Insurance coverage for crypto’s most unfair moments

Probably the most irritating factor for any perp dealer is being directionally proper on a place, however getting liquidated on the pico prime/backside of a transfer.

A single malicious wick, a flash crash, or a fat-finger promote on a low-liquidity pair can wipe out your place in milliseconds – even when the worth snaps again 10 seconds later. You’re left rekt, whereas the market instantly recovers and runs in your authentic course.

It’s not unhealthy danger administration. It’s the character of 24/7, hyper-leveraged markets.

Till now.

Introducing Wick Insurance coverage — The First Actual Safety In opposition to Rip-off Wicks

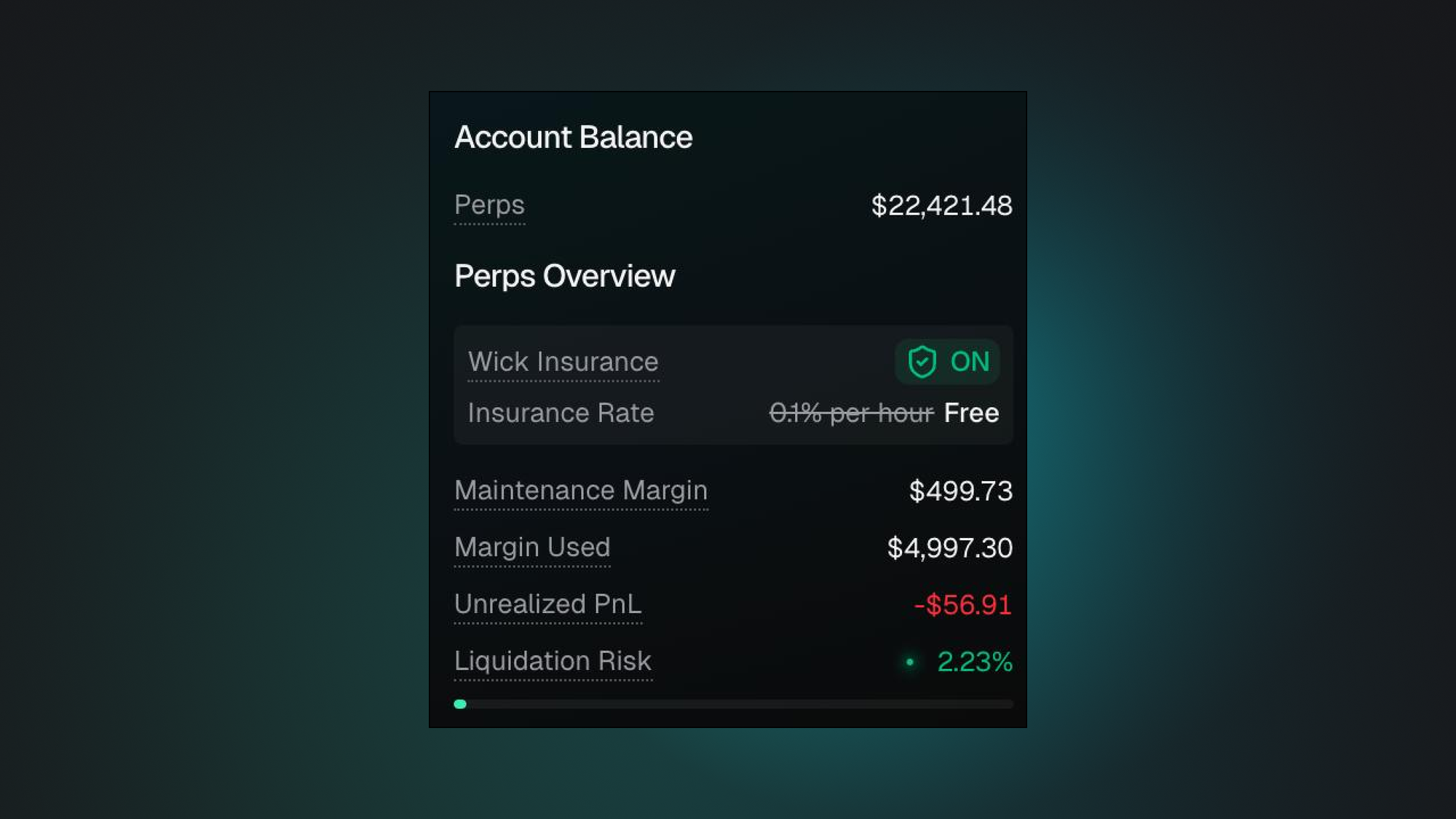

Wick Insurance coverage is a novel characteristic that offers you a configurable grace interval when your place quickly breaches your liquidation stage. As an alternative of immediately zeroing your account, Synthetix’s wick insurance coverage will disable liquidations for a brief time frame, permitting the market to show whether or not it was only a wick or an actual transfer.

If the worth recovers and your margin well being is restored inside that window → you’re unfrozen and again within the commerce. No liquidation.

If the transfer is actual → liquidation occurs usually, simply delayed by minutes.

It’s insurance coverage designed particularly for crypto’s most unfair moments.

Bear in mind, Bear in mind the tenth of October

10/10 was probably the most violent single-day liquidations in crypto historical past. In lower than 45 minutes in the course of the Asian session:

- BTC plunged over 14% from highs close to $126,000 to as little as $104,782.

- ETH fell roughly 20%, with altcoins like Solana and Layer-2 tokens cratering 30–70% in flash drops.

- The biggest day of liquidations noticed a staggering $19 billion in leveraged positions wiped throughout exchanges.

After which?

Amazingly, the transfer nearly fully reversed inside hours. BTC clawed again above $112,000 by day’s finish, and altcoins bounced 10–33% from their lows, turning what might have been a multi-week massacre right into a brutal however fleeting shakeout.

But 1000’s of merchants acquired obliterated by structural failures that led to a brief and sharp liquidation cascade that noticed costs tank and bounce.

