Solana (SOL) is trying to reclaim a robust resistance zone for the fourth time, which has led some traders to counsel that the rally received’t final lengthy. Nonetheless, on-chain information means that SOL’s subsequent leg up might be beginning.

Associated Studying

Solana Breaks Out Of Triangle Sample

On Thursday, Solana hit a six-month excessive of $216 after breaking out of considered one of its most important resistance zones. The cryptocurrency bounced 16% from Monday’s lows and reclaimed the $200 barrier as assist on Wednesday, closing the day above this space.

SOL briefly reclaimed this stage through the early August breakout, however the latest market corrections dragged its value to the $175-$195 space. Amid Thursday’s rally, market watcher Daan Crypto Trades highlighted its efficiency, asserting that it’s “at an fascinating spot.”

The dealer defined that Solana is buying and selling in a multi-month rising wedge sample, presently nearing the resistance stage that has held over the months. Notably, the cryptocurrency has been rejected from the sample’s higher boundary a number of occasions since July, retesting the ascending assist line on every event.

Supporting SOL’s case, Daan argued that it has “been sturdy on the again of treasury autos being spun up and potential upcoming shopping for + frontrunning,” noting that “rising wedges are usually leaning bearish however in bull markets it’s nothing new for these to interrupt in direction of the upside as a substitute.” Primarily based on this and the cryptocurrency’s latest efficiency, he forecasted that it will attain larger ranges later this yr.

Equally, analyst Ali Martinez pointed out a six-month ascending triangle sample on the altcoin’s chart, which targets the $360 space. Solana retested the sample’s resistance thrice over the previous month and a half, however finally failed to show the $205-$207 zone into assist.

Because the altcoin pushed previous the $210 mark, the analyst raised the query of whether or not the continuing breakout try might be profitable or if SOL’s rally could be short-lived for the fourth time.

Fourth Time’s The Attraction?

Martinez shared a number of technical indicators that counsel Solana might lastly get away of this sample and intention for the long-awaited $300 barrier. The analyst defined that the backdrop of social sentiment and on-chain positioning differentiate the present value transfer from the earlier makes an attempt.

In contrast to the earlier breakout makes an attempt, sentiment throughout the neighborhood is extra subdued. “Traditionally, euphoric sentiment above the ‘230’ index stage coincided with native tops, as extreme optimism preceded retracements,” he detailed. In line with the analyst’s chart, sentiment is muted this time, which suggests “skepticism relatively than crowded bullish positioning.”

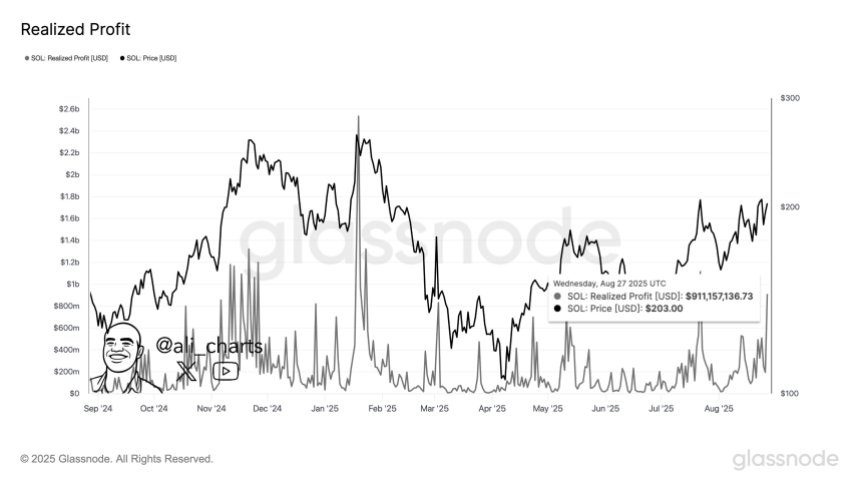

Moreover, round $1 billion in realized earnings have been booked after the surge to $212, signaling that some merchants seemingly stay unconvinced that momentum will maintain throughout this try.

He additionally highlighted that there are important accumulation zones beneath $207, with a number of assist zones between $165 and $206, offering a robust base to proceed rallying, which contrasts with the dearth of resistance above the $212 space.

Associated Studying

“If shopping for strain builds, the trail towards $300 is relatively much less obstructed,” Martinez affirmed, including that Solana’s fundamentals, together with the proposed Alpenglow consensus improve, can also add gas to the breakout.

“With skepticism nonetheless current, sturdy accumulation beneath $207, and little resistance overhead, this try has a better chance of succeeding in comparison with prior failures. A confirmed breakout above $212–$215 on sustained quantity would shift focus to the $300 goal zone,” he concluded.

As of this writing, Solana is buying and selling at $212, a 17% enhance within the weekly timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com