Beneath is the EB Weekly Market Report that I despatched out earlier to our EarningsBeats.com members. This gives you an thought of the depth of our weekly report, which is a really small piece of our common service choices. We known as each the inventory market high in February and inventory market backside in April, and inspired EB members to decrease danger on the time of the previous and improve danger on the time of the latter.

There is no such thing as a higher time to expertise our service for your self as we’re at present operating a FLASH SALE that provides a 20% low cost on annual memberships. The timing to affix could not be higher as I will be offering my Q3 outlook to all EB annual members at 5:30pm ET as we speak. A recording shall be supplied for many who can’t attend the session dwell. So in case you enroll later as we speak or tomorrow or the subsequent day, we’ll be sure to get a time-stamped copy of the recording.

Within the meantime, get pleasure from this complimentary copy of this week’s report….

ChartLists/Spreadsheets Up to date

The next ChartLists/Spreadsheets have been up to date over the weekend:

- Sturdy Earnings (SECL)

- Sturdy Future Earnings (SFECL)

- Sturdy AD (SADCL)

- Raised Steering (RGCL)

- Bullish Trifecta (BTCL)

- Brief Squeeze (SSCL)

- Main Shares (LSCL)

- Manipulation Spreadsheet*

*We continued so as to add extra shares to our Manipulation Spreadsheet and you may see that a number of have tabs, however don’t have knowledge but. These 3 are nonetheless “beneath development”. I additionally added a “Abstract” tab the place I’ve begun to type the person shares so as primarily based on a proprietary relative AD rating system. Do not ask me what it means but, as a result of it is nonetheless very a lot a piece in progress as properly. I am trying on the intraday relative efficiency of particular person shares vs. the benchmark S&P 500. So constructive percentages characterize higher intraday AD efficiency than the S&P 500, whereas damaging percentages characterize the alternative. One factor I will be watching is to see if stronger relative AD strains precede relative power in shares on a forward-looking foundation. It definitely did within the case of each Netflix (NFLX) and Microsoft (MSFT) from a number of weeks in the past once I identified what appeared to me to be important accumulation in March/April when the inventory market bottomed. Each NFLX and MSFT have soared since that point. I will preserve everybody posted on the progress of my analysis over the subsequent many weeks and months.

