Bitcoin has struggled under the $90,000 degree since final week and is now making an attempt to stabilize as promoting strain continues to form market sentiment. The sharp downturn from the latest cycle excessive has left bullish merchants on the defensive, with confidence weakening throughout spot and derivatives markets. Analysts who simply weeks in the past projected continuation towards new all-time highs at the moment are shifting their tone, with many calling for the start of a bear market.

Associated Studying

The broader market setting has amplified these issues. Momentum has flipped downward, liquidity has thinned, and consumers have been unable to reclaim key resistance ranges that may sign energy. As Bitcoin searches for assist, traders at the moment are watching reactions across the high-$80K area to find out whether or not this decline is a part of a deeper structural reversal or a brief correction inside the bigger pattern.

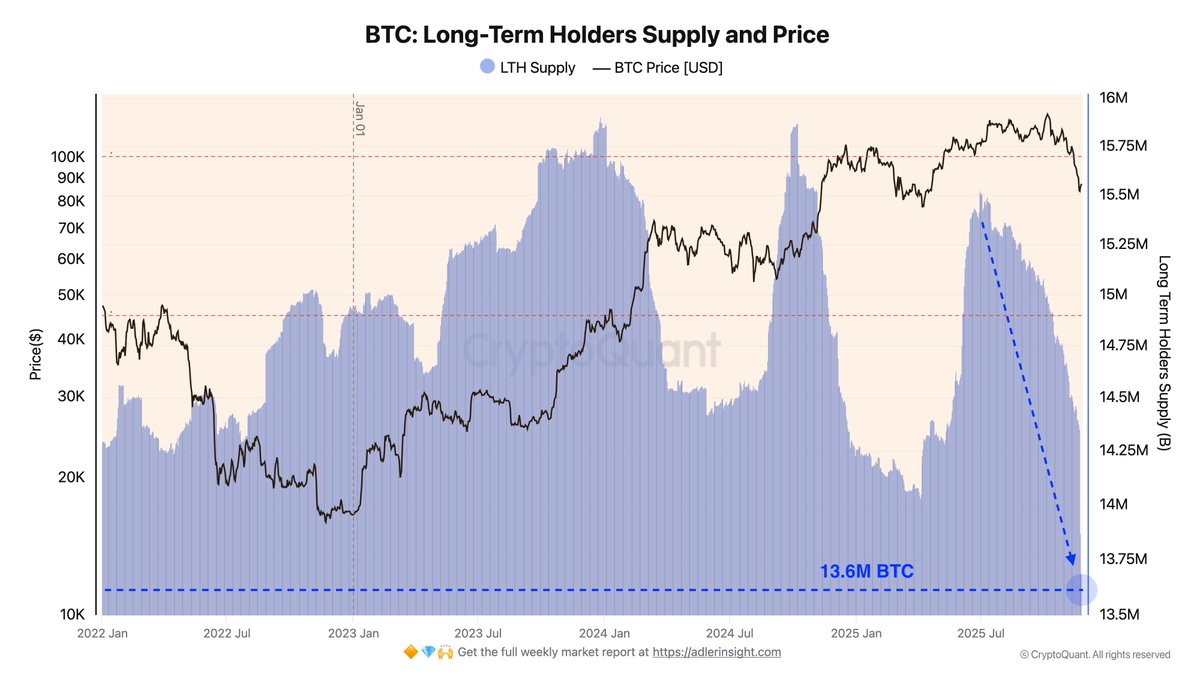

In accordance with high analyst Axel Adler, Lengthy-Time period Holders have performed a pivotal position within the present downturn. He studies that this cohort performed the most important profit-taking occasion of all the cycle, decreasing positions by 1.57 million BTC over the quarter as costs fell towards $80,000. This scale of distribution traditionally aligns with exhaustion phases and late-cycle tops, intensifying hypothesis that Bitcoin could also be coming into a extra extended interval of weak point.

Lengthy-Time period Holder Distribution Alerts Main Cycle Shift

Axel Adler highlights that Lengthy-Time period Holders (LTH) are conducting large profit-taking, pushing provide ranges again to early 2023 lows. In accordance with his knowledge, the 30-day Internet Place Change now displays one of many deepest sell-offs seen in all the bull cycle. LTH provide has fallen sharply from the height of 15.75 million BTC to the present 13.6 million BTC—marking the bottom studying for the reason that starting of the cycle. Adler notes that this sample aligns with a traditional smart-money distribution section usually noticed close to main market tops.

Over simply the previous two weeks (November 11–25), LTH offered 803,399 BTC, representing a drop of 5.54% and averaging 53,560 BTC per day. Traditionally, such compression in provide has solely occurred throughout main inflection durations.

Adler compares the present studying to earlier extremes—March 2024, following the $73,000 all-time excessive sell-off, and October 2024, when Bitcoin corrected from the ATH towards $85,000. The current section demonstrates aggressive coin dumping, with deeply damaging purple bars on the Internet Place Change whereas value concurrently declined from the October peak.

This mixture of speedy provide discount and falling value means that LTH distribution is exerting significant strain available on the market. The info implies that the cycle could also be transitioning towards a structurally weaker section except new demand re-enters to soak up the sell-side quantity.

Associated Studying

BTC Makes an attempt Stabilization After Sharp Breakdown

Bitcoin’s value motion on the every day chart reveals a market struggling to regain footing after a steep decline from the $120K area to a latest low close to $80K. The present buying and selling degree round $86,800 displays an tried reduction bounce, but the broader pattern stays clearly bearish.

Worth is positioned under the 50-day, 100-day, and 200-day transferring averages, all of which at the moment are sloping downward—a construction that sometimes indicators sustained draw back momentum. The rejection from the mid-November breakdown zone reinforces the concept that former assist has flipped into resistance.

Associated Studying

Quantity spikes throughout the selloff point out pressured liquidation and capitulation-driven promoting reasonably than orderly distribution, whereas the latest bounce has occurred on noticeably lighter quantity, suggesting weak conviction from consumers.

For bulls, the important thing focus is whether or not Bitcoin can construct a base above the $85K area to keep away from one other wave of promoting strain. Dropping this degree may expose additional draw back towards $78K and doubtlessly $72K.

Featured picture from ChatGPT, chart from TradingView.com