KEY

TAKEAWAYS

- Nobody can forecast the market’s subsequent transfer, so use charting instruments that will help you navigate the market.

- The McClellan Summation Index can minimize by means of the noise to offer clearer indicators.

- Mix a number of indicators to substantiate potential market strikes.

When the inventory market appears to be drifting sideways with out displaying a transparent bullish or bearish bias, it is regular for buyers to get anxious. It is like being at a crossroads, questioning whether or not to go left, proper, or keep put.

When the inventory market appears to be drifting sideways with out displaying a transparent bullish or bearish bias, it is regular for buyers to get anxious. It is like being at a crossroads, questioning whether or not to go left, proper, or keep put.

The reality is no one has a crystal ball, and predicting what the market will do subsequent is a idiot’s errand. Do you have to soar in and purchase now, or await the worth to dip decrease? As an alternative of fretting over these questions, what you are able to do is empower your self with the correct instruments to make knowledgeable choices.

For one instance, creating ChartLists is a terrific strategy to control the charts which are necessary to you.

A logical start line is to watch a broad market index such because the S&P 500 ($SPX), which acts as a barometer for the general well being of the market. The chart from this week’s article “Navigate the Inventory Market with Confidence” highlighted some necessary ranges to watch. The world between 5950 and 6050 is vital; a break above or beneath these ranges can sign what’s coming subsequent.

Under is the chart of the S&P 500, with the important thing ranges and up to date to mirror the info after Wednesday’s shut. Notice that the index continues to be throughout the 5950 to 6050 vary. Fed Chairman Jerome Powell’s press convention did not do a lot to maneuver the market, though there was a little bit of a selloff in the direction of the shut. However that is nothing to be alarmed about. Lively individuals would have unloaded their positions forward of Wednesday’s shut because of the Center East battle and the market being closed on Thursday to watch Juneteenth.

FIGURE 1. DAILY CHART OF THE S&P 500. Monitor the worth motion at key help and resistance ranges.Chart supply: StockCharts.com. For academic functions.

If the S&P 500 breaks beneath 5950, it may imply an extra decline or a market reversal. Alternatively, if the index breaks above 6050, it may point out a transfer in the direction of new highs, or it may reverse after hitting its all-time excessive. With so many doable outcomes, navigating the inventory market can really feel like a puzzle.

That is the place affirmation instruments develop into your finest buddies. When the general market is wavering, these instruments present that further little bit of confidence you want.