Weekly Market Recap

Main Indices

Sectors

Prime 10 Industries Final Week

Backside 10 Industries Final Week

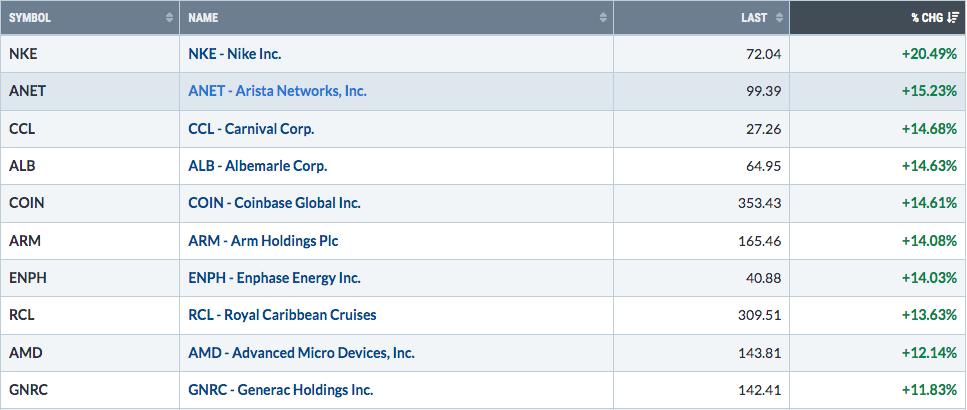

Prime 10 Shares – S&P 500/NASDAQ 100

Backside 10 Shares – S&P 500/NASDAQ 100

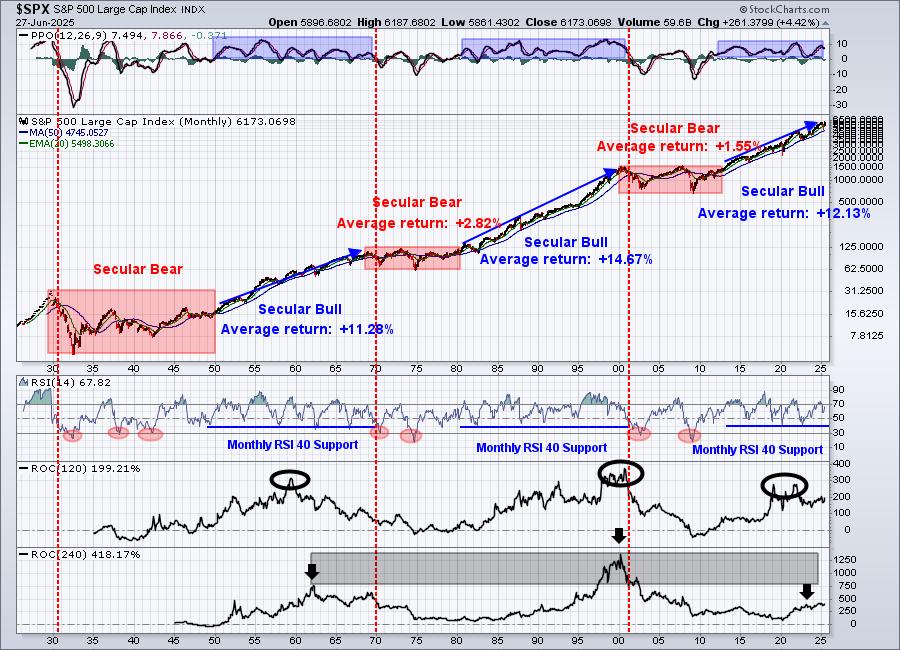

Huge Image

In case you’re a long-term investor, stepping again and searching on the inventory market utilizing this 100-year chart lets you keep away from pulling pointless promote triggers, due to the media, permabears, damaging nellie’s, and all of the “information” on the market. The above chart by no means as soon as flashed something remotely signaling a promote sign and now, right here we’re, again at all-time highs. Merely put, it filters out all of the noise that we hear on a day-to-day foundation and retains our wits about us.

Sustainability Ratios

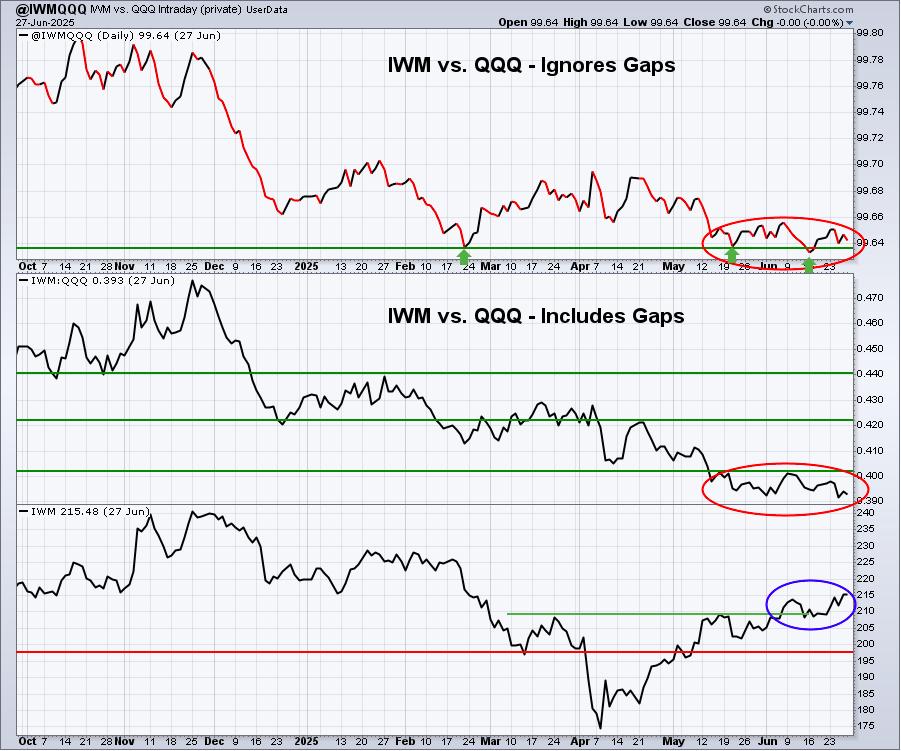

This is the newest take a look at our key intraday ratios as we comply with the place the cash is touring on an INTRADAY foundation (ignoring gaps):

