The sign engine consists of:

- Adaptive Momentum Detection: Makes use of a multi-band construction that dynamically responds to real-time worth shifts

- Directional Shift Monitoring: Detects key transitions in market conduct to mark clear potential reversals

- Extremum Filtering: Alerts are validated solely at confirmed market extremes, filtering out intermediate noise

- Noise Management Logic: Consists of an inner alternation system that avoids over-signaling throughout development phases

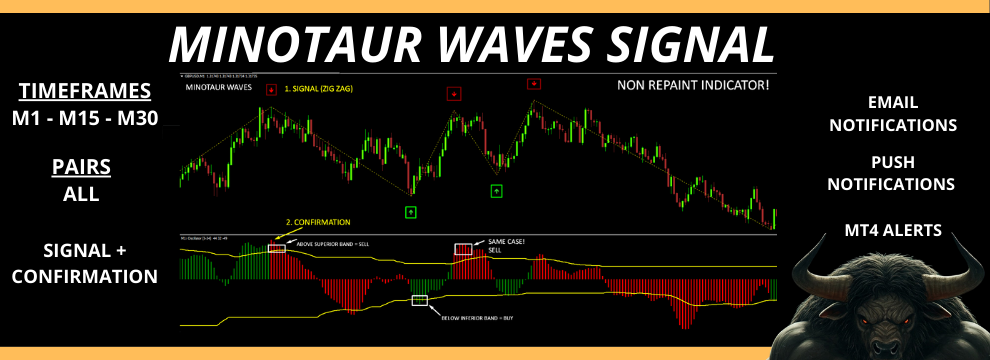

Every confirmed sign is marked with a visible arrow on the chart and accompanied by real-time alerts with the image, timing, and worth particulars.

Sign Situations

Alerts are solely generated when:

- Value breaks above or beneath dynamic validation ranges outlined by the momentum bands

- A big breakout or reversal is recognized, supported by latest worth motion patterns

- A confirmed directional shift is validated by a marked extremum and a single directional sign

All calculations are carried out strictly on closed candles — no repainting, no lag.

Visible Interface

- Development Path Standing: Primarily based on band slope and the relative place of worth

- Sign Markers: Inexperienced arrow = BUY | Crimson arrow = SELL

- Alert System: Sound, push notifications, e mail, and on-screen messages

- Dynamic Bands: Show key momentum thresholds for visible affirmation

Beneficial Utilization

- Advised Pairs: EURUSD, GBPUSD, USDJPY (absolutely appropriate with all symbols)

- Perfect Timeframes: M1, M5, and M15 for energetic buying and selling; M30 for broader intraday strikes

- Greatest Periods: London and New York, when clearer momentum constructions are likely to emerge

Alerts are restricted to 1 per directional shift, serving to keep a clear sign setting with diminished noise publicity.