Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #203. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week* the Research will spotlight the technical modifications of the 16 cryptocurrencies that I observe in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As at all times, paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e mail. Previous publications together with the Weekly ETF Research will be accessed by paid subscribers through The Market’s Compass Substack Weblog.

*I returned from my journey early which permits for the traditional weekly publishing of the Candy Sixteen Research to renew on schedule.

A proof of my goal Particular person Technical Rankings and Candy Sixteen Whole Technical Rating go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”. What follows is a Cliff Notes model* of the total clarification…

*The technical rating system is a quantitative strategy that makes use of a number of technical issues that embody however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative energy. The TR of every particular person Cryptocurrency can vary from 0 to 50.

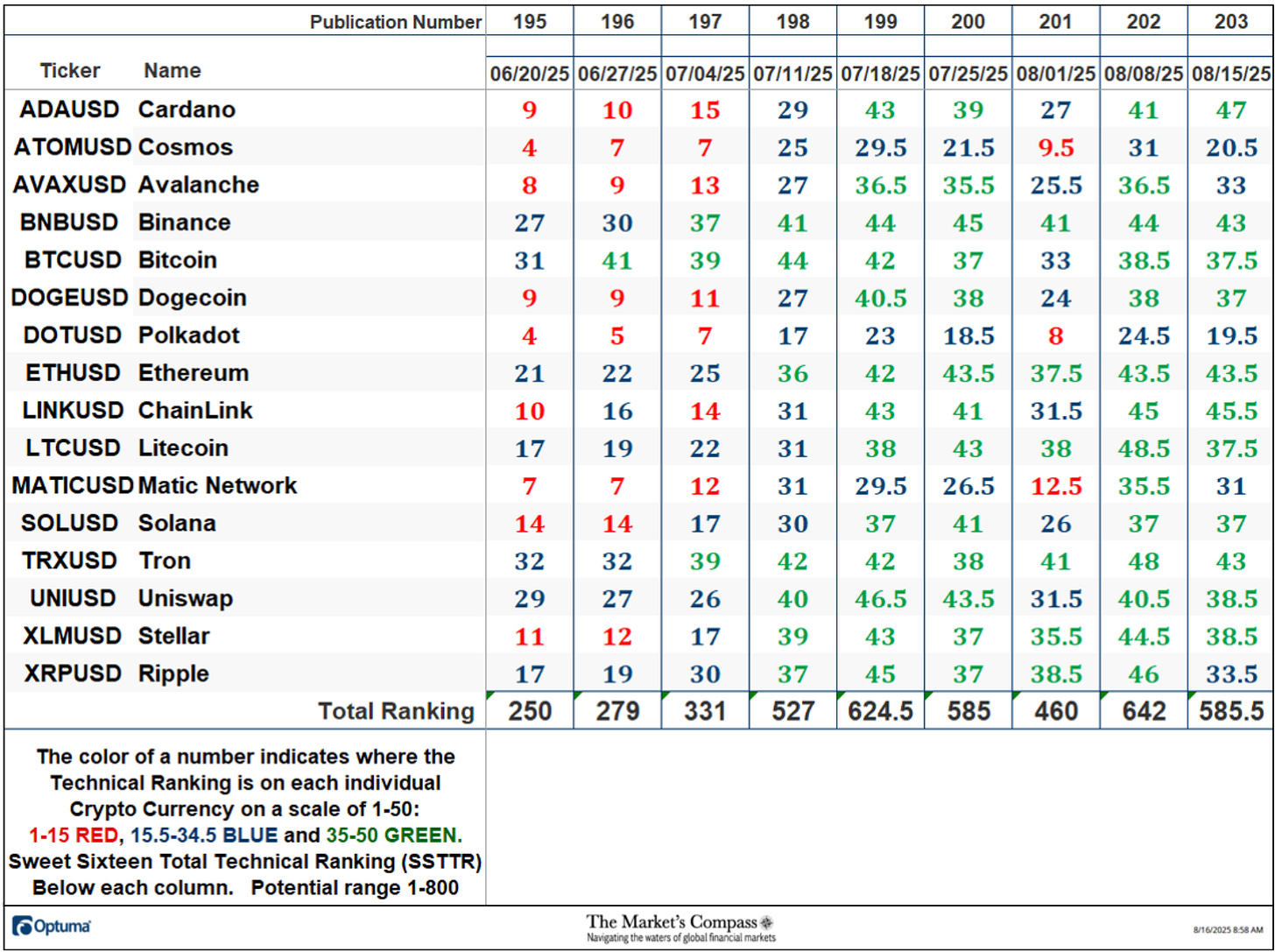

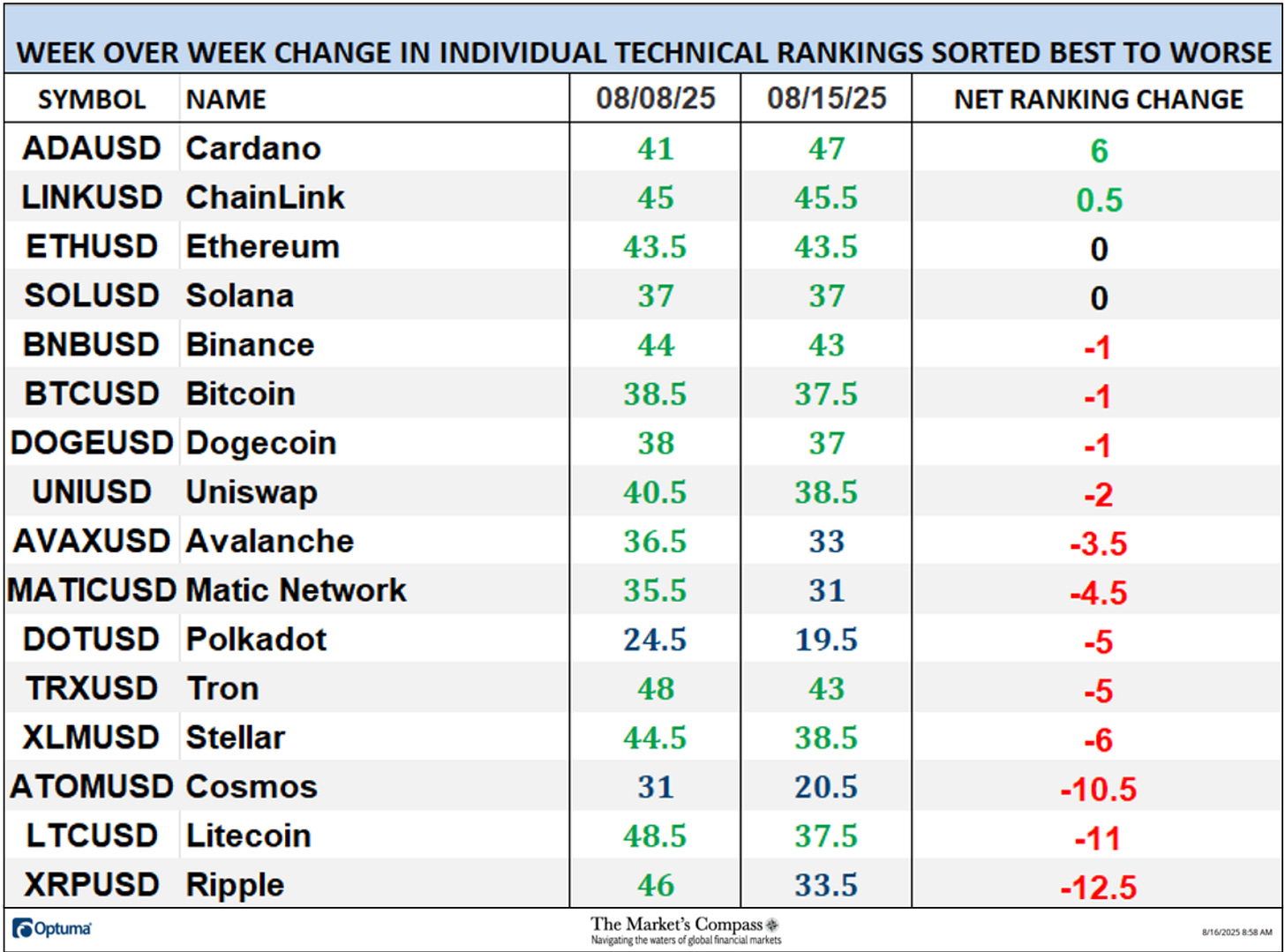

The Excel spreadsheet under signifies the the target Technical Rating (“TR”) of every particular person Cryptocurrency and the Candy Sixteen Whole Technical Rating (“SSTTR”) as of final Friday. The second Excel spreadsheet signifies the week over week change within the “TR” of every particular person Cryptocurrency.

Rankings are calculated as much as the week ending Friday August fifteenth

The Candy Sixteen Whole Technical Rating or “SSTTR” fell final week to 585.5 which was a 8.80% drop from the earlier weeks studying of 642 which was the best studying since December of final 12 months.

