Welcome to The Market’s Compass Rising Market’s Nation ETF Research, Week #579. As at all times, it highlights the technical modifications of the 20 EM Nation ETFs that I observe on a weekly foundation and publish each third week. Paid subscribers will obtain this week’s unabridged Rising Market’s Nation ETF Research despatched to their registered e-mail. Previous publications may be accessed by paid subscribers by way of The Market’s Compass Substack Weblog. Subsequent week I will probably be publishing The Market’s Compass Developed Markets Nation ETF Research. On Sunday I printed the newest version of The Market’s Compass Crypto Candy Sixteen Research which I publish on a weekly foundation and tracks the technical modifications of sixteen of the bigger capitalized Cryptocurrencies.

This morning’s Market’s Compass Rising Markets Nation ETF Research is being despatched to free subscribers in addition to my common paid subscribers in a not so vailed try to lure free subscribers to assist the work executed within the three ETF Research and the Weekly Crypto Candy Sixteen Research.

To grasp the methodology utilized in developing the target EM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”. What follows is a Cliff Notes model* of the total rationalization of the methodology I exploit…

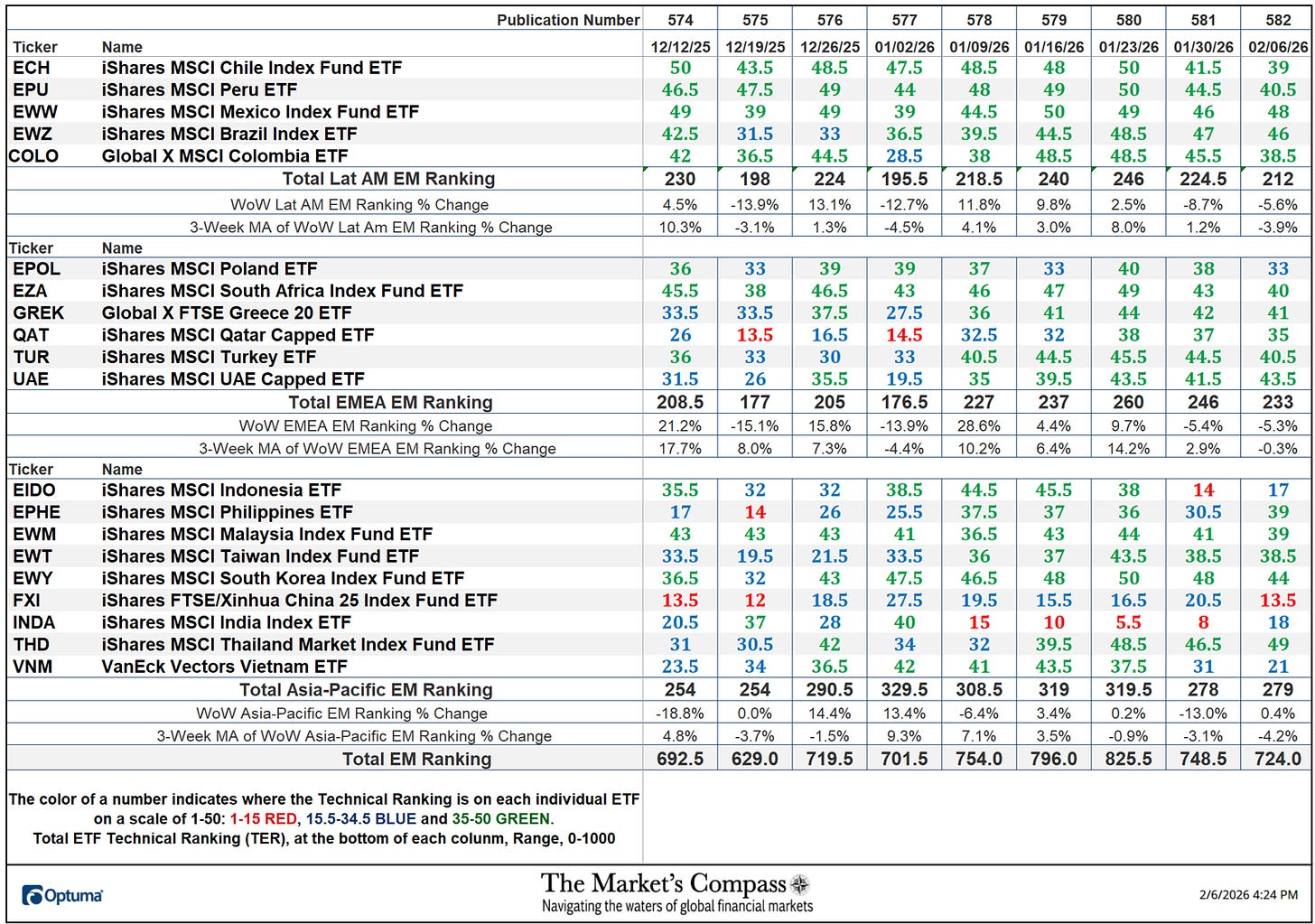

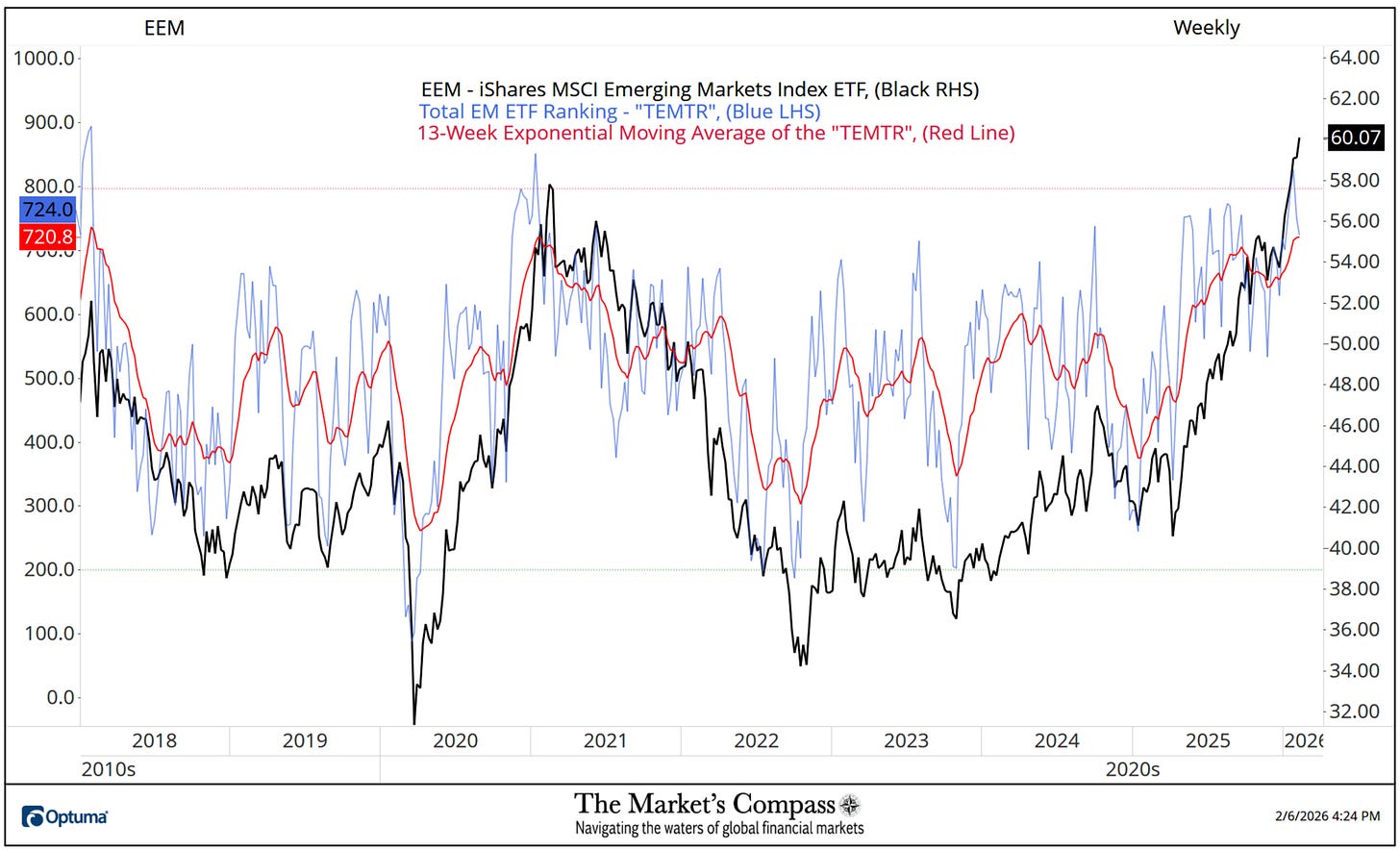

*The technical rating system is a quantitative method that makes use of a number of technical issues that embody however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative power of every particular person 20 EM Nation ETFs that may vary between 0 and 50. The Complete EM Technical Rating or “TEMTR” is the sum of the twenty particular person TRs and may be considered as an overbought / oversold indicator in addition to a affirmation / non-confirmation indicator. There may be additionally a Complete Rating for every geographic area that may be considered as a relative measurement on per week over week foundation.

This previous week The Complete EM Technical Rating or “TEMTR” fell -3.27% to 724 from 748.5 the earlier week which was down from the 825.5 studying three weeks in the past for the week ending 2/23, which was the best “TEMTR” since January 2021. The Complete Lat Am EM Rating fell the many of the three geographic areas, down -5.6% to 212 from 224.5 the week earlier than. The Complete EMEA EM Rating fell -5.3% to 233 from 246. The Complete Asia-Pacific EM Rating rose barely, up 0.4% to 279 from 278 the earlier week.

