The MT4 worth motion indicator strips away that complexity. As a substitute of calculating derivatives of worth knowledge, it highlights what truly issues: assist and resistance zones, swing highs and lows, and candlestick patterns that institutional merchants watch. This instrument doesn’t predict the long run. It merely organizes worth construction so merchants could make knowledgeable choices based mostly on what markets are doing proper now.

What the MT4 Value Motion Indicator Really Does

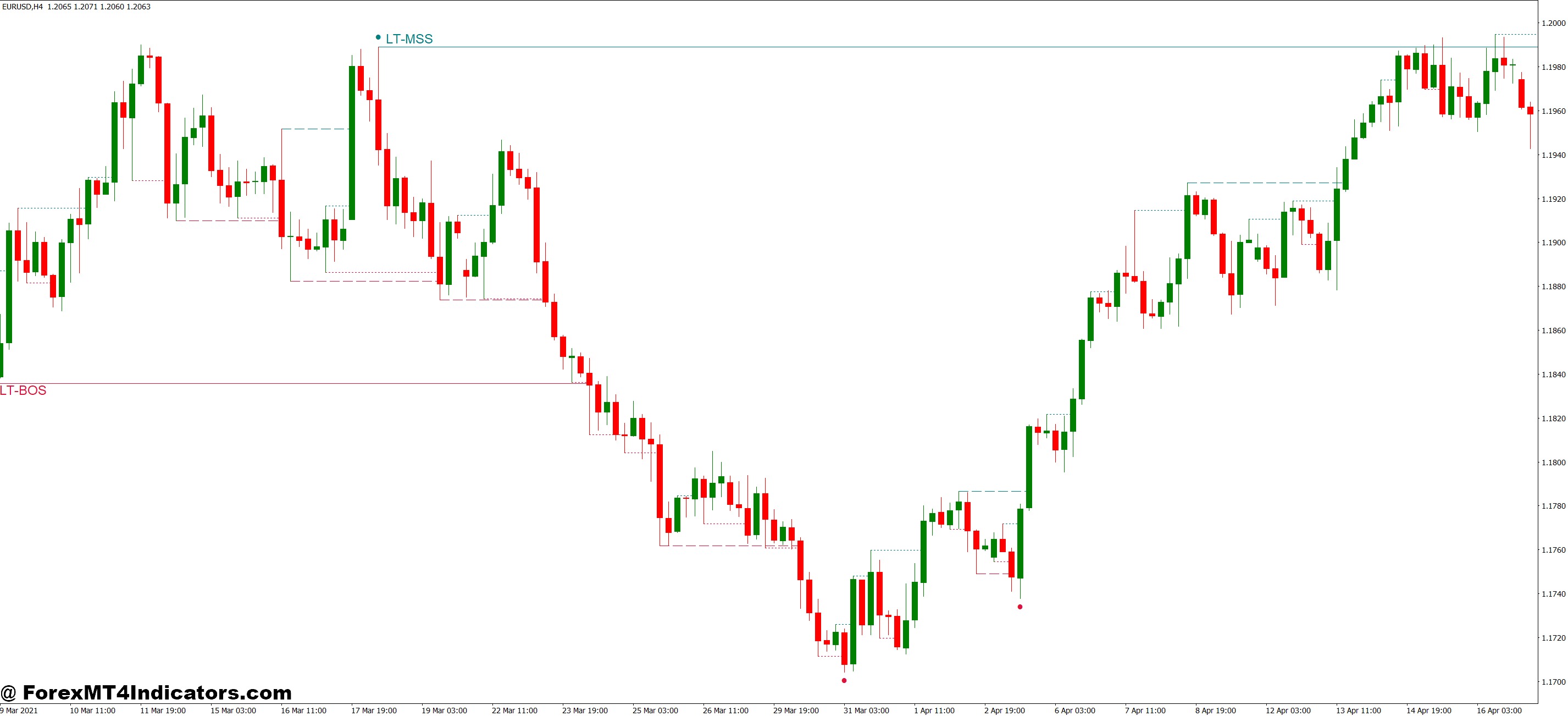

In contrast to oscillators that calculate mathematical formulation from closing costs, the MT4 worth motion indicator identifies and marks key worth ranges straight on the chart. Consider it as automated sample recognition. The indicator scans current worth historical past—sometimes 50 to 200 candles relying on settings—and flags vital swing factors the place worth reversed or consolidated.

Some variations mark assist and resistance zones utilizing horizontal strains at worth ranges that rejected strikes a number of occasions. Others establish candlestick patterns like pin bars, engulfing candles, or inside bars that always precede directional strikes. The higher ones mix each approaches, giving merchants a visible map of market construction.

The core logic is simple. When worth makes a better excessive adopted by a decrease excessive, that’s a swing excessive—potential resistance. When worth makes a decrease low adopted by a better low, that’s a swing low—potential assist. The indicator automates what skilled merchants do manually: marking these pivot factors to know the place provide and demand confirmed up beforehand.

How Value Motion Indicators Calculate Key Ranges

Most MT4 worth motion indicators use a swing detection algorithm. The indicator appears to be like again a set variety of bars (the “lookback interval”) to establish native peaks and troughs. For a swing excessive, worth should make a excessive that’s larger than the bars each earlier than and after it. A 5-bar swing excessive means the center candle’s excessive exceeds two candles on either side.

Right here’s the place it will get sensible. On a 4-hour GBP/USD chart with a 5-bar swing setting, the indicator would possibly flag a swing excessive at 1.2750 from final Tuesday. That degree issues as a result of sellers beforehand overwhelmed patrons there. If worth approaches 1.2750 once more, merchants look ahead to rejection—a clue that sellers would possibly defend that zone once more.

The calculation for assist and resistance zones varies. Some indicators draw rectangles round worth clusters the place candles overlapped closely, indicating consolidation. Others use percentage-based proximity—if worth touched inside 0.5% of a degree 3 times in 100 bars, that’s a sound zone. The precise math issues lower than understanding the idea: these instruments establish the place worth reminiscence exists.

Superior variations incorporate candlestick sample recognition. They scan for particular formations—a pin bar requires a small physique with a protracted wick (no less than 2:1 ratio), positioned within the outer third of the entire vary. When this sample varieties at a key assist or resistance degree, the indicator generates an alert. That’s not a commerce sign. It’s a heads-up that worth construction is exhibiting potential setup circumstances.

Actual Buying and selling Eventualities: The place This Software Shines

Testing this indicator on EUR/USD throughout the September 2024 rally supplied clear examples. On the every day chart, the indicator marked swing lows at 1.0780 and 1.0820, zones the place worth bounced a number of occasions in August. When worth pulled again to 1.0830 in early September, merchants watching these ranges had context—would this be one other bounce?

The indicator flagged a bullish pin bar at 1.0835 on September eleventh. The setup made sense: worth examined assist, rejected decrease, and closed close to the excessive. Merchants coming into lengthy at 1.0845 with stops under 1.0790 caught a 150-pip transfer to 1.1000 over the subsequent week. The indicator didn’t predict that transfer. It merely highlighted favorable risk-reward construction at a confirmed assist zone.

However the instrument isn’t magic. That very same month, GBP/JPY chopped sideways between 190.00 and 192.50 for 2 weeks. The indicator marked each ranges as legitimate assist and resistance—which they had been. However worth whipsawed between them every day, triggering six false breakout alerts. Merchants taking each setup obtained chopped up. The lesson? Value motion indicators work greatest in trending markets or at main swing extremes, not throughout tight consolidation.

On the 1-hour chart, the indicator helps with intraday timing. Throughout NFP releases, worth usually spikes then retraces to a swing degree earlier than making the true transfer. In October 2024, USD/CAD spiked from 1.3580 to 1.3630 on robust jobs knowledge, then pulled again to check 1.3600—a swing degree the indicator had marked from earlier that week. The rejection at 1.3600 supplied a cleaner entry than chasing the preliminary spike.

Customizing Settings for Completely different Types

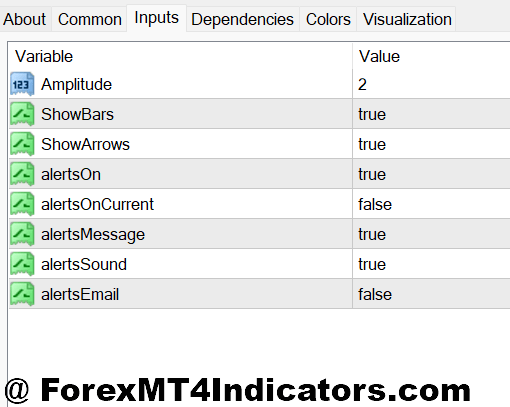

The lookback interval determines what number of current candles the indicator analyzes. Shorter durations (20-50 bars) establish near-term swings, helpful for scalpers and day merchants. Swing merchants want 100-200 bars to deal with weekly or month-to-month pivots. There’s no “appropriate” setting—it depends upon holding time choice.

For GBP/USD on the 15-minute chart, a 30-bar lookback identifies swing ranges from the previous seven to eight hours—related for London session merchants. The identical 30-bar setting on a every day chart appears to be like again six weeks, extra acceptable for place merchants. Matching the lookback to buying and selling timeframe prevents the indicator from cluttering charts with irrelevant ranges.

The swing sensitivity setting controls how strict the pivot detection is. A 3-bar swing (worth should exceed one bar on either side) generates extra ranges however consists of minor fluctuations. A ten-bar swing (5 bars on either side) produces fewer, extra vital pivots. Rookies usually begin with decrease sensitivity, then improve it as they study to tell apart main from minor construction.

Coloration coding helps. Some merchants set main assist in inexperienced, main resistance in crimson, and minor ranges in grey. Others use zones as a substitute of strains—a 10-pip rectangle round every degree accounts for unfold and slippage. On unstable pairs like XAU/USD (gold), wider zones (20-30 pips) make extra sense than precise strains.

Alert settings deserve consideration. Too many notifications create noise and result in alert fatigue. Setting alerts just for worth approaching main swing ranges or confirmed candlestick patterns retains alerts actionable. The purpose is relevance, not fixed pings.

Benefits Over Lagging Indicators

The first profit is immediacy. Shifting averages lag by definition—a 20-period EMA displays the place worth was 10 durations in the past. Value motion indicators reply to present construction. When GBP/USD varieties a pin bar at 1.2650, that info is out there now, not three candles later after an oscillator crosses a threshold.

Visible readability issues too. As a substitute of deciphering whether or not RSI at 45 is bullish or bearish, merchants see direct proof: worth rejected at prior resistance. That’s concrete. There’s much less ambiguity, which reduces emotional decision-making. Newer merchants particularly profit from this directness—they’re studying market footprints, not mathematical transformations of footprints.

These indicators additionally work throughout all timeframes with out adjustment. The identical rules of assist and resistance apply whether or not analyzing a 5-minute or month-to-month chart. That universality helps merchants keep constant evaluation no matter buying and selling fashion. An oscillator would possibly want completely different settings for various timeframes; worth construction doesn’t.

Limitations Each Dealer Ought to Perceive

Value motion indicators are reactive, not predictive. They present the place worth reversed earlier than, not the place it’ll reverse subsequent. That’s essential. Markets evolve. A assist degree that held 3 times would possibly break on the fourth check. The indicator can’t forecast that change—it solely is aware of historic knowledge.

Throughout ranging markets, these instruments generate extreme alerts. When EUR/JPY bounces between 160.00 and 162.00 for weeks, the indicator marks each ranges as legitimate. And they’re. However taking each contact leads to dozens of small losses from failed breakouts. The indicator wants context from larger timeframe tendencies or elementary catalysts to filter high quality setups.

False patterns create issues. A candlestick would possibly appear like an ideal pin bar however kind throughout ultra-low quantity Asian hours when worth drifts randomly. The indicator flags it mechanically as a result of the geometry matches—lengthy wick, small physique. However that sample lacks the conviction of 1 fashioned throughout London-New York overlap with actual quantity behind it. Merchants should add discretion.

Subjectivity nonetheless exists. What constitutes a “main” versus “minor” swing degree? The indicator makes use of mathematical standards, however merchants finally resolve which ranges advantage consideration. Two merchants utilizing similar settings would possibly interpret outcomes otherwise based mostly on their broader market evaluation. That’s not a flaw—it’s the character of discretionary buying and selling.

How It Compares to Various Approaches

Fibonacci retracement instruments and worth motion indicators overlap conceptually—each establish potential reversal zones. However Fibonacci requires manually drawing from swing excessive to swing low, whereas worth motion indicators automate degree detection. The tradeoff: Fibonacci ranges usually align with psychological spherical numbers (like 1.3000 on USD/CAD), whereas indicator-generated ranges would possibly land at 1.3047—technically legitimate however much less watched by the broader market.

