What to Know:

- Saylor’s ‘I Received’t Again Down’ message comes as Bitcoin slides towards $80K–$85K, pressuring leveraged gamers and reigniting crash warnings.

- Technique’s 649K+ BTC stack stays worthwhile on paper, however the inventory premium has almost vanished, testing investor persistence with the treasury wager. U.At the moment+1

- Bitcoin Hyper goals to unravel Bitcoin’s throughput, charges, and programmability points with an SVM-based Layer-2 that retains Bitcoin because the settlement layer.

- The $HYPER presale has raised over $28M, affords round 41% staking rewards, and targets multi-X upside if its Layer-2 roadmap and ecosystem supply succeed.

Bitcoin simply pulled off one of many nastiest rug-pull-looking dips of the complete cycle. In a matter of hours, the value fell from above $120K to sub-$90K and even depraved into the $80,600 zone, wiping out billions in longs and reigniting the traditional “it’s over, lads” refrain throughout Crypto X.

And proper in the midst of the chaos, Michael Saylor dropped 4 phrases that might mainly be printed on his enterprise card: “I gained’t again down.” This time, the road carried additional weight.

His firm, Technique, is now sitting on roughly 649,870 BTC at a mean value close to $74,430, nonetheless in revenue regardless of the crash, even because the inventory will get punished and critics surprise how lengthy a leveraged Bitcoin maxi can stare down this sort of volatility.

Technique even ran a ballot that confirmed almost 78% of respondents had been merely HODLing by the sell-off. Hardcore Bitcoiners nonetheless see turbulence, not terminal failure, however not everybody’s constructed for that diploma of mark-to-market ache.

Retail, smaller funds, and DeFi merchants are more and more looking for methods to maintain Bitcoin publicity with out simply holding spot and praying.

That’s the place the brand new rotation narrative is available in. If Bitcoin stays the financial spine of crypto, the greatest altcoins this cycle would be the ones fixing what Bitcoin can’t: throughput, charges, and programmability.

Bitcoin Hyper ($HYPER) matches that thesis virtually too properly, positioning itself as a Bitcoin Layer-2 designed to make BTC behave like a quick, versatile, programmable asset, all with out compromising the bottom layer.

Bitcoin Hyper Turns Bitcoin Volatility Into Layer-2 Utility

Behind the branding, Bitcoin Hyper is focusing on a really actual structural hole within the Bitcoin ecosystem. BTC nonetheless handles solely a handful of transactions per second, and costs spike at any time when exercise will increase, which is why most of at this time’s DeFi, NFTs, and on-chain experimentation have migrated to sooner environments, equivalent to Solana.

Bitcoin Hyper’s resolution is a rollup-style Layer-2 anchored to Bitcoin however powered by an SVM (Solana Digital Machine) execution layer. Customers ship BTC to a monitored main-chain deal with, a canonical bridge verifies the deposit, and the community mints an equal quantity of wrapped BTC on Hyper.

From there, transactions run on a high-throughput chain with near-instant finality and low charges, whereas zero-knowledge proofs periodically settle again to Bitcoin L1.

The structure goals to protect Bitcoin’s safety whereas shifting precise exercise, funds, DEX trades, lending, NFT markets, even meme-coin chaos, onto a sequence that feels Solana-fast.

As a result of it makes use of SVM, present Rust builders can port their apps with minimal friction, giving Hyper a practical shot at constructing an ecosystem as a substitute of turning into one other fairly however empty L2.

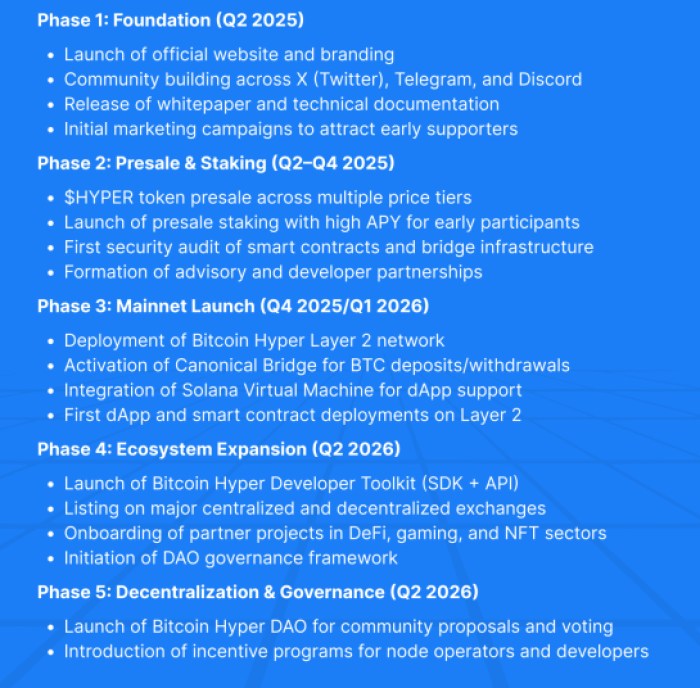

After all, there are dangers. $HYPER continues to be in presale, and the roadmap is formidable: audits and presale all through 2025, mainnet and SVM+dApp integration between late 2025 and early 2026, then token listings, SDKs, and a DAO rollout in 2026. Execution must hit these milestones for the L2 thesis to play out.

