings, sending DOGE deeper into bearish territory.

Including to the awful outlook, high analyst Ali Martinez shared knowledge from Santiment revealing that whales have offered over 1.32 billion Dogecoin in simply the previous 48 hours. This vital outflow is a transparent reflection of the risk-off sentiment dominating the market. In response to Martinez, this conduct is probably going pushed by panic and rising expectations {that a} extended bear market is growing.

Till sentiment shifts and macro circumstances stabilize, Dogecoin’s path stays precarious. The mixture of whale dumping, market-wide concern, and world financial pressure might hold DOGE underneath stress within the close to time period. Bulls might want to reclaim key ranges shortly to keep away from a deeper collapse — however for now, the development stays firmly bearish.

Associated Studying

Bulls Wrestle At Key Stage As Promoting Stress Persists

Dogecoin is buying and selling at $0.14, almost 75% beneath its 200-day transferring common round $0.25 — a placing indicator of how far the meme coin has fallen. The downtrend accelerated when DOGE misplaced assist on the $0.25 degree, and since then, bulls have didn’t mount any significant restoration. Continued macroeconomic stress and weak investor sentiment have solely added to the promoting stress, dragging costs decrease with every passing week.

For Dogecoin to start a possible restoration section, holding above the $0.15 degree is crucial. This zone might act as a short-term assist base, giving bulls an opportunity to regroup. Nevertheless, merely stabilizing isn’t sufficient. A push towards the $0.20 mark is required to reestablish momentum and break the present bearish construction. Reclaiming that degree would additionally carry DOGE nearer to its 200-day MA, a key technical milestone for development reversal.

Associated Studying

On the draw back, dropping the $0.14–$0.15 space might open the door to deeper losses. If assist fails to carry, a fast transfer towards the $0.10 degree is feasible — doubtlessly signaling a return to bear market lows. For now, DOGE stays underneath heavy stress, with bulls on the defensive and time working out to keep away from one other breakdown.

Featured picture from Dall-E, chart from TradingView