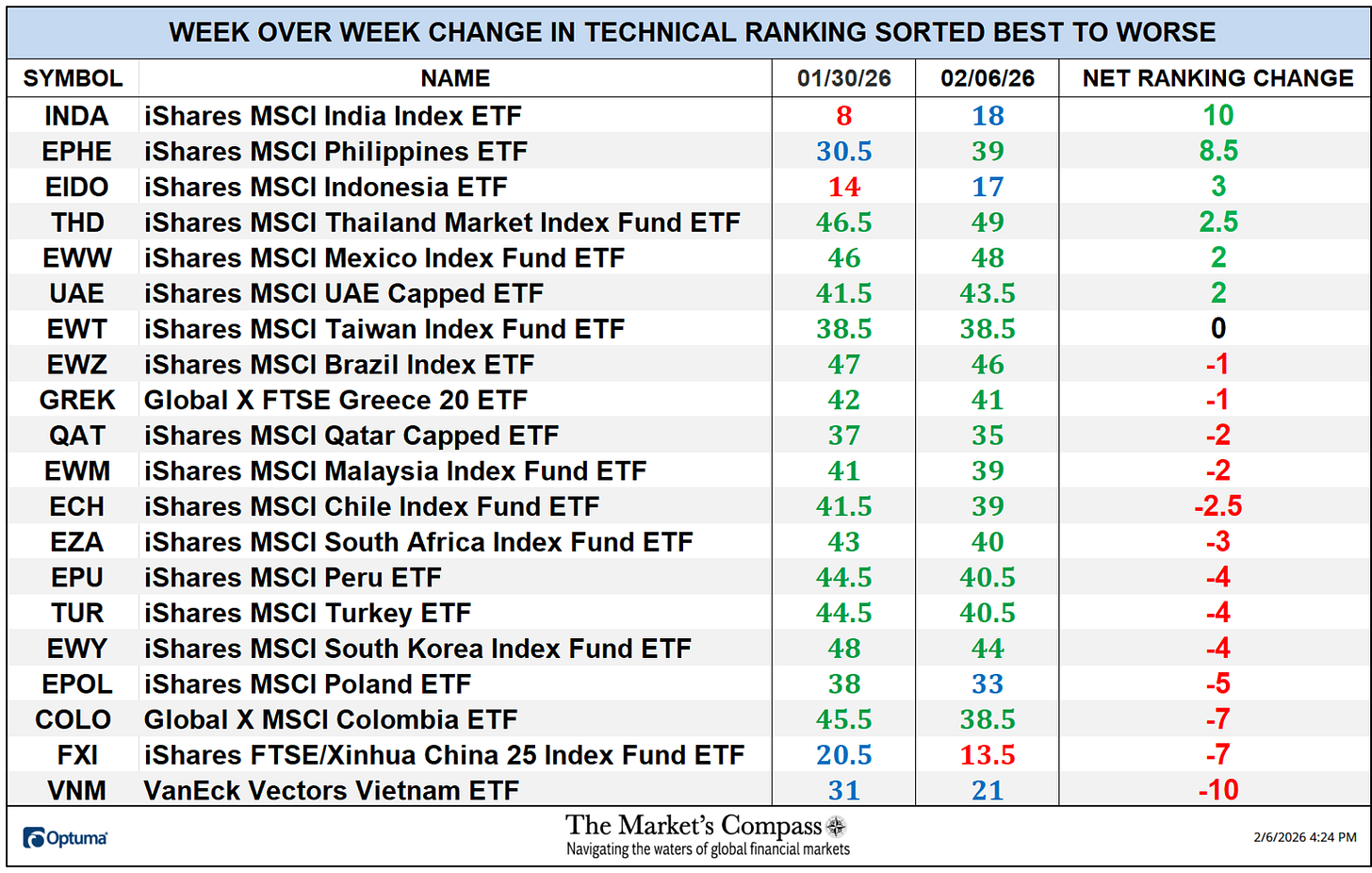

Six of the twenty EM Nation ETFs I observe in these pages registered a acquire of their Technical Rankings or TRs over the previous week; one was unchanged and 13 had TRs that fell. Final week fifteen TRs have been within the “inexperienced zone” (TRs between 34.5 and 50), 4 have been within the “blue zone” (TRs between 15.5 and 34), and two have been within the “purple zone” (TRs between 0 and 15). The common TR loss was -1.23 vs the common TR loss the earlier week of -3.85 when solely two TRs rose and 18 moved decrease. For the week ending 2/23, eighteen of the EM Nation ETF TRs ended the week within the “inexperienced zone”, one was within the “blue zone”, and one was within the “purple zone”.

