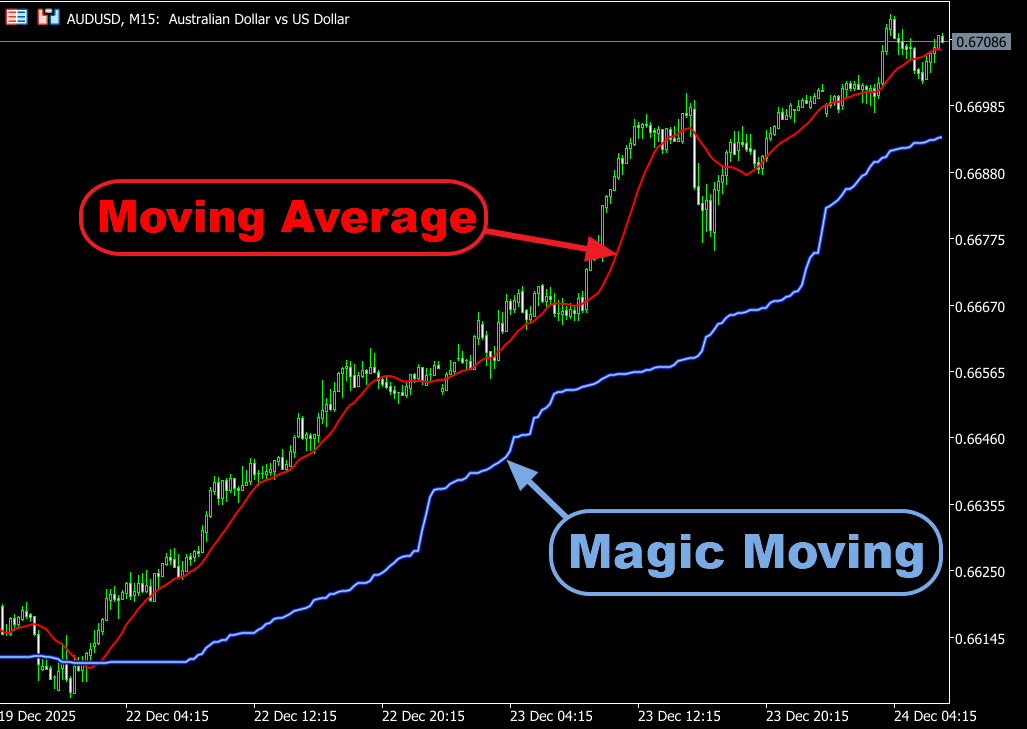

The Transferring Common (MA) is a cornerstone of technical evaluation. It smooths worth information over a set interval, serving to merchants spot tendencies and potential turning factors. However regardless of its reputation, it’s removed from excellent. Let’s break down its key strengths and weaknesses.

Execs

- Simplicity: Simple to know and apply, even for newbies.

- Pattern Identification: Clearly exhibits the path of the market pattern.

- Noise Discount: Filters out short-term worth fluctuations, providing a smoother view of worth motion.

- Broadly Acknowledged: Utilized by hundreds of thousands of merchants, making it a typical reference level for market evaluation and algorithmic logic.

Cons

- Lagging by design: Based mostly on previous costs, so it reacts slowly to new strikes.

- False indicators in sideways markets: Can set off purchase/promote alerts throughout range-bound situations, resulting in losses.

- No forecasting capacity: Displays historical past—it doesn’t predict the long run.

- Extremely delicate to settings: A 20-period MA behaves very otherwise from a 200-period one; improper selections mislead.

- Fails throughout excessive volatility: Gaps and spikes distort the common, lowering reliability.

- Not common: No single setting works effectively throughout all belongings or timeframes.

f you’re pissed off with the constraints of conventional shifting averages, strive Magic Transferring—a sophisticated different designed to remove lag, scale back false indicators, and adapt dynamically to market situations.

Say goodbye to outdated indicators!

Obtain Magic Transferring : https://www.mql5.com/en/market/product/35363