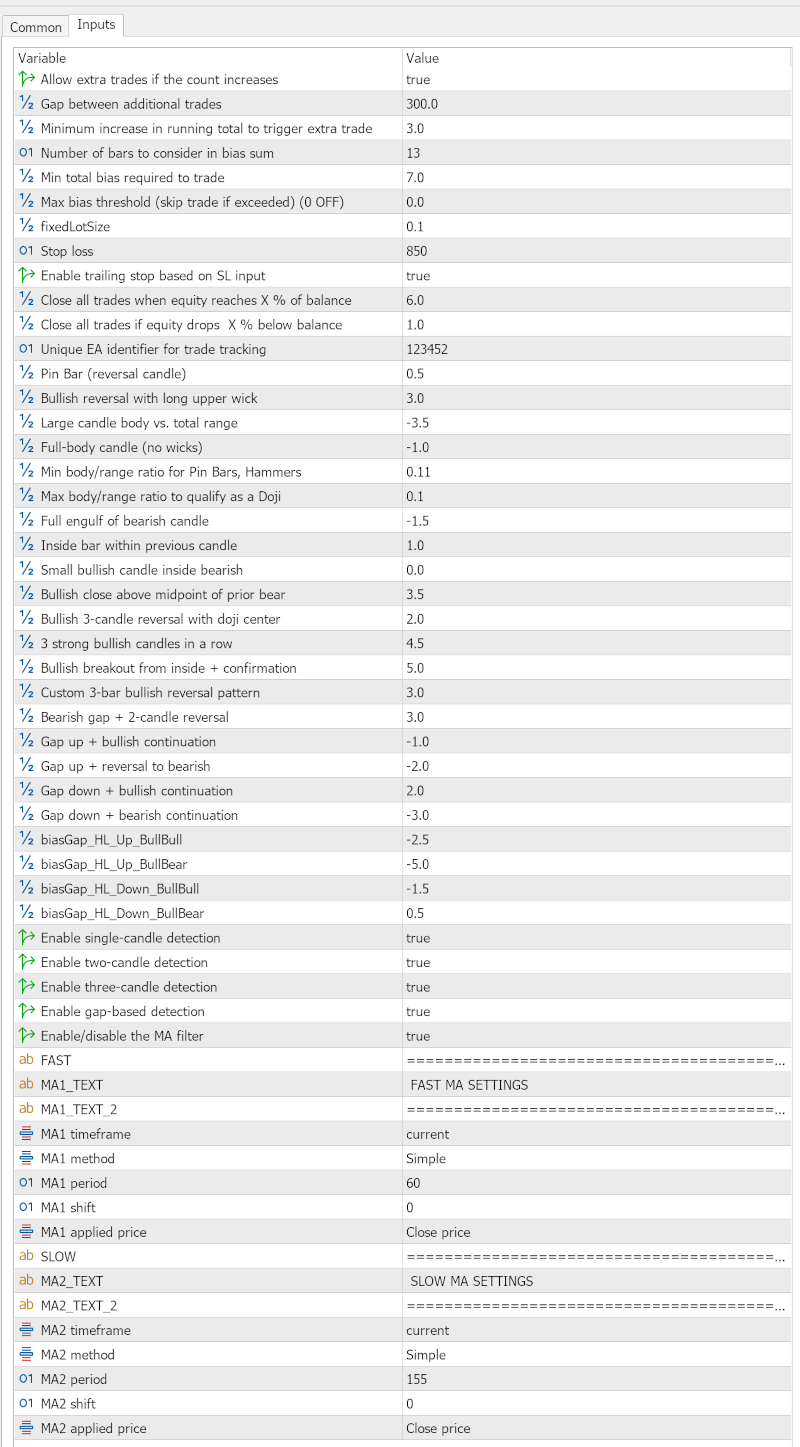

EA Primary Setup -Inputs

Technique Management Inputs

These inputs decide how the EA behaves with respect to opening further trades and the sensitivity of alerts.

-

enter bool enableAdditionalTrades = true;

Objective: Allows (or disables) the flexibility to open further trades if the buying and selling bias (working complete) will increase considerably.

When enabled: The EA can add to an current place if the sign grows stronger. -

enter double additionalTradeGap = 300.0;

Objective: Defines the minimal value hole (in pips, transformed to factors internally) that have to be met between consecutive extra trades.

Utilization: Helps keep away from fast re-entry or “whipsaw” when the worth hasn’t moved sufficient from the earlier extra entry. -

enter double additionalTradeThreshold = 3;

Objective: Units the minimal improve within the working complete (i.e., the cumulative bias from latest bars) required to set off a further commerce.

Utilization: Ensures that an additional commerce is simply taken when the sign’s energy will increase by at the very least this quantity in comparison with the earlier commerce sign.

Operating Complete Configuration

These parameters management how the EA calculates the bias (or sign energy) by summing the contributions from a number of bars.

-

enter int runningTotalBars = 13;

Objective: Defines the variety of earlier bars used to compute the working complete of bias values.

