MarketKing

When buying and selling a number of currencies, one of many key benefits is the potential for diversification. If one forex pair is experiencing a loss, there’s a sturdy chance that one other forex pair could also be performing properly, thus balancing your total portfolio. That is largely because of the correlation between completely different forex pairs.

Buying and selling with A number of Currencies Utilizing an EA

Utilizing this Professional Advisor (EA) to commerce a number of forex pairs concurrently, equivalent to GBP/USD, AUD/USD, and GBP/AUD, could be an efficient technique for managing threat and optimizing returns. Right here’s how this strategy works:

Advantages of Buying and selling A number of Forex Pairs

-

Diversification: By buying and selling completely different forex pairs, you’ll be able to unfold your threat. If one pair is underperforming, the good points from one other pair can assist offset these losses.

-

Micro Lot Measurement: Buying and selling with micro lot sizes (1,000 items of the bottom forex) permits for decrease drawdown and extra environment friendly threat administration. That is notably helpful for merchants who wish to decrease their publicity whereas nonetheless collaborating within the foreign exchange market.

-

Automated Buying and selling: This EA can automate the buying and selling course of, executing trades based mostly on predefined methods and parameters. This can assist in sustaining self-discipline and consistency in buying and selling choices.

EA operates when the worth is ‘overbought’ situation, it’s prone to decline, signaling a superb alternative to promote. Conversely, when the worth is ‘oversold,’ it signifies a possible rise, suggesting it’s a good time to purchase. This technique aligns with the primary buying and selling rule of shopping for at low costs and promoting at excessive costs.

Bollinger Bands and Stochastic Oscillator Buying and selling Technique

The Bollinger Bands (BB) and Stochastic Oscillator technique is a well-liked buying and selling strategy that mixes these two highly effective indicators to establish potential entry out there. Right here’s how this technique works:

Understanding the Indicators

-

Bollinger Bands: This indicator consists of a center band (the straightforward shifting common) and two outer bands that symbolize volatility. The gap between the bands varies based mostly on market circumstances. When the worth approaches the higher band, it could point out that the asset is overbought, whereas approaching the decrease band suggests it could be oversold .

-

Stochastic Oscillator: This momentum indicator compares a selected closing value of an asset to a variety of its costs over a sure interval. It generates values between 0 and 100, with readings beneath 20 indicating oversold circumstances and above 80 indicating overbought conditions.

-

Common True Vary (ATR)

The Common True Vary (ATR) is a extensively used technical indicator that measures market volatility. It offers merchants with insights into how a lot a forex pair or asset usually strikes over a specified interval, which could be essential for making knowledgeable buying and selling choices.

Makes use of of ATR

Trailing Stops: One of the first functions of ATR is in setting trailing stops. A trailing cease is a dynamic stop-loss order that strikes with the market value, permitting merchants to lock in income whereas giving the commerce room to develop. Through the use of ATR, merchants can determine an applicable distance for the trailing cease based mostly on present market volatility. For instance, a standard technique is to set the trailing cease at a a number of of the ATR beneath the present value in an uptrend.

Measuring Volatility: ATR quantifies volatility by calculating the common vary of value actions over a selected timeframe. This helps merchants perceive whether or not the market is experiencing excessive or low volatility, which may affect their buying and selling methods. In unstable markets, merchants may select to implement wider stops to accommodate bigger value swings .

Understanding EA Parameters

Professional Advisors (EAs) are automated buying and selling techniques utilized in Foreign currency trading to execute methods with out human intervention. The effectiveness of an EA largely relies on its parameters, which may considerably affect buying and selling efficiency.