Safety is not less than trending positively. The contracts have already cleared audits from Coinsult and SpyWolf, with no hidden mint capabilities or apparent backdoors flagged, a very good begin, even when it doesn’t get rid of the everyday smart-contract and market dangers related to new chains.

For anybody who desires to remain structurally lengthy Bitcoin whereas additionally capturing upside from the place the subsequent wave of blockspace demand may land, $HYPER affords a clear play.

If Bitcoin exercise will increase and DeFi migrates towards BTC-secured infrastructure, a functioning Bitcoin-anchored Layer-2 may soak up a disproportionate share of that worth.

Contained in the Bitcoin Hyper Presale and $HYPER Token Economics

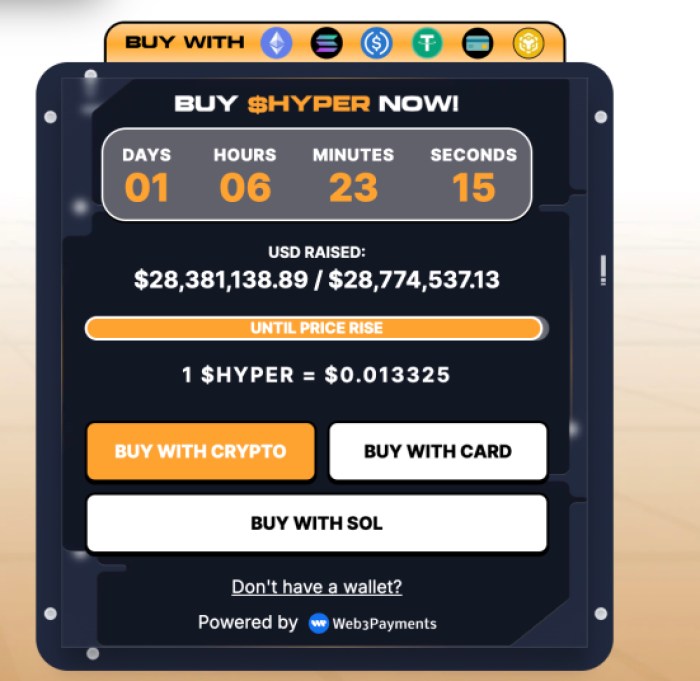

Whereas Bitcoin has been violently whipsawing, the Bitcoin Hyper presale has been doing the other, grinding steadily upward. It has now crossed $28.3M raised, with the present stage pricing $HYPER round $0.013325.

That also places it in micro-cap vary, however the elevate is now massive sufficient that that is now not a small degen side-quest. Actual capital is flowing in.

Presale patrons also can stake $HYPER at 41% rewards, with greater than a billion tokens already locked. These yields will naturally taper off as extra wallets take part, however the intent is obvious: early contributors are inspired to behave like long-term community companions, not short-term flippers.

It aligns neatly with the thought of $HYPER performing as a “beta on Bitcoin’s evolution” quite than simply one other momentum meme.

On the valuation aspect, upside eventualities being circulated are daring however not less than mathematically grounded. One broadly shared basic assessment places a possible 2025 excessive close to $0.02595 as soon as mainnet is stay and liquidity deepens, roughly a 2x from the present presale vary if the thesis holds.

Extra aggressive fashions challenge additional out, mapping a attainable 2026 excessive round $0.08625 and a 2030 goal close to $0.253, assuming the roadmap lands, the ecosystem fills in, and main exchanges ultimately record the token.

Relative to at this time’s pricing, that suggests roughly 6–7x to the 2026 stage and near 19x by 2030. Nothing is assured, nevertheless it explains why $HYPER retains exhibiting up in alt-rotation threads at any time when merchants focus on uneven setups tied to Bitcoin infrastructure as a substitute of random meme noise.

Crucially, $HYPER isn’t pitched as a hedge towards Bitcoin; it’s pitched as a method to amplify it.

If Saylor’s “I Received’t Again Down” stance represents the diamond-hands finish of the spectrum, Bitcoin Hyper is the place the extra risk-tolerant crowd is rotating: nonetheless ideologically lengthy BTC, however seeking to high-beta Layer-2 infrastructure for greater potential multiples because the cycle churns by volatility.

This text is informational solely; crypto, particularly presales, is very unstable. At all times do your individual analysis and by no means danger hire cash.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/information/best-altcoins-saylor-wont-back-down-bitcoin-hyper-presale