Final week solely two of the Crypto Candy Sixteen TRs rose, two had been unchanged, and fourteen fell (9 of which had double-digit TR beneficial properties) vs. the week earlier than when all sixteen of the Crypto Candy Sixteen TRs rose, with 9 marking double-digit beneficial properties. The typical Candy Sixteen TR loss was -3.53 vs. a median TR acquire of +11.38 the week earlier than. Eleven crypto forex TRs I observe ended the week within the “inexperienced zone” (TRs between 35 and 50) and 5 TRs had been within the “blue zone” (TRs between 15.5 and 34.5). The earlier week fourteen TRs had been within the “inexperienced zone” (TRs between 35 and 50), and two had been within the “blue zone” (TRs between 15.5 and 34.5). This marked a slight “TR” deterioration.

*The CCi30 Index is a registered trademark and was created and is maintained by an unbiased group of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general development, every day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars will be discovered at CCi30.com).

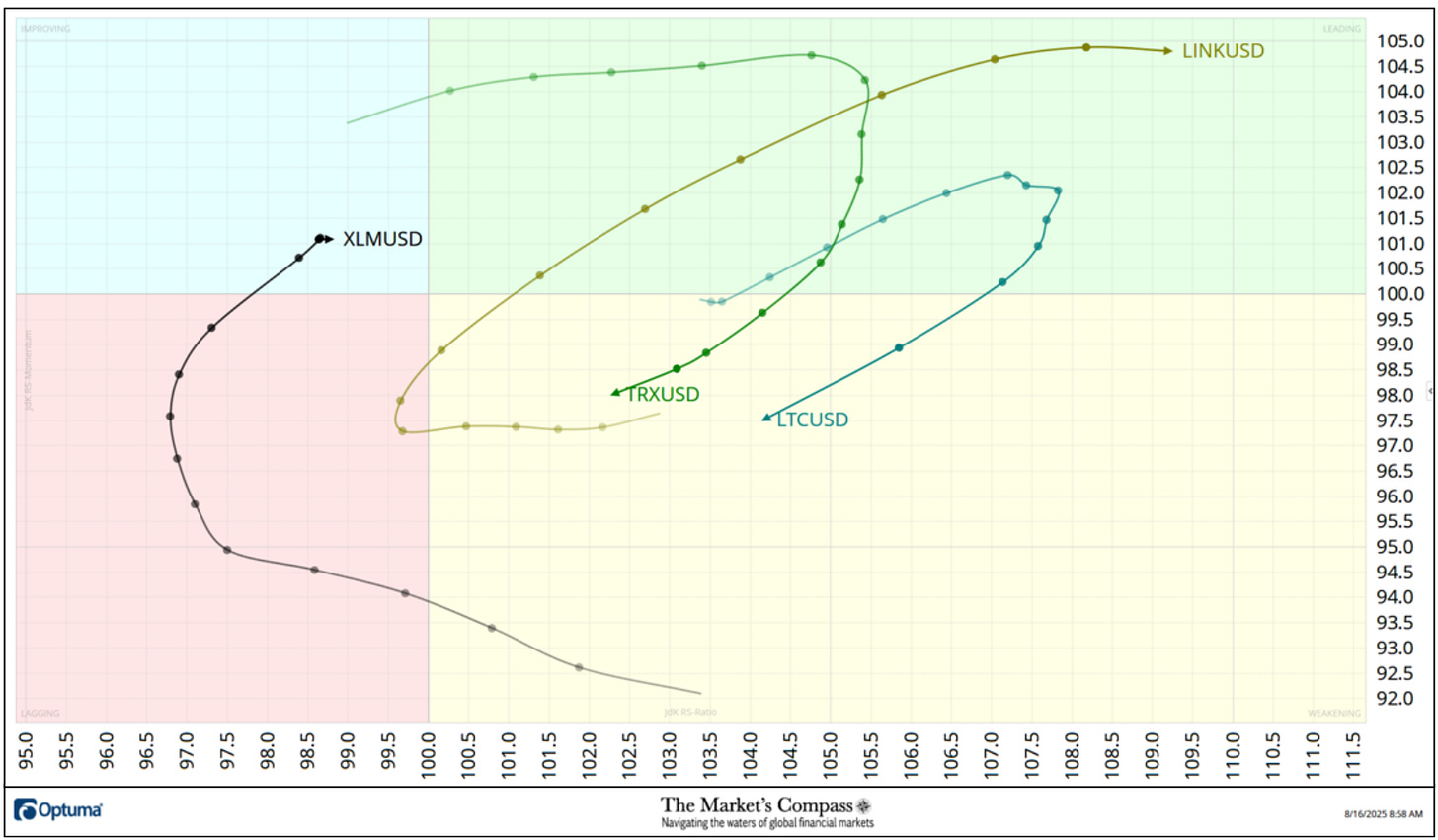

The chart under has two weeks, or 14 days, of Relative information factors vs. the benchmark, the CCi30 Index, on the heart, deliniated by the dots or nodes. Not all the Candy Sixteen are plotted on this RRG Chart. I’ve finished this for readability functions. These which I imagine are of upper technical curiosity stay.

