Bitcoin is navigating a important juncture after reaching a brand new all-time excessive of $124,500 final week earlier than rapidly retreating. The worth is now trying to find assist, with volatility intensifying and merchants debating whether or not that is the beginning of a deeper correction or just a wholesome consolidation section earlier than continuation. Some analysts stay optimistic, seeing this pullback as a pure reset in an overheated market, whereas others argue that momentum is fading as bearish indicators emerge.

Associated Studying

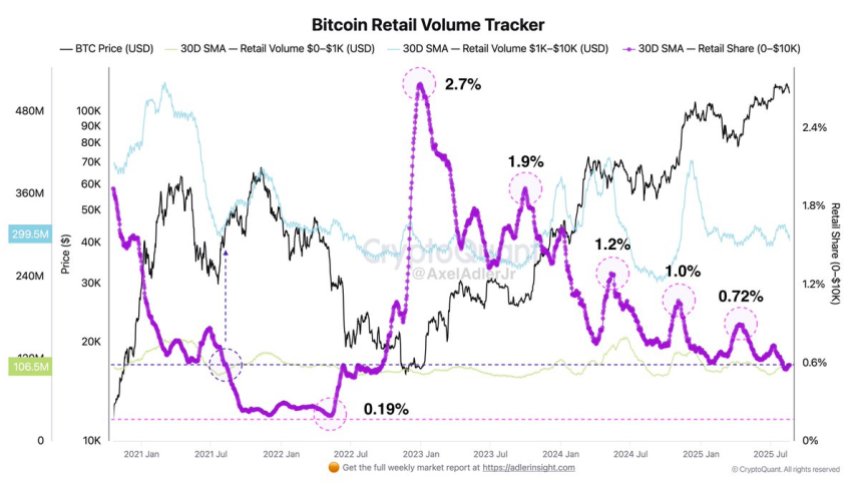

Including weight to the dialogue, CryptoQuant analyst Axel Adler highlighted a key development in retail participation. The share of retail transfers within the $0–$10K vary inside Bitcoin’s whole USD turnover has been steadily declining all through this cycle. From a peak of two.7%, the share has now dropped to simply 0.6%.

Traditionally, such declines in retail participation have coincided with the later levels of bull cycles. This dynamic raises questions on whether or not the present section marks a cooling of retail enthusiasm at a important time for Bitcoin, as institutional and long-term holders dominate market construction.

Bitcoin Retail Exercise Declines as Market Cools

In accordance with CryptoQuant analyst Axel Adler, whereas the share of retail exercise in Bitcoin’s community has dropped sharply, in absolute phrases it nonetheless stays vital. Retail transfers within the $0–$10K vary quantity to over $400 million per day, however this represents solely 0.6% of whole USD turnover throughout the community. This shrinking share highlights a transparent development: whereas small buyers are nonetheless lively, their relative impression on general market flows is diminishing.

Adler notes that this cooling of retail demand was additionally noticed in autumn 2021, on the peak of the earlier cycle. At the moment, the retail share fell to a historic low of simply 0.19%, coinciding with overheated market situations and marking the ultimate levels of that bull cycle. The present decline in retail participation mirrors that sample, suggesting that the market could possibly be approaching the same late-cycle atmosphere.

This dynamic is vital as a result of retail buyers have historically been a powerful driver of momentum throughout bull markets. With their decreased affect, institutional flows, long-term holders, and treasury methods now play an excellent better function in shaping market route. The approaching weeks will likely be important as altcoins, led by Ethereum, present renewed power. ETH is approaching its 2021 all-time excessive, and lots of analysts imagine that its efficiency may dictate the broader crypto market’s subsequent transfer.

If retail demand continues to fade whereas institutional accumulation grows, Bitcoin might consolidate additional, whereas capital rotation towards altcoins features momentum.

Associated Studying

Bulls Defend Key Demand Stage

The 8-hour chart reveals Bitcoin (BTC) underneath stress because it trades close to $113,400, struggling to carry above its 200-day transferring common (crimson line), at the moment aligned round $113,416. This degree has turn into a important assist zone after BTC didn’t maintain momentum above the $123,217 resistance, which has acted as a transparent rejection level a number of occasions this cycle.

Shorter-term transferring averages spotlight the bearish momentum. The 50-day SMA (blue) at $117,017 and the 100-day SMA (inexperienced) at $117,087 are each trending above the present worth, creating overhead resistance. The breakdown beneath these averages confirms a weakening development, with BTC struggling to regain misplaced floor. Worth motion additionally reveals a sequence of decrease highs and decrease lows for the reason that rejection on the $124K zone, reinforcing bearish short-term sentiment.

Associated Studying

For bulls, reclaiming the 100-day SMA close to $117K could be key to reversing momentum and reattempting a push towards the $120K–$123K vary. Failure to carry the 200-day SMA dangers accelerating draw back, doubtlessly opening the trail towards $110K, a serious psychological degree.

Featured picture from Dall-E, chart from TradingView