Utilization: A bigger quantity smooths out random fluctuations; a smaller quantity makes the EA extra delicate to latest strikes. -

enter double minCountThreshold = 7;

Objective: Units the minimal sum of bias (from the latest bars) required to set off a brand new commerce.

Utilization: Helps filter out weak or indecisive market situations. -

enter double maxCountThreshold = 0;

Objective: Establishes an higher restrict for the bias—if the working complete exceeds this threshold, the EA would skip the commerce.

Utilization: When set to 0, it’s successfully turned off; if a nonzero worth is supplied, it prevents buying and selling in overly sturdy situations the place the bias is likely to be excessively excessive.

Commerce and Threat Administration Inputs

These settings decide your commerce dimension and danger thresholds.

-

enter double fixedLotSize = 0.1;

Objective: Defines the fastened variety of heaps to commerce for every order.

Utilization: That is the bottom quantity that shall be normalized later to adjust to the dealer’s quantity settings. -

enter int stopLossPoints = 850;

Objective: Specifies the cease loss distance in factors (a “level” being the minimal value motion outlined by the dealer’s image settings).

Utilization: Determines how removed from the entry value the cease loss is positioned to restrict potential losses. -

enter bool useTrailingStop = true;

Objective: Allows (or disables) a trailing cease mechanism.

Utilization: When enabled, the EA will modify the cease loss throughout the lifetime of the commerce, probably locking in income because the market strikes favorably. -

enter double takeProfitPercent = 6;

Objective: Units the take revenue threshold as a proportion acquire relative to the account stability.

Utilization: When fairness reaches this proportion above the stability, the EA will shut all trades to safe income. -

enter double maxDrawdownPercent = 1;

Objective: Defines the utmost allowable drawdown (as a proportion beneath the account stability) earlier than all trades are closed.

Utilization: Acts as a security mechanism to restrict losses in adversarial market situations. -

enter int MagicNumber = 123452;

Objective: Gives a novel identifier for all trades executed by this EA.

Utilization: Distinguishes these orders from these positioned manually or by different EAs working on the identical account.

Single Candle Patterns – Bias and Detection Thresholds

These inputs set bias values for alerts generated by sure single-candle patterns and decide detection standards.

-

enter double biasPinBar = 0.5;

Objective: Assigns a bias rating for detecting a Pin Bar sample (a reversal candle with a protracted tail).

Utilization: A Pin Bar contributes positively or negatively to the buying and selling sign relying on its context. -

enter double biasInvertedHammerBull = 3;

Objective: Units the bias for an Inverted Hammer sample in a bullish situation, the place a protracted higher wick might sign a reversal. -

enter double biasWideRangeBull = -3.5;

Objective: Assigns a bias to wide-range bullish candles (a big candle physique in comparison with the general vary), which might point out sturdy momentum. -

enter double biasMarubozuBull = -1;

Objective: Determines the bias for a Marubozu candle—a candle with little or no wicks that signifies sturdy directional conviction. -

enter double minPinBodyRatio = 0.11;

Objective: The minimal ratio of the candle physique to the total vary required for a candle to qualify as a Pin Bar or hammer sample. -

enter double dojiBodyThresholdRatio = 0.1;

Objective: Establishes the utmost body-to-range ratio for a candle to be thought-about a Doji.

Utilization: Ensures that solely candles with little or no physique (indicative of market indecision) are flagged.

Two Candle Patterns – Bias Settings

These inputs are used for patterns involving two consecutive candles.

-

enter double biasBullEngulfing = -1.5;

Objective: Units the bias for a bullish engulfing sample the place a bullish candle utterly engulfs a earlier bearish candle. -

enter double biasInsideBarBull = 1;

Objective: Gives a optimistic bias for an inside bar sample, the place the present candle’s vary is totally inside the earlier candle’s vary. -

enter double biasHaramiBull = 0;

Objective: Defines the bias for a bullish Harami sample—a small bullish candle contained inside a bigger bearish candle.

Utilization: A zero worth means it has a impartial impression on the sign. -

enter double biasPiercing = 3.5;

Objective: Assigns a bias for a Piercing sample. This can be a bullish reversal sample the place a bullish candle closes above the midpoint of a previous bearish candle.

Three Candle Patterns – Bias and Detection Thresholds

These inputs apply to alerts derived from three-candle formations.

-

enter double biasMorningStar = 2;

Objective: Bias for a Morning Star sample (a three-candle bullish reversal that always features a doji), indicating a shift in momentum. -

enter double biasThreeWhiteSoldiers = 4.5;

Objective: A robust bullish bias when three consecutive bullish candles (Three White Troopers) are detected. -

enter double biasThreeInsideUp = 5;

Objective: Bias for a “Three Inside Up” sample, the place an inside sample confirms bullish reversal. -

enter double biasThreeBarBullRev = 3;

Objective: Units a bias for a custom-defined three-bar bullish reversal sample. -

enter double biasUpsideGapTwoCrows = 3;

Objective: Though named with a “crows” reference, it’s related to bearish hole patterns involving two candles.

Utilization: The setting means that such a formation contributes a selected bias to the general sign.