A short clarification of how one can interpret RRG charts will be discovered at The Market’s Compass web site www.themarketscompass.com Then go to MC’s Technical Indicators and choose Crypto Candy 16. To be taught extra detailed interpretations, see the postscripts and hyperlinks on the finish of this Weblog which can be courtesy of Optuma.

Each Litecoin (LTC) and Tron (TRX) started to lose Relative Energy and Relative Energy Momentum final weekend as they fell out of the Main Quadrant and fell into the Weakening Quadrant. Stellar (XLM) has made a three-quadrant restoration by rising from the Weakening Quadrant by way of the Lagging Quadrant and simply entered the Main Quadrant. That mentioned the constructive Relative Energy Momentum started to gradual on the finish of final week. ChainLink (LINK) rose out of the Weakening Quadrant final weekend and rose sharply (notice the gap between the every day nodes) within the Main Quadrant because it displayed the most effective Relative Energy of the Candy Sixteen.

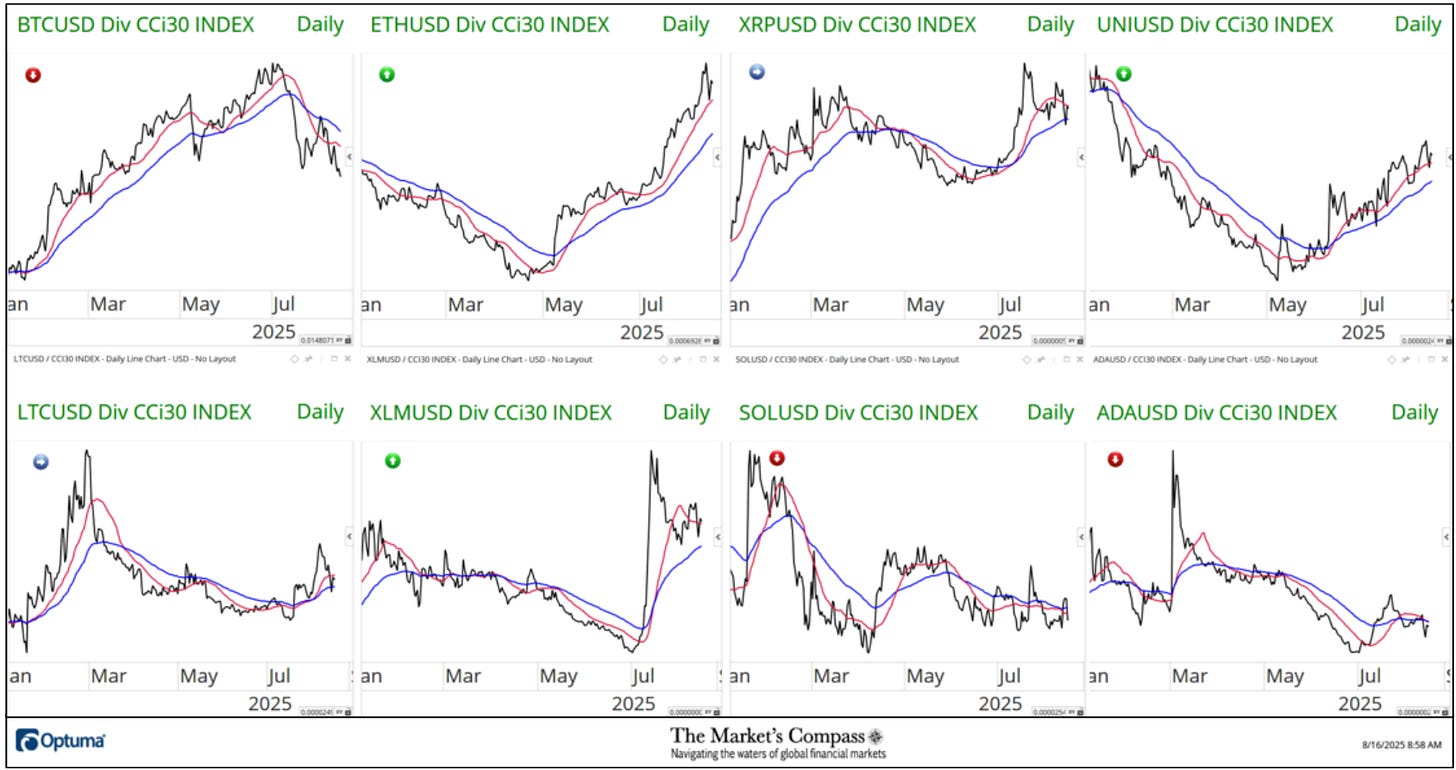

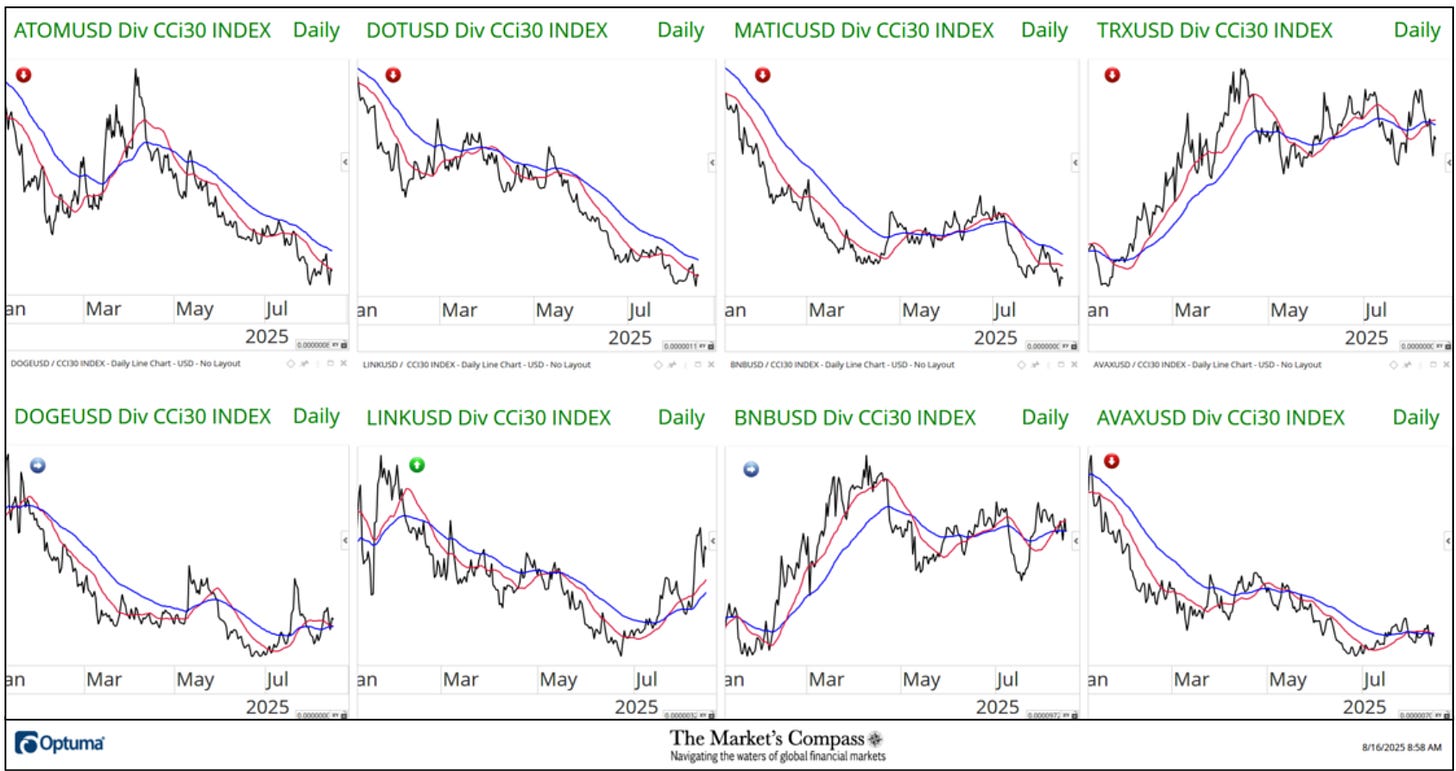

The 2 panels under include long run line charts of the Relative Energy or Weak spot of the Candy Sixteen Crypto Currencies vs. the CCi30 Index which can be charted with a 55-Day Exponential Shifting Common in blue and a 21-Day Easy Shifting Common in crimson. Pattern course and crossovers, above or under the longer-term transferring common, reveals potential continuation of development or reversals in Relative Energy or Weak spot.

Just a few weeks in the past, I initiated a Relative Energy or Weak spot notation system of the Candy Sixteen Crypto Currencies vs. the CCi30 Index. Within the higher left nook of every of the person ratio line charts I’ve positioned coloured circles, inexperienced with an up arrow, blue with a sideways arrow, and crimson with a down arrow that displays the present state of relative energy or weak spot.