Key Parameters for EAs

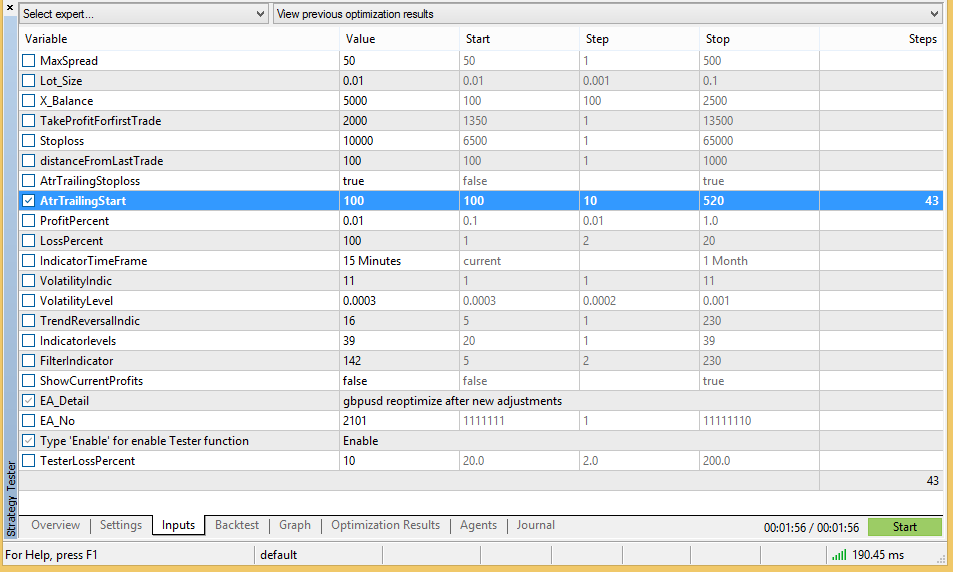

TakeProfitForfirstTrade: EA create TP for first purchase or promote commerce

ProfitPercent : P.c of Revenue of complete purchase or promote commerce individually and shut on complete stability p.c.

LossPercent : P.c of Revenue of complete purchase or promote commerce individually and shut on complete stability p.c.

Stoploss : Cease-losses for each open commerce after first commerce.

AtrTrailingStart : Pip factors from present bid value for purchase and ask value for promote

-

Max-spread : Most unfold value for open new commerce.

-

Lot Measurement: This parameter determines the scale of every commerce. Adjusting the lot measurement can have an effect on the general threat and potential return of the buying and selling technique.

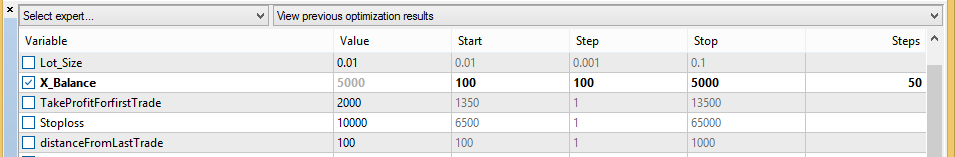

X_Balance : Stability choose for commerce.

Lot_Size : Lot measurement choose for commerce.

-

Danger Administration Settings: Parameters associated to threat administration, equivalent to most drawdown and risk-to-reward ratio, are important for sustaining a sustainable buying and selling strategy.

-

Timeframes: The timeframe settings for the EA may also be a parameter that influences how trades are executed. Completely different methods might carry out higher on completely different timeframes.

-

Optimization Algorithms: Using optimization algorithms can assist in dynamically adjusting EA parameters to search out the simplest settings for various market circumstances .

DistanceFromLastTrade : pip distinction kind final purchase open commerce for purchase commerce and identical for promote commerce.

IndicatorTimeFrame : Time frame for indicators.

VolatilityIndic : Atr worth.

VolatilityLevel : ranges for volatility measure with Atr.

FilterIndicator : Bollanger Bands worth, use for alerts filter.

TrendReversalIndic : Modified Stochastic indicator values.

Indicatorlevels : Ranges of indicators for overbuy and oversell.

EA_Detail : feedback about ea.

EA_No : Magic quantity.

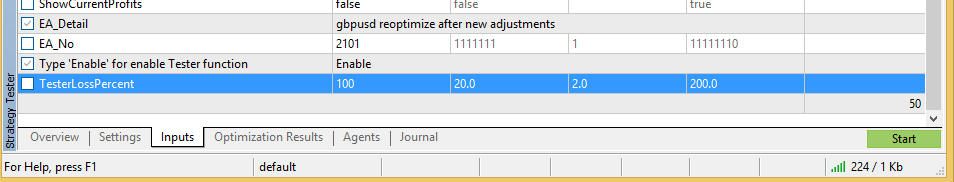

TesterLossEnable : Calculate Trades losses throughout back-testing.