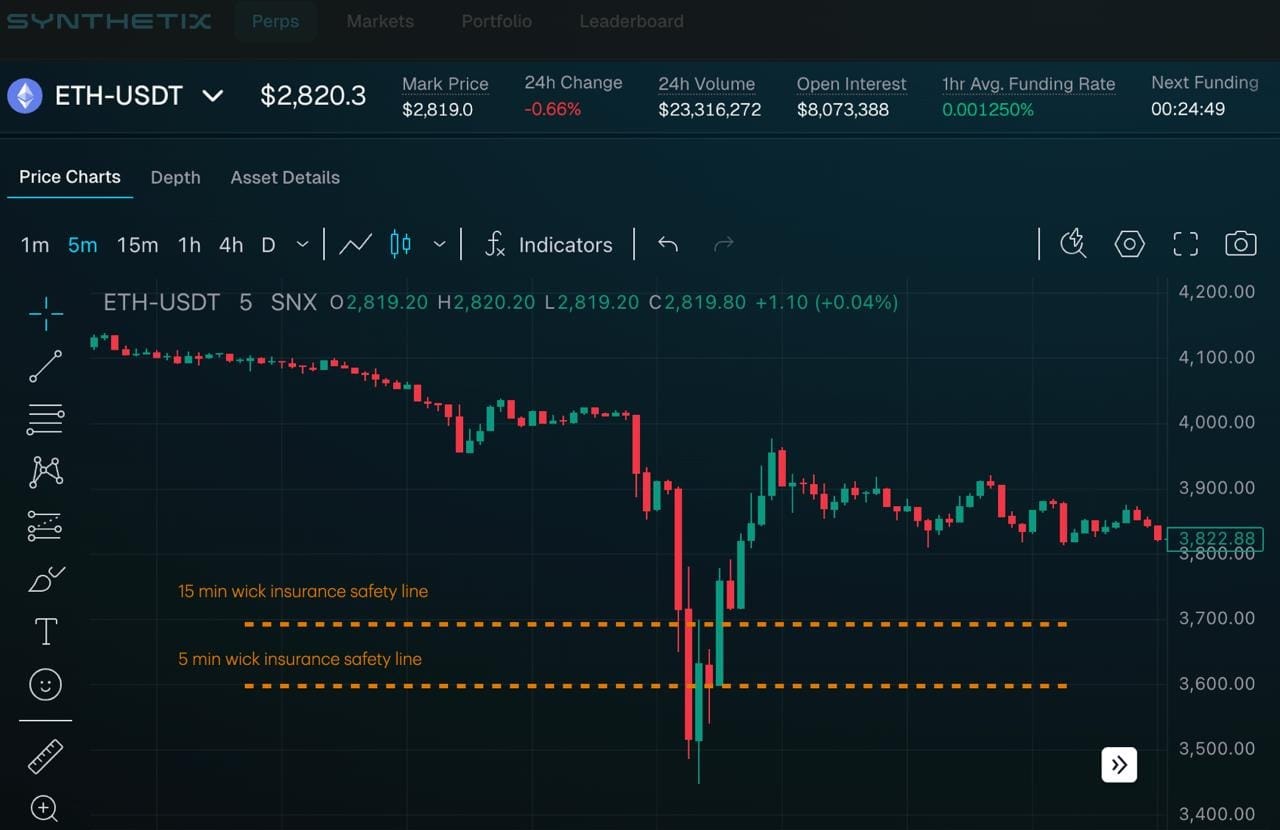

With Wick Insurance coverage lively on ETH-USDT that day:

- A dealer with 5-minute insurance coverage would have survived with a liquidation value above drop beneath $3,600.

- Anybody working 15-minute insurance coverage would have survived with a liquidation value above $3,700

- Accounts would have unfrozen as value recovered, letting them experience the rebound that liquidated everybody else.

10/10 wasn’t a bear market. It was principally a wick occasion.

And Wick Insurance coverage is a doubtlessly useful safeguard in opposition to violent strikes like this.

What This Truly Means for You as a Dealer

- Commerce with actual conviction once more: You possibly can lastly dimension correctly on high-conviction setups with out the fixed concern of getting “wick-hunted.”.

- Survive flash crashes & fat-finger occasions: We’ve all seen it: a $200M market promote on BTC, value drops >3% in a minute(s), then recovers totally in two minutes. 1000’s liquidated. With Wick Insurance coverage, most of these merchants would have survived and profited.

- Maintain by means of short-term manipulation: Low-liquidity altcoin pairs are infamous for wicks that set off liquidations. Wick Insurance coverage neutralizes this.

- Peace of thoughts = higher resolution making: Whenever you’re not petrified of a 2-second candle destroying your account, you cease over-managing positions, revenge buying and selling, or closing winners too early.

How It Works (in Plain English)

- When a dealer turns wick insurance coverage on, they’ll choose from a listing of pre-defined time durations they want to defend in opposition to rip-off wicks.

- When your account would usually be liquidated, Wick Insurance coverage kicks in robotically when turned on.