*Friday August 1st to Friday August fifteenth

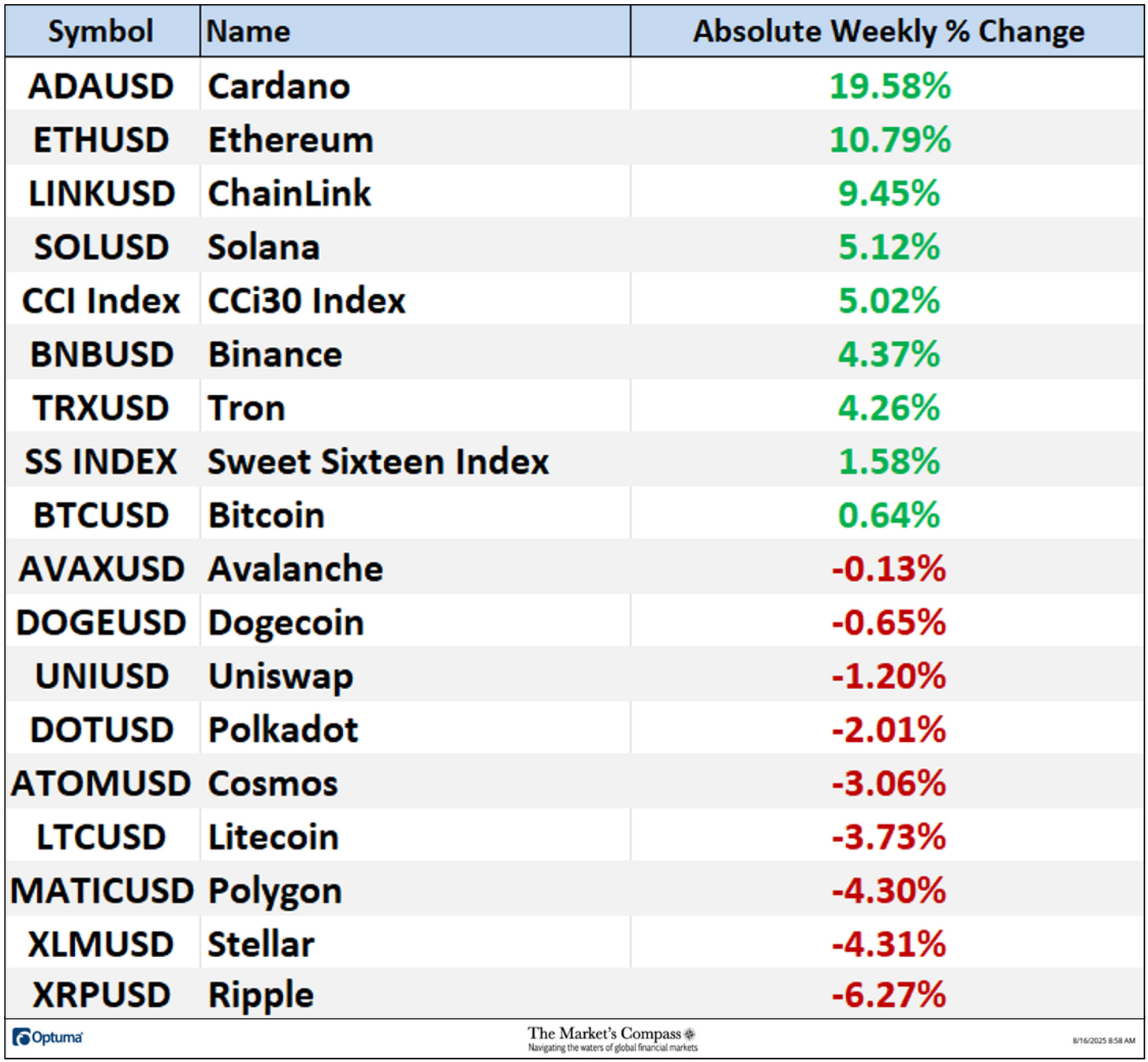

Seven of Crypto Currencies I observe gained absolute floor over the previous seven days vs. the week earlier than when all of the Candy Sixteen had been up on an absolute foundation (twelve registered double-digit proportion beneficial properties that week) The seven-day common absolute worth acquire was +1.78% (with out the outsized beneficial properties in ADA and ETH -0.13%) vs. a +13.01% common acquire two weeks in the past. Each weekly averages exclude the 2 Indexes.