TesterLossPercent : P.c from complete stability, if loss attain beneath regulate degree throughout backtasting take a look at course of cease and swap to check subsequent ea parameters. Learn how to optimize for finest settings

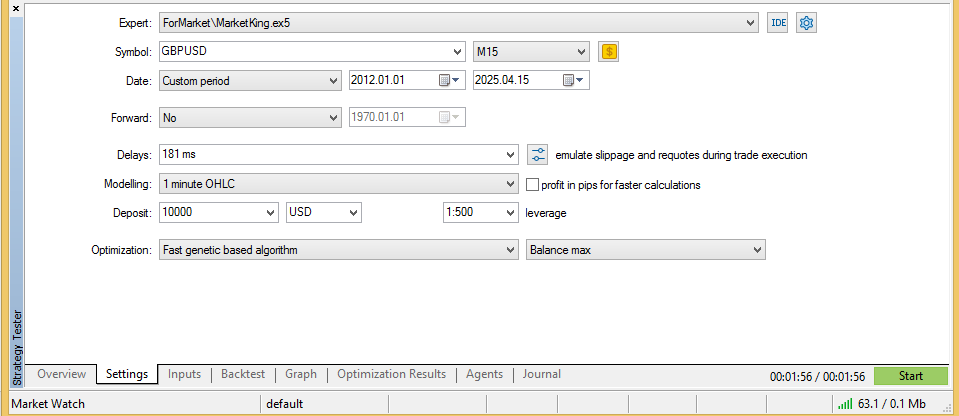

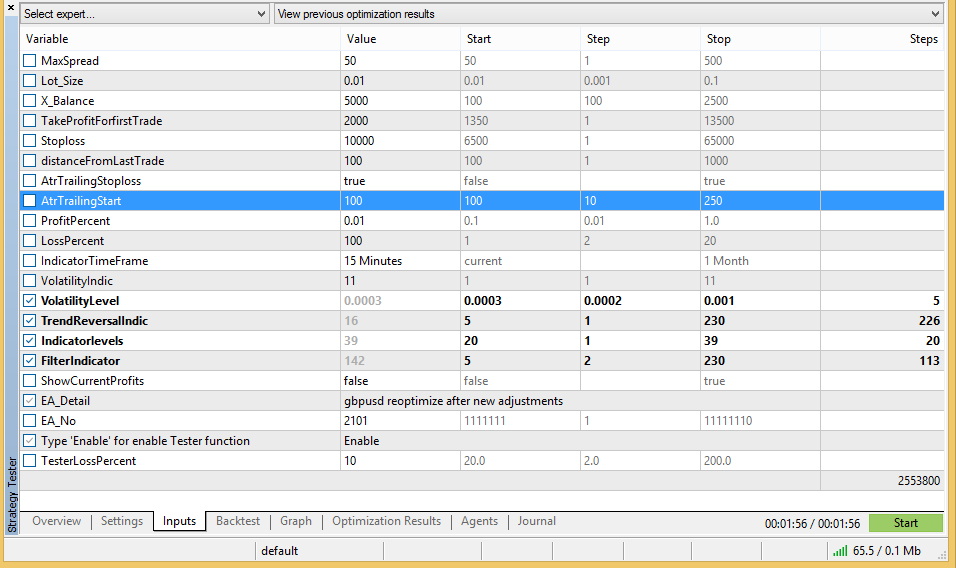

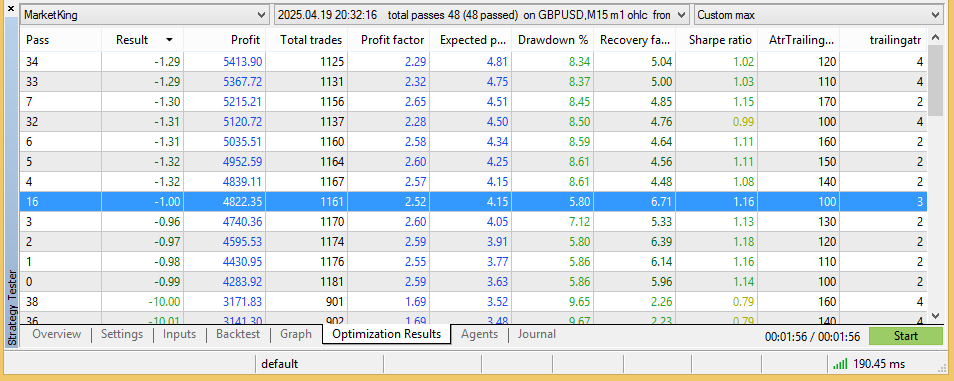

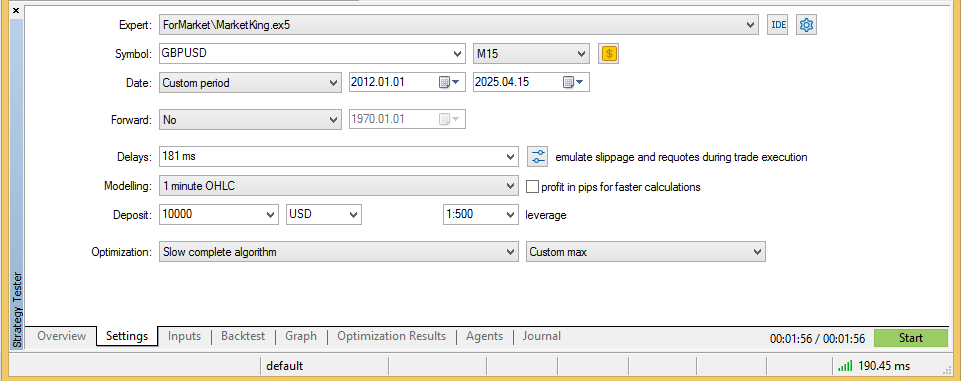

Comply with steps beneath in image.

Select date, ahead,delays,modeling,deposit,leverage and optimization.

Select settings you wish to optimize.

