The UT Bot MT4 Indicator emerged as an answer to this precise drawback, providing automated alerts that try to catch traits whereas retaining merchants out of uneven, directionless markets. Constructed on a mixture of Common True Vary (ATR) and transferring common calculations, this instrument has gained traction amongst foreign exchange merchants searching for clearer entry and exit factors with out the fixed second-guessing.

What the UT Bot Indicator Really Does

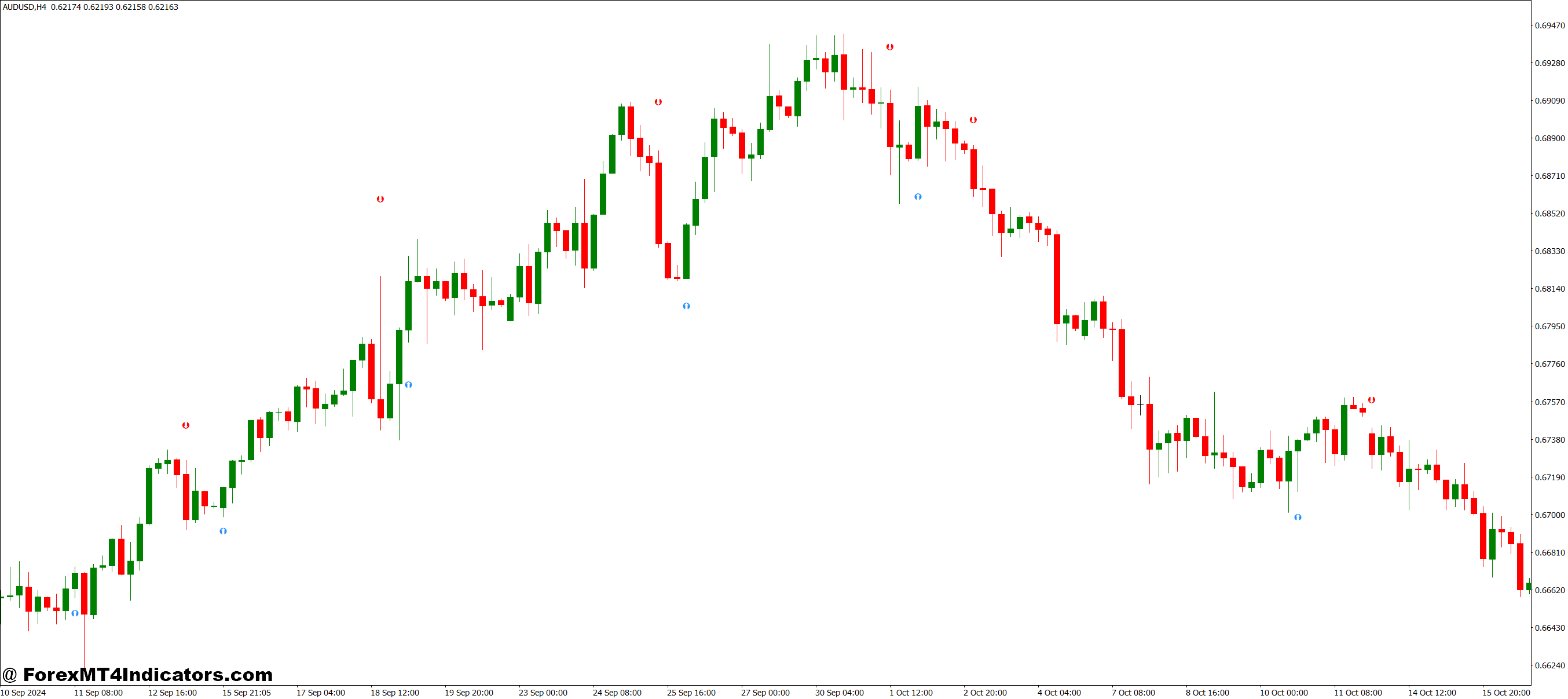

The UT Bot is a trend-following indicator that plots purchase and promote alerts straight on the value chart. In contrast to primary transferring common crossovers, it makes use of ATR to create dynamic trailing stops that adapt to market volatility. The indicator calculates a baseline utilizing exponential transferring averages, then provides or subtracts a a number of of ATR to create higher and decrease bands. When the value crosses these bands, the indicator generates alerts.

Right here’s what makes it completely different: The ATR part means the indicator widens throughout risky classes (like London open or NFP releases) and tightens throughout quiet Asian hours. This volatility filter helps scale back false alerts that plague fixed-threshold indicators.

