Welcome to The Market’s Compass US Index and Sector ETF Examine, Week #571. As at all times it highlights the technical modifications of the 30 US Index and Sector ETFs that I monitor on a weekly foundation and usually publish each third week. Previous publications could be accessed by paid subscribers through The Market’s Compass Substack Weblog.

This week, in celebration of Thanksgiving, free subscribers can even obtain this week’s complete Examine in a not so veiled try to lure them to turn out to be paid subscribers.

To know the methodology utilized in establishing the target U.S. Index and Sector ETF Particular person Technical Rankings go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”. What follows is a Cliff Notes model* of the complete clarification…

*The technical rating system is a quantitative method that makes use of a number of technical issues that embody however aren’t restricted to pattern, momentum, measurements of accumulation/distribution and relative energy of every particular person 30 U.S Index and Sector ETFs that may vary between 0 and 50.

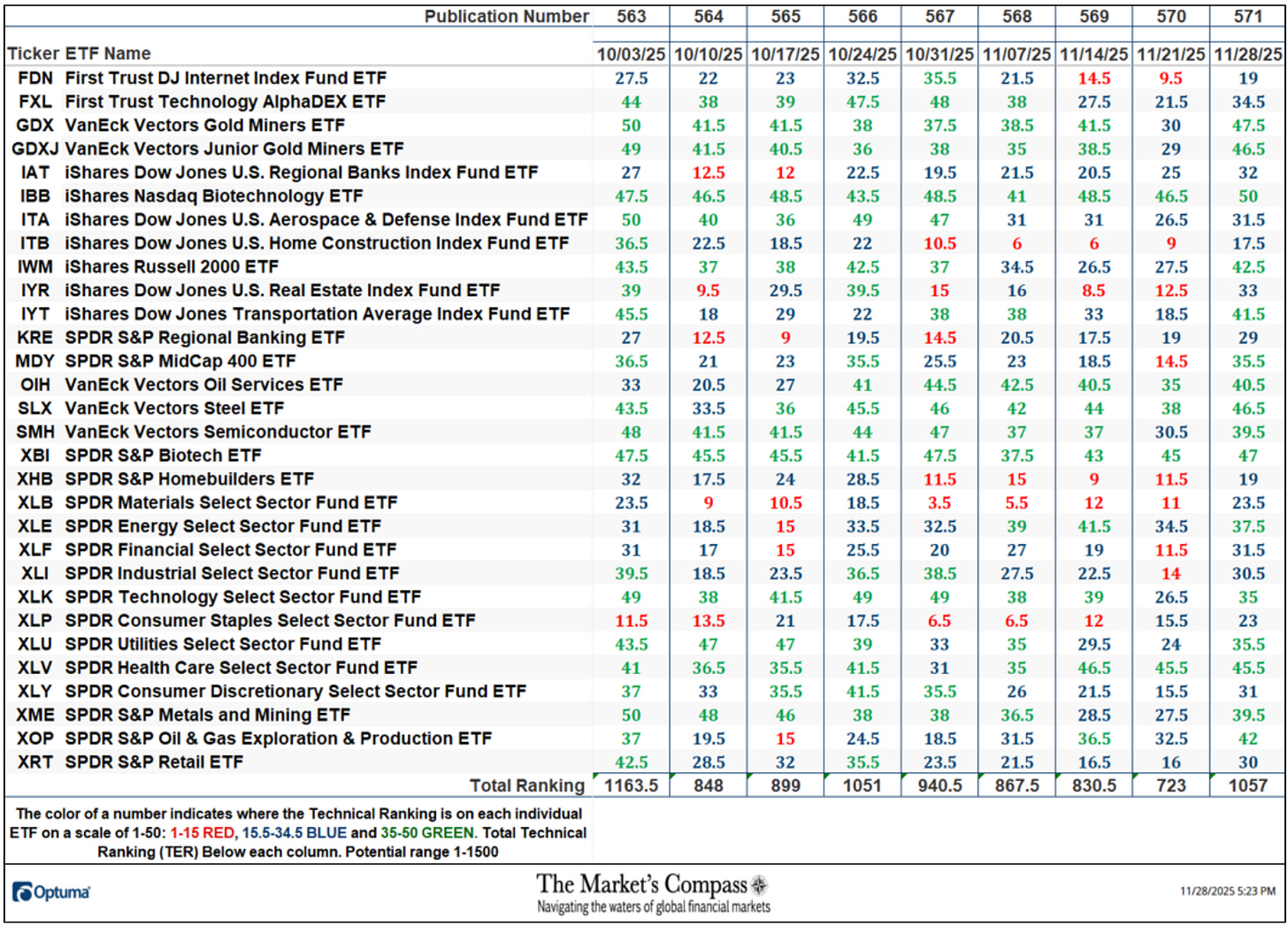

Complete US ETF Rating or “TER” rose sharply final week, rising +46.20% to 1057 from 723 which was the fifth week of declines within the “TER”.