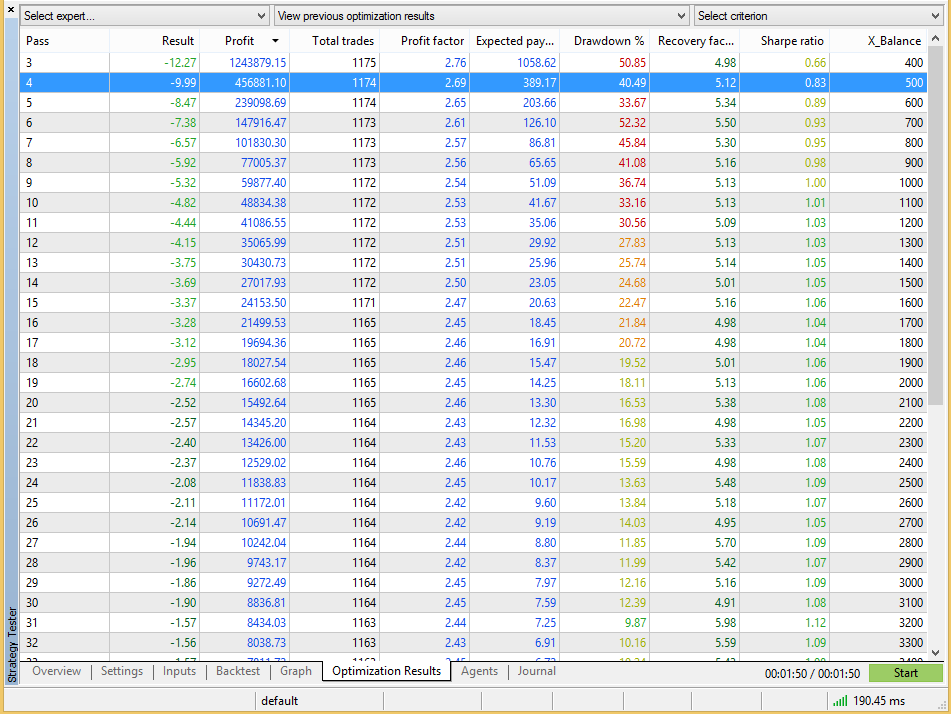

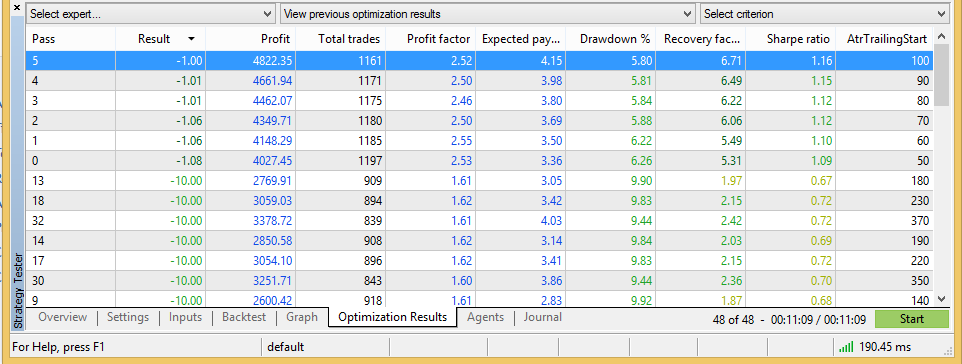

Select finest settings

If you wish to extra optimize select one after the other setting

Choose “Sluggish full algorithm”

Select your setting

And choose remaining finest end result

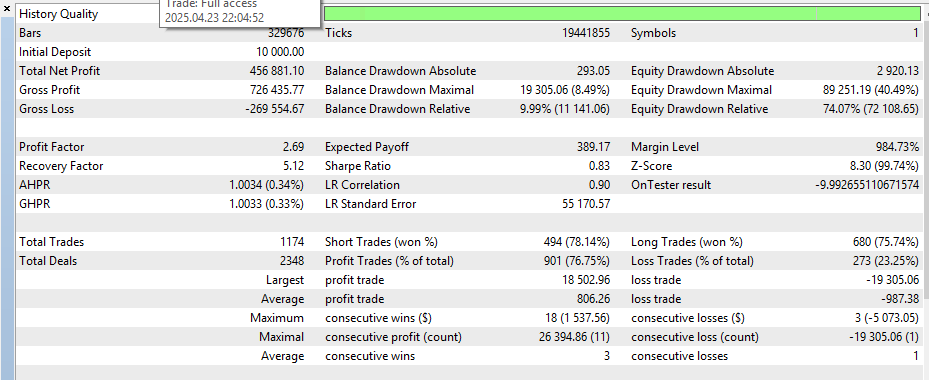

Study the end result

Then take a look at X_balance out of your alternative, i choose from 100 to 5000 with 100 worth step

