July 2, 2025

The next submit comprises a recap of stories, tasks, and vital updates from the Spartan Council and Core Contributors from final week.

👉TLDR

- Synthetix is coming house: launching a perp DEX on Ethereum Mainnet.

- No bridges, no extensions, no pockets switching, simply seamless UX with Infinex Join.

- SNX staking is again, higher, and dwell for Infinex patrons.

- Part 0 of “The Relaunch” is underway: sUSD/sUSDe vaults.

- Orderbook > AMM: high-performance off-chain matching, L1 custody & settlement.

- sUSD and SNX reclaim their roles on the coronary heart of Synthetix.

- Mainnet Perp Summer time is right here☀️

Spartan Council and SIP updates

Since a part of the workforce has been touring to Cannes or Brooklyn, let’s take this chance to look again on the previous few weeks and talk about what’s to return. As you’ve in all probability been listening to, Synthetix is returning to Ethereum Mainnet to launch a high-performance perps DEX. And it’s been a very long time coming!

Again in 2019, Synthetix made the early leap to L2s (like Optimism) to unravel scaling. That transfer unlocked velocity and effectivity, but it surely got here at the price of fragmentation: liquidity, capital, and a focus — all scattered throughout dozens of L2s. Within the meantime, Ethereum Mainnet remained the middle of gravity for actual worth, institutional flows, and long-term belief.

And now, Ethereum is scaling, block area is opening up, and even Vitalik is championing a return to Mainnet. The infrastructure is right here and Synthetix is able to ship the primary critical perps alternate constructed for it.

However the protocol needed to be taught some exhausting classes to win on Mainnet. For too lengthy, DeFi merchandise chased ideological purity on the expense of usability. Synthetix constructed for the principled few, however left behind the numerous who merely needed to commerce shortly, securely, and with a UI that wasn’t too difficult.

That stops now. With Infinex, Synthetix has confirmed that it’s doable to supply non-custodial, on-chain merchandise that really feel as clean because the centralized alternate options. No fuel ache, no chain switching, no pop-up jungle. Simply click on, commerce, completed. And that is already dwell for Infinex patrons!

And this subsequent chapter? It’s constructed round one key perception: orderbooks beat AMMs for perps. After years of experimenting with AMM-based perps, it turned clear that one of the best liquidity and dealer experiences nonetheless come from orderbooks. So Synthetix has rebuilt its structure from the bottom up: trades are matched off-chain with institutional-grade efficiency, whereas custody and settlement stay on Ethereum L1 — no bridges, no belief assumptions.

Funds keep on Mainnet, orders fly off-chain, and withdrawals are at all times on-chain and permissionless. As Ethereum scales, Synthetix will migrate much more again on-chain. It’s one of the best of each worlds and a serious step ahead for DeFi UX.

In fact, none of this may be doable with out SNX and sUSD, and the protocol has made main modifications to each. SNX staking has been utterly overhauled, so there aren’t any extra complicated debt mechanics or hedging methods. Simply stake and earn, and protocol charges circulate on to stakers. It’s easy, clear, and dwell proper now for Infinex patrons by way of the Join alpha launch (severely, staking SNX with Infinex Join takes just some clicks).

In the meantime, sUSD (DeFi’s third-longest-living stablecoin) is regaining middle stage. Whereas V3 briefly sidelined its utility, Synthetix is bringing it again with a vengeance. The brand new Treasury Market dynamically mints, burns, and deploys sUSD to maintain the peg tight and to maintain liquidity flowing. It’s the deposit asset of selection for market makers, and it earns yield by charges and liquidations on the perp alternate.

All of this leads into the largest Synthetix launch ever, and what’s being formally deemed “The Relaunch.”

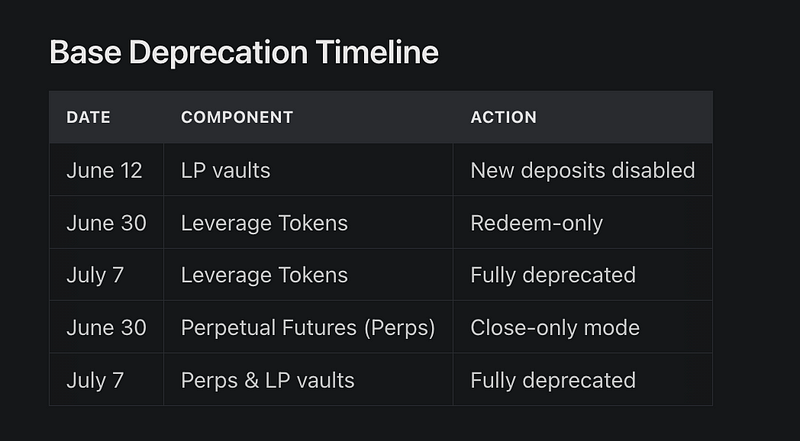

The protocol is kicking issues off with early deposit vaults for sUSD and sUSDe, 500 unique early entry codes, and a brand new incentive construction based mostly round factors. Factors will probably be earned by depositing early, buying and selling properly, referring buddies, they usually’ll unlock rewards like SNX, stablecoins, and extra. Here’s a reminder of the Base deprecation timeline:

That is the second that Synthetix has been constructing towards. It’s time to reclaim the consumer expertise, the liquidity layer, and the protocol’s function in DeFi’s evolution. Mainnet Perp Summer time is formally on!

SNXweave YouTube Podcast: https://www.youtube.com/@snxweave

Comply with us on Twitter! @snx_weave