QQQ:SPY

Absolute worth motion on each the S&P 500 and NASDAQ 100 has now seen all-time excessive breakouts, which alone is sort of bullish. We wish to see aggressive vs. defensive (or progress vs. worth) ratios transferring larger to point sustainability of any S&P 500 advance. In my opinion, we’re seeing that. However the intraday QQQ:SPY ratio continues to hesitate. A breakout on this intraday relative ratio would most positively add to the present bullish market atmosphere.

IWM:QQQ

I am seeing indicators of an impending price minimize by the Fed. Nevertheless, if I am being fully sincere, one sign that we must always see is outperformance in small caps and a rising IWM:QQQ ratio. That hasn’t occurred – a minimum of not but. If a price minimize begins to grow to be clearer, I’d completely anticipate to see far more relative power in small caps. Hold a watch out for that.

XLY:XLP

I pay very shut consideration to the XLY:XLP ratio and, extra particularly, this INTRADAY XLY:XLP ratio. This chart helped me really feel assured in calling a market high again in January/February. In case you recall, that is after we stated it was waaaaay too dangerous to be lengthy the U.S. inventory market. By the point we had bottomed in April, the blue-shaded space highlighted the truth that the XLY vs. XLP ratio had already begun to SOAR! That is why, on Friday, April eleventh, I stated I used to be ALL IN on the lengthy aspect once more.

These alerts are golden and, when used along with all of our different alerts, can present us extraordinarily useful clues about inventory market path. If these ratios start to show decrease in a giant means, then sure we’ll have to develop extra cautious. Nevertheless, proper now, they could not be any extra bullish. Count on larger costs forward.

Sentiment

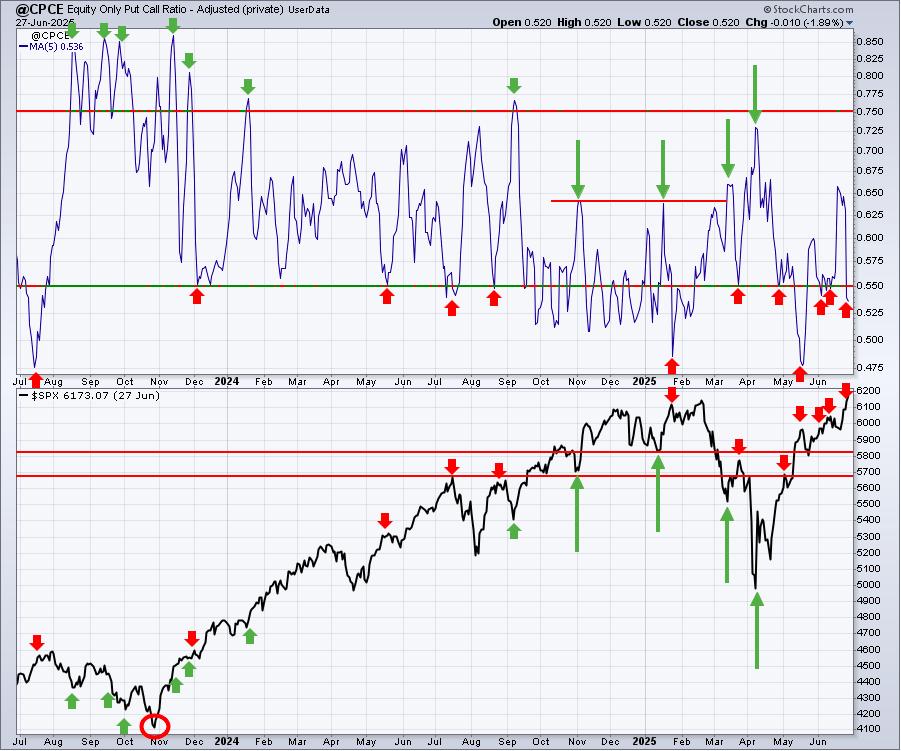

5-day SMA ($CPCE)

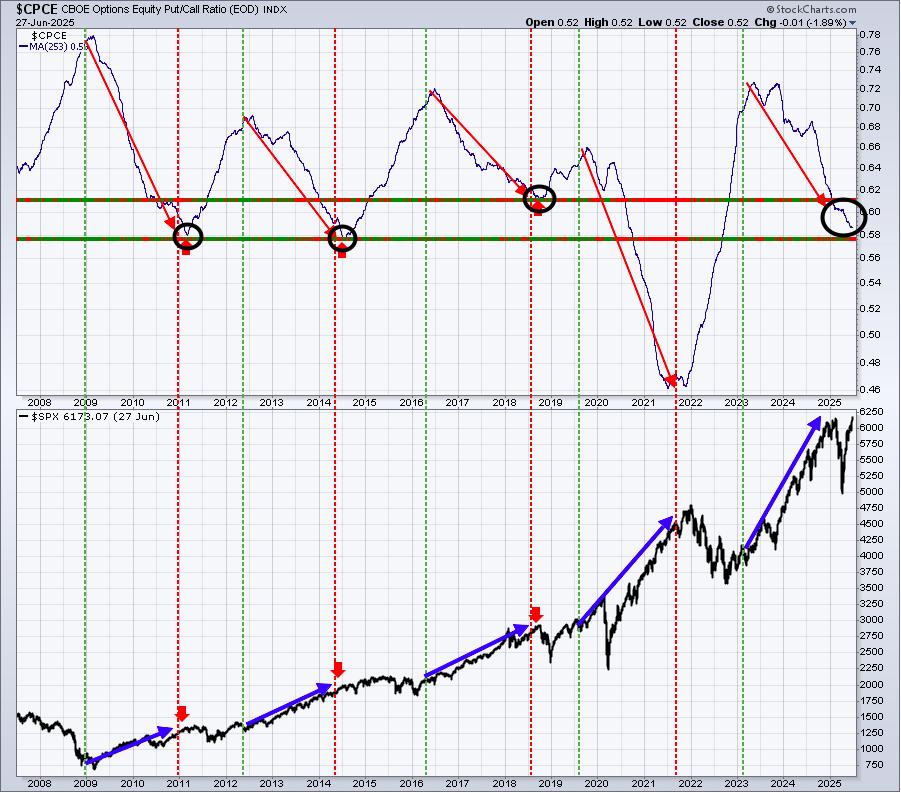

Sentiment indicators are contrarian indicators. Once they present excessive bullishness, we have to be a bit cautious and after they present excessive pessimism, it could possibly be time to grow to be far more aggressive. Main market bottoms are carved out when pessimism is at its absolute highest degree.

The S&P 500 had struggled a bit as soon as 5-day SMA readings of the CPCE fell to the .55 space, an indication of market complacency and a potential short-term high. We noticed a little bit of a pullback in June, which many occasions is all we get throughout a secular bull market advance. My sustainability ratios are supporting the next transfer by shares and I do know from historical past that overbought circumstances can stay overbought. I additionally know that sentiment does a significantly better job of calling bottoms than it does calling tops. That is why I can’t overreact each time this 5-day transferring common of the CPCE falls again under .55. Throughout This autumn 2024, we noticed loads of 5-day SMA readings under .55 and, whereas the S&P 500 was uneven, bullishness prevailed all through. So simply please at all times remember the fact that these 5-day SMA readings are our “velocity boat” sentiment indicator that adjustments fairly continuously. When it strains up with different bearish or topping alerts, we must always take word. However reacting to each refined transfer on this chart is a giant mistake, in my view.

253-day SMA ($CPCE)

This longer-term 253-day SMA of the CPCE is our “ocean-liner” sign, not like our speedboat indicator. This one normally supplies us a really strong long-term sign as the general market atmosphere strikes from certainly one of pessimism to complacency and vice versa. Take a look at the above chart. When the 253-day SMA is transferring decrease like it’s now, it accompanies our most bullish S&P 500 strikes. It makes excellent frequent sense as properly. As soon as this 253-day SMA strikes to extraordinarily excessive ranges and begins to roll over, the bears have already offered. We usually have nowhere to go on our main indices, besides larger as soon as sentiment turns into so bearish. The other holds true when the 253-day SMA reaches excessive complacency and begins to show larger. We noticed that to begin 2022, which, on the time, I acknowledged was my greatest concern as we began 2022. In case you recall, I stated to search for a 20-25% cyclical bear market over a 3-6 month interval on the primary Saturday in January 2022. The above chart was my greatest purpose for calling for such a giant selloff forward of the decline.

