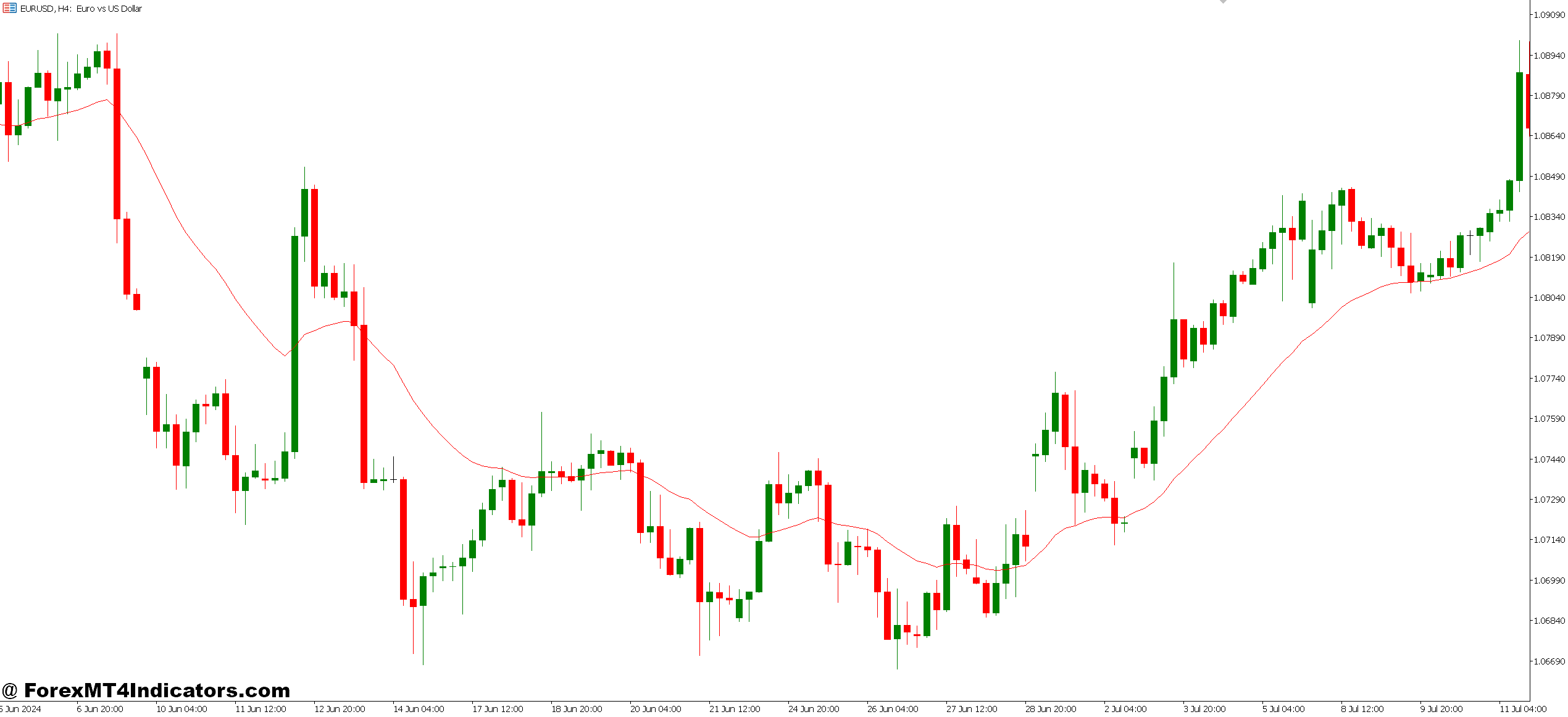

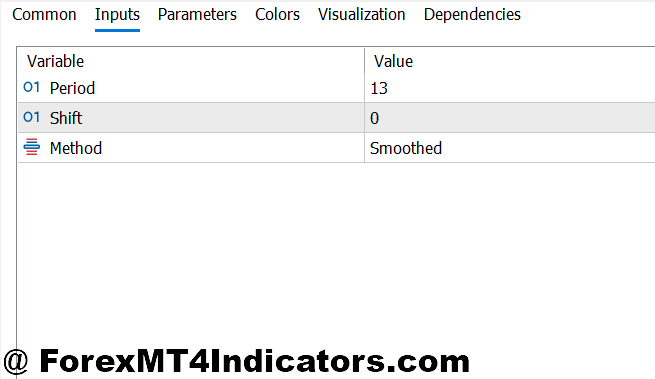

The Shifting Common in MetaTrader 5 calculates the imply worth over a specified interval, then plots it as a line on the chart. However MT5 takes this fundamental idea additional by providing 4 distinct calculation strategies: Easy (SMA), Exponential (EMA), Smoothed (SMMA), and Linear Weighted (LWMA).