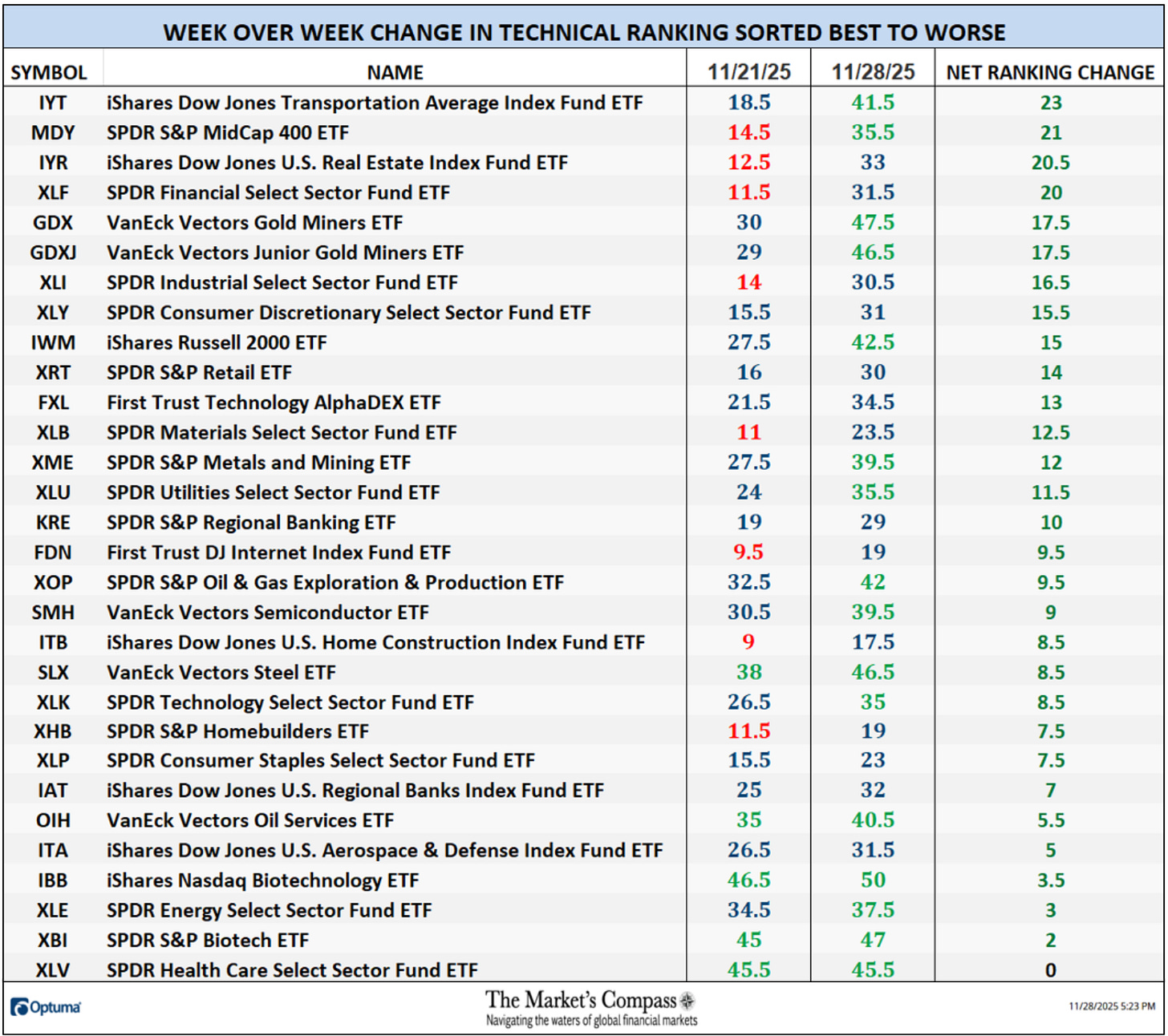

In a broad-based technical enchancment of the thirty US ETFs we monitor twenty-nine confirmed positive aspects of their Technical Rankings or “TR”, and one was unchanged. That was the SPDR Well being Care Choose Sector Fund ETF (XLV), but it surely ought to famous, regardless of being unchanged, its TR was nonetheless solely simply 4.5 factors of close to good. Fourteen ETFs made double-digit positive aspects of their TRs. Sixteen ETF TRs ended the week within the “inexperienced zone” (TRs from 35 to 50) and fourteen ended within the “blue zone” (TRs from 15.5 to 34.5) vs. the earlier week when there have been solely 5 within the “inexperienced zone”, seventeen within the “blue zone”, and eight had been within the “crimson zone” (TRs between 