These charts matter.

Lengthy-Time period Commerce Setup

Since starting this Weekly Market Report in September 2023, I’ve mentioned the long-term commerce candidates under that I actually like. Usually, these shares have glorious long-term observe information, and plenty of pay good dividends that principally develop yearly. Solely in particular instances (exceptions) would I think about a long-term entry right into a inventory that has a poor or restricted long-term observe report and/or pays no dividends. Beneath is a fast recap of how these shares regarded one week in the past:

- JPM – difficult all-time excessive

- BA – substantial enchancment, wish to see 185-190 help maintain

- FFIV – very bullish motion above its 20-month SMA

- MA – very regular and bullish long-term performer

- GS – trending larger above 20-month EMA

- FDX – attempting to clear falling 20-week EMA

- AAPL – month-to-month RSI at 50, which has been a wonderful time to purchase AAPL over the previous twenty years

- CHRW – 85-90 is strong longer-term help

- JBHT – wish to see 120-125 help maintain

- STX – long-term breakout in play, glorious commerce

- HSY – breaking above 175 could be intermediate-term bullish

- DIS – now testing key worth resistance in 120-125 vary

- MSCI – month-to-month RSI hanging close to 50, strong entry

- SBUX – moved again above 50-week EMA, short-term bullish

- KRE – long-term uptrend stays in play

- ED – has been a strong income-producer and funding because the monetary disaster low in 2009

- AJG – few shares have been steadier to the upside over the previous decade

- NSC – continues to sideways consolidate in very bullish style

- RHI – trending down with potential sight set on 30

- ADM – appears to be like to be reversing larger off long-term worth help close to 43

- BG – 65-70 worth help held, now trying to clear 50-week SMA to the upside

- CVS – glorious help at 45 or simply under, simply failed on bounce at 50-month SMA at 72

- IPG – month-to-month RSI now at 37 and likewise testing 4-year worth help close to 22.50

- HRL – long-term worth help at 25 and inventory now exhibiting constructive divergence on month-to-month chart – bullish

- DE – one of many higher 2025 momentum shares on this checklist

Take into account that our Weekly Market Studies favor those that are extra within the long-term market image. Due to this fact, the checklist of shares above are shares that we consider are safer (however nothing is ever 100% protected) to personal with the long-term in thoughts. Almost every thing else we do at EarningsBeats.com favors short-term momentum buying and selling, so I needed to elucidate what we’re doing with this checklist and why it is completely different.

Additionally, please remember the fact that I am not a Registered Funding Advisor (and neither is EarningsBeats.com nor any of its workers) and am solely offering (principally) what I consider to be strong dividend-paying shares for the long run. Firms periodically undergo changes, new competitors, restructuring, administration adjustments, and many others. that may have detrimental long-term impacts. Neither the inventory worth nor the dividend is ever assured. I merely level out attention-grabbing inventory candidates for longer-term buyers. Do your due diligence and please seek the advice of together with your monetary advisor earlier than making any purchases or gross sales of securities.

Trying Forward

Upcoming Earnings

Only a few corporations will report quarterly outcomes till mid-April. The next checklist of corporations is NOT an inventory of all corporations scheduled to report quarterly earnings, nonetheless, simply key experiences, so please remember to test for earnings dates of any corporations that you simply personal. Any firm in BOLD represents a inventory in certainly one of our portfolios and the quantity in parenthesis represents the market capitalization of every firm listed:

- Monday: None

- Tuesday: STZ ($29 billion)

- Wednesday: None

- Thursday: None

- Friday: None

Key Financial Studies

- Monday: June Chicago PMI

- Tuesday: June PMI manufacturing, June ISM manufacturing, Could development spending, Could JOLTS

- Wednesday: June ADP employment report

- Thursday: Preliminary jobless claims, June nonfarm payrolls, unemployment price & common hourly earnings, Could manufacturing facility orders, June ISM providers

- Friday: None – inventory market closed in observance of Independence Day

Historic Information

I am a real inventory market historian. I’m completely PASSIONATE about learning inventory market historical past to offer us extra clues about seemingly inventory market path and potential sectors/industries/shares to commerce. Whereas I do not use historical past as a main indicator, I am at all times very conscious of it as a secondary indicator. I like it when historical past strains up with my technical alerts, offering me with far more confidence to make explicit trades.