Every methodology treats worth knowledge in a different way. The SMA offers equal weight to all intervals—a 20-period SMA on EUR/USD averages the final 20 closes with no bias. The EMA, against this, prioritizes latest costs utilizing an exponential weighting issue. Merchants testing this on the 4-hour GBP/JPY chart shortly discover the EMA hugs worth motion tighter than its easy counterpart.

The SMMA provides one other layer of smoothing, primarily making a shifting common of a shifting common. It reacts slower than the EMA however filters out extra noise. The LWMA falls someplace between, assigning linearly reducing weights to older costs.

How MT5 Calculates the Shifting Common

Right here’s the place issues get technical. The Easy Shifting Common makes use of this formulation: SMA = (P1 + P2 + … + Pn) / n, the place P represents worth and n equals the interval size. That’s simple math—add up the closes and divide by the variety of intervals.

The Exponential Shifting Common will get trickier. It makes use of: EMA = (Shut – Earlier EMA) × Multiplier + Earlier EMA. The multiplier equals 2 / (n + 1), giving extra weight to latest knowledge. A 12-period EMA on USD/CAD reacts roughly twice as quick as a 26-period model when worth shifts course.

The Smoothed Shifting Common calculation includes: SMMA = (Earlier SMMA × (n – 1) + Shut) / n. This creates the slowest-moving line of the bunch, which some swing merchants want for filtering intraday noise on each day charts.

MT5 handles these calculations mechanically, however understanding the mathematics helps merchants grasp why a 50-period EMA responds in a different way than a 50-period SMA throughout unstable NFP bulletins. The EMA drops quicker when dangerous information hits, whereas the SMA takes its candy time adjusting.

Actual-World Utility and Settings

Most merchants begin with the basic 50 and 200-period combo on each day charts. When the 50 crosses above the 200 on AUD/USD, that’s traditionally signaled stronger uptrends. However right here’s the factor—these “golden cross” setups work higher on trending pairs like GBP/NZD than range-bound ones like EUR/CHF.

For day buying and selling, the settings want adjustment. A scalper working the 5-minute EUR/USD chart would possibly use a 9-period EMA for fast entries, watching how worth bounces off the road throughout London session tendencies. The quicker interval catches strikes earlier however generates extra false alerts when the market chops sideways throughout lunch hours.

Swing merchants typically want the 20 and 50-period EMAs on 4-hour charts. When USD/JPY holds above each shifting averages, the bias stays bullish till worth closes under the 20 EMA. That stated, merchants ought to take a look at completely different intervals as a result of the “proper” setting is dependent upon the pair’s common true vary and buying and selling session.

The utilized worth setting issues too. MT5 lets merchants calculate primarily based on shut, open, excessive, low, or median costs. Most follow shut costs for end-of-period affirmation, however some commodity forex merchants use median costs to scale back spike affect on AUD/USD throughout Reserve Financial institution bulletins.

Benefits and Sincere Limitations

The MT5 Shifting Common excels at figuring out development course with out cluttering charts. Not like oscillators that bounce between mounted ranges, this indicator adapts to any worth vary. A dealer glancing at NZD/USD is aware of immediately whether or not the market’s trending when worth constantly stays above the 200 EMA.

The a number of calculation strategies provide actual flexibility. Throughout high-volatility Brexit votes, switching from SMA to EMA helped GBP pairs merchants react quicker to real breakouts versus fakeouts. The indicator additionally doubles as dynamic help and resistance—worth typically bounces off the 50-period MA throughout sturdy tendencies.

However no device’s good. Shifting averages lag by design since they use historic knowledge. That 200-period SMA on USD/CHF displays the place worth was, not the place it’s going. By the point the shifting common confirms a development reversal, sharp merchants already caught the early transfer utilizing worth motion.

Uneven markets homicide shifting common methods. When EUR/GBP trades sideways for weeks, the crossover alerts flip-flop continually. Merchants who adopted each 20/50 EMA cross throughout August range-trading misplaced cash on whipsaws. The indicator can’t distinguish between a pullback and a reversal till after the very fact.

