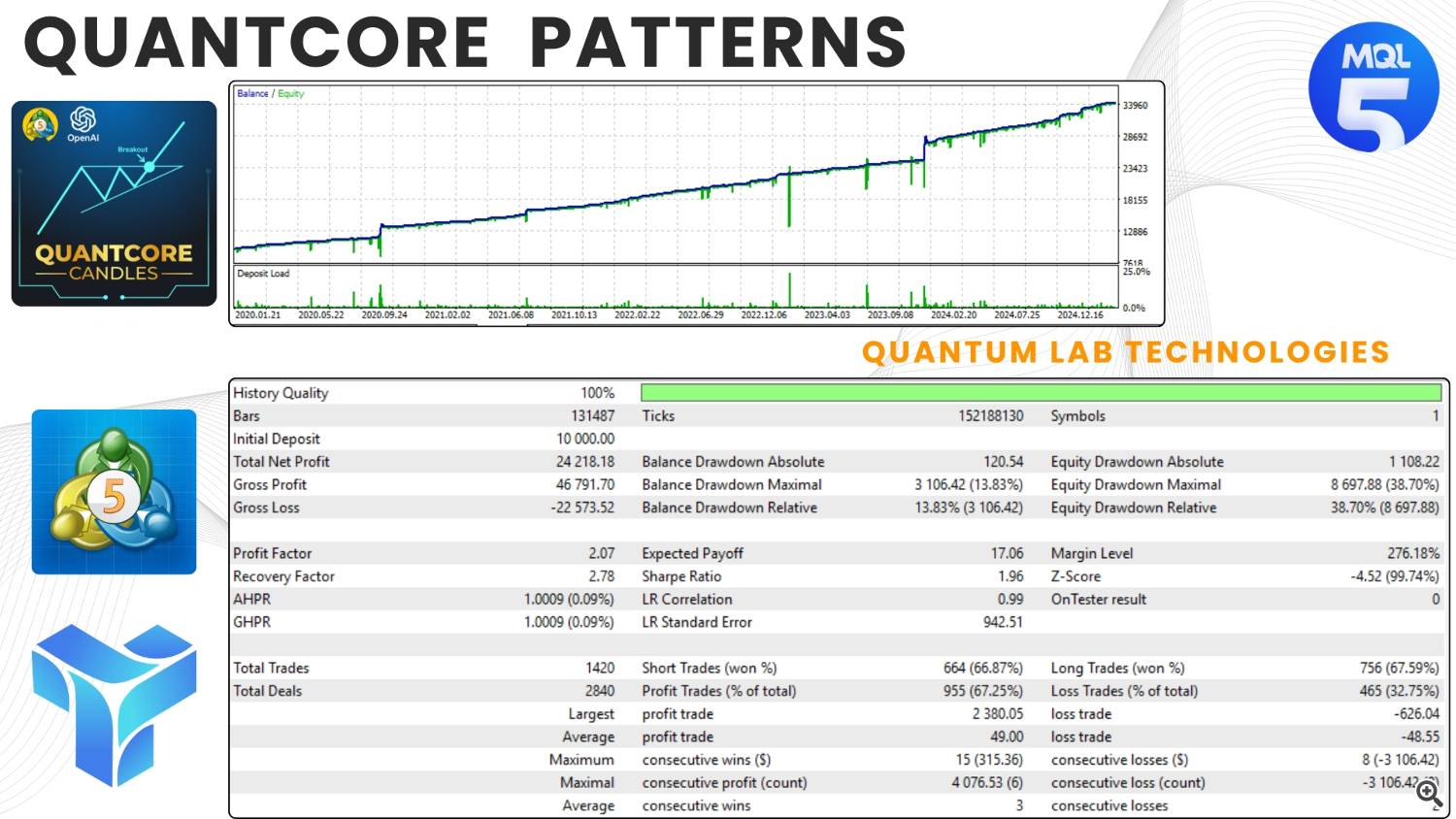

QuantCore Patterns — an clever buying and selling advisor based mostly on patterns. Automate your evaluation. Handle your income.