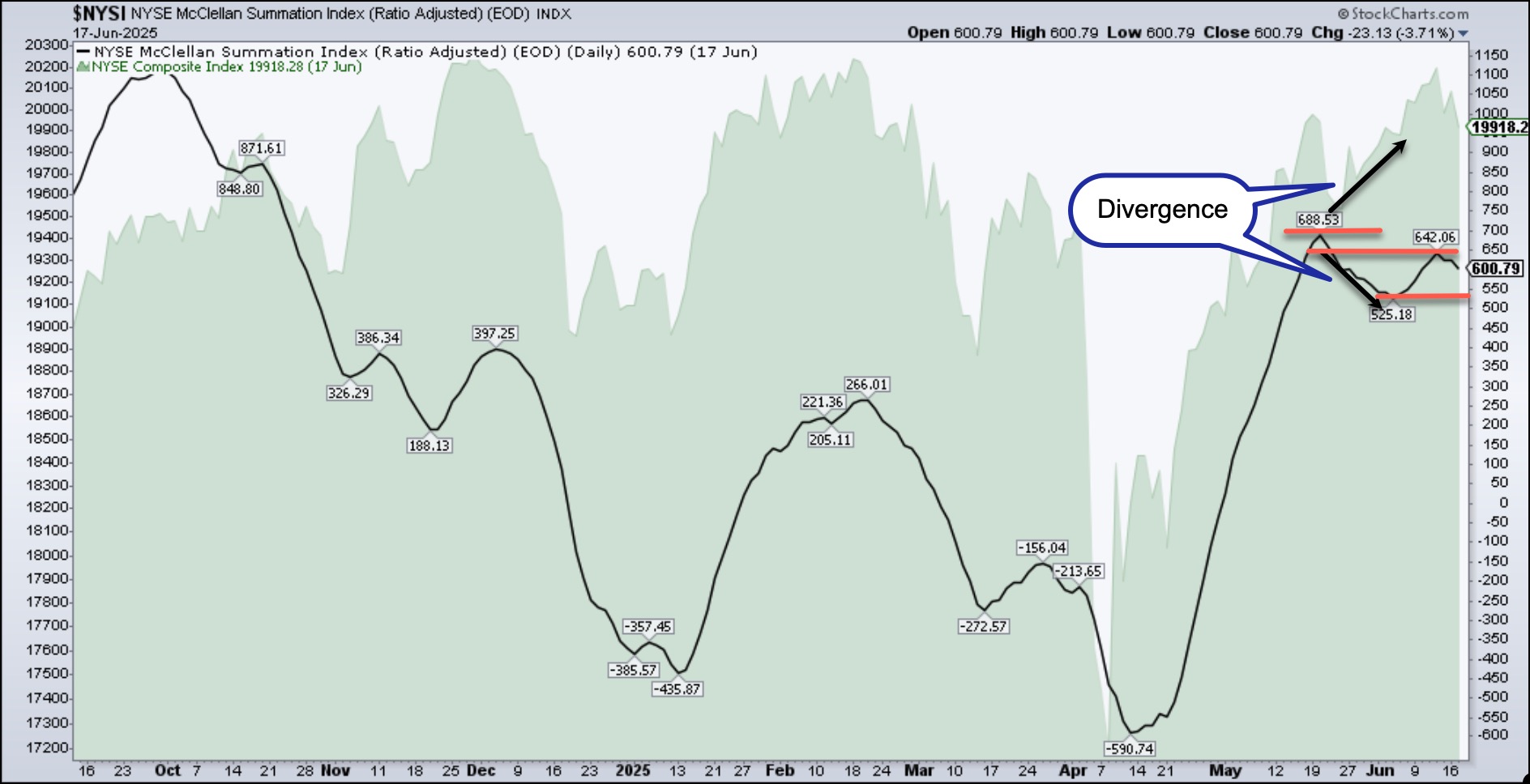

Take the McClellan Summation Index for instance. Should you’re a daily reader of our weekly ChartWatchers publication (and if not, it is best to undoubtedly test it out — it is full of insights), you may acknowledge the chart beneath from final week’s challenge.

FIGURE 2. NYSE MCCLELLAN SUMMATION INDEX VS. THE NYSE COMPOSITE INDEX. Notice the divergence between the 2 and the assorted ranges (purple horizontal traces). Chart supply: StockCharts.com. For academic functions.

This chart shows the NYSE McClellan Summation Index ($NYSI) overlaid on an space chart of the NYSE Composite Index ($NYA). The McClellan Summation Index tends to generate fewer indicators, making it useful for medium and long-term tendencies. It helps to chop by means of the noise of an indecisive market and provides you a clearer image.

Discover how, after its April low, the $NYSI climbed from -590 to 688 comparatively shortly in sync with the NYSE. However this is the place it will get fascinating: after hitting 688, there’s a divergence. Whereas the NYSE continued to maneuver increased, the $NYSI began trending decrease, making decrease highs. This may very well be an early warning signal that the market’s upward momentum could also be waning.

The McClellan Summation Index provides us some clear ranges to watch.

- Bearish state of affairs. If the S&P 500 falls beneath the 5950 stage, adopted by the $NYSI dropping beneath its final low of 525, then it is possible equities may see additional declines.

- Bullish state of affairs. If the S&P 500 breaks above the 6050 stage, adopted by the $NYSI shifting increased than 642 after which the 688.50 stage, it might be a optimistic signal for equities.

The Backside Line

So in case you’re questioning when may be a very good time to “purchase the dip” however are not sure about when that dip may happen, a majority of these charting instruments might help information your funding choices. In case your indicators line up and make sure an upward transfer, contemplate investing a portion of your capital after which including extra if the market continues to maneuver in your favor. An enormous a part of how properly you handle your funds has to do with cash administration.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. She was the Managing Editor for TD Ameritrade’s thinkMoney journal.

Study Extra