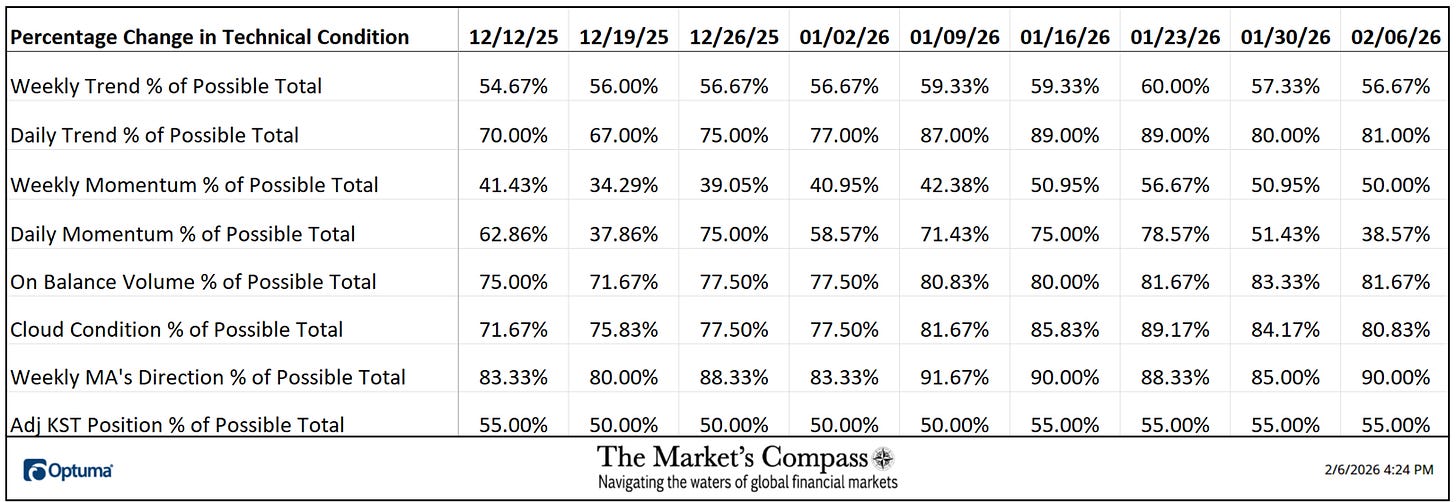

*To grasp the development the of The Technical Situation Components go to the Market’s Compass web site www.themarketscompass.com and go to the mc’s technical indicators web page and choose “em nation etfs”.

A brief model of the how the Technical Situation Components are calculated follows…

There are eight Technical Situation Components (“TCFs”) which are a summation of the twenty ETFs TRs technical situation of every TCF query. The eight Technical Situation Components don’t ask the identical variety of questions. That’s the reason it’s calculated as a proportion. If a TCF particular person studying is 100% that might imply that every one Twenty ETFs fullfilled that exact TCF criterior.

This previous week a studying of 38.57% was registered within the Each day Momentum Technical Situation Issue (”DMTCF”) or 54 out of a potential whole of 140 constructive factors.

As a affirmation instrument, if all eight TCFs enhance on a week-over-week foundation, extra of the 20 ETFs are bettering internally on a technical foundation, confirming a broader market transfer increased (consider an advance/decline calculation). Conversely if all eight TCFs fall on a week-over-week foundation it confirms a broader market transfer decrease. Final week, two TCFs rose, 5 fell, and one was unchanged.

