Now we have all seen GBP/USD struggling in current classes, sliding in the direction of the 1.34 space.

On the floor, it seems like a traditional correction, however behind the candles there’s a deeper story.

Markets usually are not simply reacting to inflation knowledge; they’re questioning the UK’s fiscal credibility. For us merchants, this issues as a result of the bond market and sterling at the moment are shifting hand in hand.

Macro Background: The Fiscal Aspect of the Story

Latest UK knowledge confirmed producer costs choosing up once more (+1.9% YoY) whereas shopper inflation remains to be round 3.8%. Too excessive for the Financial institution of England to chop charges comfortably, however too gentle to justify additional aggressive hikes. In different phrases, financial coverage is caught within the center.

The actual stress, nonetheless, comes from public funds.

-

The UK now spends over £100 billion per 12 months simply on debt curiosity.

-

The ten-year gilt yield trades close to 4.9%, the very best since 2008.

-

The 30-year yield has surged to 5.6–5.7%, ranges not seen for the reason that late Nineties.

Although demand for gilts stays excessive (the final £14 billion public sale drew document orders above £140 billion), the fee is what issues. Each new issuance locks in greater curiosity bills, and that eats into the federal government’s fiscal house.

For merchants, this interprets right into a easy sign: confidence is shaky, and the pound tends to weaken when long-term yields rise for the “fallacious” causes — not due to development, however due to fiscal doubts.

A Disaster of Confidence

The 2024/25 fiscal deficit reached £151.9 billion, properly above the £137 billion forecast. Revenues disenchanted, whereas spending on welfare, well being care, and debt servicing stored climbing. This widening hole feeds right into a notion downside: the UK authorities is seen as missing a reputable plan to stabilise debt dynamics.

Political uncertainty provides to the combination. The current reshuffle and appointment of Minouche Shafik as financial adviser weren’t seen as a present of energy however as a defensive transfer by Chancellor Rachel Reeves. Markets don’t like the concept of a weak Treasury when fiscal self-discipline is urgently wanted.

Because of this, traders now demand the next time period premium — the additional yield required to carry long-dated gilts. That’s the reason yields are rising even with out new inflation shocks.

The Vicious Circle

The UK is caught in a suggestions loop:

-

Greater yields enhance the price of debt.

-

A wider deficit erodes investor belief.

-

Markets demand even greater yields.

This cycle seems similar to the UK bond crises of the Nineties, however with one essential distinction: immediately, debt-to-GDP is greater than twice as excessive.

What Might Break the Cycle?

The market message is evident: marginal tax modifications usually are not sufficient. To revive credibility, London should ship structural spending cuts, particularly in welfare and present expenditures. With out that, each gilts and sterling stay beneath stress.

The Financial institution of England additionally has restricted room. With steadiness sheet discount ongoing, its capability to clean long-end yields is constrained. That’s the reason the autumn Price range is the true check. Merchants will watch intently: both the federal government sends a robust sign of fiscal self-discipline, or markets will preserve promoting sterling rallies.

Chart View: GBP/USD with Weekly Pivots

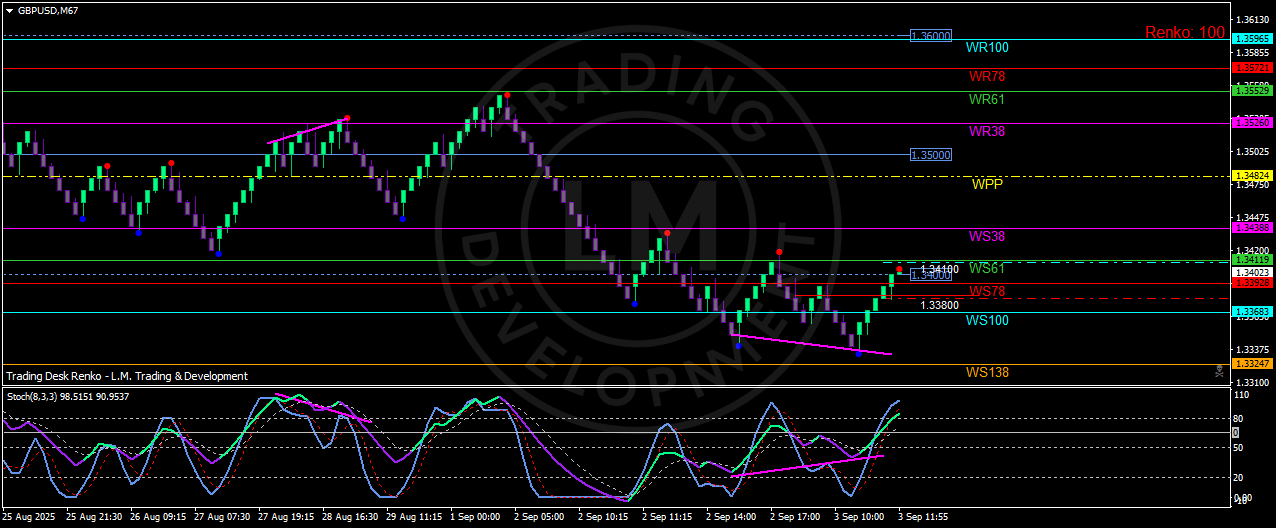

Now, let’s take a look at the chart facet. On a Renko GBP/USD M67 setup with weekly pivot ranges, the image is evident:

-

Resistance ranges:

-

1.3500 (psychological + WR38)

-

1.3525–1.3550 (WR61)

-

1.3595–1.3600 (WR100, high vary)

-

-

Help ranges:

The Stochastic (8,3,3) is already deep in overbought (>90), suggesting the present bounce is dropping momentum.

Buying and selling Situations

-

Bearish bias: So long as GBP/USD trades beneath 1.3500, sellers stay in management. A rejection right here might push the pair again in the direction of 1.3380 after which 1.3325.

-

Bullish state of affairs: Solely a decisive shut above 1.3525–1.3550 would unlock additional upside in the direction of 1.3600. Till then, rallies are suspect.

-

Impartial setup: Between 1.3380 and 1.3500, the pair stays uneven. Merchants might want to attend for a breakout affirmation earlier than committing.

Conclusion

The UK is going through fiscal stress that markets can not ignore. Gilt yields are rising, not due to booming development, however as a result of traders demand the next danger premium. That weighs immediately on sterling, and GBP/USD displays it clearly.

For us merchants, the important thing takeaway is straightforward: fundamentals and technicals are aligned. Macro doubts weaken the pound, whereas the chart reveals sturdy resistance close to 1.35. Except London regains fiscal credibility quickly, each sterling rally could also be a chance to fade.

This evaluation displays a private view for instructional functions solely. It isn’t monetary recommendation