Within the period of knowledge overload and market volatility, skilled merchants and buyers are in search of correct, confirmed options that may guarantee stability and capital progress. That is precisely the answer – QuantCore Patterns – a high-tech buying and selling algorithm that may acknowledge and use the facility of market patterns for automated buying and selling.

- Advisable pairs: EURUSD, GBPUSD, USDCAD, NZDUSD, AUDUSD

- Timeframe: M15 — means that you can mix accuracy and frequency of transactions

- Minimal deposit: $1000 per forex pair (you should use cent accounts)

- Danger administration: 0.01 lot for each $1000 of deposit

- Situations: minimal unfold, ideally ECN accounts

To make use of the Knowledgeable Advisor you want a VPS: ➡️ https://myforexvps.com/billing/aff.php?aff=1426

We advocate you to make use of cashback to return the unfold ➡️ https://fxcash.ru/?id=X79614

Greatest EA Buying and selling Account ➡️ https://telegra.ph/Open-a-RoboForex-Account-04-16

Chart patterns are a well-liked technique utilized in technical evaluation to analyse and predict value actions within the monetary markets. Merchants and buyers use chart patterns to establish potential entry and exit factors out there, which might help them make extra knowledgeable buying and selling choices. These patterns are shaped by the value actions of a monetary instrument, similar to a inventory, forex pair, commodity, or index, over a selected time frame. Right here, we’ll discover some frequent chart patterns and their traits.

What are the commonest chart patterns?

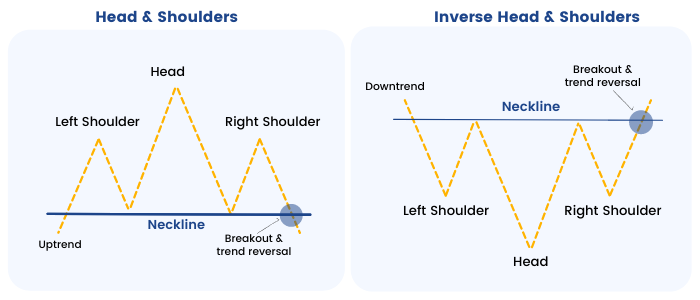

1. Head and Shoulders Sample:

- This sample consists of three peaks with the center peak (head) being larger than the opposite two (shoulders).

- The left shoulder kinds as the value rises to a peak, adopted by a decline.

- The pinnacle kinds as the value rises once more however reaches the next peak than the left shoulder, adopted by one other decline.

- The precise shoulder kinds as the value rises as soon as extra however fails to exceed the top’s peak, adopted by a decline.

- It’s thought-about a reversal sample, indicating a possible pattern change from bullish to bearish.

2. Inverse Head and Shoulders Sample:

- That is the other of the top and shoulders sample and signifies a possible pattern change from bearish to bullish.

- It consists of three valleys with the center valley (head) being decrease than the opposite two (shoulders).

- The sample’s traits mirror these of the common head and shoulders sample however in an inverted method.

3. Double High and Double Backside:

- A double prime is shaped when the value reaches a peak (resistance), then declines, and later rises once more to type a second peak at an analogous degree as the primary one.

- A double backside is the other, shaped by two value troughs (assist) at roughly the identical degree.

- These patterns point out potential pattern reversals.

4. Triple High and Triple Backside:

- Just like double tops and double bottoms, however these patterns have three peaks or troughs as a substitute of two.

- The third peak or trough additional confirms the potential pattern reversal.