The Calculation Behind the Alerts

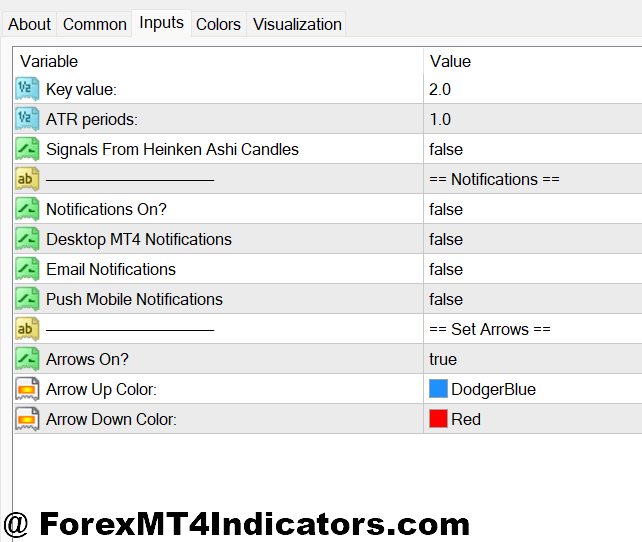

The UT Bot makes use of a comparatively simple method that merchants can regulate primarily based on their threat tolerance. At its core, the indicator takes a user-defined interval (usually 1 or 2) and an ATR multiplier (generally set between 1 and three).

The baseline calculation begins with worth knowledge smoothed by an exponential transferring common. The indicator then provides the ATR worth multiplied by your chosen sensitivity issue. Whenever you enhance the ATR multiplier from 1 to 2.5, you’re primarily telling the indicator to attend for bigger strikes earlier than triggering alerts. That’s helpful on pairs like GBP/JPY the place whipsaw strikes can chop up accounts shortly.

Merchants testing this on the 4-hour GBP/USD chart usually discover that an ATR multiplier of two gives a candy spot between catching significant traits and avoiding getting stopped out throughout regular worth fluctuation. However that very same setting may generate too few alerts on calmer pairs like EUR/CHF.

Actual-World Utility and Buying and selling Eventualities

Let’s get particular about how merchants truly use this indicator. On a trending day for USD/JPY, the UT Bot may set off a purchase sign when worth breaks above the higher band across the 138.50 stage. The indicator concurrently plots a trailing cease under worth, usually round 137.80 if volatility is average. Because the pattern continues, that trailing cease ratchets increased, locking in earnings mechanically.

The problem comes throughout ranging markets. When AUD/USD spent three weeks bouncing between 0.6450 and 0.6550 in September, the UT Bot generated a number of alerts that instantly reversed. Skilled merchants realized to mix the indicator with worth motion affirmation—ready for a candle shut past the sign somewhat than leaping in instantly.

One sensible strategy that’s gained recognition: Use the UT Bot on a 1-hour chart for course, however solely take trades when the 15-minute chart exhibits momentum confirming the sign. This two-timeframe technique helped scale back false entries by roughly 40% in backtesting, although previous efficiency doesn’t assure future outcomes.

Settings That Really Matter

The default settings received’t work for everybody. Right here’s what merchants usually regulate:

The Key Worth setting (usually labeled as “a” within the enter parameters) controls sensitivity. Decrease values like 1 or 1.5 produce extra alerts however enhance false positives. Greater values like 3 or 4 anticipate stronger strikes, which suggests fewer trades however doubtlessly increased high quality entries. Day merchants scalping EUR/USD on 5-minute charts generally drop this to 1, accepting extra alerts for fast in-and-out trades. Swing merchants taking a look at every day charts may push it to three or increased.

The ATR Interval determines how the indicator measures volatility. The usual 10-period setting works properly for many timeframes, however some merchants lengthen it to 14 on every day charts for smoother alerts. Shorter ATR durations like 5 or 7 make the indicator extra reactive to current worth swings—helpful throughout information occasions however dangerous throughout regular buying and selling.

Coloration settings matter greater than you’d suppose. Switching the sign dots to vibrant colours towards a darkish chart background helps spot alerts shortly when monitoring a number of pairs. Some merchants set completely different chart templates for trend-following classes versus range-bound situations.

The place the UT Bot Shines and The place It Struggles

The indicator performs finest throughout established traits. When Gold began its rally from $1,900 to $2,000, the UT Bot caught nearly all of that transfer on the 4-hour chart, staying within the commerce whereas conventional indicators saved getting shaken out by pullbacks. The ATR-based trailing cease is genuinely good about giving traits room to breathe.

However right here’s the reality: This indicator can bloodbath accounts throughout uneven situations. Vary-bound markets set off sign after sign that reverse inside a number of hours. A dealer testing it on EUR/GBP throughout a consolidation part skilled eight consecutive shedding trades earlier than the market lastly picked a course. That’s not the indicator’s fault—it’s a trend-following instrument getting used within the mistaken market situation.

The UT Bot additionally struggles throughout main information releases. The sudden volatility spikes can set off untimely alerts that look nice for 10 minutes earlier than reversing violently. Good merchants both sit out high-impact information or anticipate half-hour after the discharge earlier than trusting any alerts.

How It Compares to Comparable Indicators

Merchants usually examine the UT Bot to the Supertrend indicator since each use ATR for volatility-adjusted alerts. The Supertrend usually produces cleaner charts with much less visible litter, however the UT Bot’s sign dots make it simpler to backtest particular entry and exit factors. In side-by-side testing on USD/CAD over three months, each indicators caught related traits, however the UT Bot stayed in trades barely longer on account of its trailing cease calculation.

