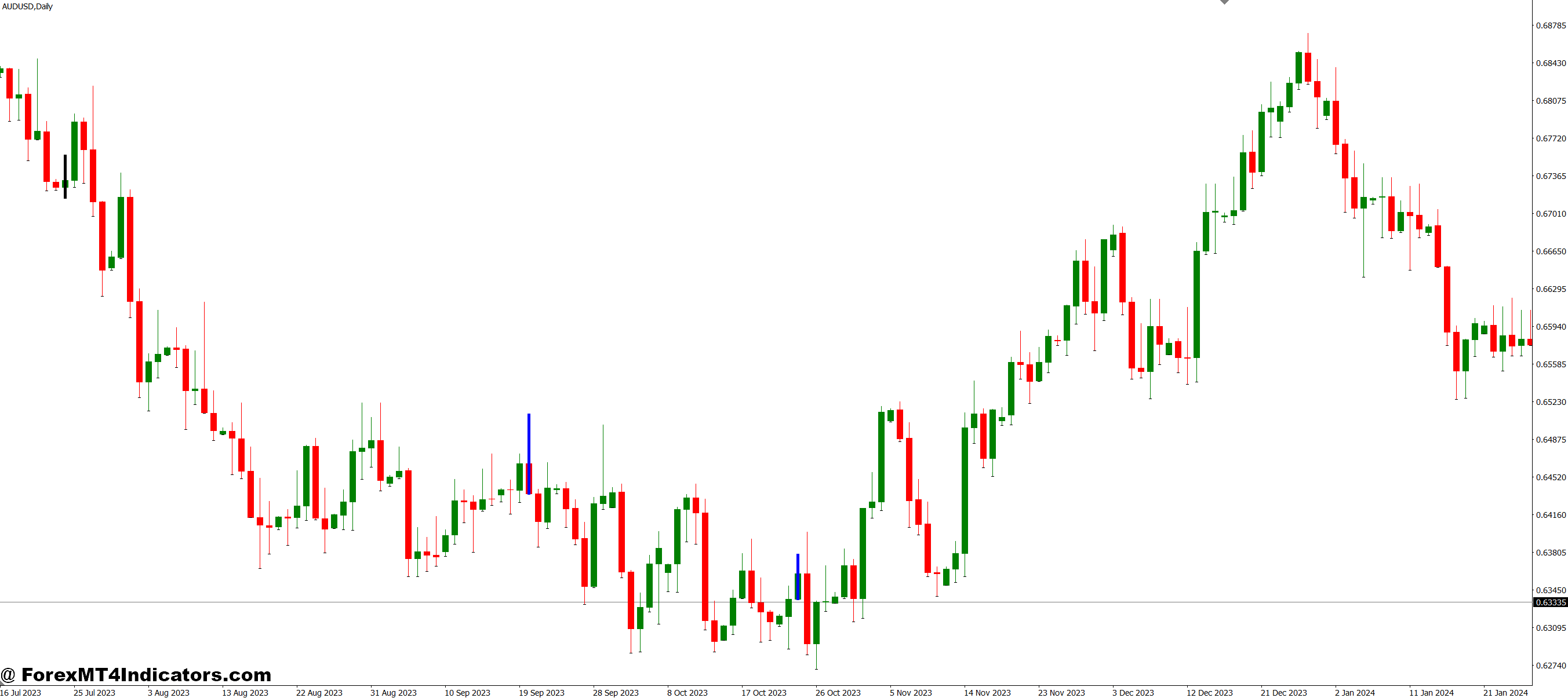

Divergence happens when value motion and a momentum oscillator transfer in reverse instructions. The MT4 divergence indicator automates the method of recognizing these discrepancies throughout a number of timeframes and forex pairs. As a substitute of manually drawing trendlines on each value and oscillator home windows, the indicator does the heavy lifting.

Most MT4 divergence indicators scan for 4 sorts: common bullish, common bearish, hidden bullish, and hidden bearish. Common divergence indicators potential pattern reversals. Hidden divergence suggests pattern continuation after a pullback. Merchants who perceive this distinction keep away from complicated indicators that happen throughout completely different market phases.