And sort 100% in testerlosspercent

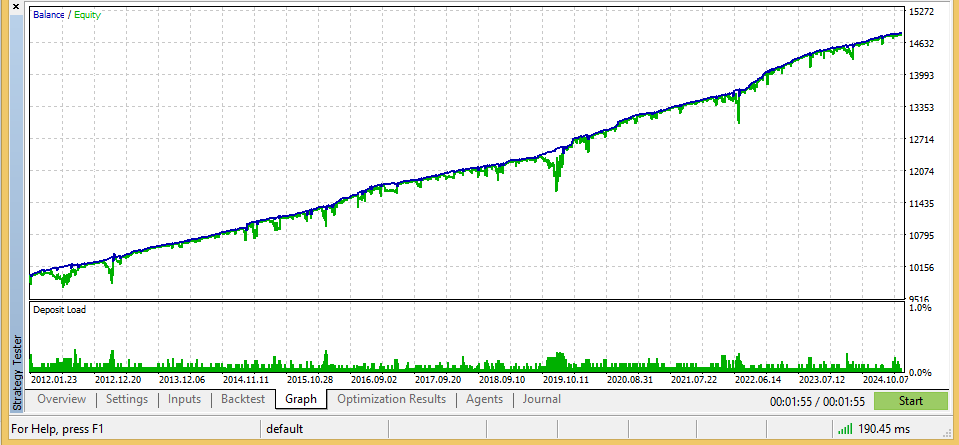

