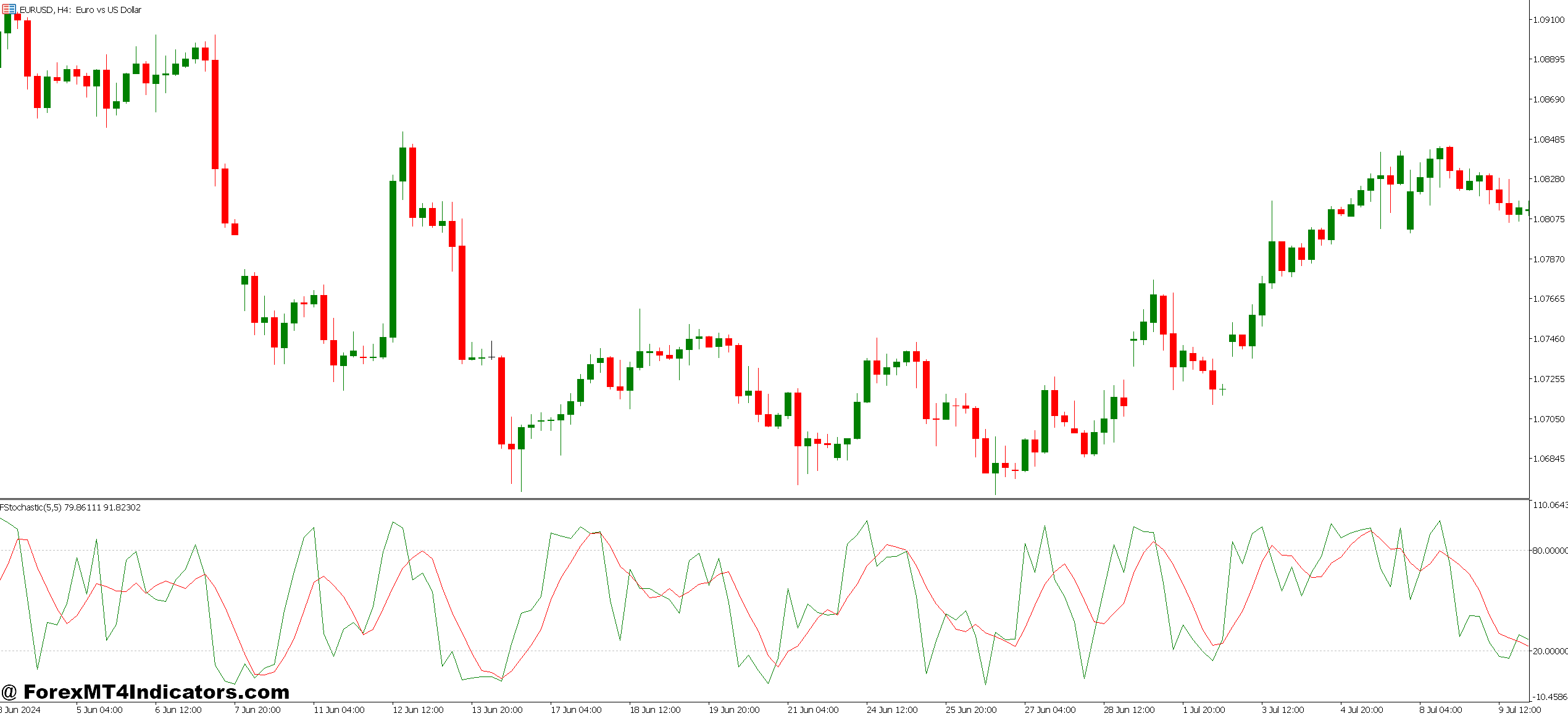

The stochastic oscillator tracks momentum by evaluating the newest closing worth to the worth vary over a particular lookback interval. It’s displayed as two traces %Ok (the quick line) and %D (the gradual sign line) that fluctuate between 0 and 100.

Right here’s what it’s actually telling you: When the stochastic reads 80 or above, the present worth is close to the highest of its latest vary. When it drops under 20, worth is buying and selling close to the underside of that vary. Consider it as a snapshot of whether or not bulls or bears have been profitable the latest battle.

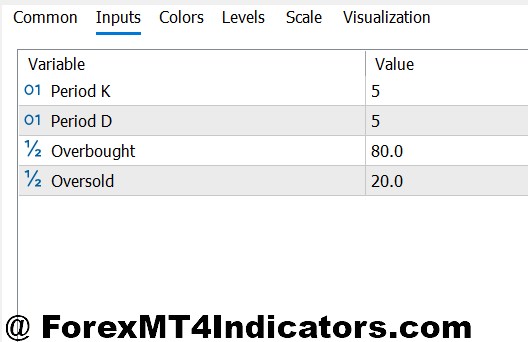

The usual MT5 setup makes use of a 5-3-3 configuration (5-period %Ok, 3-period %D, 3-period smoothing), although many merchants alter these primarily based on their timeframe. George Lane, who developed this indicator within the Fifties, believed that momentum adjustments route earlier than worth does which is why merchants look ahead to stochastic divergence and crossovers.

How the Calculation Works

The maths behind the stochastic isn’t difficult, however understanding it helps you grasp why the indicator behaves the best way it does.

The %Ok line calculation appears to be like like this: Take the present shut, subtract the bottom low out of your lookback interval, then divide by the vary (highest excessive minus lowest low) over that very same interval. Multiply by 100. That proportion tells you the place worth at present sits inside the latest vary.

The %D line is solely a shifting common of %Ok normally a 3-period easy shifting common. This smoothing creates the sign line that helps filter out noise and cut back false alerts.

When merchants discuss “quick” versus “gradual” stochastic, they’re referring to how a lot smoothing will get utilized. The quick model is extra responsive however generates extra false alerts. The gradual model (default on MT5) applies further smoothing to each traces, making it extra dependable however barely delayed.

Buying and selling the Stochastic in Actual Market Circumstances

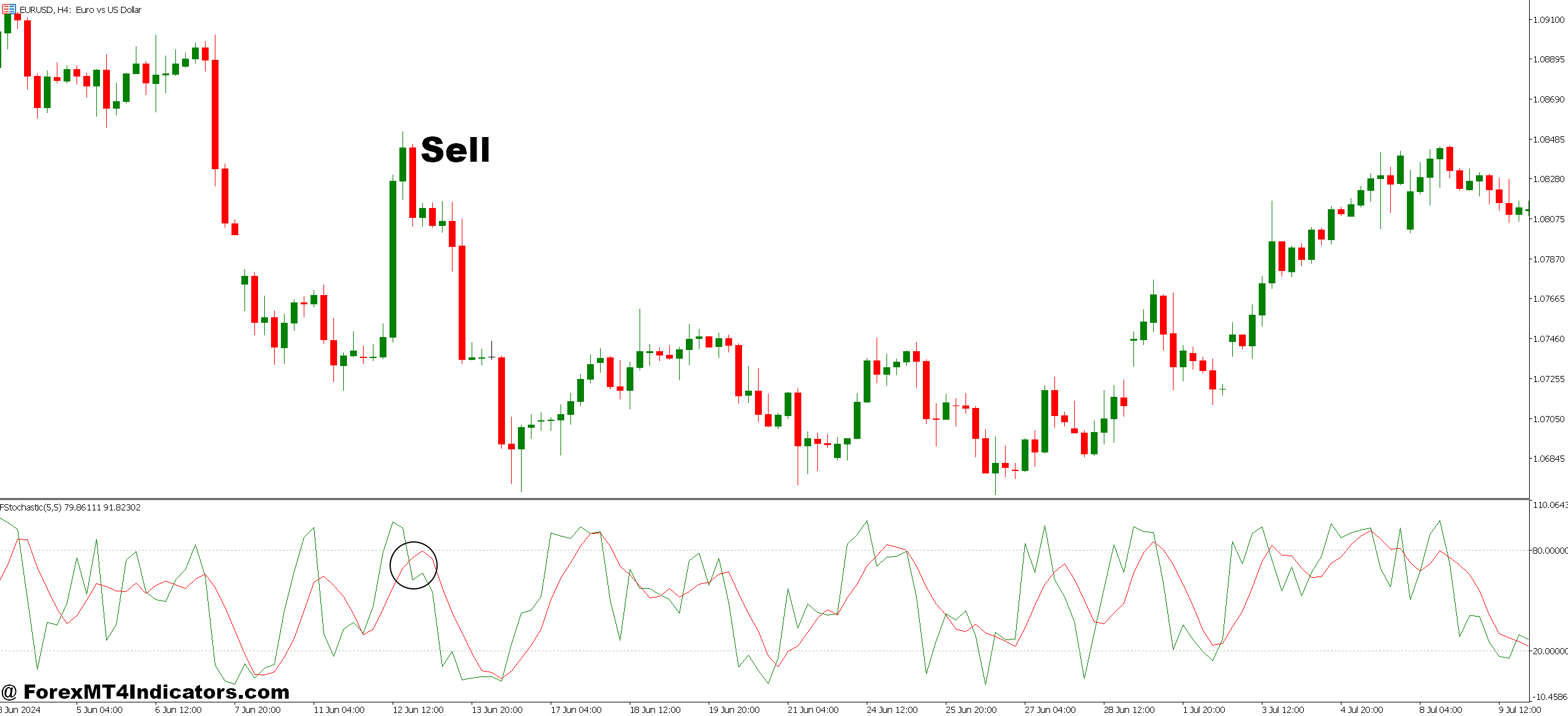

Let’s get sensible. The textbook method says purchase when stochastic crosses above 20 from oversold territory, and promote when it crosses under 80 from overbought. However anybody who’s tried this on a stay account is aware of it’s not that easy.

I’ve discovered the stochastic works finest in two particular eventualities. First, throughout range-bound markets the place worth lacks clear directional bias. On GBP/JPY’s 4-hour chart final month, worth chopped between 188.50 and 191.20 for 2 weeks. Merchants who purchased close to the help zone when stochastic dipped under 20 and offered close to resistance when it climbed above 80 had a number of high-probability setups.

Second, use it to identify divergence throughout developments. When USD/JPY was trending up in December, worth made greater highs round 157.80, however the stochastic shaped decrease highs. That bearish divergence signaled weakening momentum earlier than worth reversed giving alert merchants a heads-up to tighten stops or take income.

The most important mistake? Shorting simply because stochastic hits overbought throughout a robust uptrend. Throughout trending markets, the indicator can keep pegged in excessive territory for dozens of candles whereas worth continues working. That’s the place you want affirmation from worth motion look forward to a decrease excessive or rejection at resistance earlier than performing on stochastic alerts.

Customizing Settings for Completely different Buying and selling Kinds

Default settings don’t match each dealer or market situation. Day merchants on the 5-minute or 15-minute charts typically discover the usual 5-3-3 too gradual. Bumping it to 8-3-3 and even 10-3-3 reduces whipsaw alerts throughout the London and New York periods.

Swing merchants working off day by day or weekly charts would possibly do the alternative utilizing a sooner 3-2-2 setup to catch momentum shifts earlier. The tradeoff is all the time the identical: sooner settings offer you earlier alerts however extra false positives, whereas slower settings lag however filter noise higher.

Some merchants alter the overbought/oversold ranges too. As an alternative of the normal 80/20, they use 70/30 for extra alerts or 85/15 for higher-quality setups. Check what works along with your most well-liked forex pairs and timeframe. Risky pairs like GBP/NZD would possibly want wider bands, whereas secure pairs like EUR/CHF work high-quality with normal ranges.

One trick I’ve seen skilled merchants use: mix two stochastic indicators with completely different intervals on the identical chart. When each align say a 5-3-3 and a 14-3-3 each exhibiting oversold circumstances it confirms momentum is shifting throughout a number of timeframes.

Strengths, Weaknesses, and When It Fails

The stochastic excels at figuring out potential reversal factors in ranging or corrective markets. It’s additionally wonderful for divergence buying and selling, typically recognizing momentum shifts earlier than they’re apparent on worth charts. The clear visible alerts (crossovers, excessive readings) make it beginner-friendly too.

However right here’s the place it struggles. Throughout sturdy developments, the indicator turns into almost ineffective as a standalone software it’ll scream “overbought” whereas worth continues climbing for hours. You’ll additionally get chopped up throughout consolidation intervals when worth whipsaws backwards and forwards, triggering false alerts on each side.

The stochastic doesn’t let you know something about development route or energy. It solely measures the place worth sits inside its latest vary. Meaning you want context from different instruments shifting averages, help and resistance ranges, or development traces to know whether or not you’re buying and selling with or in opposition to the dominant development.

Danger administration issues much more with oscillator-based entries. Simply because stochastic exhibits oversold doesn’t imply worth can’t drop one other 50 pips earlier than reversing. Set your stops primarily based on worth construction, not indicator ranges.

How It Compares to RSI and Different Oscillators

Merchants typically examine the stochastic to the Relative Power Index (RSI), they usually’re each momentum oscillators with overbought/oversold readings. The important thing distinction? RSI measures the magnitude of latest worth adjustments, whereas stochastic measures place inside the latest vary.

In uneven markets, stochastic tends to be extra responsive as a result of it reacts to the worth vary instantly. RSI would possibly keep extra impartial throughout the identical circumstances. That stated, RSI tends to work higher throughout developments as a result of its calculation doesn’t get pinned to extremes as simply.

Another choice is the Stochastic RSI, which applies stochastic calculations to RSI values. It’s extra delicate than both indicator alone, producing alerts sooner but additionally producing extra false readings. It’s overkill for many merchants.

What works? Many profitable merchants use stochastic alongside trend-following indicators. Mix it with a 50-period or 200-period shifting common to filter alerts solely take oversold purchase alerts when worth is above the MA, and solely take overbought promote alerts when worth is under it.

Easy methods to Commerce with MT5 Stochastic Indicator

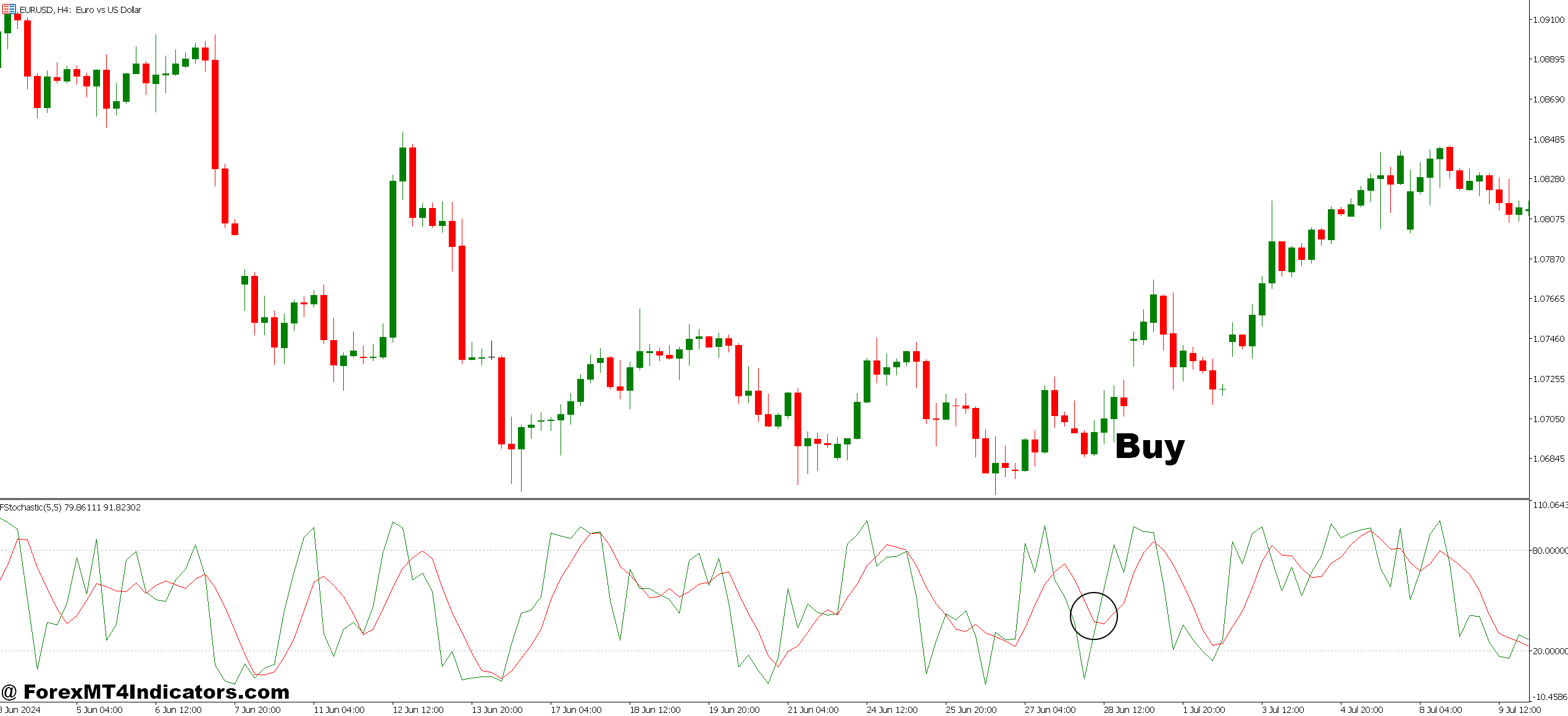

Purchase Entry

- Oversold crossover under 20 – Watch for %Ok line to cross above %D line whereas each are beneath 20 on EUR/USD 1-hour chart, then enter on the following candle open with 20-30 pip cease loss.

- Bullish divergence affirmation – When worth makes decrease lows however stochastic varieties greater lows on 4-hour GBP/USD, enter after stochastic crosses above 30 with cease under latest swing low.

- Vary help bounce – Purchase when stochastic hits 15-20 close to established help on day by day timeframe, however skip this sign if worth breaks help by greater than 10 pips.

- Double-dip setup – Enter when stochastic drops under 20 twice inside 8-12 candles with out breaking help, signaling sturdy shopping for stress constructing beneath.

- Development pullback entry – On uptrending pairs above 200 EMA, purchase when stochastic touches 40-50 (not ready for 20), catching the dip early with tighter 15-pip stops.

- Keep away from throughout sturdy downtrends – Don’t purchase oversold readings when worth is under 50-period MA on 4-hour charts, as stochastic can keep oversold whereas worth retains dropping.

- Watch for candle affirmation – By no means enter mid-candle on stochastic alerts; look forward to the candle to shut above entry stage to keep away from false breakouts that reverse rapidly.

- Danger solely 1-2% per commerce – Even with excellent stochastic alerts, restrict place measurement so your cease loss equals 1-2% of account steadiness most.

Promote Entry

- Overbought crossover above 80 – Promote when %Ok crosses under %D whereas each traces are above 80 on EUR/USD 4-hour chart, putting stops 25-35 pips above latest swing excessive.

- Bearish divergence play – When worth makes greater highs however stochastic varieties decrease highs on day by day GBP/USD, quick after stochastic drops under 70 with affirmation candle.

- Vary resistance rejection – Promote when stochastic reaches 80-85 at confirmed resistance on 1-hour charts, however cancel if worth breaks resistance cleanly with quantity.

- Failed breakout sign – Quick when stochastic hits overbought (80+), worth touches resistance, then reverses with bearish engulfing candle inside 2-3 intervals.

- Development retest entry – In downtrends under 200 EMA, promote when stochastic bounces to 50-60 zone throughout pullbacks, coming into sooner than ready for full 80 studying.

- Skip in sturdy uptrends – Ignore overbought alerts when worth is 100+ pips above 50 MA on 4-hour charts, as trending markets keep overbought for prolonged intervals.

- Information occasion warning – Don’t commerce stochastic alerts half-hour earlier than or after main information (NFP, FOMC, CPI), as volatility creates false alerts and huge spreads.

- Path stops after 30+ pips – As soon as your quick runs 30-40 pips in revenue, transfer cease to breakeven and let stochastic staying oversold information your exit timing.

Making the Stochastic Work for Your Buying and selling

The MT5 Stochastic Indicator received’t rework your buying and selling in a single day, however it may well present actual worth when used intelligently. It really works finest for timing entries in ranging markets, recognizing divergence throughout developments, and confirming momentum shifts alongside different evaluation strategies.

Preserve your expectations reasonable. No indicator catches each transfer or avoids each shedding commerce. The merchants who revenue persistently with stochastic use it as one piece of a broader technique combining it with worth motion, help and resistance, and stable threat administration. In addition they know when to disregard it utterly, like when markets are trending laborious or throughout high-impact information occasions.

Buying and selling foreign exchange carries substantial threat, and indicators are instruments, not ensures. Check any setup on a demo account first, hold your place sizes manageable, and by no means threat capital you’ll be able to’t afford to lose. The stochastic might help you learn momentum however the choices, and the accountability, stay yours.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90