The calculation logic varies by indicator, however most scan for pivot factors in value and examine them to corresponding pivot factors in oscillators like RSI, MACD, or Stochastic. When value makes a brand new excessive, however the oscillator doesn’t, the algorithm flags it. The identical precept applies in reverse for lows.

How Merchants Apply It to Actual Setups

Right here’s the place principle meets actuality. On GBP/JPY’s day by day chart throughout risky periods, a dealer would possibly spot the value making a brand new swing low at 180.50, breaking beneath the earlier low of 181.20. However the RSI kinds the next low. That’s common bullish divergence—momentum is strengthening whilst value drops. Good merchants don’t leap in instantly. They look forward to affirmation: a candlestick reversal sample, a break above a minor resistance stage, or quantity affirmation.

The indicator shines brightest on the 1-hour and 4-hour charts. Decrease timeframes generate too many false indicators throughout uneven markets. Every day charts work, however indicators seem much less often. When buying and selling the EUR/USD in the course of the London session overlap, the 1-hour chart typically supplies the candy spot between sign frequency and reliability.

That stated, divergence doesn’t work nicely in robust trending markets. Throughout NFP releases or central financial institution bulletins, momentum indicators can keep “oversold” or “overbought” for prolonged intervals whereas the value continues trending. Skilled merchants keep away from divergence indicators throughout high-impact information occasions.

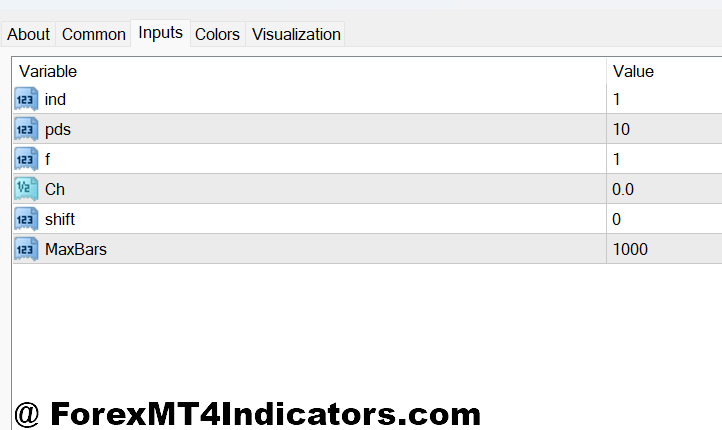

Settings That Really Matter

Default settings on most MT4 divergence indicators embrace a 14-period RSI or a 12/26/9 MACD. These work positive for traditional timeframes, however customization improves outcomes. For scalping on the 15-minute chart, some merchants scale back the RSI interval to 9 or 10 for extra responsive indicators. Swing merchants on the 4-hour chart would possibly enhance it to 21 for smoother readings.

The lookback interval—what number of bars the indicator scans for pivot factors—impacts sign technology. A 5-bar lookback catches divergences rapidly however produces extra noise. A ten-bar lookback filters out minor fluctuations however would possibly lag throughout quick reversals. There’s no good setting. It is determined by the forex pair’s volatility and the dealer’s timeframe.

Alert settings deserve consideration too. Pop-up alerts, electronic mail notifications, or cellular push alerts assist merchants catch divergences with out observing charts all day. However right here’s the catch: too many alerts result in alert fatigue. Merchants begin ignoring them. Setting alerts just for divergence on larger timeframes (4-hour or day by day) retains the signal-to-noise ratio manageable.

The Sincere Reality: Benefits and Limitations

The most important benefit? Early warning indicators. Divergence typically seems earlier than value reversals turn into apparent. On USD/CAD, merchants who caught the bearish divergence close to the 1.3800 stage in early pattern exhaustion had higher entry costs than those that waited for a confirmed downtrend.

One other plus: it really works throughout all forex pairs and timeframes. The logic behind momentum-price disagreements applies whether or not buying and selling majors, crosses, or exotics. It’s not pair-specific like some assist/resistance ranges that solely matter on sure devices.

However let’s be actual in regards to the limitations. Divergence can persist for dozens of bars earlier than value truly reverses. That’s referred to as “staying improper longer than you may keep solvent.” Worth would possibly make a number of new highs with divergence exhibiting on every one. Merchants who brief too early get stopped out repeatedly.