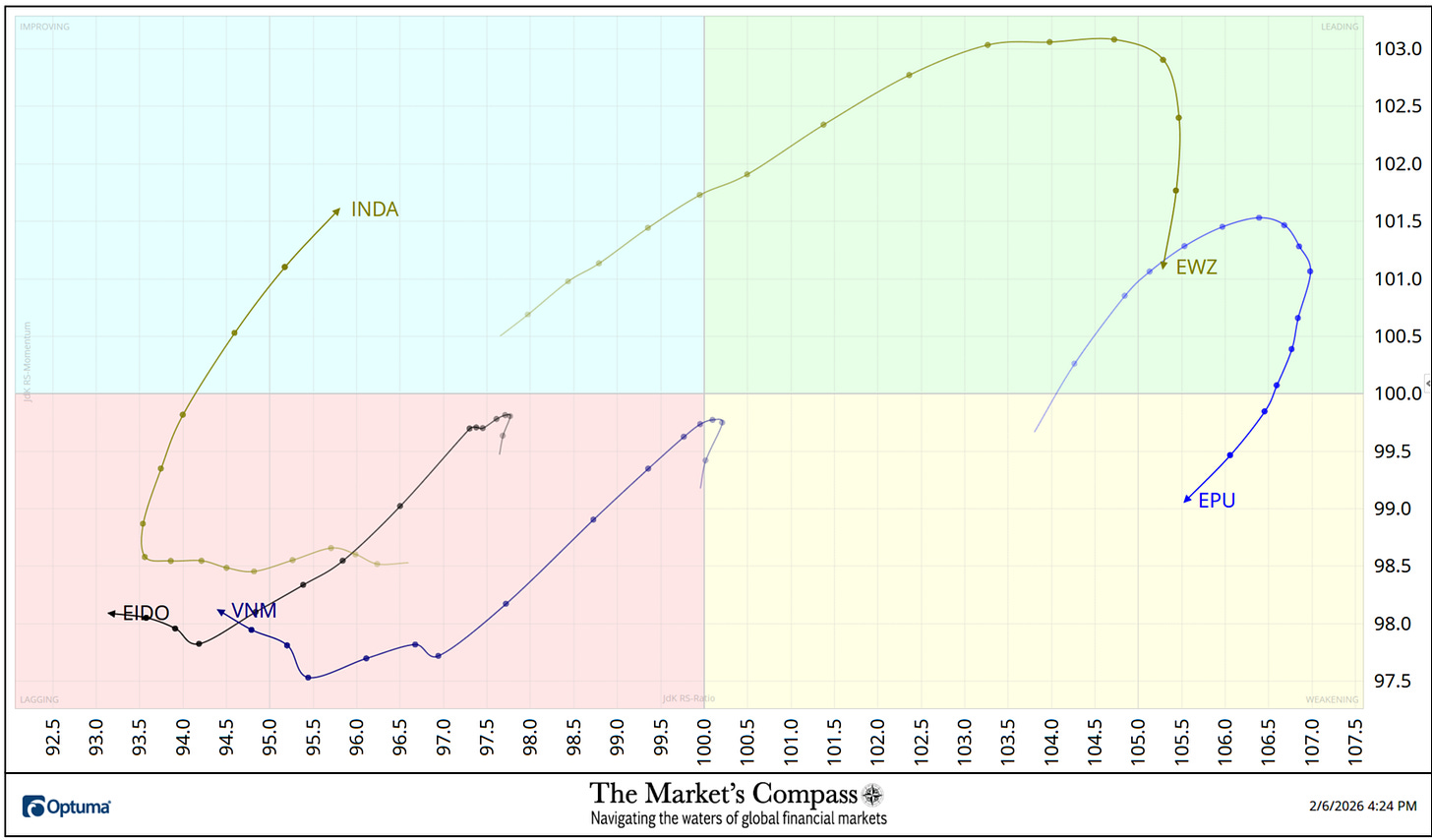

The Relative Rotation Graph, generally known as RRGs have been developed in 2004-2005 by Julius de Kempenaer. These charts are a novel visualization instrument for relative power evaluation. Chartists can use RRGs to investigate the relative power tendencies of a number of securities in opposition to a typical benchmark, (on this case the EEM) and in opposition to one another over any given time interval (within the case under, every day) over the previous three weeks. The ability of RRG is its skill to plot relative efficiency on one graph and present true rotation. All RRGs charts use 4 quadrants to outline the 4 phases of a relative development. The Optuma RRG charts makes use of, From Main (in inexperienced) to Weakening (in yellow) to Lagging (in pink) to Bettering (in blue) and again to Main (in inexperienced). True rotations may be seen as securities transfer from one quadrant to the opposite over time. That is solely a quick rationalization of the best way to interpret RRG charts. To be taught extra, see the publish scripts and hyperlinks on the finish of this Weblog.

Not all 20 ETFs are plotted on this RRG Chart. I’ve executed this for readability functions. These which I imagine are of upper technical curiosity stay.

After weeks of bettering Relative Energy and Relative Energy Momentum each the iShares MSCI Brazil Index ETF (EWZ) the iShares MSCI Peru ETF (EPU) rolled over within the Main Quadrant with EPU main the cost decrease however as may be seen within the Tabulation Desk under the EPU nonetheless sports activities the very best Relative Energy vs. the EEM regardless of the contraction in each Relative Energy and Momentum even with the truth that it has entered the Weakening Quadrant. Initially of the 12 months the iShares MSCI India Index Fund ETF (INDA) fell into the Lagging Quadrant and struggled there till per week in the past final Friday when it hooked increased and moved into the Bettering Quadrant exhibiting spectacular Relative Energy Momentum towards the tip of week (notice the space between the every day nodes). Each the VanEck Vectors Vietnam ETF (VNM) and the iShares Indonesia ETF (EIDO) fell deeper within the Lagging Quadrant till each started to stabilize and hook increased final week.