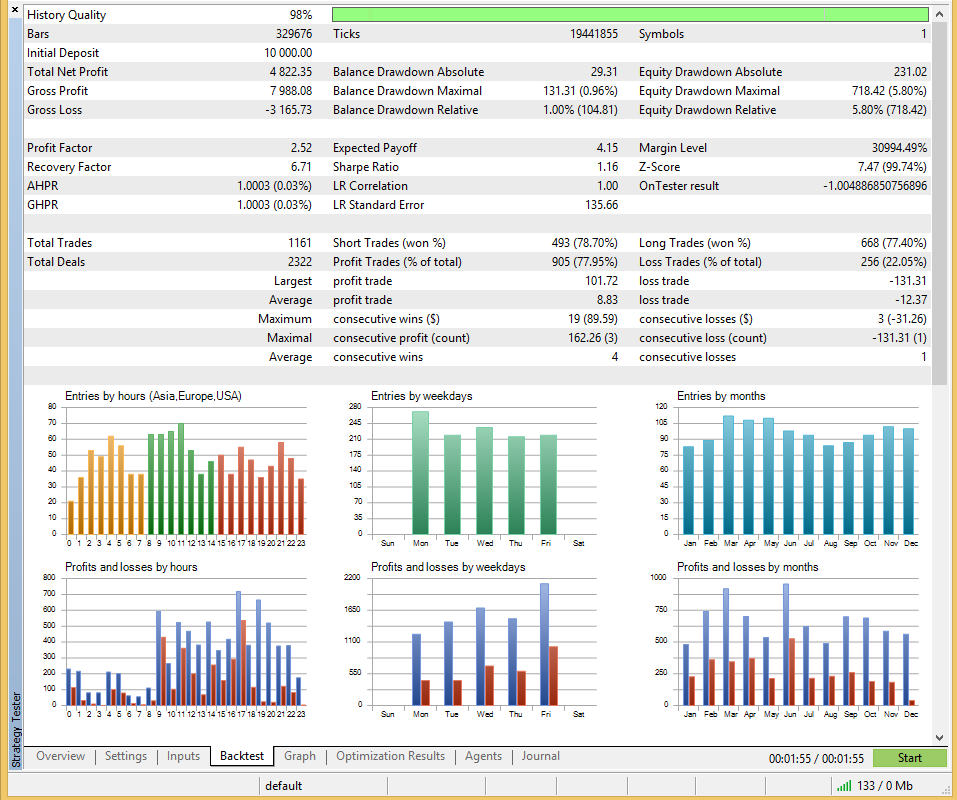

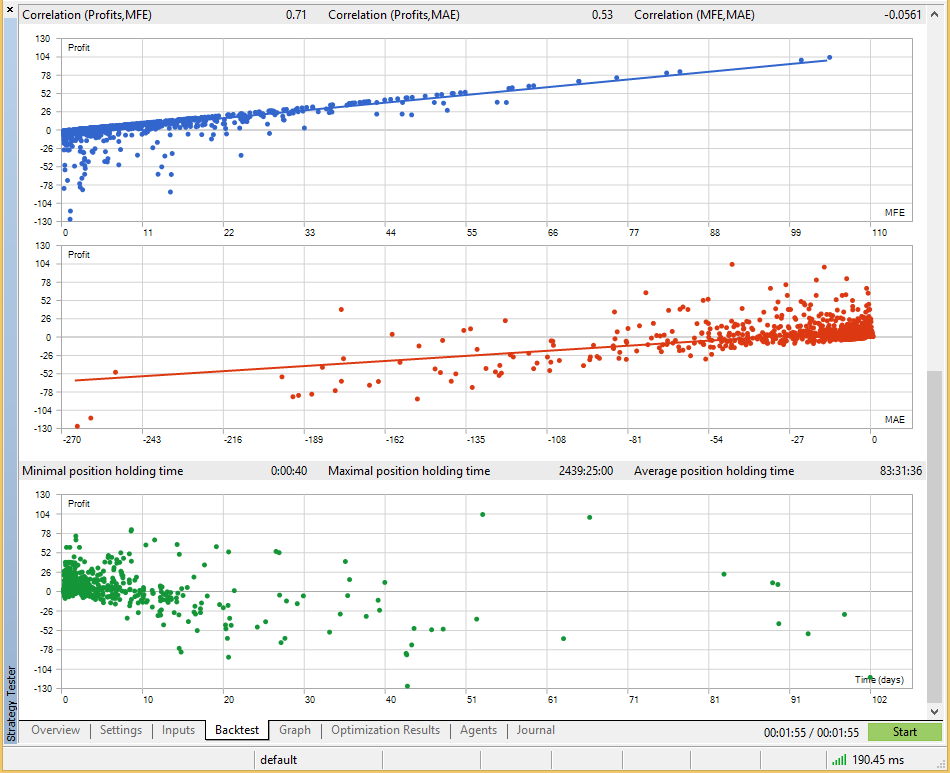

That is the ultimate end result