Semler Scientific (Nasdaq: SMLR) has acquired 167 further bitcoins for $16.2 million between April 30 and Might 2, 2025, utilizing proceeds from its at-the-market (ATM) fairness providing. This newest buy brings the corporate’s whole BTC holdings to three,634, making it one of many largest public Bitcoin treasury corporations in the US. “$SMLR acquires 167 #Bitcoins for $16.2 million and has generated BTC Yield of twenty-two.2% YTD. Now holding 3,634 $BTC and is now the fourth largest Bitcoin Treasury Firm within the U.S.,” stated Eric Semler, Chairman of Semler Scientific, in a publish on X.

“$SMLR acquires 167 #Bitcoins for $16.2 million and has generated BTC Yield of twenty-two.2% YTD. Now holding 3,634 $BTC and is now the fourth largest Bitcoin Treasury Firm within the U.S.,” stated Eric Semler, Chairman of Semler Scientific, in a publish on X.

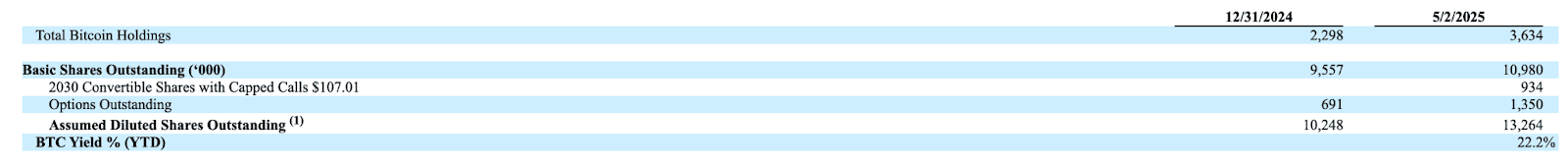

The common buy value for this current acquisition was $97,093 per bitcoin, inclusive of charges and bills. The corporate’s whole bitcoin funding now sits at $322.3 million, with a market worth of $352.4 million as of Might 2, 2025.

Semler Scientific additionally reported a BTC Yield of twenty-two.2% year-to-date—a key efficiency indicator the corporate makes use of to evaluate how effectively it’s utilizing fairness capital to accumulate Bitcoin. The KPI is derived from the change within the ratio between bitcoin holdings and assumed diluted shares excellent.

Since launching its ATM fairness program on April 15, Semler has raised roughly $39.8 million by promoting over 1.1 million shares. The technique is a part of a broader capital shift towards a Bitcoin-heavy treasury strategy that Semler Scientific believes is accretive to shareholders.

This daring Bitcoin accumulation technique has not solely moved the corporate into the Bitcoin highlight but in addition revived its market narrative.

“We have been the second U.S. public firm to undertake Bitcoin as a major treasury reserve technique,” Semler acknowledged in an interview final month. “It appeared eerily just like MicroStrategy in August of 2020… We weren’t actually rising. We wanted to determine a option to leap begin our progress and we settled on Bitcoin, which was an awesome resolution.”

What started as a play to flee stagnant market valuation—what Semler referred to as a “zombie firm”—has advanced right into a defining transformation. “Our inventory at one level had quadrupled. Now it’s mainly doubled… it was doing nothing for years,” he acknowledged.

Now a reference level for establishments in search of oblique publicity to BTC, SMLR continues to achieve relevance. “Most funding funds can’t purchase ETFs,” stated Semler. “We’re actually their solely option to get publicity to Bitcoin within the inventory market.”

And the mission isn’t slowing down. “We’re early in accumulating Bitcoin, and we’re gonna proceed to try this.”