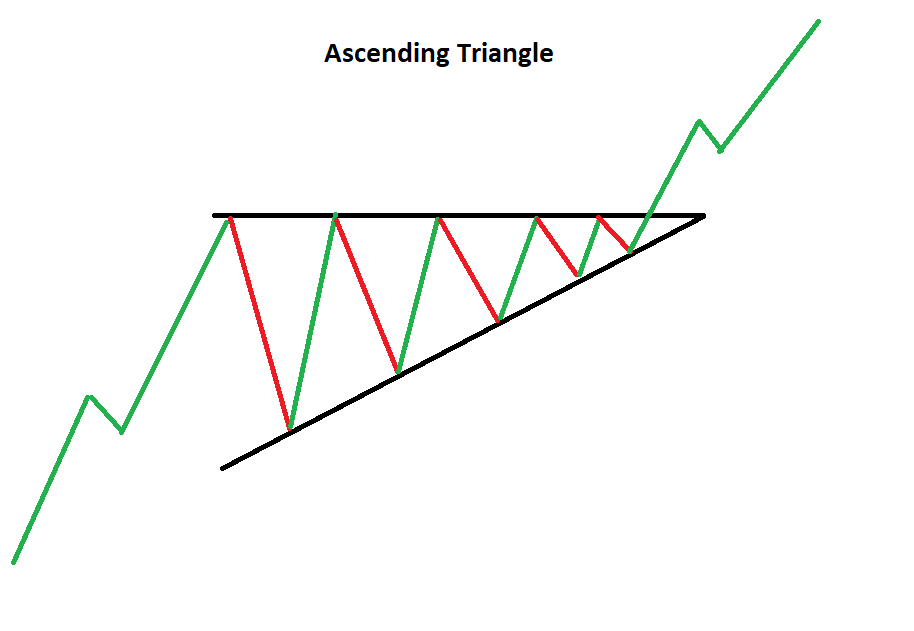

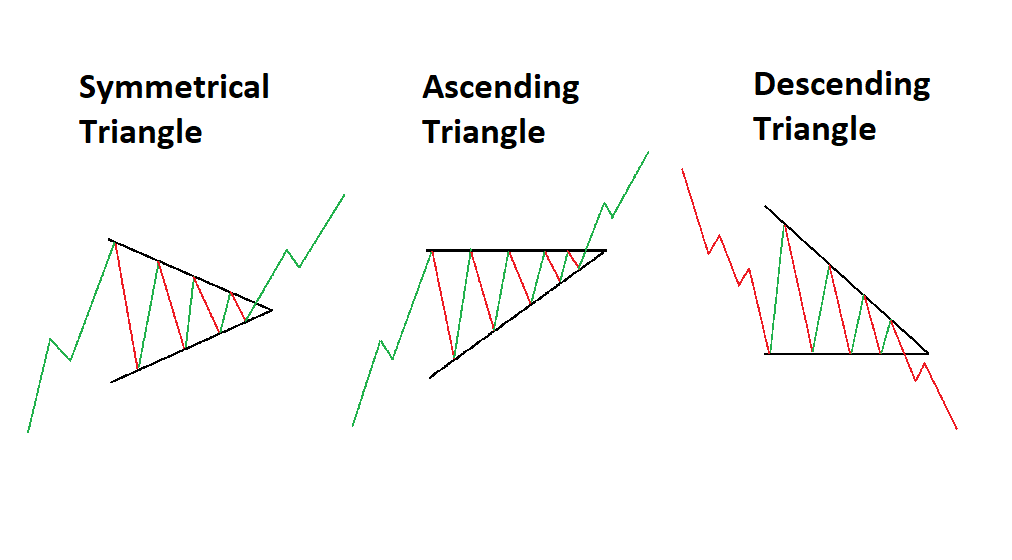

5. Ascending Triangle:

- Shaped by a horizontal resistance degree and an upward-sloping assist line.

- Every time the value touches the resistance, it retreats, and every time it touches the assist, it bounces again.

- This sample means that the value might escape upwards, indicating a possible bullish pattern continuation.