Conventional assist and resistance indicators draw horizontal strains at current highs and lows. Value motion indicators go additional by incorporating candlestick sample recognition and zone width calculations. They’re extra nuanced but additionally extra complicated. For merchants preferring simplicity, manually marking ranges is perhaps clearer.

Ichimoku Cloud supplies dynamic assist and resistance that adjusts with worth motion. Value motion indicators sometimes use static ranges—as soon as drawn, they don’t transfer until worth creates new swing factors. Static ranges supply consistency (you understand the place to look at), whereas dynamic methods adapt to altering volatility. Neither strategy is superior; they serve completely different philosophies.

The way to Commerce with MT4 Value Motion Indicator

Purchase Entry

- Look ahead to bullish pin bar at assist – Enter 2-5 pips above the pin bar excessive when worth rejects a marked assist zone on EUR/USD 4-hour chart, with cease loss 5 pips under the pin bar low for tight risk-reward.

- Affirm the swing low maintain – Solely take lengthy entries after worth checks a swing low degree marked by the indicator no less than twice and bounces; single touches on GBP/USD usually fail throughout ranging circumstances.

- Examine larger timeframe alignment – Earlier than coming into on 1-hour bullish alerts, confirm the every day chart exhibits worth above a serious swing assist zone; counter-trend trades towards every day construction have 60-70% failure charges.

- Enter on bullish engulfing at resistance-turned-support – When worth breaks above resistance, look forward to a pullback to that degree the place a bullish engulfing candle varieties, then enter 3 pips above candle shut with 30-40 pip cease loss.

- Keep away from purchase alerts throughout main resistance clusters – Skip lengthy entries when the indicator exhibits 3+ resistance ranges inside 20 pips above present worth on EUR/USD; worth sometimes stalls and reverses in these zones.

- Measurement down throughout Asian session setups – Lower place dimension by 50% for purchase alerts that kind between 11 PM – 5 AM EST when quantity is skinny and worth motion patterns produce extra false breaks.

- Path stops to breakeven after 20 pips – As soon as a purchase entry strikes 20 pips in revenue, transfer cease loss to entry worth to get rid of danger; worth motion setups usually retrace 40-50% earlier than persevering with.

- Require momentum affirmation above 1.5% every day vary – Don’t take purchase alerts on days when EUR/USD has moved lower than 60 pips whole; low volatility days produce weak follow-through even on legitimate patterns.