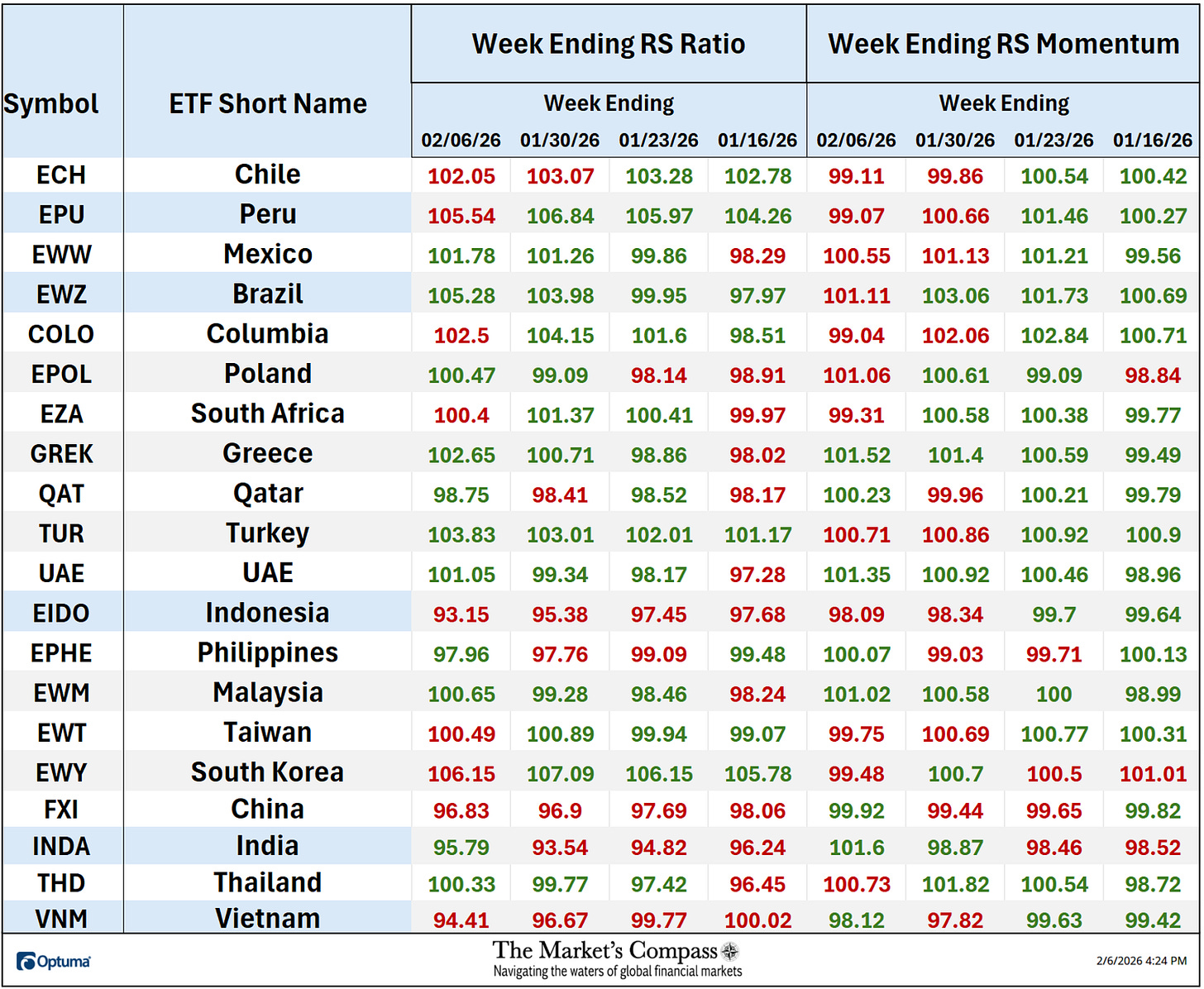

The “Tabulation Desk” under marks the Relative Energy and Relative Energy Momentum readings vs. the iShares MSCI Rising Markets Index ETF or EEM. It begins with the readings on the finish of final week adopted by the trailing three weeks that features the readings from the final Research for the week ending 1/16. If there was an enchancment in both the Relative Energy Ratio or the Relative Energy Momentum studying on a week-over-week foundation I’ve highlighted it in inexperienced. If there was a contraction in both, it’s highlighted in purple and an unchanged studying in both will stay black. The colour-coding system serves as a warmth map over the previous 4 Friday’s readings highlighting both the continued enchancment, deterioration, or stasis vs. the benchmark, the EEM. The ETFs which are displayed on the RRG chart above are highlighted in blue.

*The “TEMTR” is the sum of the 20 Particular person Goal EM ETF Technical Rankings. It serves as an overbought or oversold in addition to a affirmation / non-confirmation indicator.

The EEM closed the week at a brand new weekly closing value excessive at 60.07 however as will probably be seen within the shorter-term Weeky Candle Chart and Each day Candle Chart that observe, the longer-term Weekly shut Line Chart above doesn’t inform a full value motion image. One factor that may be seen above, after the TEMTR confirmed the brand new closing value highs it has pulled again from overbought territory and on the finish of final week it was testing assist on the nonetheless rising 13-Week Exponential Shifting Common of the TEMTR (purple line). Nonetheless the Shifting Common continues to be rising. Extra particulars to observe…

*The “ATR” just like the “TEMTR” serves as an overbought or oversold in addition to a affirmation / non-confirmation indicator.