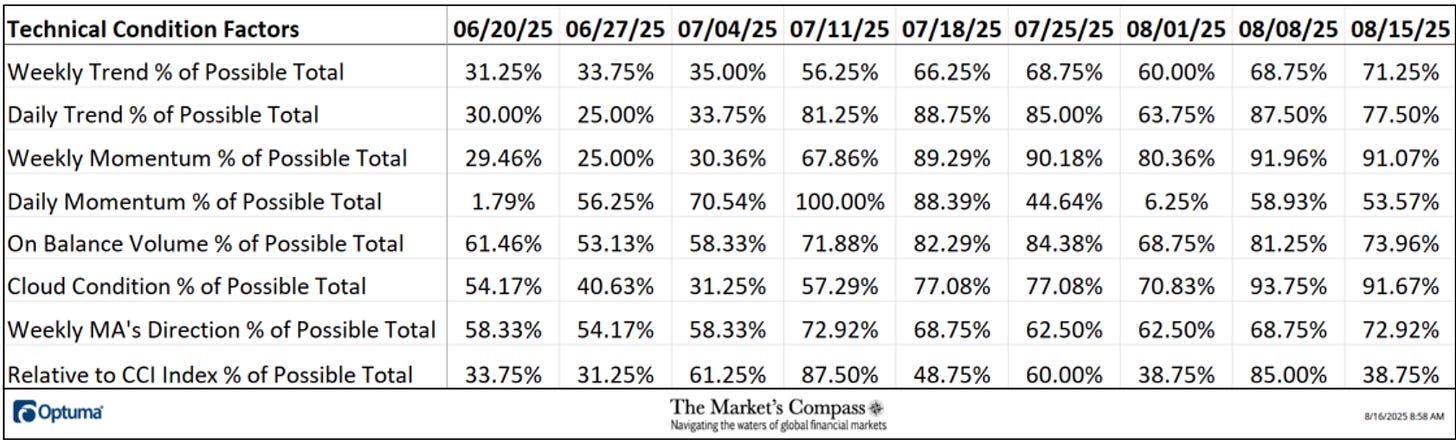

*The Technical Situation Elements are utilized within the calculation of the Particular person Crypto Currencies Technical Rankings. What’s proven within the excel panel under is the full TCFs of all sixteen TRs. Just a few TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet under calculates every issue’s weekly studying as a proportion of the attainable complete.

A full clarification of my Technical Situation Elements go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

The Day by day Momentum Technical Situation Issue or “DMTCF” fell again barely to 53.57% or 60 out of a attainable 112 final week from the studying of 58.93% or 66 the earlier week.

As a affirmation instrument, if all eight TCFs enhance on per week over week foundation, extra of the 16 Cryptocurrencies are bettering internally on a technical foundation, confirming a broader market transfer increased (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on per week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week all six TCFs felland two moved increased.

For a clarification on how one can interpret the Candy Sixteen Whole Technical Rating or “SSTTR” vs the weekly worth chart of the CCi30 Index within the decrease panel, go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16. A short clarification follows…

The Candy Sixteen Whole Technical Rating (“SSTTR”) Indicator (backside panel within the chart under) is a complete of all 16 Cryptocurrency Particular person Technical Rankings and will be checked out as a affirmation/divergence indicator in addition to an overbought / oversold indicator.

After struggling to overhaul Median Line (violet dotted line) of the Schiff Modified Pitchfork (violet P1 by way of P3) for 4 weeks the CCi30 Index cleared that hurdle and held newly minted help there by the tip of the week. MACD continues to climb increased above its sign line in constructive territory and the shorter-term Stochastic Momentum Index held its sign line is monitoring increased once more. After seeing the blended absolute beneficial properties and losses final week within the Candy Sixteen, a pullback within the Whole Technical Rating isn’t a shock. If the Index can maintain tentative help on the Median Line, there’s a higher than even probability that it’s going to simply problem the Higher Parallel (strong gold line) of the longer-term Customary Pitchfork (gold P1 by way of P3). Key help stays on the 19,590 degree.

After the CCi30 Index overtook the Higher Parallel (strong violet line) of the Schiff Modified Pitchfork (violet P1 by way of P3) a short interval of backing and filling unfolded till early final week. On Wednesday the broad-based index rallied and closed at a brand new every day closing excessive. On Thursday a pointy reversal unfolded main me to attract a brand new shorter-term Schiff Pitchfork from the intra-day excessive. I selected that variation of pitchfork after a lookback to June and July when on a closing foundation, costs held a sliding parallel (gold SP) that was on the identical vector of the brand new pitchfork. Thursday’s reversal bounced off the Median Line (gold dotted line) and the Tenkan Plot (crimson line). The Candy Sixteen Day by day Momentum / Breadth Oscillator has edged under the shorter-term transferring common (crimson line) nevertheless it stays above the longer-term 45-day exponential transferring common. It’s shocking that the Stochastic Momentum Index has fallen from being overbought throughout Thursday’s worth weak spot however MCD to nonetheless monitoring quietly increased above its sign in constructive territory. Holding Median Line help and the Kijun Plot (inexperienced line) is essential to any bullish argument.

