KEY

TAKEAWAYS

- The inventory market is holding regular after final week’s bounce, however stays hesitant.

- Massive tech earnings and financial knowledge are the main target this week.

- Sector rotation signifies that buyers are shifting to defensive mode.

Talking total, the inventory market hasn’t modified course after final week’s bounce; the upside momentum remains to be right here, albeit appearing somewhat tentative. One piece of reports which will have helped transfer the market increased on Tuesday, although, was President Trump’s determination to cut back on auto tariffs.

Talking total, the inventory market hasn’t modified course after final week’s bounce; the upside momentum remains to be right here, albeit appearing somewhat tentative. One piece of reports which will have helped transfer the market increased on Tuesday, although, was President Trump’s determination to cut back on auto tariffs.

Traders appear to be wanting ahead to any information of progress on commerce negotiations and key financial knowledge, particularly Q1 GDP, March private consumption expenditures worth index (PCE), and the April jobs report. There are additionally some vital earnings this week, together with META Platforms, Inc. (META), Microsoft Corp. (MSFT), Amazon.com, Inc. (AMZN), and Apple, Inc. (AAPL), amongst others. So, do not be stunned if there’s some turbulence this week.

Latest financial knowledge hasn’t moved the needle a lot. The newest JOLTS report confirmed fewer job openings in March, however layoffs declined. This means the labor market remains to be robust. The April nonfarm payrolls report on Friday will deliver extra readability.

Client confidence took a success, falling to its lowest studying since Might 2020. This drop displays issues about tariffs and the way they could push up costs. The underside line is that customers are nervous about what’s forward.

Technical Replace

Regardless of its bounce, the S&P 500 ($SPX) remains to be down round 9.0% from its February excessive, however up about 15% from its April lows. The weekly chart beneath has the Fibonacci retracement ranges from the October 2022 lows to the February 2025 highs. The index bounced off its 50% retracement degree and is now above its 38.2% degree. It is also buying and selling beneath its 40-week easy transferring common (SMA), which is the equal of a 200-day SMA.

FIGURE 1. WEEKLY CHART ANALYSIS OF S&P 500. The index has bounced off its 50% Fibonacci retracement degree, and breadth is enhancing. Nonetheless, the market seems to be in a wait-and-see mode, and any adverse information might ship the index decrease. Chart supply: StockCharts.com. For instructional functions.

It is encouraging to see the S&P 500 Bullish P.c Index (BPI) above 50%, and the proportion of S&P 500 shares buying and selling above their 200-day transferring common exhibiting slight indicators of reversing from a downtrend. Nonetheless, the S&P 500 seems indecisive and is ready for some catalyst to maneuver the index in both path.

Does the day by day chart present a distinct situation? Let’s have a look.

FIGURE 2. DAILY CHART ANALYSIS OF S&P 500. The 50% Fibonacci retracement degree is a crucial degree to watch because it might act as a assist degree. Resistance ranges to the upside are the 50-day transferring common, the 61.8% Fib retracement degree, and the 200-day transferring common. Chart supply: StockCharts.com. For instructional functions.

The day by day chart of the S&P 500 above reveals the index buying and selling beneath its 200-day SMA. As well as, the 50% Fibonacci retracement degree (from the February 2025 excessive to the April 2025 low) is appearing as a assist degree. One level to notice is the wide-ranging days in April, which have subsided towards the tip of the month. This means buyers have calmed down—the Cboe Volatility Index ($VIX) has pulled again and is now beneath 30.

The short-term perspective reveals the development is leaning towards transferring increased. Regulate the 5500 degree as assist and the 50-day SMA as the following resistance degree. If the S&P 500 can break above the 61.8% Fibonacci retracement degree with robust momentum, that is motive to be optimistic. A break above the 200-day SMA could be extra optimistic.

Whereas the S&P 500 is inching increased, one thing is brewing beneath the floor—a shift towards the extra defensive sectors.