0 and 15). Final week was the primary time in 4 weeks when there wasn’t at the very least one TR within the “crimson zone”. The common TR achieve on the week was +11.19 (the biggest common TR achieve in current reminiscence) vs. the week earlier than common TR lack of -3.53.

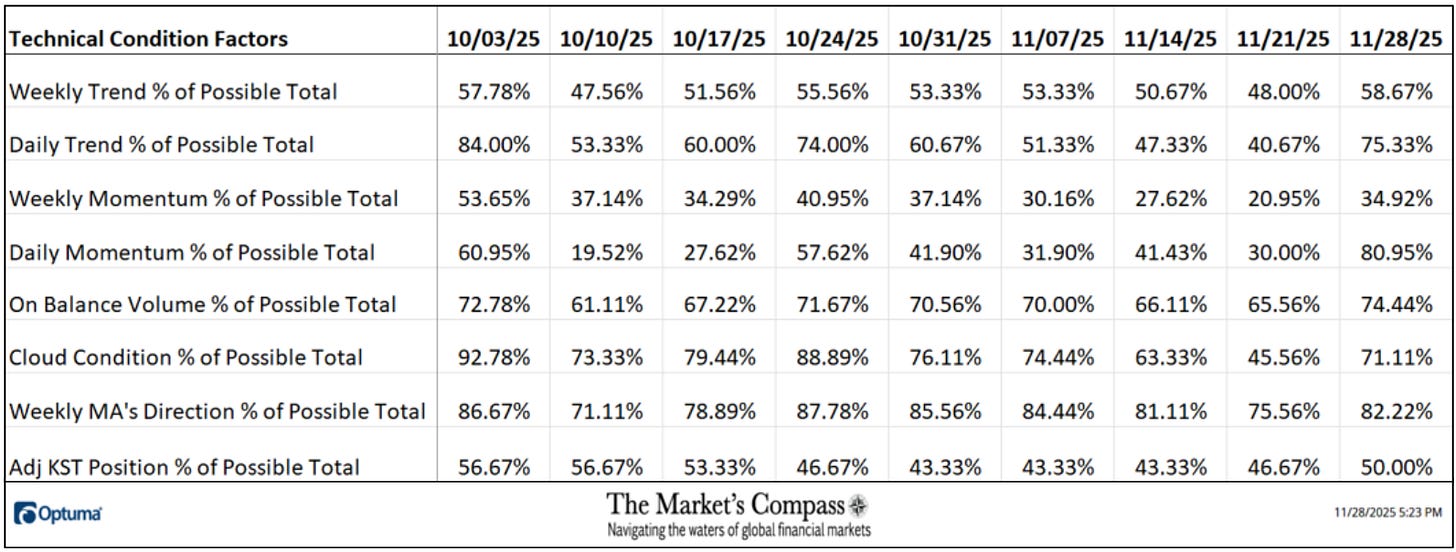

*The Technical Situation Elements are derived from a calculation of the full Particular person US Index and Sector ETF Technical Rankings. What’s proven within the excel panel beneath is the full TCFs of all thirty TRs. A couple of TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Consider compiling every particular person TR of every of the 30 ETFs. Due to that, the excel sheet beneath calculates every issue’s weekly studying as a share of the attainable complete.

