How I Made $63 At this time with Dynamic Overbought/Oversold Ranges

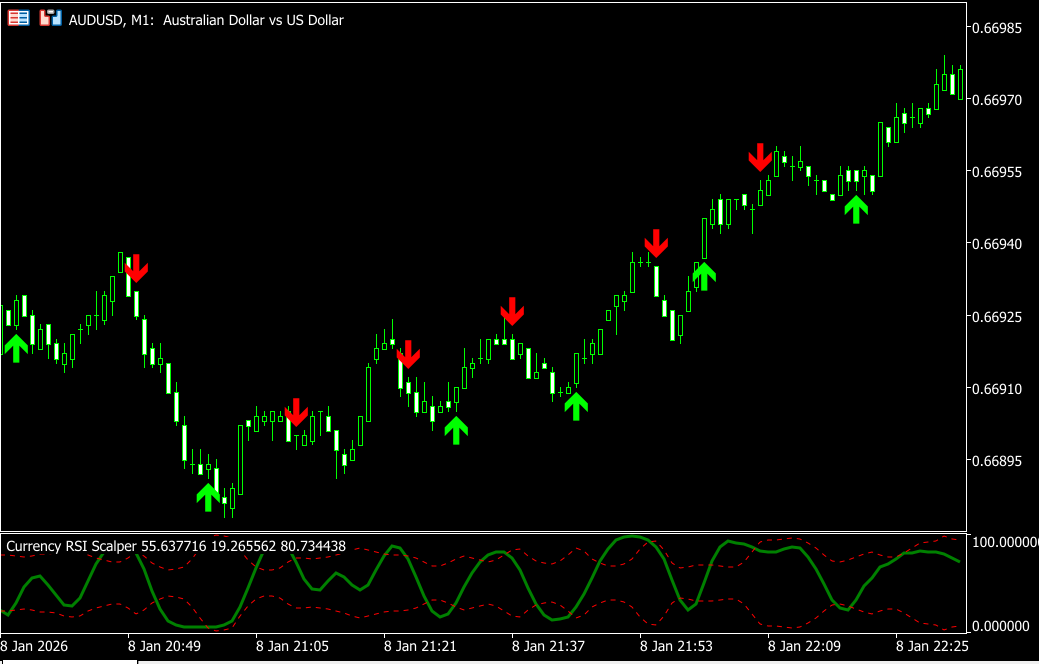

Guys, neglect the hype—as we speak I made +$63 buying and selling AUDUSD on the M1 chart utilizing only one device: Forex RSI Scalper. No AI, no magic—simply adaptive RSI logic that truly works in actual market situations.

My options on MQL5 Market: Evgeny Belyaev’s merchandise for merchants

Right here’s how I commerce it:

✅ Purchase sign: When the indicator line crosses the dynamic oversold stage upward. If I’m quick—shut it instantly.

✅ Promote sign: When the road crosses the dynamic overbought stage downward. Shut any longs.

🔥 If a number of alerts stack in the identical route? I add to my place—no want to shut the primary one.

⛔ Solely when an reverse sign seems do I shut all open trades in that route.

At this time’s session was textbook: fast, exact entries on AUDUSD M1, minimal display screen time, and +$63 in revenue earlier than lunch.

What makes Forex RSI Scalper completely different?

- It adapts its overbought/oversold ranges primarily based on present market volatility—in contrast to the basic RSI.

- No repainting: alerts lock in strictly on bar shut.

- Cellular alerts let me react quick—even after I’m not glued to the charts.

- Optimized for velocity: zero lag, even on M1.

If you happen to scalp main pairs like USDJPY or commerce crypto, this indicator is value a severe look:

Bear in mind: self-discipline > complexity. Persist with the foundations, use correct threat administration, and let the indicator do the heavy lifting.

Commerce good. Good luck on the market!