One other limitation: shifting averages provide zero predictive worth about magnitude. They’ll sign an uptrend began, however received’t inform if that transfer will achieve 50 pips or 500 pips. Buying and selling foreign exchange carries substantial danger. No indicator ensures income, and previous development identification doesn’t predict future worth motion.

How It Compares to Different Shifting Averages

MT5’s model stands out from rivals primarily by customization. Different platforms would possibly restrict merchants to SMA and EMA, however MT5 consists of SMMA and LWMA out of the field. TradingView presents related selection, although MT5’s LWMA calculation runs barely completely different because of platform-specific implementations.

In opposition to Bollinger Bands—which incorporate shifting averages plus normal deviations—the fundamental MA feels stripped down. Bollinger Bands present each development course and volatility, whereas the MA solely handles development. However that simplicity helps inexperienced persons keep away from info overload. A clear 50 EMA on CAD/JPY beats a cluttered chart with six indicators any day.

In comparison with MACD, which makes use of shifting common convergence-divergence, the fundamental MA lacks momentum affirmation. MACD catches early development modifications by histogram crosses, whereas the MA waits for worth to truly cross the road. Some merchants run each: the 200 EMA for general bias, MACD for entry timing on GBP/AUD.

The Ichimoku Cloud makes use of a number of shifting averages plus shifted strains, making a extra full image. However the MT5 Shifting Common wins on pace—it hundreds quicker, calculates faster, and doesn’t lavatory down when testing methods throughout a number of pairs and timeframes.