To totally perceive the development the of The Technical Situation Elements go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”.

One technical takeaway can be for instance, if the DMC Issue or DMCTF rises to an excessive between 85% and 100%, it will recommend a short-term overbought situation. Conversely, a studying within the vary of 0% to fifteen% would recommend an oversold situation was creating. This previous week a studying of 80.95% was registered within the DMCTF or 170 out of a complete of 210 constructive factors, which was up from 30.00% the earlier week.

As a affirmation instrument, if all eight TCFs enhance on every week over week foundation, extra of the 30 ETFs are enhancing internally on a technical foundation confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fell over the week it confirms a transfer decrease within the broader market. Final week all eight TCFs gained floor confirming the broad-based rally within the S&P 500 Index.

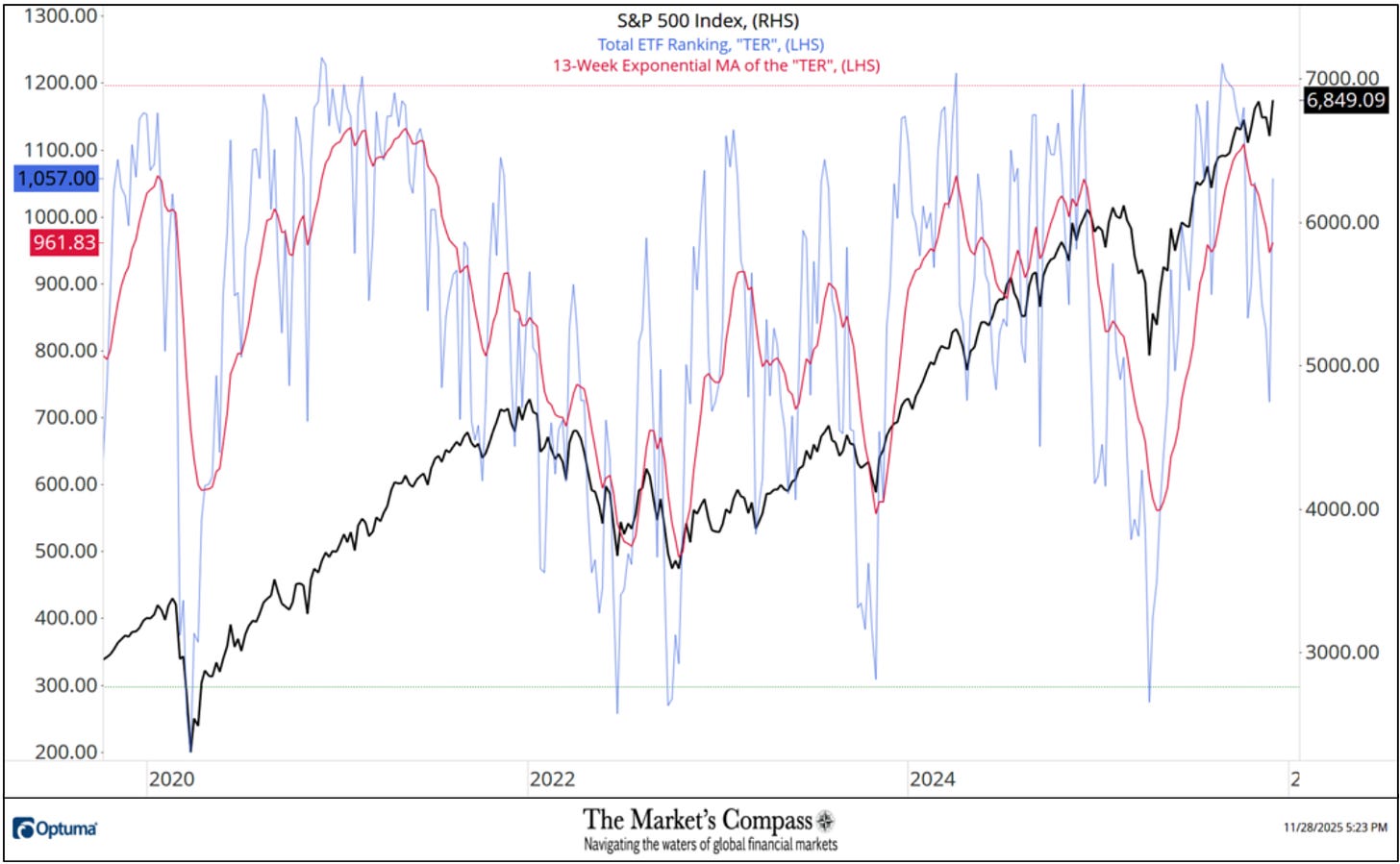

The Complete US ETF Technical Rating (“TER”) Indicator is a complete of all 30 ETF rankings and could be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator.

