Ethereum remains to be struggling beneath $3,000 regardless of the Bitcoin value sitting near all-time highs. On the present ranges, Ethereum continues to look extremely bearish, with sell-offs dominating the market at this degree. Whereas piling shorts are pointing to a attainable reduction rally, there may be additionally the likelihood that the worth will crash again down from right here. Crypto analyst Weslad maps out the ETH value trajectory utilizing the ABCDE wave construction, displaying a attainable crash beneath $2,000.

The Bullish Ethereum Situation

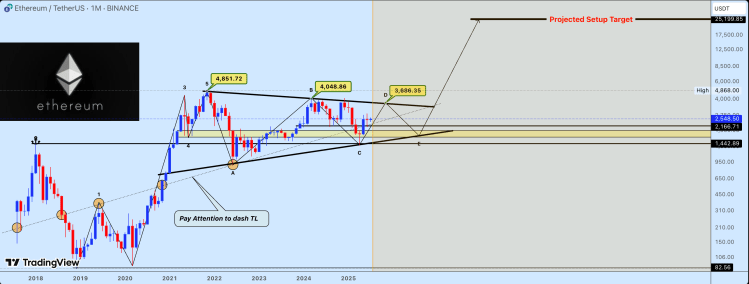

Weslad factors to the 2021 Ethereum peak when the worth reached $4,851 as the purpose when a large-scale symmetrical pennant had fashioned for the digital asset. Apparently, this has continued for a number of years already, and continues to play out even in 2025, 4 years later. Up to now, the analyst believes that the altcoin has been in a long-term accumulation section in an outlined corrective vary.

Associated Studying

One other vital improvement is the formation of an ABCDE wave sample. This sample usually predicts peaks and troughs, and relying on the place the asset is within the sample, it may level to a restoration or a crash. Presently, the crypto analyst places the Ethereum value as being someplace in a D wave, which is nonetheless bullish for the worth.

“At the moment, value motion is growing close to level D, approaching the higher boundary of the pennant, an important space that might outline the subsequent directional transfer,” the analyst mentioned. If this D wave performs out as anticipated, then the Ethereum value is predicted to truly surge from right here. The highest of this sample would put it above $3,500 earlier than the transfer is accomplished.

On the higher finish of that is the formation of an Inverse Head and Shoulders Sample. This sample has seen the $2,855 performing as key resistance, beating the Ethereum value down a number of instances this yr. Nevertheless, if a sustained break is achieved above this degree, along side a breakout from Wave D, then it’s attainable that the worth does rally to new all-time highs above $6,000.

The Bearish Situation

Whereas the formation of the ABCDE wave depend factors to some bullishness for the Ethereum value, there may be nonetheless the likelihood that the worth may go in the other way. For instance, after the D wave is accomplished, comes the subsequent wave within the sequence, which is the E wave, and it is a bearish wave.

Associated Studying

Because the crypto analyst explains, a non permanent rejection on the neckline or pennant resistance would set off an E wave retracement. On this case, the Ethereum value may see an over 30% crash, placing it again towards the $1,400-$1,800 degree, the place there may be essentially the most help.

“Latest value conduct reveals compressed volatility and elevated shopping for curiosity on dips, reinforcing the potential of an imminent directional breakout,” Weslad warned. “A decisive transfer outdoors this macro construction might mark the start of a brand new section of long-term value growth.”

Featured picture from Dall.E, chart from TradingView.com