I’m excited to introduce Heiken Ashi Professional, an indicator designed to ship clear buying and selling indicators, clean value circulate, and noise-free charts.

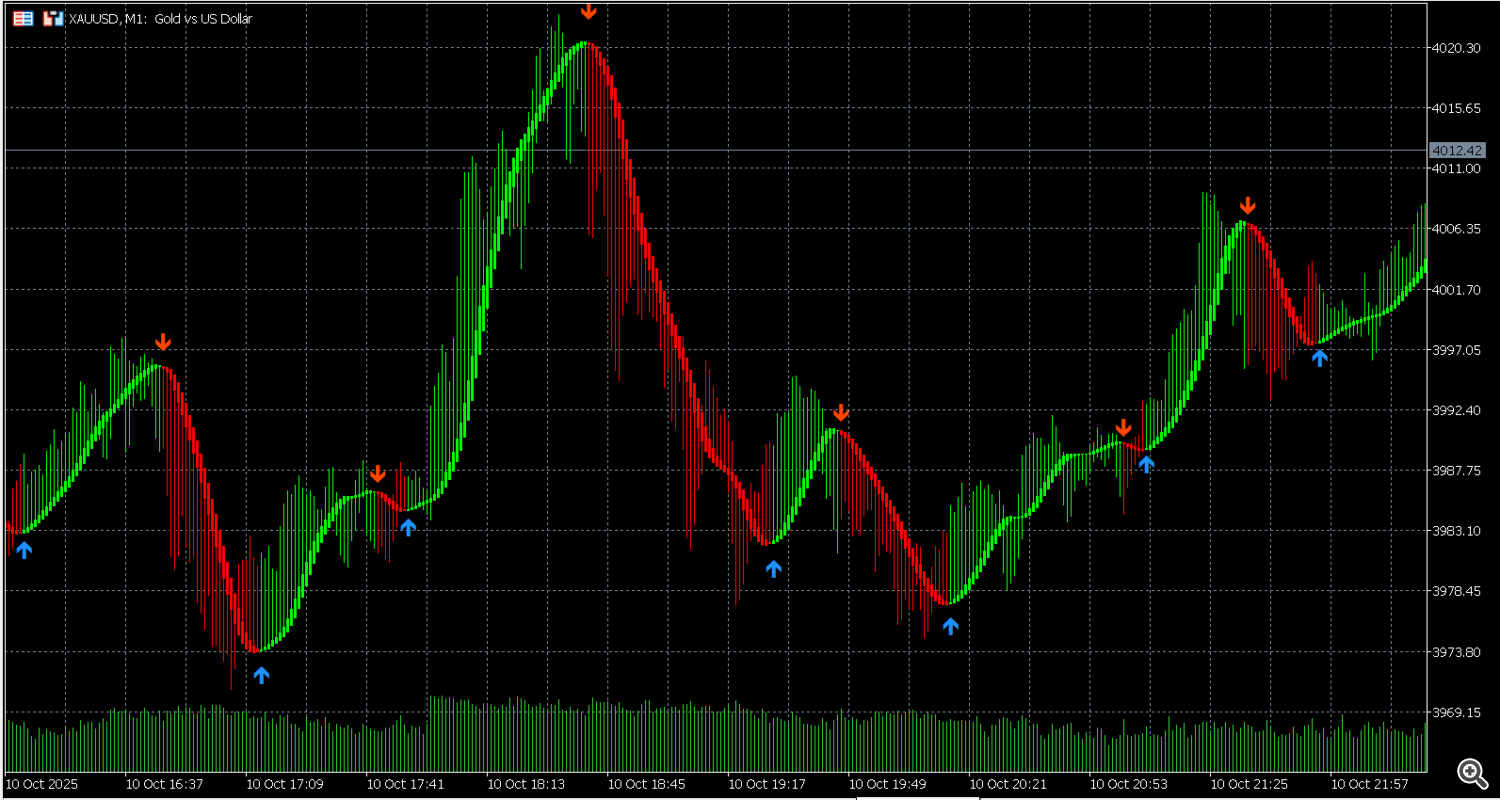

In Technique Model #2, Heiken Ashi Professional combines Heiken Ashi candles with HULL Transferring Common as its primary smoothing methodology.