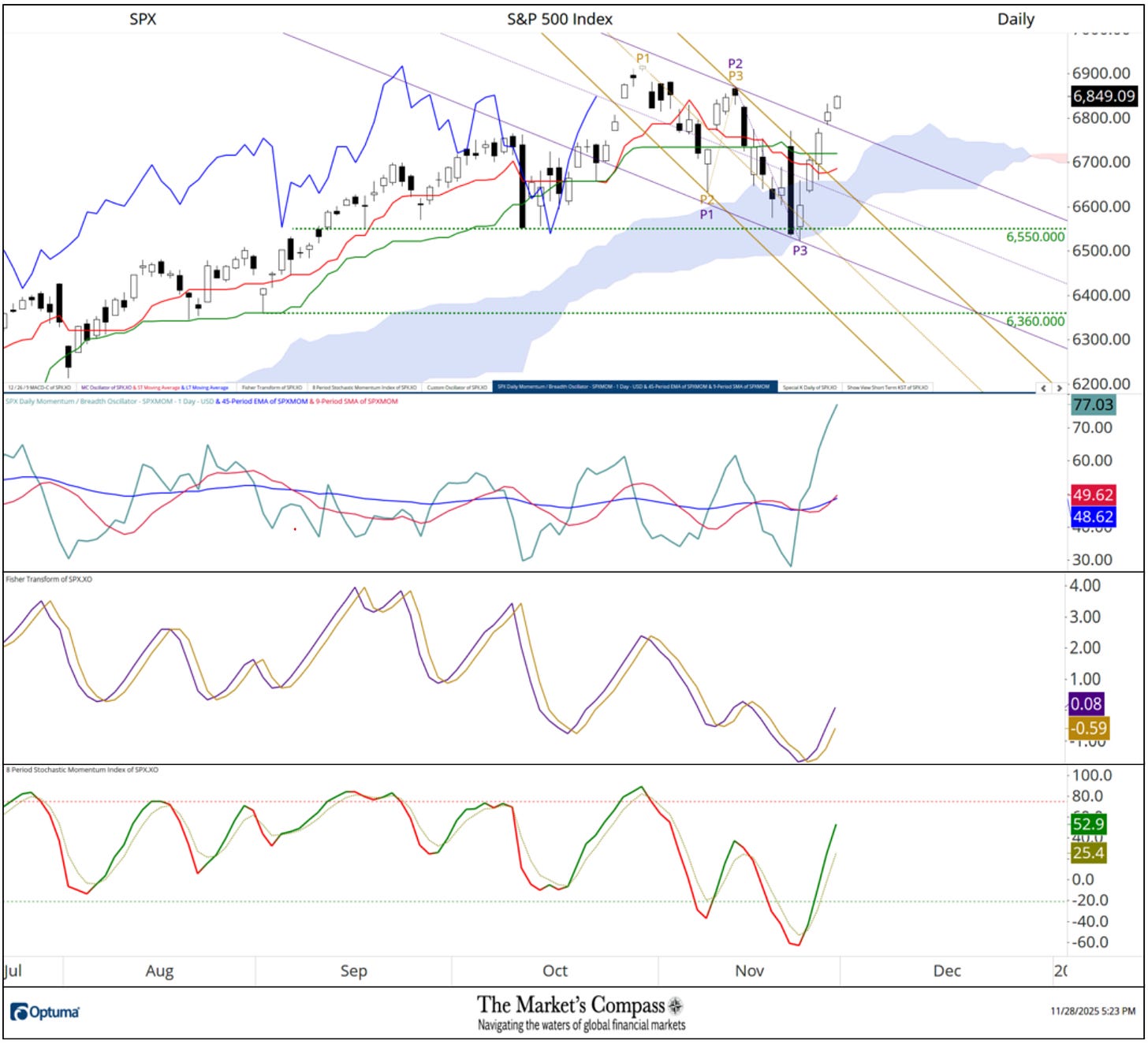

The S&P 500 Index rallied 3.73% final week to shut at a brand new weekly closing excessive, thus avoiding a decrease low and protecting the collection of upper lows and better highs on a weekly closing foundation since April low intact. The Complete US ETF Technical Rating or “TER” rose sharply to a better excessive to finish the week at 1,057 confirming final week’s rally within the giant cap index.

The Weekly Common Technical Rating (“ATR”) is the common Technical Rating of the 30 US Index and Sector ETFs we monitor. Just like the TER, it’s a affirmation/divergence in addition to an overbought/oversold indicator.

Once I final printed the US Index and Sector ETF Examine on November tenth for the week ending November seventh, the SPX had pulled again on the Median Line (crimson dotted line) of the Customary Pitchfork* (crimson P1-P3). Two weeks in the past the index fell and closed beneath the Tenkan Plot (crimson line) which had cradled costs on an weekly closing foundation since early Might however by the tip of that week the Decrease Parallel (stable line) held an extra selloff and final week the SPX rallied impulsively, suggesting that brief time period correction from the file intra-week excessive at 6,910 had run its course. Just like the Complete Technical Rating the “ATR” by rising from a decrease low to a better excessive in live performance with the 9-Week SMA (crimson line in decrease panel) avoiding a violation of the 45-Week EMA (blue line). These technical options level to a problem of the Median Line and the all-time intra-week excessive at 6,910 within the weeks and maybe days to come back.

