It’s so tempting for buyers to chase the following flashy get-rich-quick theme and gamble on speculative “growthy” shares, hoping to catch lightning in a bottle. Such property might ship life-changing returns, however their market-churning volatility often leaves many buyers’ accounts bleeding. Nevertheless, actual generational wealth can nonetheless be constructed within the background, quietly, with out taking over an excessive amount of capital danger, by proudly owning important property that generate boatloads of money yr after yr.

You don’t essentially must accept the security of a slow-growing utility, although. There’s a TSX-listed infrastructure large that provides the rock-solid stability of a utility mixed with a hidden progress engine tied on to the world’s greatest funding traits. I’m referring to Brookfield Infrastructure Companions (TSX:BIP.UN), and it may very well be top-of-the-line core holdings in your retirement portfolio.

Brookfield Infrastructure Companions inventory: A world empire constructed on “boring” necessities

Brookfield Infrastructure Companions is a worldwide powerhouse that owns the mission-critical property you employ every single day and not using a second thought. Its portfolio is diversified throughout 4 important segments: Utilities, Transport, Midstream, and Knowledge.

The infrastructure powerhouse owns all the pieces from pure fuel pipelines and electrical energy transmission strains to railways, ports, and toll roads. It owns power storage services and the info centres and cell towers that energy our digital lives. Property are unfold throughout North America, South America, Australia, and different nations. This world footprint is extremely defensive.

A large 85% of Brookfield’s money movement is both regulated or tied to long-term contracts and shielded from, or listed to, inflation. The US$37 billion billion infrastructure portfolio has been a monetary fortress for BIP.UN items buyers for years.

BIP’s “quietly wealthy” two-engine progress technique

Brookfield Infrastructure Companions builds buyers’ wealth utilizing two highly effective engines, and that is the place its story will get thrilling.

The primary is the “quiet” earnings stream. This infrastructure powerhouse is a dividend-growth machine. It has a 17-year historical past of persistently growing its dividend payout, actively focusing on 5–9% annual progress for that distribution. The present payout yields 5% yearly. Given administration’s dividend dedication to shareholders, this dependable passive earnings stream may develop quicker than inflation, and it has been a big supply of returns for buyers over the previous 20 years.

However earnings is just half the story. Capital positive factors on this infrastructure play may make buyers satisfactorily wealthy.

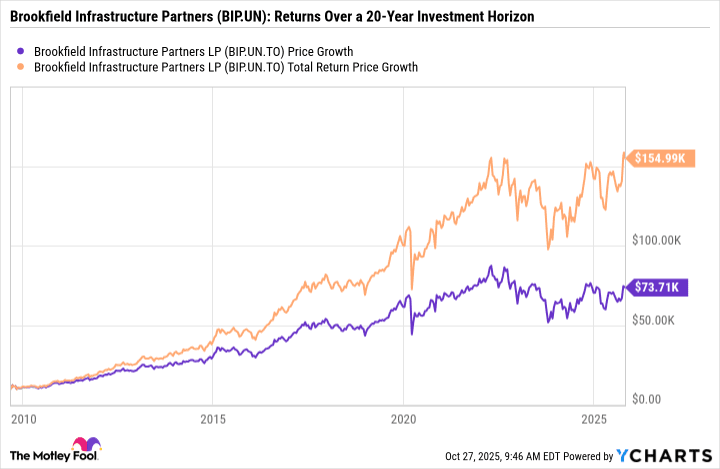

Simply Brookfield’s historic observe file, a hypothetical $10,000 funding in BIP.UN a decade in the past, with dividends reinvested, may have grown to just about $155,000 immediately. Even in case you simply pocketed the dividends, the capital positive factors alone may have turned that $10,000 into greater than $73,000.

However how may the “boring” infrastructure firm develop buyers’ capital over the following decade?

The “secret” AI engine hiding in plain sight

BIP is arguably the very best Canadian infrastructure inventory to purchase proper now to revenue from the bogus intelligence (AI) revolution. Whereas administration focuses on three unstoppable megatrends: Decarbonization, Deglobalization, and Digitalization, the final one is a goldmine.

The fast-emerging AI-powered world financial system requires a large build-out of bodily property, and Brookfield is constructing this infrastructure spine. Its information section already contains over 140 information centres, 308,000 telecom towers, and even two semiconductor manufacturing foundries. In truth, Brookfield’s partnership with Intel to construct a US$30 billion semiconductor facility in Arizona is on the mark. Intel’s Arizona fabs will mass-produce the corporate’s newest and most superior silicon for 2026, beginning this quarter. Such offers are core progress drivers.

Brookfield fuels its progress with a superb technique known as “capital recycling”. It’s promoting mature, slow-growing property for good earnings to reinvest that money into high-growth areas. The infrastructure powerhouse’s asset recycling is gaining momentum with many takers in 2025, bringing in billions in contemporary liquidity to plow into new acquisitions just like the Hotwire fiber-to-the-home community within the U.S.

Investor takeaway

Whereas no fairness funding is risk-free, and Brookfield Infrastructure Companions basically makes use of a big quantity of debt to execute its technique, leverage is generally a priority throughout high-interest charge regimes. Charges are coming down, and Brookfield maintains a robust BBB+ investment-grade credit standing, and most of its debt is locked in at fastened charges.

Brookfield Infrastructure Companions is a “get-rich-reliably” infrastructure powerhouse that provides a mix of safe, rising dividends and a strong, hidden progress story that will efficiently experience on AI infrastructure this decade. It would simply be the very best Canadian infrastructure inventory to purchase and maintain for the following decade.