Commerce with MT5 Shifting Common Indicator

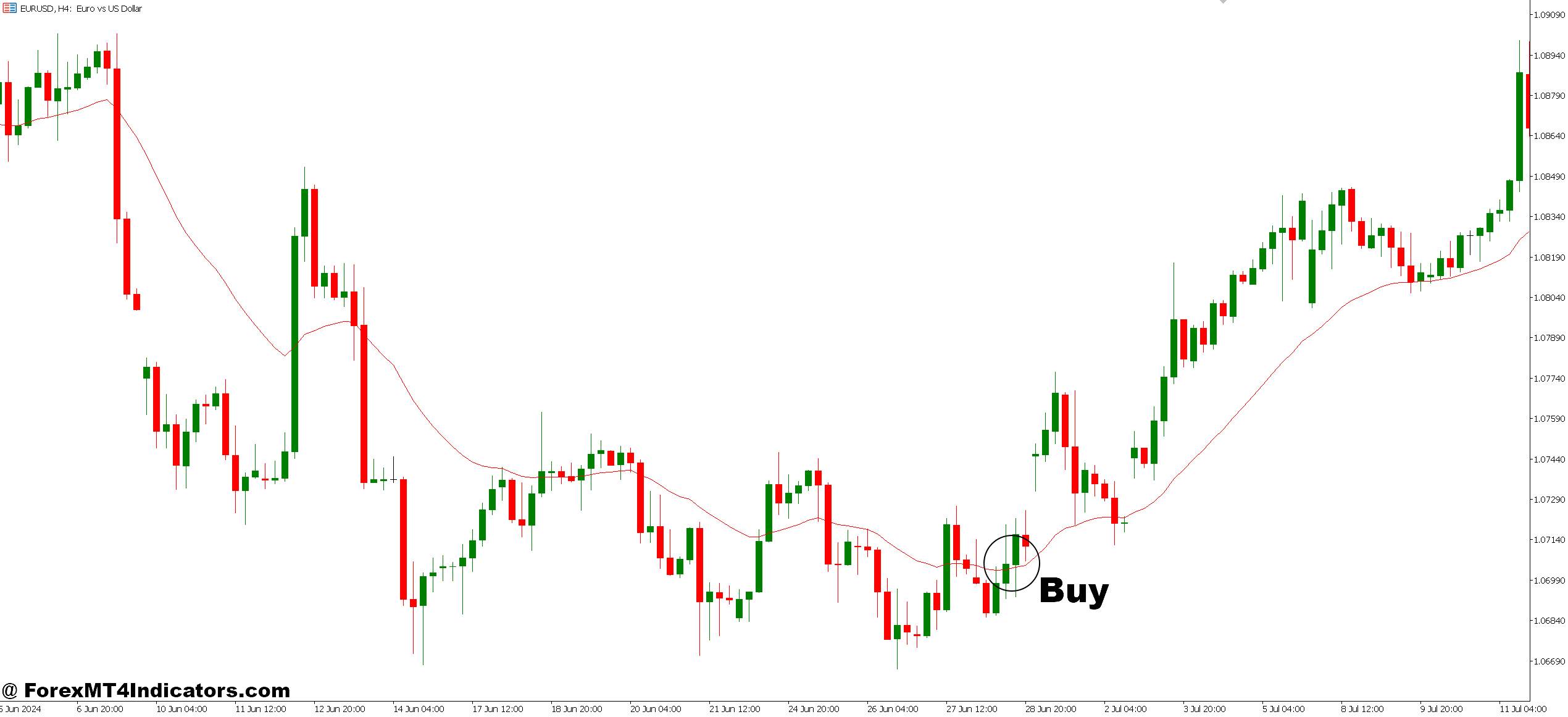

Purchase Entry

- Worth closes above 50 EMA – Look forward to a full candle shut above the 50-period EMA on the 4-hour EUR/USD chart; don’t enter on wicks or through the candle formation.

- Bullish MA crossover confirmed – Enter when the 20 EMA crosses above the 50 EMA on GBP/USD each day charts, however skip this sign if it occurs inside 30 pips of main resistance.

- Bounce off MA throughout uptrend – Purchase when worth pulls again to the touch the 20 EMA and bounces on the 1-hour chart, confirming with a bullish engulfing candle.

- A number of MAs aligned bullishly – Take lengthy positions when worth sits above 20, 50, and 200 EMAs concurrently on 4-hour timeframes, signaling sturdy development momentum.

- Danger 1-2% per commerce – Set cease loss 10-15 pips under the shifting common that triggered entry; by no means danger greater than 2% of account steadiness no matter setup high quality.

- Keep away from throughout main information – Skip MA alerts half-hour earlier than and after high-impact NFP or central financial institution bulletins when whipsaws enhance 300%.

- Quantity affirmation most popular – Search for above-average quantity on the crossover candle; weak quantity on EUR/GBP typically results in false breakouts inside 20 pips.

- Don’t chase prolonged strikes – Skip entry if worth already sits 100+ pips above the 50 EMA on each day charts; look ahead to the following pullback as a substitute.

Promote Entry

- Worth closes under 50 EMA – Enter quick when a full 4-hour candle closes under the 50-period EMA on USD/JPY, ignoring intrabar actions.

- Bearish MA crossover confirmed – Promote when the 20 EMA crosses under the 50 EMA on each day GBP/USD charts, however keep away from if worth hovers inside 25 pips of main help.

- Rejection from MA throughout downtrend – Brief when worth rallies to the 20 EMA and will get rejected with a bearish pin bar on 1-hour EUR/USD.

- All MAs pointing down – Take shorts when 20, 50, and 200 EMAs slope downward with worth under all three on 4-hour charts.

- Set tight stops on scalps – Use 8-10 pip stops when buying and selling 5-minute chart MA bounces; these quick timeframes require precision exits.

- Skip throughout ranging markets – Don’t commerce MA crossovers when EUR/CHF trades in a 50-pip vary for 3+ days; crossovers grow to be meaningless noise.

- Look forward to momentum affirmation – Pair MA alerts with RSI under 50 on each day charts; crossovers with out momentum fade 60% of the time.

- Keep away from Fridays after 12 PM EST – MA alerts on USD/CAD Friday afternoons produce 40% extra false alerts as liquidity dries up earlier than the weekend.

Placing It All Collectively

The MT5 Shifting Common indicator delivers development readability by versatile calculation strategies that merchants can tune to their technique. The 4 calculation varieties—Easy, Exponential, Smoothed, and Linear Weighted—every serve completely different buying and selling types, from scalping 1-minute charts to swing buying and selling each day timeframes. Actual-world software reveals the 50 and 200-period settings work nicely for place merchants, whereas shorter intervals like 9 or 20 swimsuit energetic day merchants on quicker charts.

That stated, shifting averages lag worth motion by nature and wrestle throughout sideways markets. They affirm tendencies after they’ve began, not earlier than. Good merchants mix them with help and resistance ranges or momentum indicators moderately than relying solely on MA alerts. Testing varied settings on demo accounts helps discover what works for particular pairs and timeframes with out risking capital.

The device’s energy lies in simplicity. A single line on the chart beats evaluation paralysis from indicator overload. Begin with one shifting common, study the way it behaves throughout completely different market situations, then add complexity provided that wanted. Generally the fundamentals work finest.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90