*An in-depth complete lesson on Pitchforks is on the market on my web site…

*Doesn’t embody potential dividends if any

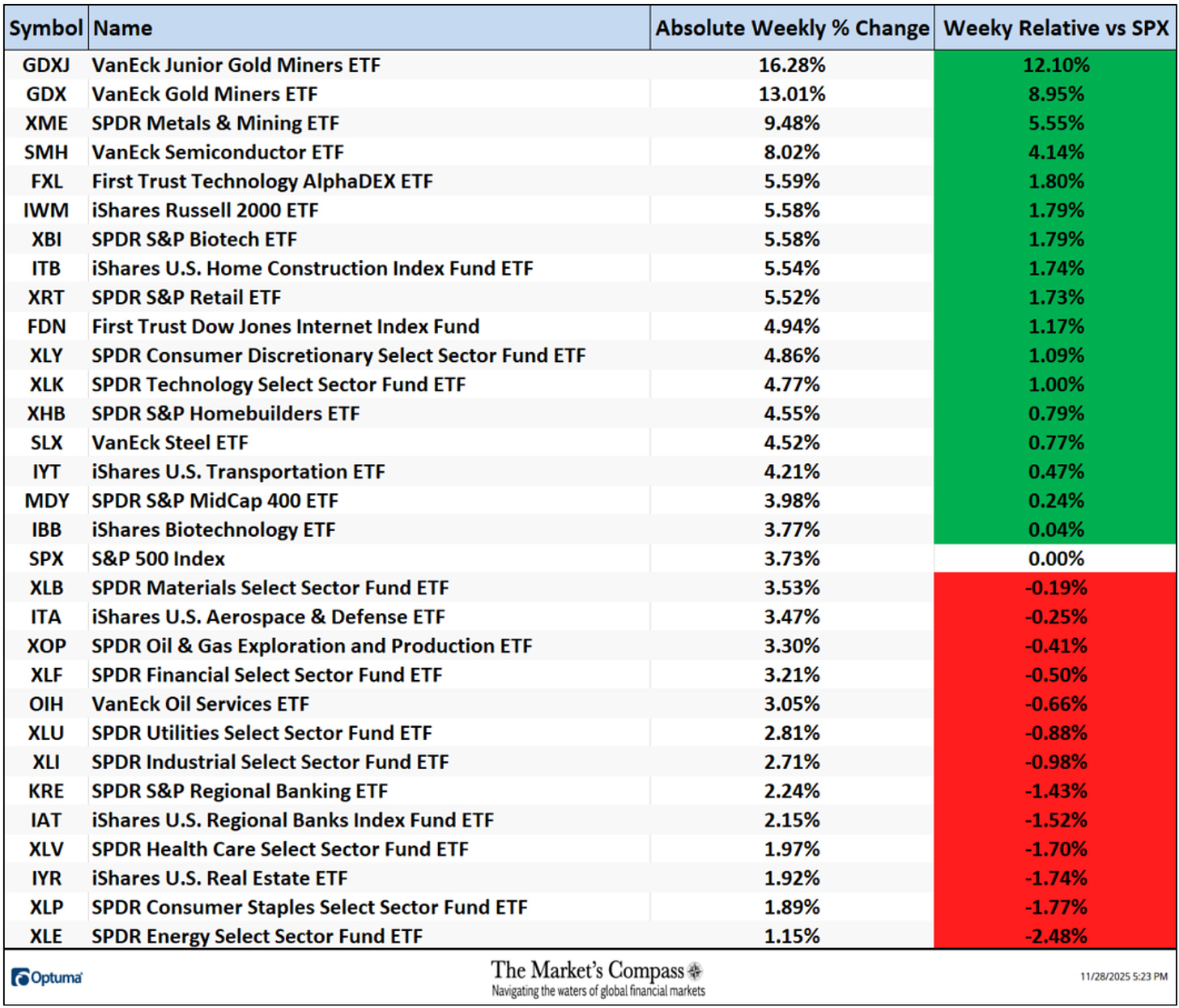

All thirty US Index and Sector ETFs we monitor on this Examine gained floor on an absolute foundation on the finish of the vacation shortened week. Seventeen of the ETFs outperformed the +3.73% achieve within the S&P 500 Index on a relative foundation and 13 underperformed. The standout gainers final week had been gold and metals / mining ETFs. The common 4-Day absolute worth achieve final week was -4.79%, vs. the common absolute 5-Day loss the week earlier than of -1.40%.

Every week in the past, final Friday, the SPX Index held assist on the backside of the Cloud respecting the oversold sign in all three oscillators and on Monday the big cap index retook the bottom above the Cloud main me to attract a second shorter-term Schiff Pitchfork (violet P1-P3). On Tuesday the SPX adopted by means of to the upside once more slicing by means of potential resistance on the Kijun Plot (inexperienced line) and the Higher Parallel (stable gold line) of the considerably longer-term Customary Pitchfork (gold P1-P3) drawn from the all-time closing excessive. Final Wednesday the SPX rallied and closed above the Higher Parallel (stable violet line) of the newly drawn Schiff Pitchfork. The “icing on the cake” was yet one more larger shut on the finish of the shortened buying and selling session on Friday that got here near bettering the October twenty ninth all-time closing excessive. I 5 buying and selling days my SPX Every day Momentum / Breadth Oscillator (just under the value panel) has completely (after which some) the oversold situation. Though it indicators a short-term overbought situation that my result in a measure of “backing and filling” doubtlessly testing assist on the overtaken Higher Parallel it confirms the impulsive worth transfer larger. That stated the three wave ABC correction is probably going full with each the Fisher Rework and the Stochastic Momentum Index leaving nary a suggestion of an instantaneous decline.