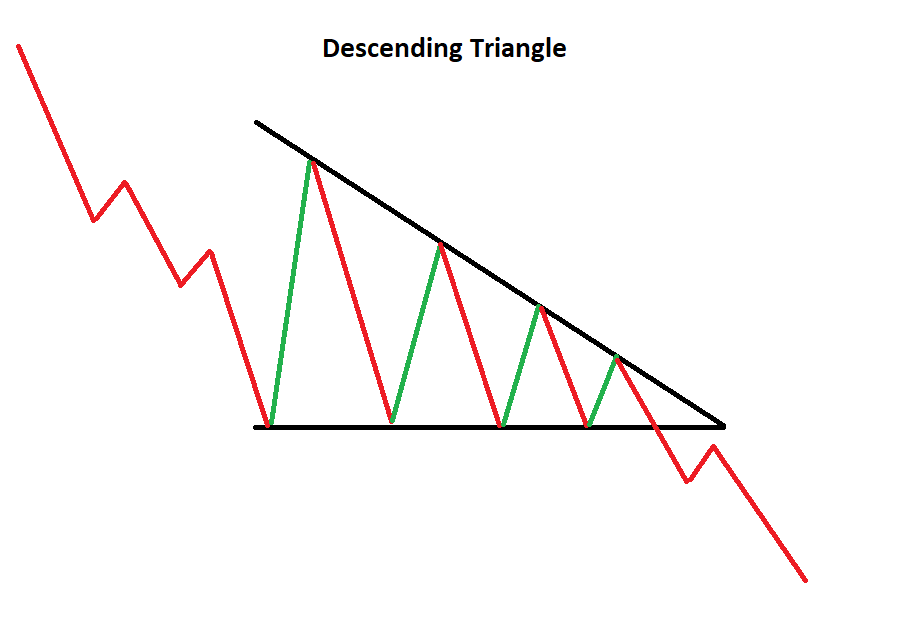

6. Descending Triangle:

- Inverse of the ascending triangle, this sample has a horizontal assist degree and a downward-sloping resistance line.

- The worth approaches the assist and will get pushed again, whereas it approaches the resistance and will get rejected.

- This sample means that the value might escape downwards, indicating a possible bearish pattern continuation.

7. Symmetrical Triangle:

- Shaped by converging trendlines, with each the assist and resistance getting nearer collectively over time.

- The worth oscillates between these traces, forming larger lows and decrease highs.

- This sample would not point out a selected directional bias and may escape both upwards or downwards.

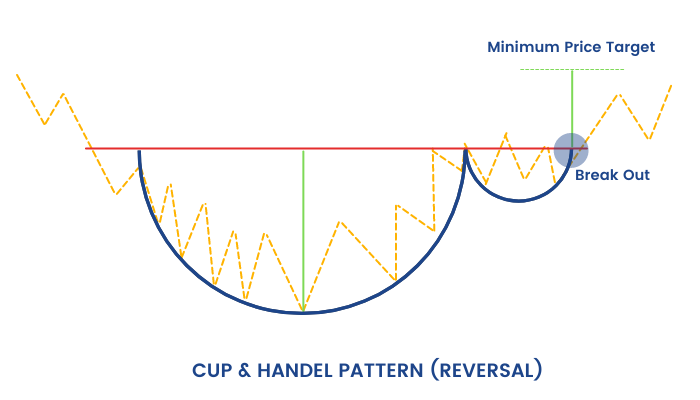

8. Cup and Deal with:

- A bullish continuation sample that resembles a cup with a deal with.

- The cup is shaped as the value regularly declines after which rises again to roughly the identical degree.

- The deal with is a small dip in value that follows the cup’s rise.

- A breakout above the deal with’s resistance degree signifies a possible uptrend continuation.

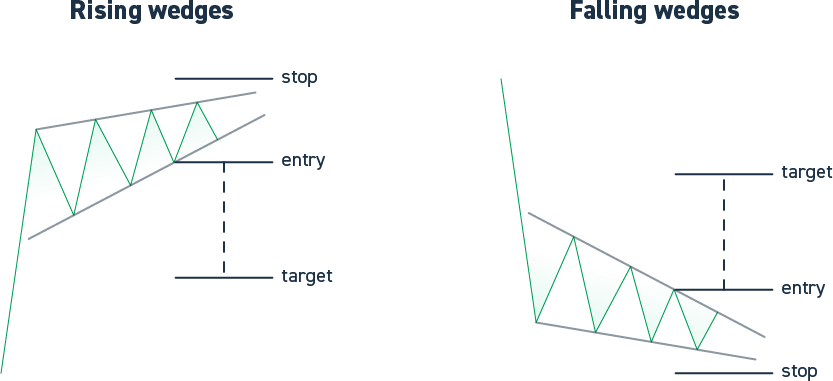

9. Wedge Patterns:

- Rising Wedge: Shaped by converging pattern traces with the next resistance line and the next assist line. It often signifies a bearish pattern.