False indicators plague divergence indicators throughout ranging markets. When value chops sideways between assist and resistance, oscillators generate divergence indicators that go nowhere. The indicator can’t distinguish between a real pattern reversal setup and meaningless noise in consolidation.

Buying and selling foreign exchange carries substantial threat. No indicator ensures earnings. Divergence indicators enhance decision-making when mixed with value motion evaluation, assist/resistance ranges, and correct threat administration. Utilized in isolation, they’re a recipe for frustration.

How It Stacks Up In opposition to Different Instruments

In comparison with easy shifting common crossovers, divergence indicators present earlier indicators. However they require extra interpretation ability. A shifting common crossover is binary—it occurred or it didn’t. Divergence requires judgment: Is that this divergence robust sufficient to behave on? Is the pattern mature sufficient to reverse?

In opposition to Fibonacci retracements, divergence affords completely different info. Fibs present potential reversal zones primarily based on value construction. Divergence reveals momentum weak point. Combining them creates highly effective setups: divergence kinds close to a 61.8% Fib stage, for instance.

The Elliott Wave merchants typically use divergence to verify wave counts. Wave 5 often reveals divergence as the ultimate thrust exhausts. That’s a extra superior software, nevertheless it demonstrates how divergence suits into broader technical frameworks.

The way to Commerce with MT4 Divergence Indicator

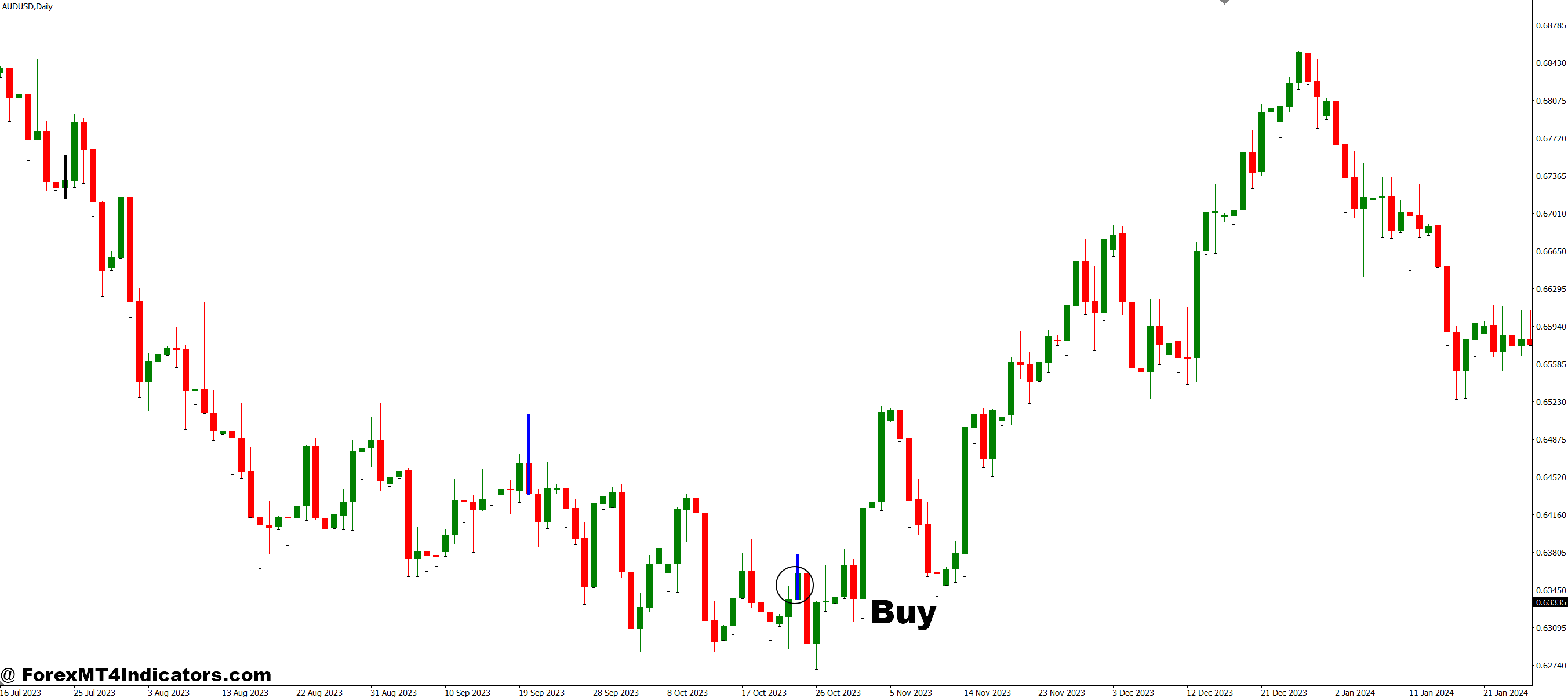

Purchase Entry