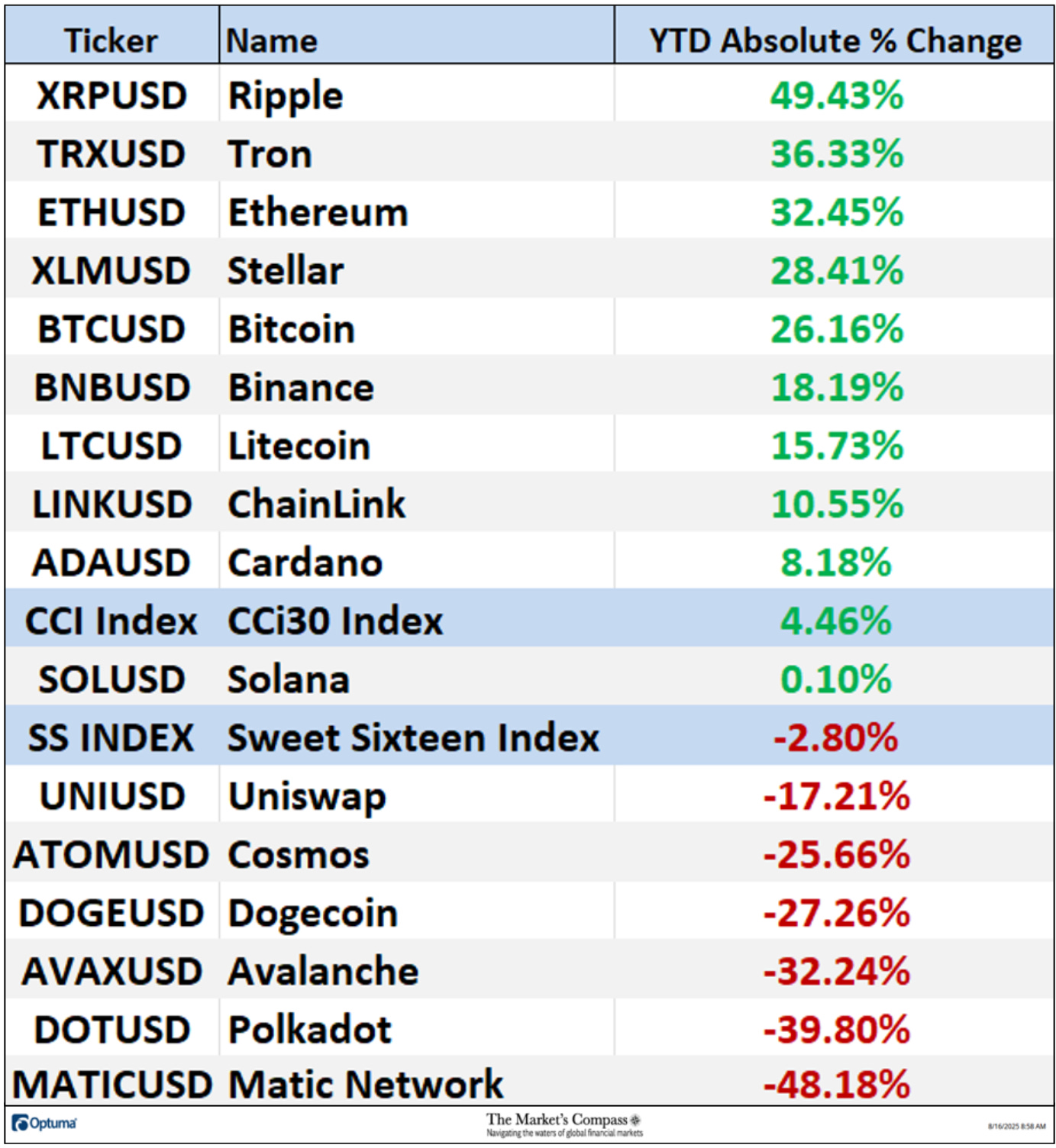

The typical absolute acquire YTD within the Candy Sixteen is now up 2.20%, up from the earlier week’s common YTD acquire of 1.60% and up from a YTD common decline of -11.09% three weeks in the past.

Most charting software program presents some type of RRG charts, however nothing comes near Optuma’s, and I urge readers to make the most of them every day. The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a fundamental tutorial on the Instruments of Technical Evaluation is accessible on my web site…