Ethereum is dealing with renewed promoting stress because the broader market struggles with worry, uncertainty, and rising bearish expectations. After weeks of weak point, many analysts at the moment are overtly calling for a protracted bear market stretching into 2026, arguing that Ethereum stays beneath key structural ranges and lacks robust momentum.

Associated Studying

Bulls are trying to defend the $2,800 mark, a stage that has turn out to be vital for sustaining short-term confidence, however worth motion continues to replicate hesitation fairly than conviction. Volatility stays elevated, and market sentiment is dominated by warning fairly than optimism.

In opposition to this fragile backdrop, on-chain information reveals a notable divergence between worth motion and conduct from skilled market contributors. In keeping with information from Hyperdash, the Bitcoin OG, identified for shorting the market throughout the October 10 crash, has as soon as once more elevated his publicity to Ethereum.

This dealer, broadly adopted for his high-conviction and well-timed positioning, simply added one other 12,406 ETH to his lengthy positions, signaling confidence at present worth ranges regardless of the prevailing bearish narrative.

Whereas retail sentiment weakens and analysts debate deeper draw back situations, strategic accumulation by seasoned gamers means that Ethereum could also be approaching a decisive section. Whether or not this marks early positioning forward of a restoration or a high-risk guess in a deteriorating market stays the important thing query forward.

A Excessive-Conviction Guess Below Stress

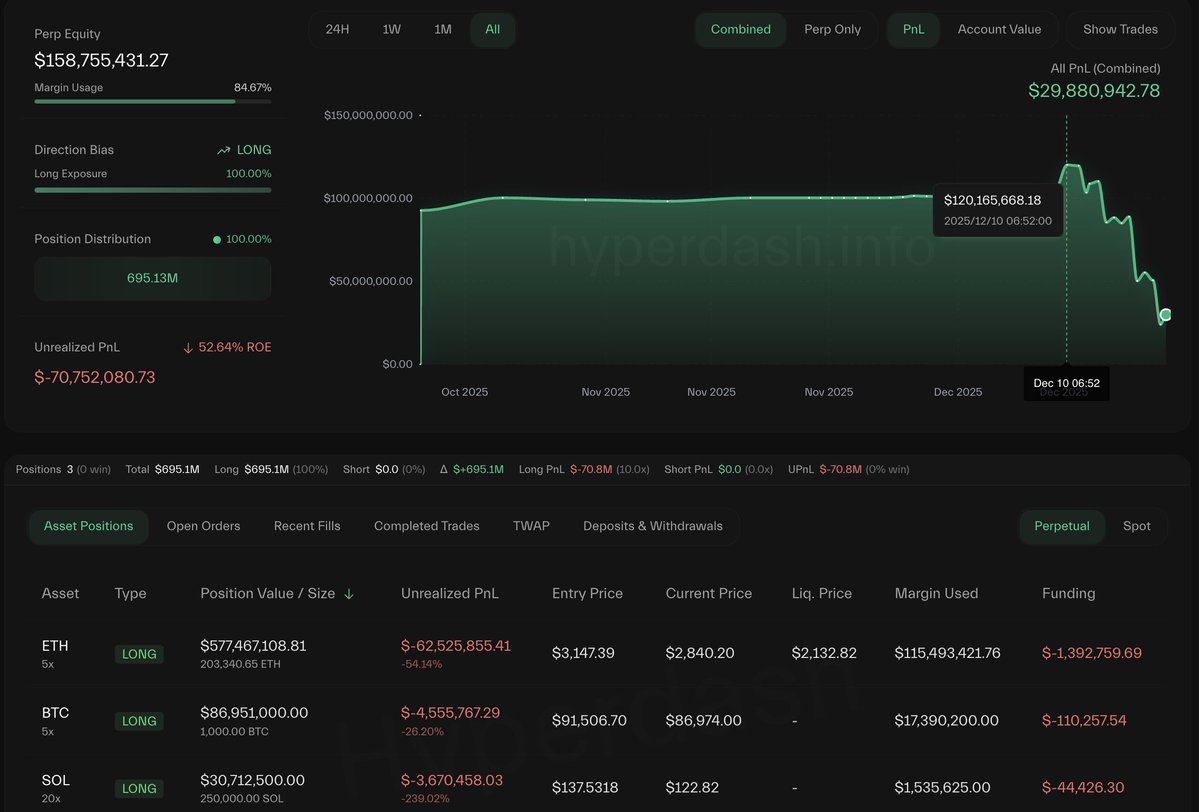

Lookonchain reviews that the Bitcoin OG continues to carry substantial, high-conviction positions throughout a number of belongings, regardless of the continuing market weak point. In keeping with the newest information, his present publicity contains 203,341 ETH valued at roughly $577.5 million, 1,000 BTC price round $87 million, and 250,000 SOL valued close to $30.7 million. This stage of focus highlights a willingness to endure vital volatility fairly than scale back danger in an more and more unsure atmosphere.

That conviction, nevertheless, has include significant drawdowns. The pockets is now down greater than $70 million from its peak. At one level, unrealized earnings exceeded $120 million, however current worth declines have decreased that determine to lower than $30 million. The swing illustrates how rapidly market situations can shift, even for merchants with a robust observe document and well-timed entries up to now.

From a broader market perspective, this positioning displays a pointy distinction between sentiment and conduct. Whereas many contributors have turned defensive and analysts debate the chance of a protracted bear market, this pockets stays closely uncovered, suggesting a perception that present ranges should provide uneven upside. On the similar time, the drawdown serves as a transparent reminder that dimension and conviction don’t take away danger in a structurally fragile market.

Associated Studying

Ethereum Exams Structural Help Amid Rising Stress

Ethereum’s weekly chart highlights a transparent lack of momentum after the rejection close to the $4,800–$5,000 area, adopted by a pointy retracement towards the $2,800–$2,900 zone. Value is at the moment buying and selling beneath the 50-week shifting common and hovering close to the 100-week MA, a stage that traditionally acts as an vital inflection level for medium-term development route. The failure to carry above the short-term averages confirms that sellers have regained management of the construction.

From a development perspective, ETH stays above the rising 200-week shifting common, which continues to outline the long-term bullish framework. Nevertheless, the widening hole between the quicker and slower averages has began to compress, signaling a transition section fairly than development continuation. Quantity has expanded on down weeks, reinforcing the concept that current draw back strikes are pushed by lively distribution fairly than passive consolidation.

Associated Studying

The $2,800 space now represents a vital demand zone. A sustained maintain above this stage would counsel that the correction is a managed pullback inside a broader vary. Conversely, a weekly shut beneath it could expose ETH to a deeper retracement towards the $2,400–$2,500 area, the place the 200-week MA and prior consolidation converge.

General, the chart displays a market caught between long-term structural help and short-term bearish momentum. Ethereum wants a decisive reclaim of the 50-week shifting common to neutralize draw back danger and restore confidence in development continuation.

Featured picture from ChatGPT, chart from TradingView.com