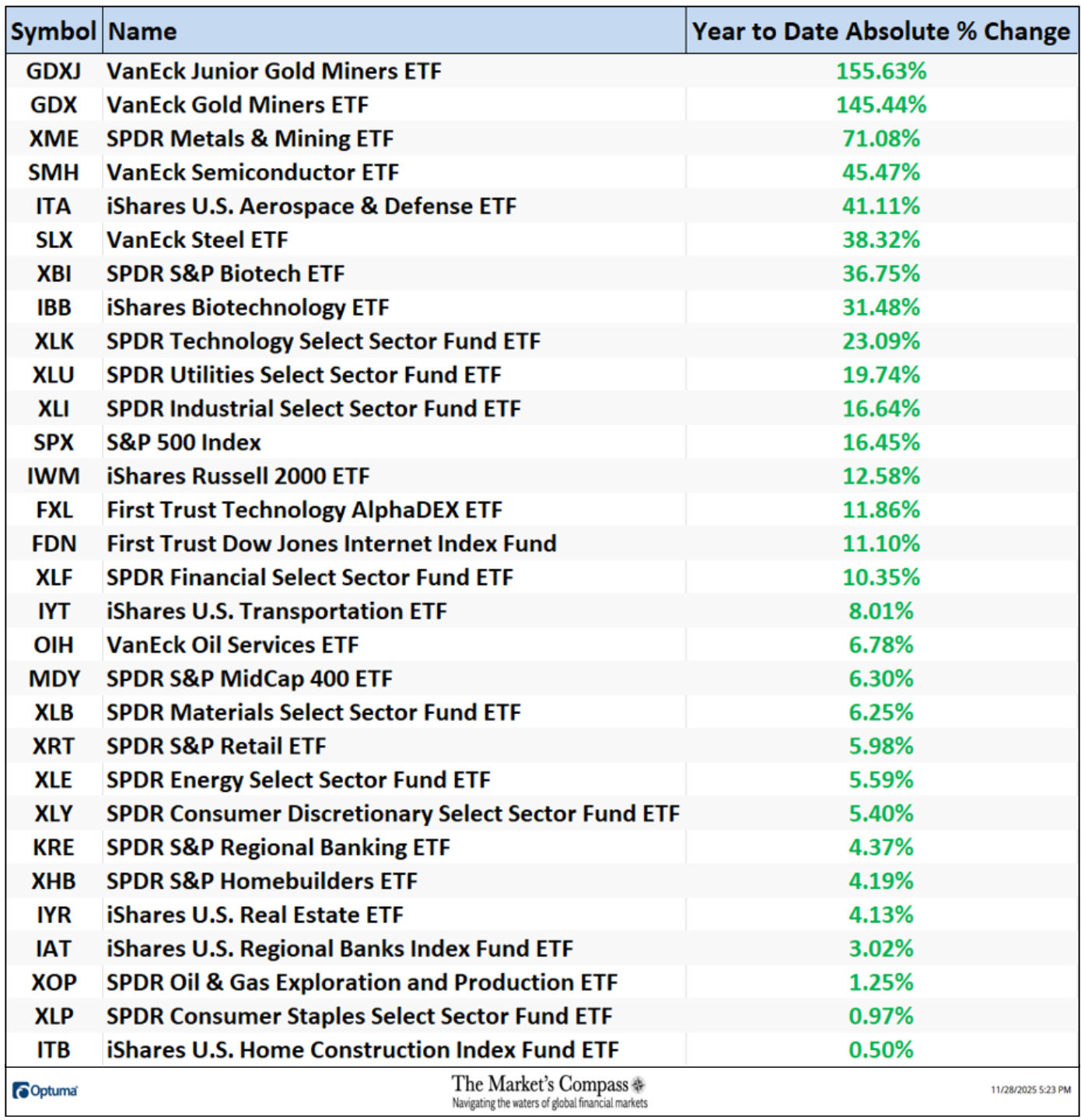

The YTD Common Absolute Worth precentage achieve jumped again to +25.29% from +18.63% final week.

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of the SPX can avail themselves of a quick tutorial titled, Instruments of Technical Evaluation and an in-depth complete lesson on Pitchforks is on the market on my web site…

Charts are courtesy of Optuma whose charting software program permits the Technical Rankings to be calculated and again examined.

To obtain a 30-day trial of Optuma charting software program go to…