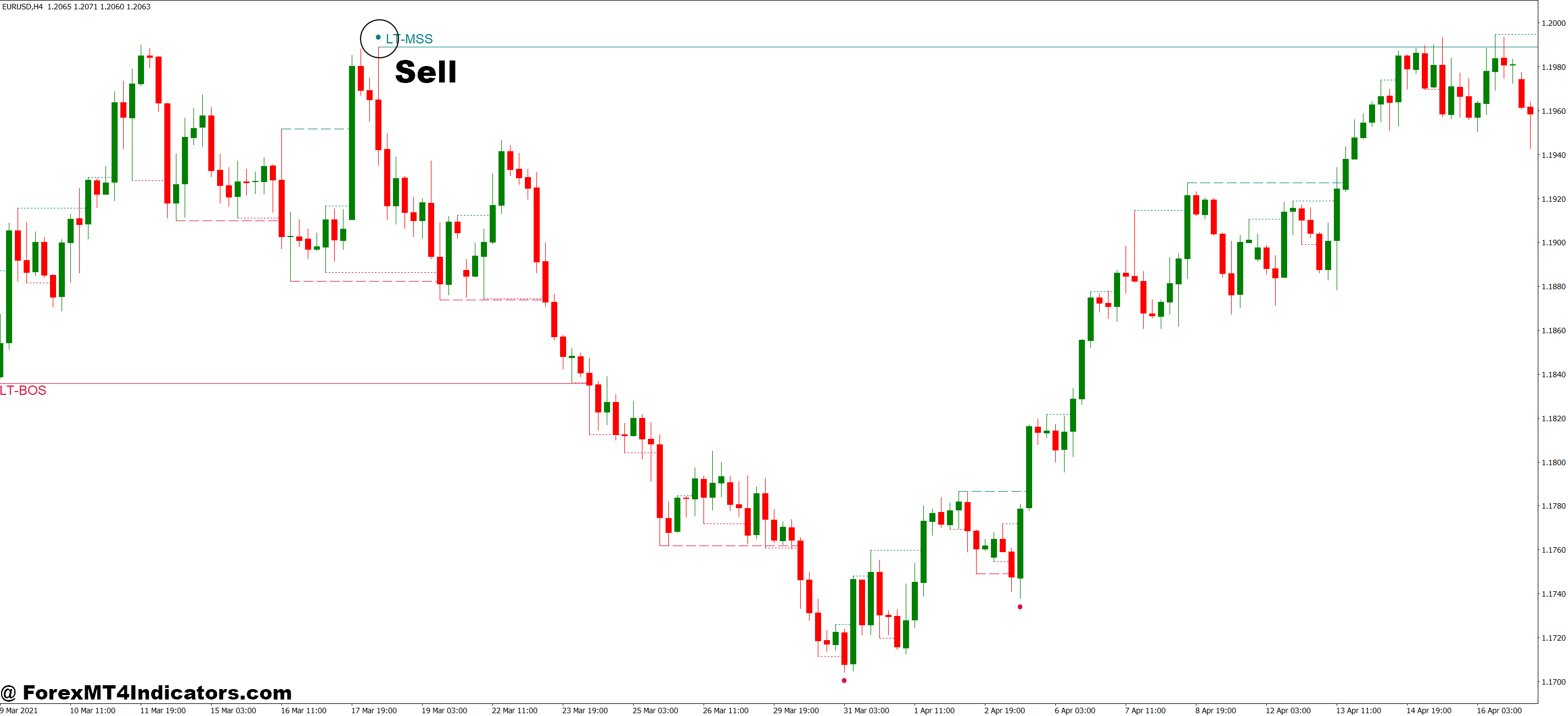

Promote Entry

- Enter under bearish pin bar at resistance – Promote 2-5 pips under the pin bar low when worth rejects indicator-marked resistance on GBP/USD 4-hour chart, putting cease loss 5 pips above the wick excessive.

- Look ahead to double-top rejection affirmation – After worth checks resistance twice and varieties decrease excessive, enter quick on break under the valley between peaks with cease 15 pips above second rejection level.

- Confirm downtrend on every day earlier than shorting – Solely take 1-hour promote alerts when every day chart exhibits worth under main swing resistance; buying and selling towards every day pattern path reduces win fee to 35-40%.

- Promote bearish engulfing at damaged assist – When assist breaks, look forward to worth to rally again and kind bearish engulfing candle at former support-turned-resistance, then quick 3 pips under candle shut.

- Skip promote alerts close to main assist clusters – Keep away from shorting when indicator exhibits 3+ assist ranges inside 20 pips under worth on EUR/USD; these zones sometimes produce robust bounces that cease out sellers.

- Cut back dimension by 50% earlier than high-impact information – Don’t take full place quick entries inside half-hour of NFP, CPI, or central financial institution bulletins; worth motion patterns fail throughout unstable whipsaws.

- Transfer cease to breakeven after 25 pips revenue – Defend quick positions by adjusting cease loss to entry as soon as commerce positive aspects 25 pips; resistance rejections usually see 30-40% retracements earlier than persevering with down.

- Ignore promote alerts throughout Friday afternoon – Keep away from new quick entries after 12 PM EST on Fridays when liquidity dries up and Monday gaps regularly reverse Friday’s late-session strikes by 40-60 pips.

Key Takeaways for Implementation

The MT4 worth motion indicator works greatest when merchants perceive its goal: organizing market construction visually to assist knowledgeable choices. It identifies the place provide and demand beforehand appeared, giving context for present worth motion. That context helps assess risk-reward, not predict future path. Merchants utilizing this instrument ought to deal with main swing ranges throughout trending circumstances whereas staying selective throughout consolidation. Combining the indicator with quantity evaluation, larger timeframe context, or elementary consciousness improves outcomes past utilizing it in isolation. The actual worth comes from sample recognition—seeing how worth behaves at key ranges repeatedly—which builds instinct over time. That’s one thing no automated instrument can shortcut, although this indicator actually accelerates the training course of.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90