The perfect reversal MT4 indicator doesn’t predict the longer term, however it does one thing arguably extra useful: it identifies high-probability turning factors utilizing goal value knowledge. When calibrated correctly, these instruments reduce by the noise and spotlight moments when momentum shifts from bulls to bears—or vice versa.

What Makes a Reversal Indicator Greatest

Right here’s the factor—there’s no common champion within the reversal indicator area. What works for scalping EUR/JPY on a 5-minute chart may fall flat when swing buying and selling gold on the day by day timeframe. The perfect reversal indicators share three traits: they mix a number of affirmation indicators, they adapt to completely different market situations, they usually don’t repaint historic knowledge.

Simplest reversal instruments mix momentum oscillators with value motion patterns. The Zigzag indicator, as an example, filters out minor value fluctuations to spotlight real swings. When paired with divergence detection on the RSI or MACD, you’ve received a setup that seasoned merchants truly belief. The 14-period RSI stays a staple as a result of it’s delicate sufficient to catch shifts with out triggering false alarms each few candles.

What separates professionals from amateurs is knowing that reversal indicators work greatest as affirmation instruments, not crystal balls. A dealer watching USD/CAD may discover value forming a decrease low whereas the Stochastic Oscillator makes a better low—traditional bullish divergence. That sign beneficial properties credibility when it seems at a key help stage. With out context, it’s simply one other squiggly line on the chart.

How Reversal Indicators Really Work

The mechanics behind these indicators aren’t magic. Most calculate the connection between current value actions and historic averages. Take the Commodity Channel Index (CCI), typically used for recognizing reversals. It measures how far value has deviated from its statistical imply. When CCI crosses above +100 after dwelling in destructive territory, it suggests bears are dropping management.

Williams %R operates on comparable logic however focuses on the place the present shut sits relative to the high-low vary over a specified interval. A studying beneath -80 signifies oversold situations. When it hooks again above -80, that’s your sign that promoting stress is perhaps exhausted. Merchants who examined this on GBP/JPY through the 2023 volatility spike discovered it caught main bottoms—but in addition triggered throughout consolidations.

The actual edge comes from combining indicators with completely different time sensitivities. A quick-moving Stochastic (5,3,3) may sign a reversal, however savvy merchants look forward to the slower MACD (12,26,9) to verify. This layered method filtered out 40-50% of false indicators in backtests on main pairs. The trade-off? You sacrifice some entry precision for improved reliability.