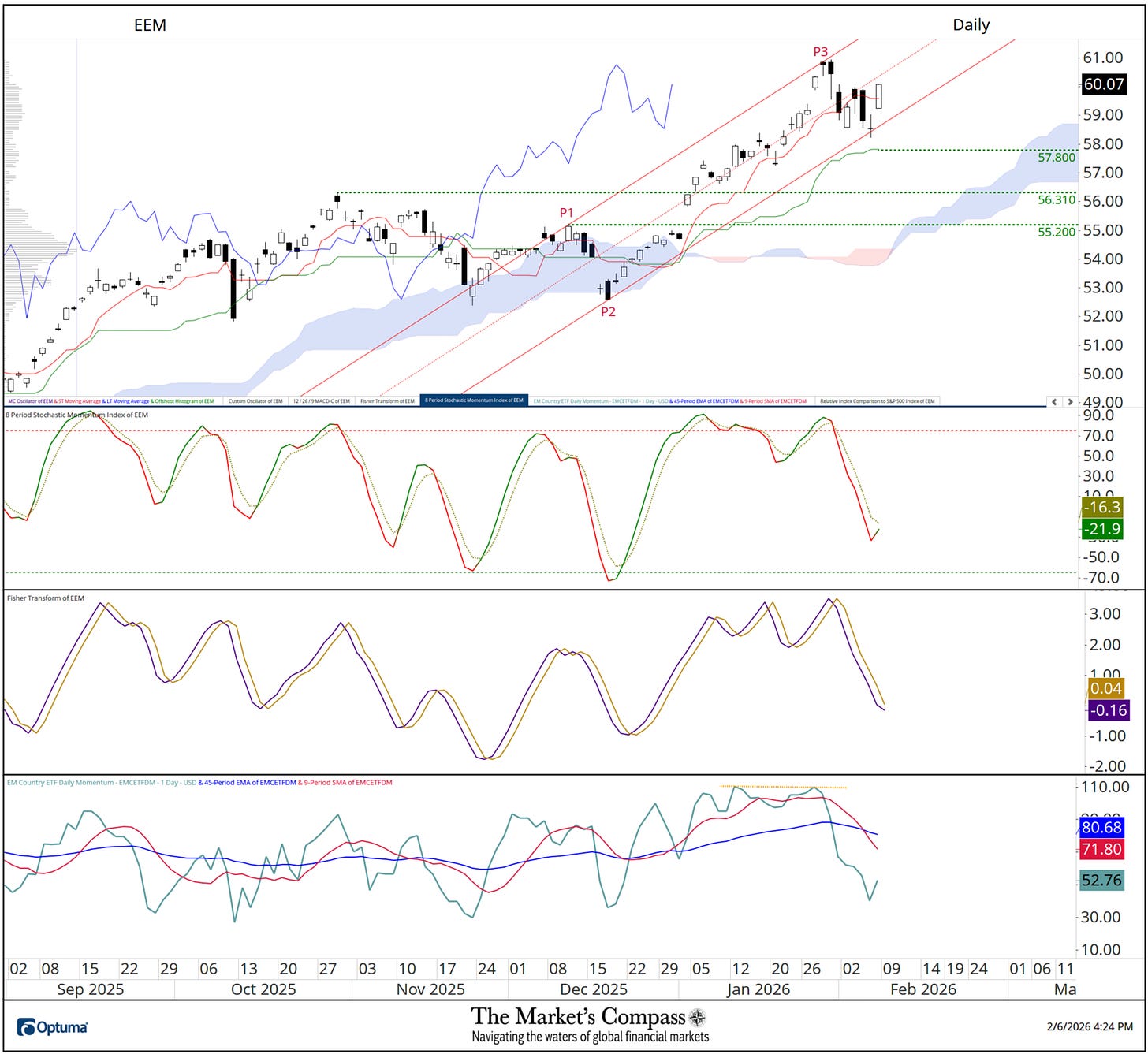

As I identified in feedback on the Weekly Line Chart, two weeks in the past the EEM rose to an all-time intra-week excessive at 60.95 however failed to carry above Higher Warning Line 2 (violet dotted line) of the longer-term Customary Pitchfork (violet P1-P3) and costs closed close to the on the lows of the week. Final week costs opened decrease however reversed and superior again above the Median Line (gold dotted line) of the shorter-term Schiff Modified Pitchfork (gold dotted line) however was capped on the UWL2 on the shut of the week. The Rising Markets Complete Situation Issue Oscillator has pulled again for the second week in a row from overbought territory and has fallen under the 5-Week Movin Common (purple line) The Common EM Technical Rating (backside panel) has executed the identical though it stays above each Shifting Averages.

Find out about Pitchforks and their applacation within the three-part Pitchfork tutorial within the Market’s Compass web site, www.themarketscompass.com

Extra on the technical situation of the EEM in Ideas on the Quick-Time period Technical Situation of the EEM however first…

*Doesn’t embody dividends if any.