Hole Patterns – Open-Shut Primarily based Bias Settings

These inputs deal with hole patterns by evaluating open/shut costs, providing extra alerts.

-

enter double biasGap_OC_Up_BullBull = -1;

Objective: Bias worth for a niche up situation the place bullish situations proceed (each earlier and present candles are bullish). -

enter double biasGap_OC_Up_BullBear = -2;

Objective: Bias for a niche up sample that reverses into bearish conduct. -

enter double biasGap_OC_Down_BullBull = 2;

Objective: Bias for a niche down that continues bullish momentum, an uncommon state of affairs the place market construction would possibly suggest a retracement. -

enter double biasGap_OC_Down_BullBear = -3;

Objective: Bias for a niche down resulting in bearish continuation.

Hole Patterns – Excessive-Low Primarily based Bias Settings

These settings take into account gaps within the high-low vary slightly than open-close ranges.

-

enter double biasGap_HL_Up_BullBull = -2.5;

Objective: Bias for a bullish affirmation in a niche up situation primarily based on the high-low vary. -

enter double biasGap_HL_Up_BullBear = -5;

Objective: A stronger bearish bias in a niche up situation when situations reverse. -

enter double biasGap_HL_Down_BullBull = -1.5;

Objective: Bias for hole down with bullish continuation. -

enter double biasGap_HL_Down_BullBear = 0.5;

Objective: A gentle bias for hole down situations that flip bearish.

Sample Group Allow/Disable Flags

These boolean switches allow you to select which units of sample analyses to run. Disabling a gaggle can simplify the decision-making course of in the event you want to deal with specific patterns.

-

enter bool analyzeSingleCandlePatterns = true;

Allows or disables the detection of single-candle patterns. -

enter bool analyzeTwoCandlePatterns = true;

Controls whether or not two-candle sample detection is lively. -

enter bool analyzeThreeCandlePatterns = true;

Toggles the evaluation for three-candle patterns. -

enter bool analyzeGapPatterns = true;

Determines if gap-based patterns are to be included within the buying and selling sign.

MA Cross Visualization Settings (Shifting Common Filter)

These inputs configure two transferring averages used as a filter to additional affirm commerce alerts.

Quick Shifting Common (MA1)

-

enter bool InpUseMAFilter = true;

Objective: Allows or disables the transferring common filter totally.

Utilization: When enabled, the EA will solely take a commerce if the quick MA is within the desired relation to the sluggish MA. -

enter string FAST and associated textual content strings ( MA1_TEXT , MA1_TEXT_2 ):

Objective: Present labels or visible separators for the quick MA settings when displayed on the chart. -

enter ENUM_TIMEFRAMES MA1_TIMEFRAME = PERIOD_CURRENT;

Objective: Units the timeframe on which the quick MA is calculated (by default, the present chart’s timeframe). -

enter ENUM_MA_METHOD MA1_MODE = MODE_SMA;

Objective: Defines the strategy used for the quick MA calculation (Easy Shifting Common on this case). -

enter int MA1_PERIOD = 60;

Objective: Specifies the interval (variety of bars) to calculate the quick MA. -

enter int MA1_SHIFT = 0;

Objective: Permits shifting the quick MA ahead or backward relative to the worth bars. -

enter ENUM_APPLIED_PRICE MA1_APPLIED_PRICE = PRICE_CLOSE;

Objective: Chooses the worth information (e.g., shut, open, excessive, low) that’s fed into the quick MA calculation.

Sluggish Shifting Common (MA2)

-

enter string SLOW, MA2_TEXT, MA2_TEXT_2 :

Objective: Much like the quick MA strings, these are used for labeling and visible group for the sluggish MA settings. -

enter ENUM_TIMEFRAMES MA2_TIMEFRAME = PERIOD_CURRENT;

Objective: Units the timeframe for the sluggish MA calculation. -

enter ENUM_MA_METHOD MA2_MODE = MODE_SMA;

Objective: Determines the strategy for the sluggish MA (once more utilizing a easy transferring common). -

enter int MA2_PERIOD = 155;

Objective: Units the variety of bars utilized in calculating the sluggish MA. Usually, an extended interval is chosen than for the quick MA. -

enter int MA2_SHIFT = 0;

Objective: Permits for adjusting the alignment of the sluggish MA. -

enter ENUM_APPLIED_PRICE MA2_APPLIED_PRICE = PRICE_CLOSE;

Objective: Selects which value to make use of (right here, the closing value) for calculating the sluggish MA.

Abstract

Every setting has been fastidiously designed to regulate both the:

-

Commerce Execution and Administration: (lot dimension, cease loss, trailing stops, danger limits, further commerce situations)

-

Sign Technology: (candlestick sample biases and thresholds, working complete calculation)

-

Market Filtering: (transferring common filter for commerce affirmation)

By adjusting these inputs, you’ll be able to fine-tune the technique’s sensitivity, danger profile, and market situation adaptability.

This thorough rationalization ought to allow you to—and any finish person—perceive the aim and performance of each configuration parameter within the EA.