Beneath you may discover the subsequent two weeks of historic knowledge and tendencies throughout the three key indices that I comply with most intently:

S&P 500 (since 1950)

- Jun 30: +34.34%

- Jul 1: +72.77%

- Jul 2: +16.76%

- Jul 3: +77.19%

- Jul 4: +0.00% (market closed – vacation)

- Jul 5: +39.40%

- Jul 6: +22.32%

- Jul 7: +17.62%

- Jul 8: -16.29%

- Jul 9: +76.54%

- Jul 10: -16.59%

- Jul 11: +13.23%

- Jul 12: +36.89%

- Jul 13: -5.67%

NASDAQ (since 1971)

- Jun 30: +73.30%

- Jul 1: +63.18%

- Jul 2: -47.43%

- Jul 3: +46.02%

- Jul 4: +0.00% (market closed – vacation)

- Jul 5: +7.04%

- Jul 6: -10.79%

- Jul 7: +60.19%

- Jul 8: -10.10%

- Jul 9: +86.44%

- Jul 10: -27.94%

- Jul 11: +11.18%

- Jul 12: +128.28%

- Jul 13: +61.52%

Russell 2000 (since 1987)

- Jun 30: +99.14%

- Jul 1: +30.53%

- Jul 2: -113.05%

- Jul 3: +44.57%

- Jul 4: +0.00% (market closed – vacation)

- Jul 5: -4.89%

- Jul 6: -76.61%

- Jul 7: +43.95%

- Jul 8: +37.24%

- Jul 9: +31.88%

- Jul 10: -17.39%

- Jul 11: +29.75%

- Jul 12: +89.15%

- Jul 13: +63.13%

The S&P 500 knowledge dates again to 1950, whereas the NASDAQ and Russell 2000 info date again to 1971 and 1987, respectively.

Last Ideas

All-time highs are at all times a time for me to say “I instructed you so” to the bears, since I have been a agency believer that we stay in a secular bull market advance – one through which we must always EXPECT to see larger costs and all-time highs. This newest rally is being absolutely supported by risk-on areas of the market, which is able to virtually definitely lead for increasingly more all-time highs down the street.

Listed here are a number of issues I am watching this week:

- Jobs. The ADP employment report shall be out on Wednesday and the more-closely-watched nonfarm payrolls shall be launched on Thursday this week because the inventory market is closed on Friday. ANY signal of weak spot in these experiences will start to place mounting stress on the Fed to chop charges in late July at their subsequent assembly.

- Technical Worth Motion. Any time we’re setting new all-time highs, I begin off with a bullish mindset. I solely flip bearish if I am inundated with warning alerts. At present, I see few of these.

- Historical past. We are able to now flip our consideration to imminent earnings season and, traditionally, that is a bullish factor. Pre-earnings season runs to the upside are frequent and, in case you scroll up and take a look at historic returns for days over the subsequent couple weeks, you may see that July usually performs properly – particularly the primary half of the month.

- 10-Yr Treasury Yield ($TNX). The ten-year treasury yield has been in decline for 3 straight weeks, falling from 4.52% on June ninth to 4.24% only a few minutes in the past. The cash rotating into bonds is a really sturdy sign that inflation is NOT an issue. It is also a sign that the Fed “needs to be” contemplating a price minimize at its subsequent assembly.

- Breakouts. We have seen massive breakouts in key areas like semiconductors ($DJUSSC), software program ($DJUSSW), and funding providers ($DJUSSB), however there shall be a lot extra. Journey & tourism ($DJUSTT) joined the occasion on Thursday. Banks ($DJUSBK) are on the verge of a breakout. The way in which I take a look at it? The extra the merrier!

Pleased buying and selling!

Tom