- Look ahead to bullish divergence affirmation on the 1-hour chart – Worth makes a decrease low whereas RSI kinds the next low; enter solely after a bullish engulfing candle closes above the divergence zone, usually 5-10 pips above the low.

- Set cease loss 10-15 pips beneath the divergence swing low – This protects in opposition to false indicators whereas giving the commerce room to breathe; on GBP/USD’s 4-hour chart, this often means 15-20 pip stops in the course of the London session.

- Goal the earlier swing excessive as the primary revenue stage – Lock in 50% place when value reaches prior resistance; this banking technique works finest on EUR/USD day by day charts the place swings are 80-150 pips.

- Keep away from divergence indicators throughout robust downtrends – If value is beneath the 200-period shifting common and making constant decrease lows, skip the sign; momentum can keep oversold for weeks throughout bearish tendencies.

- Mix with assist zones for larger chance – Bullish divergence at a significant assist stage (earlier swing low, spherical quantity, or day by day pivot) will increase win fee by 15-20% in comparison with random divergence indicators.

- Verify larger timeframe path earlier than entry – If the 4-hour reveals bullish divergence however the day by day chart is in a powerful downtrend, scale back place dimension by 50% or skip the commerce solely.

- Don’t chase after 3+ bullish candles post-divergence – If value has already rallied 30-40 pips from the divergence low, you’ve missed the entry; look forward to a pullback or discover a new setup as an alternative of shopping for prolonged strikes.

- Use 1-2% threat per commerce most – Even high-probability divergence setups fail 40-50% of the time; risking greater than 2% of account fairness per sign results in drawdowns which might be exhausting to get well from.