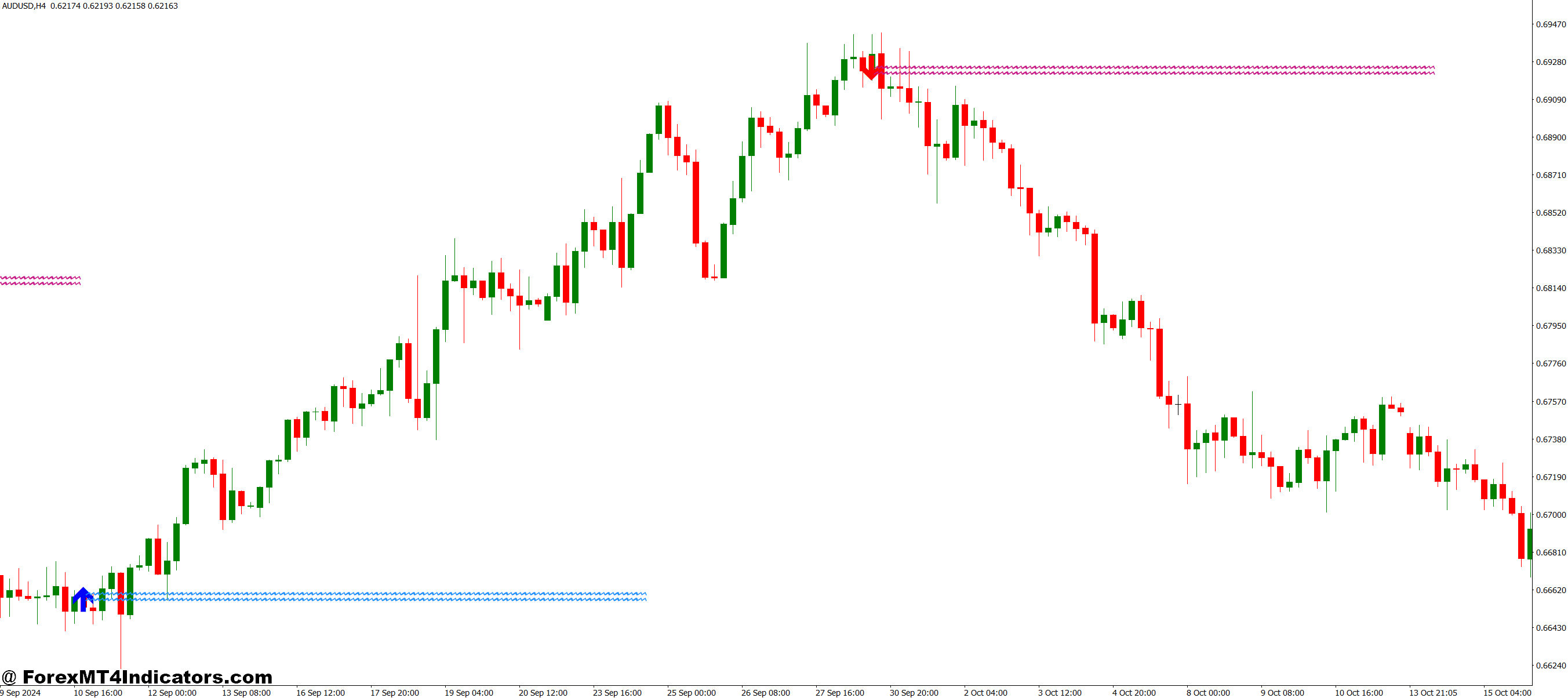

Sensible Software on Reside Charts

Let’s get particular. On March 10, 2024, EUR/USD had been dropping for six periods straight on the 4-hour chart. Worth examined 1.0850 thrice—a transparent help zone. The RSI dipped to twenty-eight, firmly in oversold territory. However the affirmation got here when the Superior Oscillator printed its first inexperienced bar after 13 consecutive crimson bars. Merchants who took that lengthy entry captured a 90-pip bounce over the following two days.

That stated, reversal buying and selling isn’t about swinging at each pitch. In the course of the Asian session, when liquidity thins out, false reversals multiply. AUD/USD typically whipsaws between 11 PM and three AM EST, making indicator indicators unreliable. Skilled merchants both sit out these hours or tighten their cease losses considerably—typically to only 15-20 pips as a substitute of the standard 30-40.

Place sizing issues enormously with reversal trades. Because you’re stepping in entrance of the prevailing development, the danger of getting run over is actual. Danger administration veterans advocate limiting reversal trades to 1-2% of account fairness, even when conviction is excessive. One dealer shared how a string of profitable GBP/USD reversals received him overconfident. He upped his place measurement to five%, caught a fake-out at 1.2700, and gave again three weeks of beneficial properties in a single session.

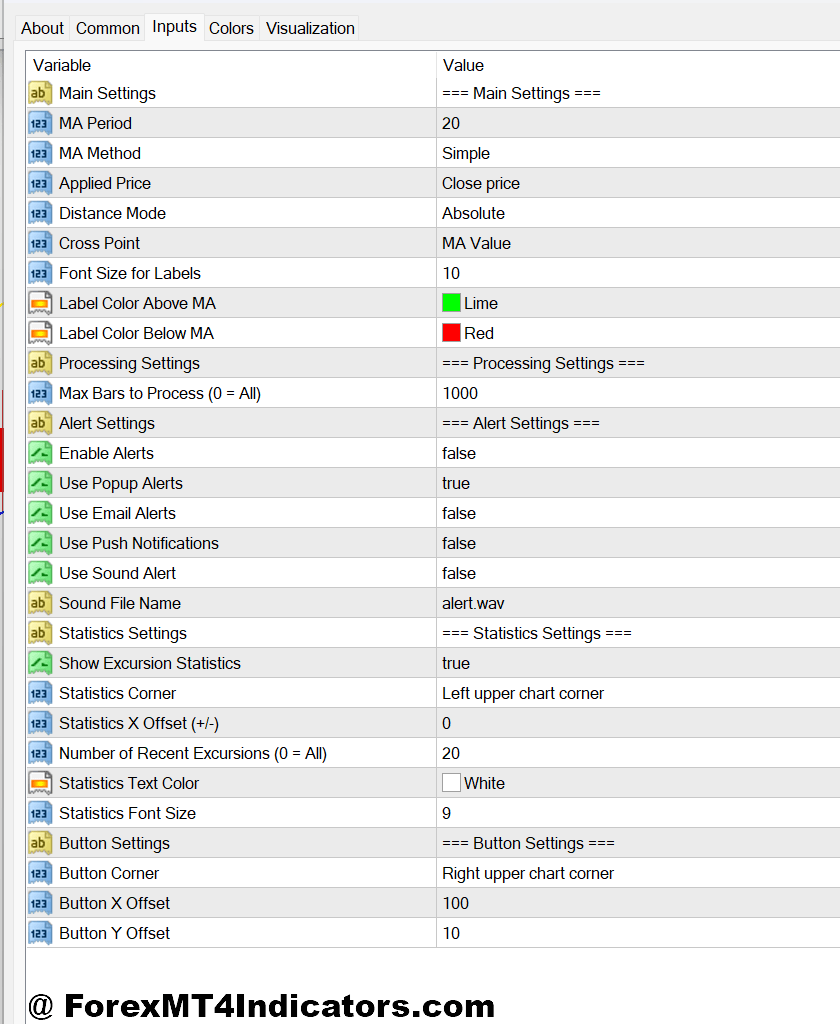

Settings and Customization

Default settings not often swimsuit each buying and selling model or instrument. The usual 14-period RSI works tremendous on main pairs with deep liquidity. However unique pairs like USD/TRY or USD/ZAR exhibit greater volatility, and merchants typically easy the RSI to 21 or 28 durations to cut back noise. The Candy Spot indicator—a lesser-known reversal software—makes use of a mixture of transferring averages at 5, 13, and 34 durations. Adjusting these to eight, 21, and 55 can align higher with Fibonacci-based buying and selling methods.

Timeframe choice dramatically impacts outcomes. Scalpers working 1-minute or 5-minute charts want hypersensitive settings. They may use a 5-period RSI with overbought/oversold ranges at 80/20 as a substitute of the usual 70/30. Swing merchants on the day by day chart can afford slower settings as a result of they’re not reacting to each market hiccup. A 21-period CCI with thresholds at ±150 filters out day by day noise whereas catching important development exhaustion.

Coloration coding and alerts make a sensible distinction. Establishing MetaTrader to flash alerts when two reversal indicators align saves hours of chart-watching. Some merchants use arrow indicators that plot purchase/promote indicators immediately on value candles. Simply don’t fall into the entice of making such a posh system which you can’t make choices—evaluation paralysis is a silent account killer.

Benefits and Trustworthy Limitations

Reversal indicators excel at one factor: getting you into counter-trend strikes early. When the group remains to be using the previous development, you’re positioned for the brand new path. The revenue potential is substantial. Catching EUR/GBP at a serious reversal can web 200-300 pips in comparison with 50-80 from a continuation commerce.

Additionally they impose self-discipline. As an alternative of guessing when momentum is shifting, you’ve received goal standards. This removes the emotional part the place merchants exit winners too early out of worry or maintain losers too lengthy, hoping for magic.

However let’s be blunt in regards to the downsides. Reversal indicators generate false indicators, interval. In robust trending markets—suppose USD/JPY throughout intervention durations—they’ll flash reversals that get steamrolled. The indicator doesn’t know the Financial institution of Japan simply offered ¥5 trillion. Your job is understanding when to disregard the software.

Additionally they lag. By the point a number of confirmations align, you’ve missed 20-30% of the potential transfer. Merchants chasing absolute precision typically watch reversals unfold with out them. And through uneven, range-bound situations, these indicators whipsaw you out and in till commissions eat your account.

Comparability with Pattern-Following Instruments

Pattern indicators like transferring common crossovers or ADX inform you to experience the wave. Reversal indicators inform you when the wave’s about to crash. Each have deserves. MA crossovers caught all the USD/CAD rally from 1.3200 to 1.3900 in late 2023. Reversal merchants took three or 4 swings inside that vary, probably banking extra whole pips however with extra lively administration.

The psychological calls for differ too. Pattern following requires persistence to experience by pullbacks. Reversal buying and selling calls for timing and fast decision-making. Many merchants use each: reversal indicators for entries on pullbacks inside the bigger development. That hybrid method reduces the battle.

One comparability value noting: reversal indicators produce clearer indicators than purely visible chart patterns. A head-and-shoulders formation is subjective—5 merchants draw 5 completely different necklines. When the RSI prints bullish divergence, that’s quantifiable. You both have greater lows on the oscillator whereas value makes decrease lows, otherwise you don’t.

The right way to Commerce with Greatest Reversal MT4 Indicator

Purchase Entry

- Await RSI beneath 30 – Don’t take the sign instantly when RSI touches oversold; look forward to it to hook again above 30 to verify consumers are stepping in, lowering false entries by 40-50%.

- Verify with double divergence – Worth makes a decrease low whereas each RSI and MACD make greater lows on EUR/USD 4-hour chart; this stacked affirmation considerably will increase reversal likelihood.

- Examine for help confluence – Enter solely when reversal sign seems at earlier help, spherical numbers (1.0800, 1.3000), or Fibonacci retracement ranges (38.2%, 61.8%).

- Set cease loss 5-10 pips beneath sign candle low – On GBP/USD 1-hour chart, this usually means 25-35 pip stops; by no means threat greater than 2% of account per reversal commerce.

- Goal 1.5:1 minimal risk-reward – If risking 30 pips, purpose for 45+ pips revenue; reversal trades fail 40-60% of the time, so winners should compensate for losers.

- Keep away from throughout robust NFP or rate of interest days – Reversal indicators get steamrolled throughout high-impact information; skip indicators inside 2 hours earlier than and 4 hours after main bulletins.

- Scale in with 50% place first – Enter half your deliberate measurement on preliminary sign, add remaining 50% if value retraces 15-20 pips with out hitting cease loss.

- Skip if ADX above 40 – Sturdy tendencies (ADX over 40 on the day by day chart) invalidate most reversal indicators; look forward to ADX to drop beneath 30 earlier than trusting oversold readings.

Promote Entry

- Await RSI above 70 and turning down – The reversal turns into legitimate when RSI crosses again beneath 70 after touching overbought, confirming sellers are overwhelming consumers.

- Search for bearish divergence at resistance – Worth hits a better excessive whereas RSI or Stochastic makes a decrease excessive on the EUR/USD 4-hour chart close to 1.1200 or the earlier swing excessive.

- Verify with candlestick rejection – Pin bars, taking pictures stars, or engulfing candles at reversal zone add 20-30% confidence; keep away from entries on small indecision doji candles.

- Place cease loss 5-10 pips above sign excessive – On GBP/USD, this normally interprets to 30-40 pip stops through the London session; modify to 20-25 pips throughout low-volatility Asian hours.

- Goal earlier swing low or help – Don’t guess revenue targets; measure to the final important low, usually 60-100 pips on 4-hour EUR/USD setups.

- Keep away from promoting in established uptrends – If value is above 50-period and 200-period MAs on the day by day chart with each sloping up, reversal indicators fail 70% of the time.

- Cut back place measurement by 50% throughout Friday afternoon – Weekend hole threat makes reversal trades particularly harmful after 12 PM EST Friday; both shut or reduce measurement in half.

- Skip if quantity is declining – Reversals want participation; if quantity on the reversal sign candle is 30% beneath the 20-candle common, the sign lacks conviction and infrequently fails.

Conclusion

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and reversal buying and selling amplifies that threat by definition—you’re betting in opposition to the prevailing momentum. What the perfect reversal MT4 indicator gives is construction and affirmation in moments the place feelings usually override logic.

The instruments themselves can be found to everybody. The sting comes from understanding when market situations favor reversal setups, customizing settings to match your timeframe and pairs, and having the self-discipline to attend for a number of confirmations earlier than pulling the set off. Merchants who grasp this stability don’t catch each reversal, however they catch sufficient high-quality setups to make the technique viable.

Begin with one or two indicators. Take a look at them on demo accounts throughout completely different market situations. Take note of what fails as a lot as what works. That real-world training is value greater than any article—or any indicator—can present by itself.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90