- Your account enters a short “frozen” state: no new trades or withdrawals, however your present place stays open. You possibly can even deposit throughout this state to extend your margin and recuperate from liquidation.

- If value recovers and your margin is wholesome once more earlier than time runs out → every thing unfreezes. You retain buying and selling like nothing occurred.

- If the transfer is actual → liquidation occurs precisely as earlier than, only a few minutes delayed.

Consider it like a circuit breaker in your private account, however smarter.

Constructed for Degens, Backed by Math

This isn’t charity. The safety is priced dynamically and pretty utilizing actual danger fashions, so safety on larger leverage and extra risky belongings will price extra.

And the platform is protected too: strict publicity caps, auto-deleveraging backstops, and cooldown mechanics forestall gaming.

Word: That is an experimental characteristic being examined in Season 2 of our buying and selling competitors and is probably not instantly rolled out with public launch.

A New Superpower in Perps Buying and selling

For the primary time ever, you may commerce leveraged crypto perps with a security web that truly understands how crypto strikes — violent, manipulative, and sometimes short-term.

No extra watching your good setup get stopped out by a wick, solely to observe as the worth rockets 20% with out you.

No extra “I used to be proper however acquired depraved out” coping.

Wick Insurance coverage isn’t only a characteristic. It’s an improve crypto leverage merchants have been ready for – as evidenced by the passionate response on 10/10.

Welcome to Wick Insurance coverage, the place your place is protected.

Comply with Synthetix as we speedrun to mainnet.

Be a part of the dialog: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Comply with on X: x.com/synthetix