The cryptocurrency market dipped 0.7% previously 24 hours, reflecting cautious sentiment forward of macro catalysts and sector-specific headwinds, such because the market pricing within the U.S. Federal Reserve’s 25 bps rate of interest lower, profit-taking throughout high-beta altcoins, and open curiosity in crypto derivatives dropping 5% as merchants diminished leverage forward of key occasions.

Regardless of the dip, altcoins proceed to outperform Bitcoin, as per the Altcoin Season Index studying of 72/100, which is in “Altcoin Season” territory. Whereas BTC dominance rose 0.15 factors to 57.06% over 24 hours, it stays under its 30-day peak of 59.32%. In the meantime, the altseason index fell 6.46%, indicating that altcoins have cooled off barely; nonetheless, their dominance development stays intact, supported by a 56% month-to-month rise within the index.

In keeping with our evaluation, the perfect cryptos to purchase at this time (09/19) are: APX ($APX), Aster ($ASTER), and Close to Protocol ($NEAR). Their respective rallies align with the broader altcoin sentiment and different components like technical breakouts, a lift for AI/DEX token initiatives, institutional demand, and hypothesis surrounding tier-1 alternate listings.

High Cryptos to Purchase At the moment With Large Revenue Potential

1. ASTER ($ASTER)

ASTER surged 45.7% during the last 24 hours, extending a 605% weekly rally. Its spike aligns with perpetual contract itemizing on the OrangeX alternate, upcoming 1:1 token swap program fueling speculative shopping for, and broader market development of merchants rotating capital from BTC into high-beta alts like ASTER.

Binance Alpha has introduced a 1:1 token swap for APX to ASTER beginning October 1, 2025. Merchants are accumulating an elevated variety of APX tokens, which surged 50-100% pre-swap, to transform into ASTER, creating synthetic demand. Nonetheless, post-swap promote stress might observe if holders money out. Historic knowledge reveals APX traded at $0.09 earlier than April 2025, suggesting excessive volatility dangers. It will likely be key for ASTER to maintain a $33 billion month-to-month buying and selling quantity post-hype, or profit-taking will reverse good points.

| $ASTER Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $0.6237 | $0.2948 | $0.3534 | $0.8371 | +2.3% |