Sector Rotation: Defensive Features

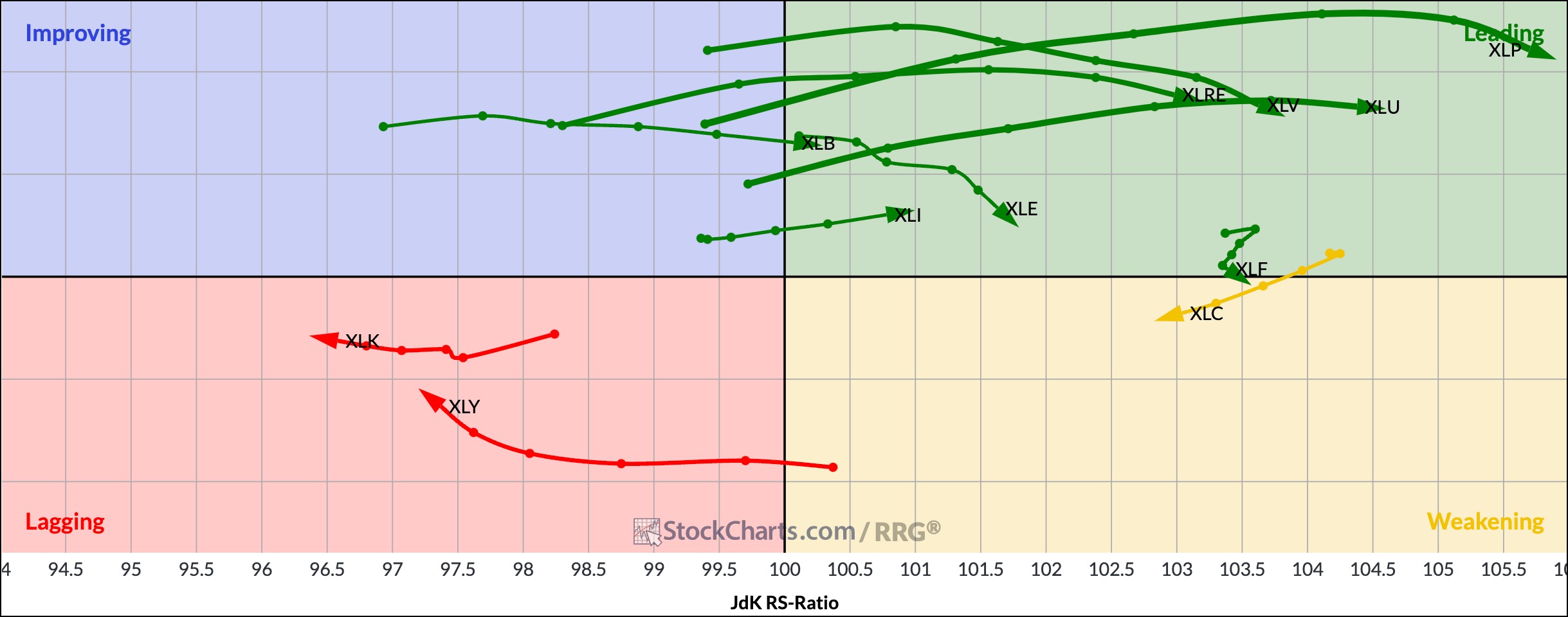

The Relative Rotation Graph beneath reveals that for the week, defensive sectors—Client Staples, Utilities, and Well being Care—are main, whereas offensive sectors, like Know-how, Client Discretionary, and Communication Companies, are lagging.

FIGURE 3. RELATIVE ROTATION GRAPH. Defensive sectors are main whereas offensive sectors are lagging. Monitor sector rotation rigorously as we head right into a unstable buying and selling week. Chart supply: StockCharts.com. For instructional functions.

This is not uncommon, since buyers are feeling extra cautious and on the lookout for stability.

What’s Forward?

There’s nonetheless key financial knowledge to watch this week. This is what’s forward:

- Wednesday: March private consumption expenditures (PCE), the Fed’s favored inflation measure. A stronger-than-expected quantity might ship the market decrease since it might make the Fed extra hawkish. There’s additionally the Q1 GDP progress, which is able to point out if financial progress is stalling or continues to be robust.

- Friday: April nonfarm payrolls will give us an concept of the power of the labor market. Proof of a strengthening labor market would cut back the chance of an rate of interest reduce, which might put stress on shares.

Closing Place

The market is feeling cautious, ready for the following catalyst to ship inventory costs increased or decrease. And any of this week’s occasions—financial knowledge, massive tech earnings, and commerce talks—might make or break this week’s worth motion. Nonetheless, even when the S&P 500 tendencies increased, it would not essentially imply the large tech progress shares are main the transfer increased. Do a sector drill-down from our new Market Abstract web page and make investments accordingly.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra