OBV for Gold & Foreign exchange Merchants:

Quantity Secrets and techniques, Development Detection, and Good Cash Indicators

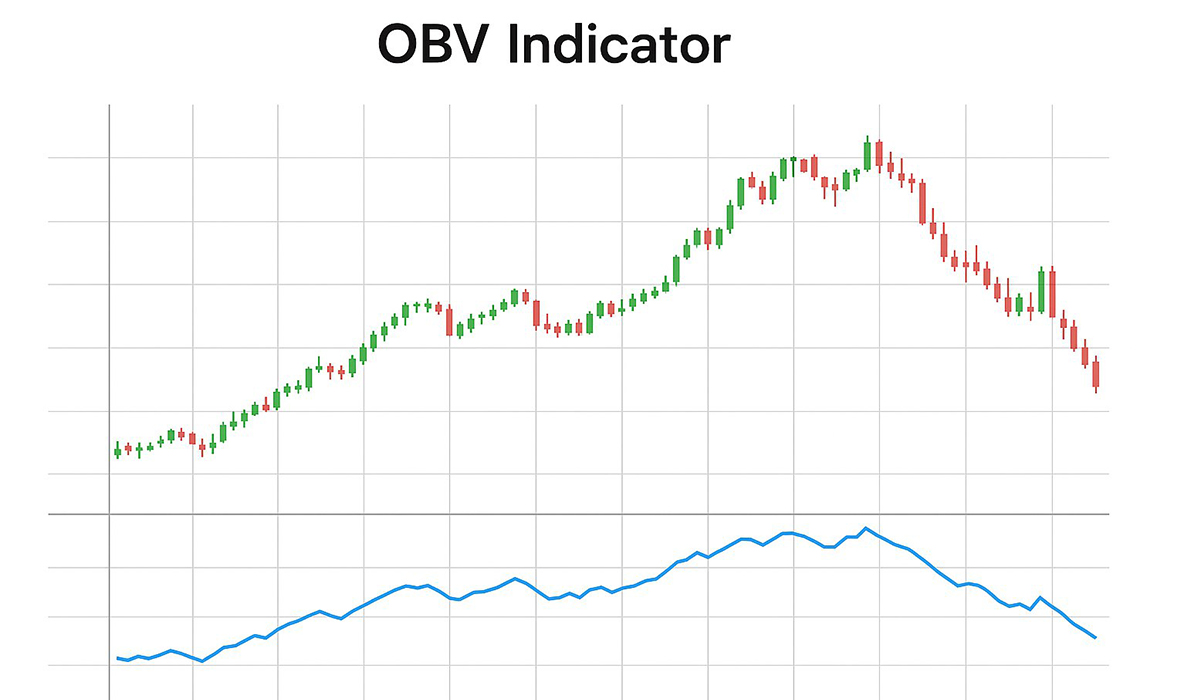

The On-Stability Quantity (OBV) indicator is among the oldest but strongest instruments in technical evaluation. Constructed on quantity and worth motion, OBV reveals the true movement of market liquidity and exposes the underlying energy or weak spot behind worth motion.

Skilled merchants use OBV for development affirmation, divergence detection, figuring out legitimate breakouts, and creating algorithmic buying and selling programs.

On this complete information, we discover all the pieces you want to learn about OBV and methods to use it as a dependable software—and even because the basis of Knowledgeable Advisors (EAs).

What Is the OBV Indicator? Understanding the Logic Behind It

The OBV indicator is a cumulative volume-based metric that tracks whether or not cash is flowing into or out of the market.

It was launched by Joseph Granville with the precept that:

If quantity will increase constantly whereas the value has not but reacted, OBV will replicate this accumulation early—typically earlier than a significant transfer begins.

This makes OBV a frontline software for forecasting market course.

How OBV Works: Easy System, Robust Output

OBV System

The core components is extraordinarily simple:

-

If at present’s Shut > yesterday’s Shut → OBV provides at present’s quantity

-

If at present’s Shut < yesterday’s Shut → OBV subtracts at present’s quantity

-

If at present’s Shut is equal → OBV stays unchanged

By means of this cumulative calculation, OBV creates a dynamic line that displays actual shopping for or promoting strain—much more precisely than worth alone.

Key Options of OBV (Why Merchants Use It All over the place)

1. OBV Is a Main Indicator

In contrast to lagging indicators resembling MACD or Transferring Averages, OBV is a main indicator.

It typically shifts course earlier than the precise worth development reverses.

When institutional merchants enter the market with giant quantity, OBV responds instantly—making it perfect for early development prediction.

2. OBV Detects Actual Market Stress

Worth alone could not reveal who controls the market, however OBV exposes the underlying energy:

This makes OBV invaluable when evaluating whether or not a development is backed by actual quantity or is weak and unsustainable.

3. OBV Clearly Reveals Development Power

By analyzing OBV swings:

Many merchants draw trendlines instantly on OBV for quick and dependable development evaluation.

4. OBV Divergence: One of many Most Dependable Market Indicators

– Bullish Divergence (Robust Purchase Sign)

When worth types a decrease low however OBV types the next low, hidden accumulation is going on.

This typically indicators the beginning of a significant bullish reversal.

– Bearish Divergence (Early Promote Warning)

If the value types the next excessive however OBV fails to verify it, distribution is underway—warning of a possible downtrend.

OBV divergence is extensively thought-about extra dependable than many momentum indicators as a result of it’s primarily based on actual quantity.

5. OBV Validates Breakouts Extra Precisely Than Worth Alone

– Confirmed Breakout

A breakout turns into extremely credible when each worth and OBV transfer above their earlier construction ranges.

– Pretend Breakout Detection

If worth breaks a help or resistance degree however OBV doesn’t verify the transfer, the breakout is probably going false.

This makes OBV an ideal affirmation software for breakout merchants in Foreign exchange, Gold (XAUUSD), and Crypto.

OBV Buying and selling Functions: From Handbook Buying and selling to EA Improvement

1. Detecting Development Reversals Early

OBV is among the quickest instruments for figuring out development exhaustion and reversals—making it helpful for swing, day, and place merchants.

2. OBV + Transferring Averages Technique

A well-liked and extremely efficient methodology is to mix OBV with Transferring Averages:

This hybrid methodology improves development readability and reduces false indicators.

3. OBV for Knowledgeable Advisors and Algorithmic Buying and selling

Due to its easy components and excessive accuracy, OBV is a wonderful indicator for algorithmic programs:

In MQL4 and MQL5, OBV is light-weight and straightforward to combine, making it perfect for superior automated programs.

4. Good for XAUUSD and Excessive-Quantity Markets

OBV performs exceptionally effectively in markets the place quantity has a robust affect:

-

Gold (XAUUSD)

-

Main Foreign exchange pairs (EURUSD, GBPUSD, USDJPY)

-

Cryptocurrency markets resembling BTC and ETH

Particularly on M30, H1, and H4 timeframes, OBV reveals development energy extra precisely than many built-in indicators.

Superior Strategies to Maximize OBV Efficiency

1. Use Increased Timeframes for Extra Correct Indicators

H4 and Day by day timeframes provide a lot cleaner quantity conduct and considerably cut back market noise—making OBV extra dependable.

2. Mix OBV With Market Construction and Worth Motion

For max precision, OBV ought to be used alongside:

-

Provide & Demand zones

-

Trendlines

-

Liquidity ranges

-

Break of Construction (BOS)

-

Assist/Resistance zones

This mixture produces extraordinarily high-quality indicators.

3. Larger Divergence = Larger Reversal

A large hole between worth and OBV signifies highly effective displacement and is usually adopted by a robust reversal transfer.

Last Conclusion: Why OBV Ought to Be in Each Dealer’s Toolbox

OBV is a easy, highly effective, and extremely dependable indicator appropriate for brand new {and professional} merchants alike.

It gives correct perception into:

Due to its light-weight construction, OBV isn’t solely a buying and selling indicator but in addition a core part for many Knowledgeable Advisors and automatic methods.

Really useful Indicator: TW Quantity Sign Professional (Based mostly on OBV Logic)

Constructed by Altan Karakaya | Skilled Quantity-Based mostly Sign Device

Alongside OBV, we extremely suggest testing the TW Quantity Sign Professional indicator, created by Altan Karakaya.

This software is designed utilizing superior quantity evaluation ideas and aligns completely with the logic behind OBV.

It gives clear, actionable, and algorithm-friendly indicators.

Why TW Quantity Sign Professional Is Price Including to Your Technique

-

Works as a excellent complementary software for OBV-based programs

-

Generates clear entry and exit indicators

-

Wonderful for technique improvement and backtesting

-

Ideally suited for constructing Knowledgeable Advisors and algorithmic buying and selling fashions

-

Extremely efficient in Foreign exchange, Gold, and Crypto markets

-

Appropriate for scalping, day buying and selling, and swing buying and selling

This indicator enhances quantity affirmation and strengthens decision-making in all market situations.

Ideally suited for Merchants Looking for Stronger Quantity Affirmation

In case your buying and selling strategy depends on quantity, momentum, or market construction,

TW Quantity Sign Professional is a robust and dependable software price testing as a part of your technique portfolio.