- Falling Wedge: Shaped by converging pattern traces with a decrease resistance line and a decrease assist line. It often signifies a bullish pattern.

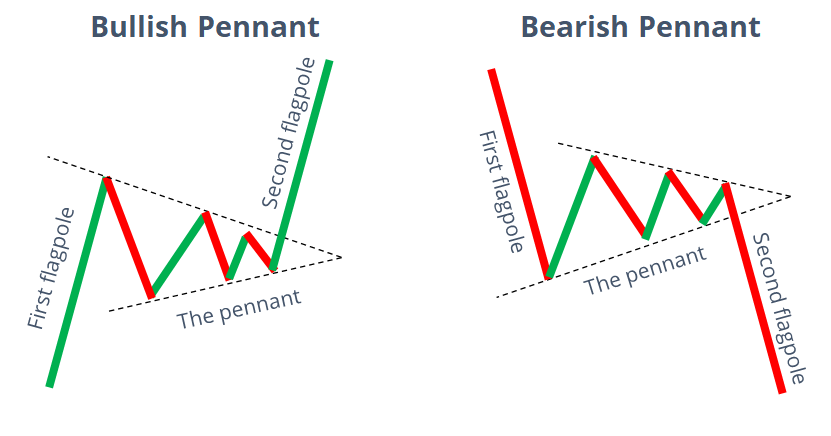

10. Pennant:

- A brief-term continuation sample that resembles a small symmetrical triangle.

- It’s shaped after a major value motion, representing a interval of consolidation earlier than the value continues within the earlier path.

11. Flag:

- One other continuation sample, shaped by two parallel trendlines, representing a short pause in a robust value pattern.

- It’s characterised by its rectangular form, resembling a flagpole (the preliminary robust value transfer) and the flag itself (a interval of consolidation).

What’s the significance of quantity in chart patterns?

Quantity can present further affirmation to a chart sample. As an illustration, larger quantity in the course of the formation of a sample can point out stronger conviction amongst market members, rising the chance of its validity.

In chart patterns, quantity can be utilized to:

- Affirm value actions. When quantity will increase as the value of a safety strikes up or down, it signifies that there’s extra shopping for or promoting exercise, which can provide the motion extra significance. For instance, if a inventory breaks out of a buying and selling vary on excessive quantity, it’s extra more likely to be a sustainable transfer than if it breaks out on low quantity.

- Determine traits. Rising quantity on uptrends and falling quantity on downtrends might help to substantiate {that a} pattern is in place. For instance, if a inventory is in an uptrend and the quantity begins to extend, it could possibly be an indication that the pattern is accelerating.

- Determine reversals. A lower in quantity after a pointy value transfer generally is a signal {that a} reversal is underway. For instance, if a inventory has been rising on excessive quantity after which the quantity begins to lower, it could possibly be an indication that the uptrend is coming to an finish.

General, quantity is a useful software for technical evaluation that may assist to substantiate value actions, establish traits, and spot reversals. Nonetheless, it is very important keep in mind that quantity is just not an ideal indicator and ought to be used at the side of different technical indicators to make buying and selling choices.

Traders ought to search for divergences between value and quantity. A divergence happens when value and quantity transfer in reverse instructions. This generally is a signal {that a} pattern is about to reverse. Contemplating the quantity of the general market in a specific inventory could be affected by the quantity of the general market. For instance, if the general market is experiencing low quantity, then it’s extra doubtless {that a} inventory will even expertise low quantity.Use quantity filters. Quantity filters can be utilized to establish shares which can be buying and selling on excessive or low quantity. This may be useful for locating shares which can be more likely to be trending or which can be about to reverse.

When ought to I enter or exit a commerce based mostly on a chart sample?

The entry and exit factors for a commerce based mostly on a chart sample can range relying on the particular sample and the dealer’s technique. Usually, merchants enter a commerce when the sample is confirmed by a breakout or breakdown of a major value degree. They could exit the commerce when the sample’s goal is reached or when there are clear indicators of a pattern reversal.