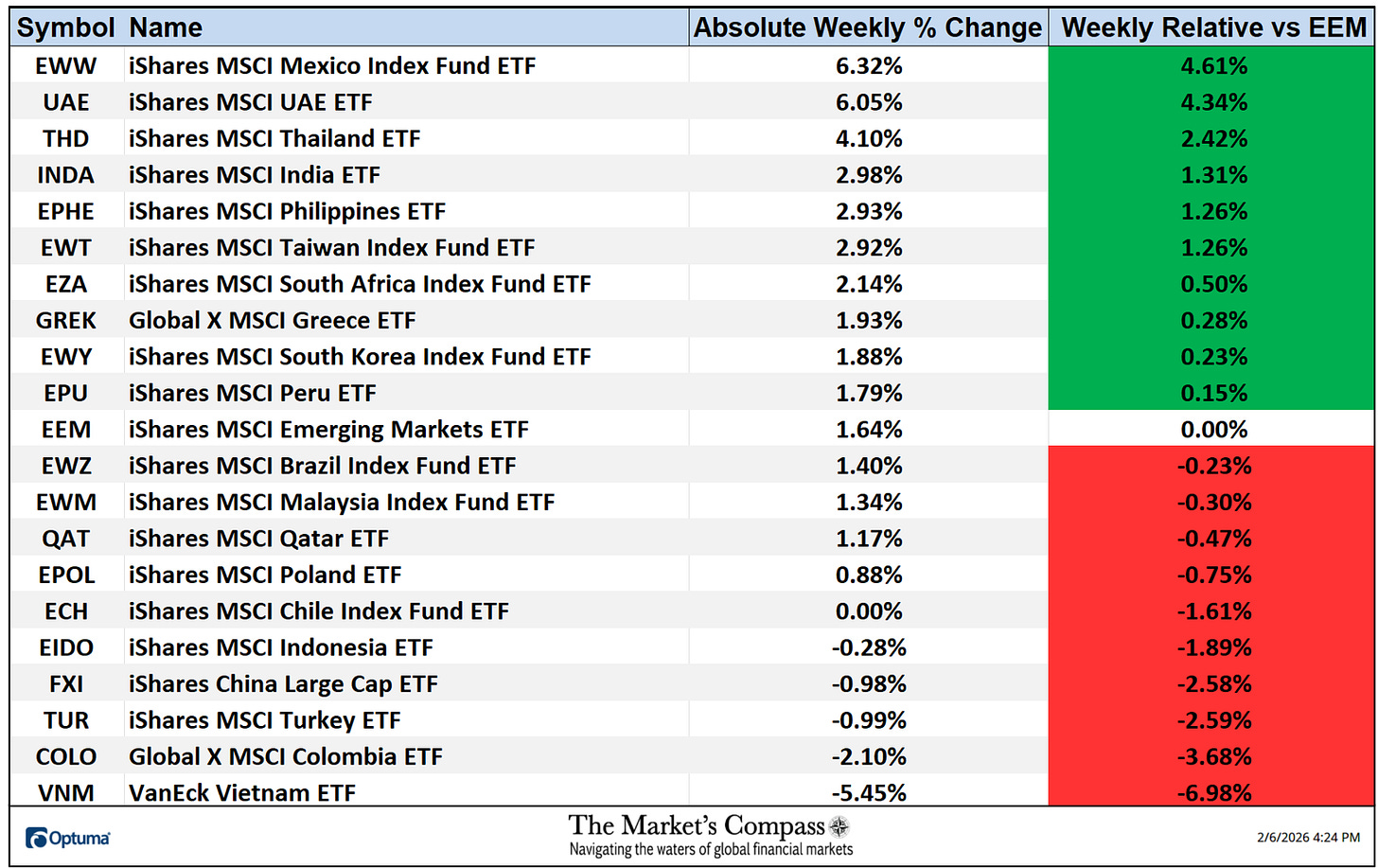

Fourteen of the twenty EM Nation ETFs have been up on an absolute foundation final week; one was unchanged and 5 traded decrease over the week. Ten EM ETFs outperformed the +1.64% acquire within the EEM on a relative foundation and ten underperformed. The common five-day absolute acquire within the EM ETFs was +1.40% vs. a +1.64% acquire within the EEM. The earlier week the common absolute loss was -0.47% vs. de minimis +0.05 acquire within the EEM.

Within the earlier Rising Markets Nation ETF Research (printed on January nineteenth), I instructed that “a retracement is forthcoming within the quick time period which is hardly a shock contemplating how stretched the EEM has grow to be”. That technical thesis proved to be untimely and the EEM rallied to new highs however per week in the past, final Thursday the chickens lastly got here house to roost. When it turned evident that the retracement was unfolding final final week I added a brand new Schiff Modified Pitchfork (purple P1 by way of P3). The EM Nation ETF Each day Momentum / Breadth Oscillator failed to substantiate the highs at P3 (yellow dashed line within the decrease panel) giving me confidence that the backing and filling was about to unfold. Final Thursday the Decrease Parallel (strong purple line) provided a measure of value assist resulting in Friday’s rally. That rally led to a slowing of the decline in each the Stochastic Momentum Index and the Fisher Remodel* though each stay under their sign traces. Solely a observe by way of to Friday’s value rally by way of the Median Line (purple dotted line) of the newly drawn Pitchfork would recommend that the value pullback might have run its course. Key phrase “might”.

*The Fisher Remodel is a technical evaluation indicator used to determine potential value reversal by remodeling value knowledge right into a Gaussian regular distribution and was developed by John Ehlers.