How I Handle Danger and Diversify Throughout A number of Prop-Agency Accounts

One of the crucial frequent errors I see amongst prop-firm merchants is concentrating an excessive amount of danger in a single technique or a single account. Even worthwhile methods can undergo troublesome durations, and when all the pieces is stacked collectively, one dangerous part can wipe out months of labor.

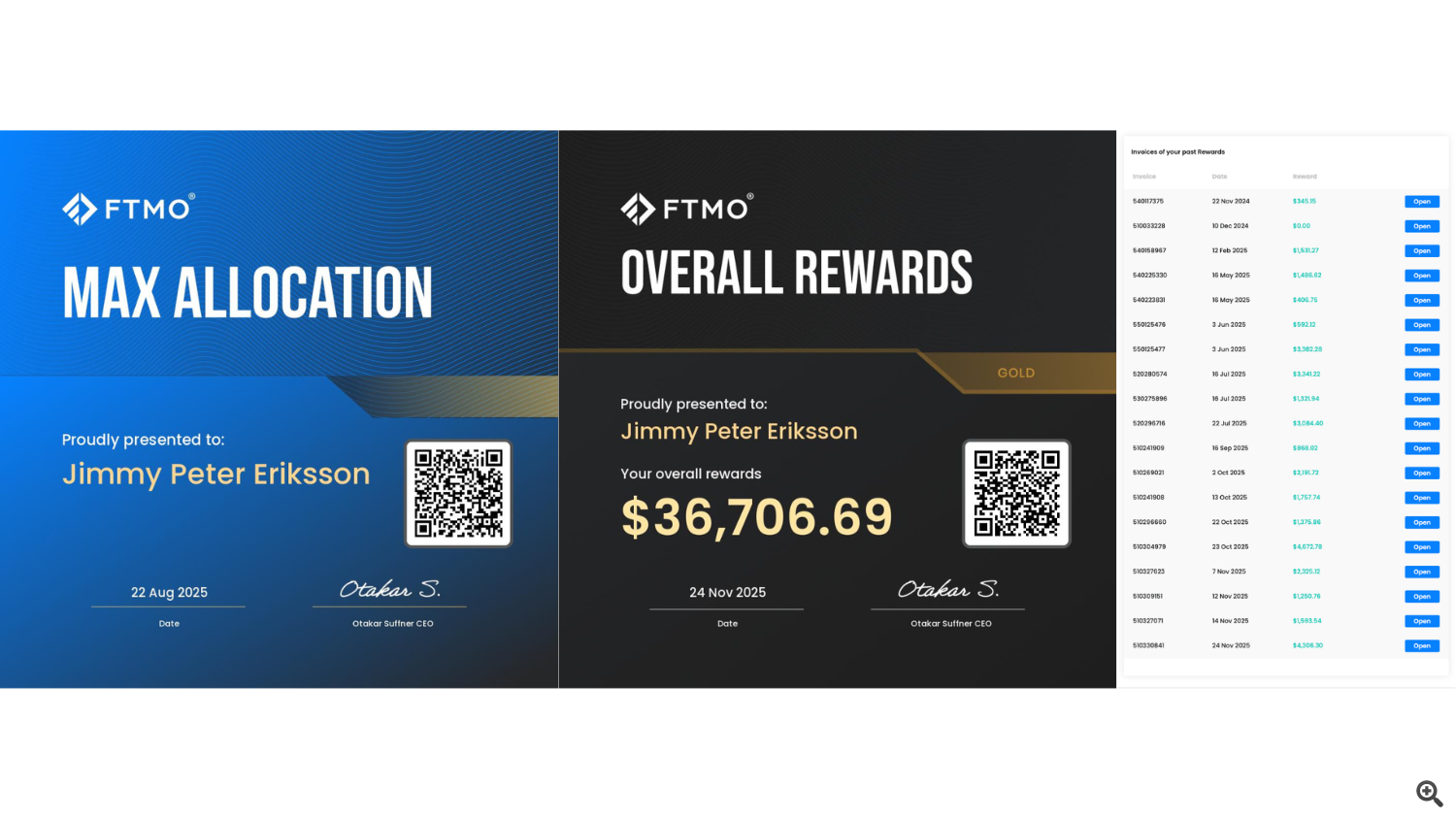

Over time, I’ve constructed a construction that focuses on danger separation, diversification, and longevity, quite than chasing short-term returns. This strategy has allowed me to generate constant payouts for over a yr, with greater than 20 payouts and over $36,000 USD withdrawn from FTMO-style accounts, whereas managing roughly $400,000 in funded capital.

This text explains precisely how I construction my accounts and why I do it this fashion.

Core Precept: Techniques Fail Quickly, Constructions Ought to Not

I don’t depend on a single “excellent” technique. As a substitute, I commerce a number of uncorrelated Knowledgeable Advisors, every primarily based on totally different market behaviors:

Any particular person system can underperform for weeks or months. The objective is to not keep away from drawdowns totally, however to make certain no single drawdown can damage your complete operation.

My Setup: 8 Uncorrelated Knowledgeable Advisors

Let’s assume I’m working 8 uncorrelated EAs and 4 × $100,000 prop-firm accounts.

Slightly than cloning the identical setup in every single place, I deliberately assign totally different roles to every account.

Account 1: Extremely-Secure, Lengthy-Time period Earnings Core

Objective: Stability and longevity

Danger: Very low

Objective: ~1–2% monthly

This account isn’t thrilling — and that’s the purpose.

It acts as a base earnings account, meant to remain funded long-term and produce regular payouts. If all the pieces else fails, this account is designed to maintain going.

Account 2: Diversified however Increased Danger

Objective: Managed progress

Danger: ~2× the ultra-safe account

Objective: Increased month-to-month returns

-

All 8 EAs are nonetheless working collectively

-

Identical diversification advantages

-

Barely elevated danger per commerce

Right here, I settle for extra volatility. I’m snug dropping this account if it generates robust payouts first. Even one good cycle can produce a number of thousand {dollars}, which already offsets the danger.

This account balances diversification with efficiency.

Accounts 3 & 4: Cut up Techniques, Cut up Danger

Objective: Danger separation and redundancy

As a substitute of working all methods collectively, I break up them:

Why do that?

-

If a selected group of methods hits a nasty interval, it solely impacts one account

-

The opposite account could stay secure or worthwhile

-

Totally different system combos behave in a different way, even in the identical market

This dramatically reduces the possibility of a number of accounts failing on the similar time.

Why This Works Higher Than a Single “Excessive-Danger” Account

Many merchants attempt to push one account laborious to succeed in targets quicker. That strategy often ends in:

My construction accepts that:

-

Some accounts could also be misplaced

-

Others are designed particularly not to be misplaced

-

General capital and payouts keep constant

It’s a portfolio mindset, not a single-bet mindset.

The Huge Benefit: Psychological and Statistical Stability

This construction offers two main advantages:

1. Psychological Stability

When one account is down, others are sometimes up. This removes the urge to intrude with methods or improve danger emotionally.

2. Statistical Robustness

Uncorrelated methods + separate accounts = fewer excessive outcomes. You’re not betting all the pieces on one market regime.

Closing Ideas

This strategy isn’t about maximizing returns in a single month. It’s about:

-

Staying funded

-

Producing constant payouts

-

Surviving dangerous market durations

-

Treating prop-firm buying and selling like a enterprise, not a big gamble

In the event you commerce a number of methods, I strongly suggest pondering not solely about how they commerce — however the place and the way they’re allotted.