Promote Entry

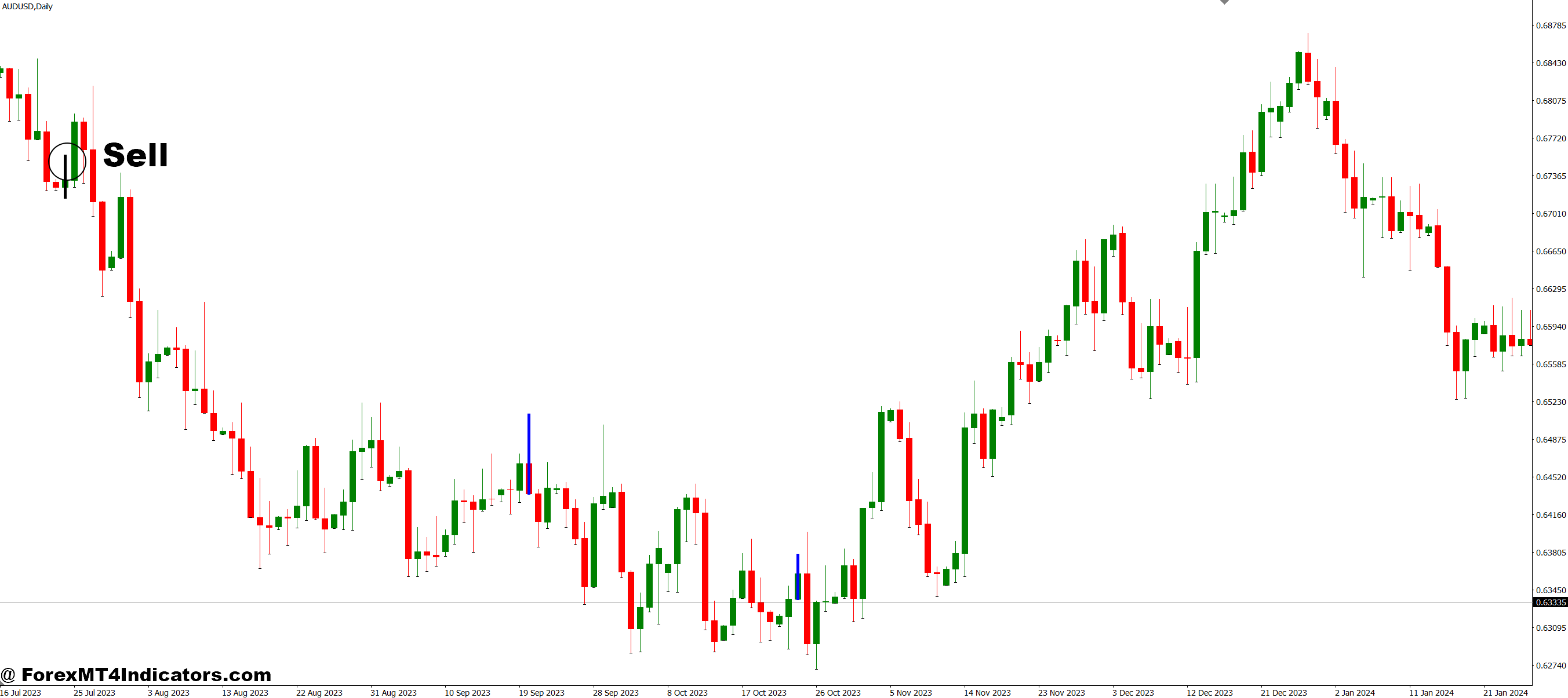

- Establish bearish divergence on 4-hour or day by day charts – Worth makes the next excessive whereas MACD kinds a decrease excessive; enter 5-10 pips beneath the bearish candle that closes beneath the divergence peak.

- Place cease loss 15-20 pips above the divergence swing excessive – On risky pairs like GBP/JPY, lengthen stops to 25-30 pips to keep away from getting stopped out by regular value fluctuation earlier than the reversal develops.

- Take revenue on the earlier swing low – Exit 50% of place when value drops to prior assist; path the remaining place with a 20-pip trailing cease to catch prolonged strikes.

- Skip indicators throughout information occasions or NFP releases – Divergence turns into unreliable when EUR/USD gaps 50+ pips on central financial institution bulletins; momentum indicators can’t predict news-driven volatility.

- Affirm with resistance rejection – Bearish divergence plus a pin bar or taking pictures star at resistance will increase chance; look forward to the rejection candle to shut earlier than coming into the brief.

- Ignore divergence in ranging markets – If EUR/USD is chopping between 1.0800-1.0850 for days, divergence indicators will whipsaw you; solely commerce divergence when there’s a transparent pattern to reverse.

- Verify if RSI is definitely overbought (above 70) – Bearish divergence works finest when oscillators are in excessive zones; divergence at RSI 55 typically fails as a result of momentum isn’t actually exhausted.

- Don’t maintain via main assist ranges – If bearish divergence commerce reaches a weekly assist zone and hasn’t triggered your revenue goal, exit manually; holding via robust assist typically leads to fast reversals that erase earnings.

Conclusion

MT4 divergence indicators excel at figuring out momentum-price disconnects that sign potential reversals or continuation setups. They work finest on 1-hour to day by day charts, battle throughout robust tendencies and information occasions, and require affirmation from value motion earlier than trades get positioned. The important thing benefit—early warnings—comes with the important thing limitation—persistence of divergence with out rapid value response.

Merchants who grasp divergence evaluation usually use it as one software amongst many, not a standalone technique. They modify settings primarily based on volatility and timeframe, filter indicators via assist/resistance ranges, and all the time handle threat appropriately. Begin by backtesting divergence indicators in your favourite pairs. Be aware which timeframes and oscillator settings produce dependable indicators in numerous market circumstances. That hands-on expertise beats any theoretical data.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90