From my preliminary backtests, the outcomes are really spectacular: smoother charts, cleaner development transitions, and fewer false indicators, giving merchants a clearer image of the market development — particularly on decrease timeframes.

⚙️ Key Inputs & Configuration

The indicator provides a clear and versatile enter panel that means that you can fine-tune its habits.

Listed below are the important thing adjustable parameters:

-

Present Heiken Ashi Candles — Allow or disable Heiken Ashi candles in your chart.

-

Smoothing Interval — Controls how a lot smoothing is utilized to cost knowledge (default: 50).

-

Smoothing Technique — Select between:

-

None — Uncooked Heiken Ashi calculation

-

EMA — Smoothed utilizing Exponential Transferring Common

-

HULL — Smoothed utilizing Hull Transferring Common for quicker but smoother response

-

(Be aware: the complete parameter listing and customization choices are accessible straight throughout the indicator settings in MetaTrader.)

💡 Why Heiken Ashi + HULL?

Heiken Ashi is already identified for its capability to clean out value motion and spotlight traits clearly.

Nevertheless, when used alone, it might nonetheless produce small fluctuations or false indicators throughout sideways markets.

HULL Transferring Common (HMA), however, is a sophisticated smoothing approach — extra responsive than EMA, but smoother and fewer lagging than SMA/EMA.

When mixed:

-

Heiken Ashi interprets value motion into smoother visible bars.

-

HULL additional refines this knowledge, producing clear colour transitions (inexperienced ↔ crimson) and a fantastically clean chart expertise.

In consequence:

-

The entry and exit indicators seem cleaner and extra dependable.

-

Noise is lowered, making it excellent for scalpers or short-term merchants who want readability in fast-moving markets.

🧭 Determination-Assist Options

-

ConfirmOnClosedBar — Confirms indicators solely after a bar closes, decreasing false alerts attributable to incomplete candles.

-

UseEMATrendFilter / UseFastSlowEMAFilter — Pattern filters that assist keep away from counter-trend entries (totally toggleable).

-

Alert Settings (Popup / E mail / Push) — Routinely notify you when a sign seems, saving time and enhancing commerce focus.

📊 Backtest Outcomes & Actual Expertise

From my preliminary exams throughout a number of pairs and timeframes, right here’s what I’ve discovered:

-

Indicators look smoother and extra constant.

-

Pattern phases are longer and extra secure, serving to with commerce administration (trailing or profit-taking).

-

False indicators drop considerably when utilizing ConfirmOnClosedBar and HULL smoothing.

After all, outcomes might fluctuate relying on the pair, timeframe, and danger administration — so I all the time suggest ahead testing or demo testing first earlier than going dwell.

🧠 Deliberate Enhancements & Group Suggestions

I’m all the time open to enhancing Heiken Ashi Professional additional.

Listed below are a couple of options presently into consideration:

-

Add extra smoothing strategies (e.g., WMA, T3, RMA).

-

Embrace alerts with advisable SL/TP zones based mostly on ATR.

-

Add choices for auto-hide EMA or multi-timeframe affirmation.

Which characteristic do you suppose would assist probably the most?

Your suggestions issues — I’ll prioritize updates based mostly on what the buying and selling neighborhood really wants.

🚀 Attempt It & Share Your Ideas

In case you’d like to check Heiken Ashi Professional, attempt the next:

-

Change between the totally different smoothing strategies (None / EMA / HULL) and evaluate how every one feels in your chart.

-

Allow ConfirmOnClosedBar and observe the distinction in sign high quality and frequency.

I’d love to listen to from you:

-

What pairs or devices do you often commerce?

-

Which timeframe works greatest on your technique?

-

Would you want me to launch a public demo model for backtesting?

Thanks for studying!

I’m genuinely excited to proceed enhancing Heiken Ashi Professional — a software constructed for clean, clear, and assured buying and selling.

Your suggestions will form the subsequent replace.