2. Belief Pockets Token ($TRUST)

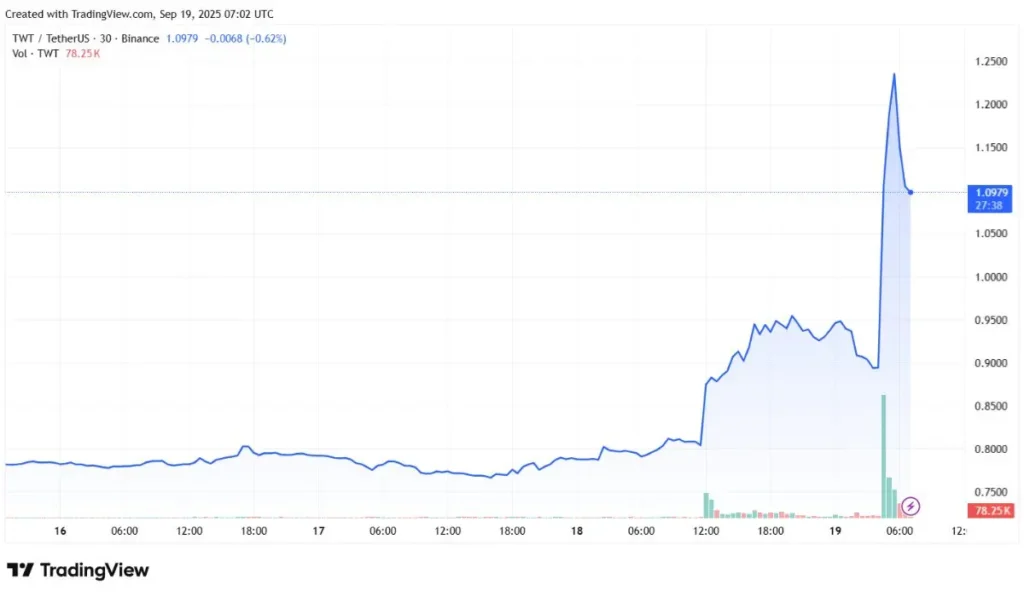

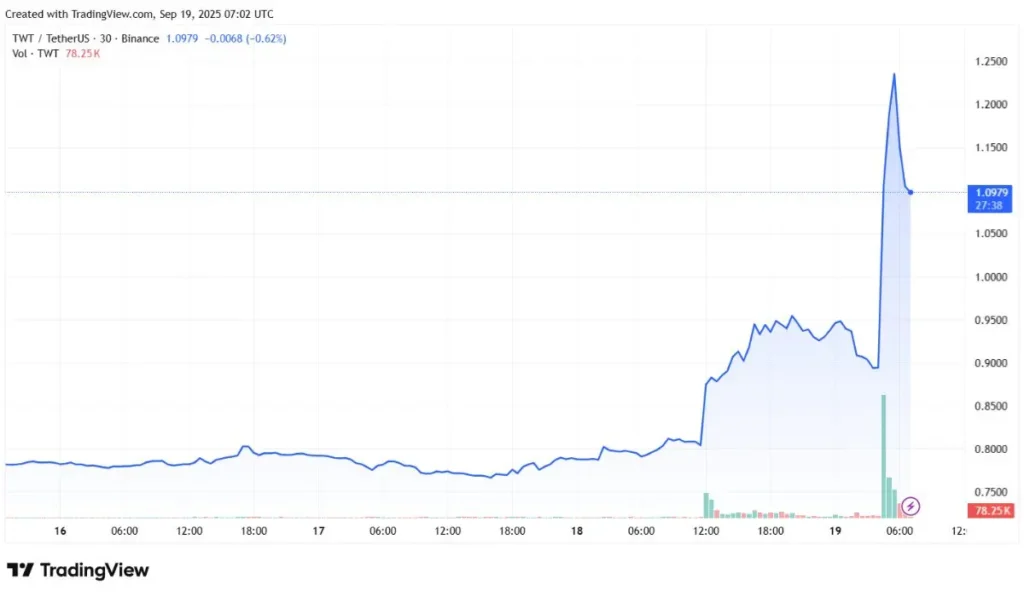

TWT rose 41.65% previously 24 hours, outpacing the broader crypto market’s weekly good points. Key drivers behind the rally embody a optimistic technical breakout that noticed TWI clearing essential resistance ranges, Belief Pockets ecosystem system development within the U.S., boosting utility narratives, and altcoin capital rotation favoring mid-cap tokens like TWT.

Picture Supply: TradingView

TWT broke above a multi-month descending trendline on July 20, which was confirmed by a 66.13% value goal of $1.50 in technical forecasts. Its 24-hour RSI sits on the overbought territory of 76.83, whereas the MACD histogram turning optimistic reveals sustained bullish momentum. Breakouts typically set off algorithmic shopping for and FOMO. The $1.13 value now assessments the 127.2% Fibonacci extension at $1.20, with the surge in buying and selling quantity validating market participation in TWT. Merchants ought to search for an in depth above $1.20, which might speed up the goal towards $1.50, whereas a drop under $1.00 may sign profit-taking.

| $TWT Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $1.16 | $0.93109 | $1.77 | $2.49 | +111.76% |

3. Close to Protocol ($NEAR)

NEAR rose 10.46% during the last 24 hours, outpacing the broader crypto market’s 0.37% dip. This follows a 17% weekly acquire that was pushed by optimistic technical momentum, the combination of Allora Community’s AI-powered predictive intelligence layer on Close to Protocol, and institutional inflows into NEAR following the Bitwise ETP launch.

NEAR broke above the important thing 23.6% Fibonacci resistance degree at $3.03, with its 7-day RSI sitting on the overbought degree of 82.14, and MACD histogram turning optimistic. The 7-day SMA at $2.81 crossed above the 30-day SMA at $2.58, confirming bullish momentum. Brief-term merchants are chasing the breakout, amplified by NEAR’s excessive quantity/market cap turnover ratio of 0.16. Nonetheless, the RSI warns of potential consolidation close to the $3.26 swing excessive. Look ahead to a sustained shut above $3.26, which might goal the 127.2% Fib extension of $3.53, whereas failure dangers a pullback to $2.89 on the 38.2% Fib.

| $NEAR Market Value | Minimal Value (2025) | Common Value (2025) | Most Value (2025) | ROI |

| $3.21 | $3.19 | $4.54 | $5.91 | +83.29% |

Last Ideas on Finest Cryptos to Purchase At the moment: $ASTER, $TWT, $NEAR

The rallies of at this time’s best-performing cryptocurrencies – Aster (ASTER), Belief Pockets Token (TWT), and Close to Protocol (NEAR) – are largely pushed by the broader market development of altcoins outperforming Bitcoin.

BTC dominance rose barely to 57.06%, whereas the Altcoin Season Index dipped from 77 to 73/100 yesterday, however stays properly in “Altcoin Season” territory. This displays continued capital rotation into alts regardless of Bitcoin’s 1.27% weekly good points. The altseason index has climbed 58.7% over the earlier month, signaling sustained momentum. Traders are diversifying past BTC, however the apex crypto stays the market’s anchor.

Altcoins are performing resulting from sector-wide rotations and coverage tailwinds, however BTC’s institutional ETF flows present much-needed stability for the market. Monitor Friday’s Federal Open Market Committee (FOMC) assembly, as a price lower might amplify alt volatility. The crypto market’s 14-day RSI at 79 warns of overextension, suggesting selective profit-taking could possibly be coming.

Readers ought to word that cryptocurrencies are extremely speculative and unstable belongings, and it is strongly recommended that you just conduct correct due diligence and search knowledgeable opinion earlier than investing determination. Moreover, the contents of this text are for informational functions and shouldn’t be construed as funding recommendation.