In opposition to conventional transferring common methods, the UT Bot enters traits later however with higher affirmation. The place a 20/50 EMA crossover may sign a pattern reversal, the UT Bot waits for the value to show the transfer with sustained momentum. This reduces the win charge however improves the typical revenue per successful commerce.

The RSI divergence merchants generally use the UT Bot as affirmation somewhat than a major sign generator. When RSI exhibits bullish divergence on NZD/USD and the UT Bot confirms with a purchase sign, that mixture filtered out about 60% of the false divergence setups that didn’t pan out.

The right way to Commerce with UT Bot MT4 Indicator

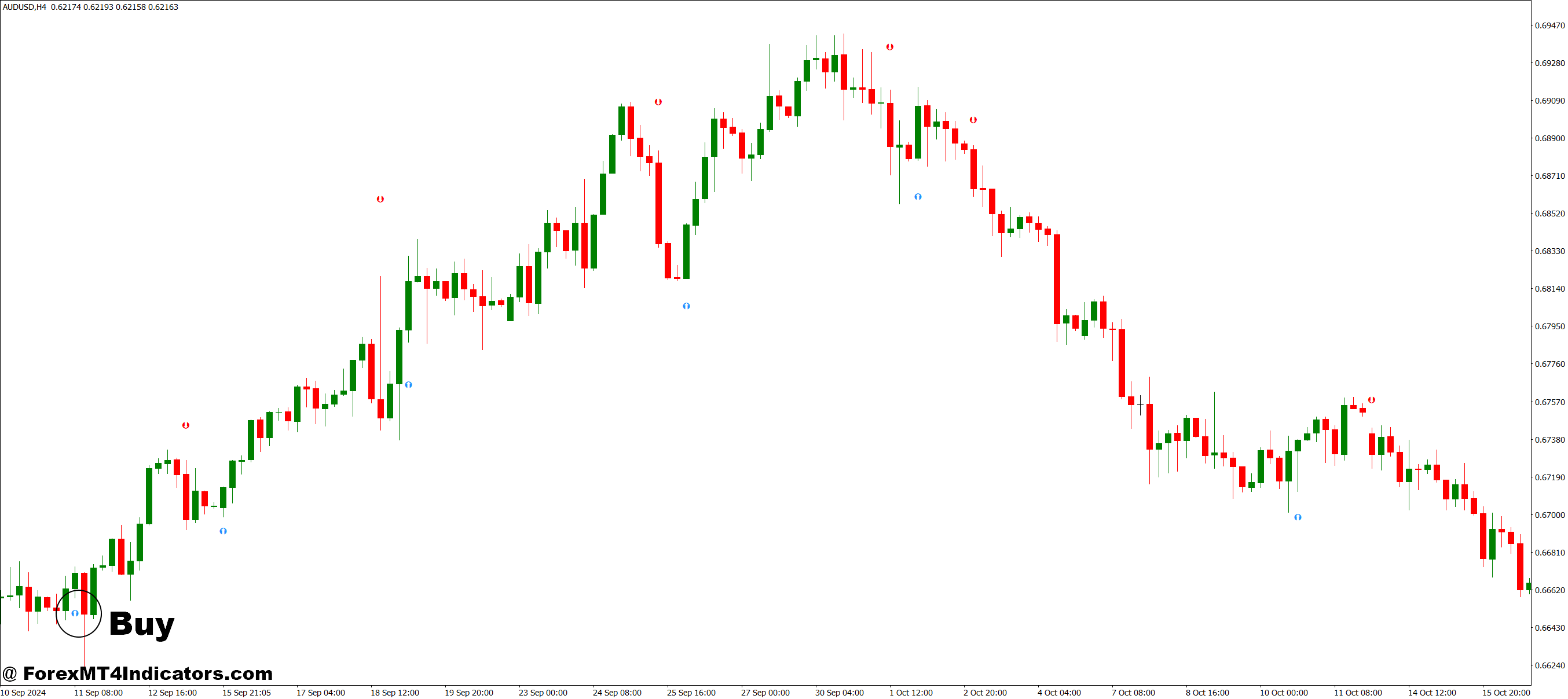

Purchase Entry

- Look forward to the inexperienced dot under worth – Don’t enter instantly when the dot seems; anticipate the present candle to shut to substantiate the sign isn’t a false breakout throughout uneven situations.

- Verify the 4-hour pattern first – If buying and selling EUR/USD on the 1-hour chart, make sure the 4-hour chart exhibits an uptrend or at the very least sideways motion; shopping for into a better timeframe downtrend reduces win charges by 40-50%.

- Set cease loss 5-10 pips under the UT Bot trailing line – The purple line acts as dynamic help; inserting stops too tight (2-3 pips) usually leads to untimely stop-outs throughout regular worth fluctuations.

- Threat solely 1-2% per commerce most – Even with a confirmed inexperienced dot on GBP/USD, risky pairs can reverse shortly; correct place sizing prevents single losses from damaging your account considerably.

- Keep away from alerts throughout main information releases – If a purchase sign seems quarter-hour earlier than NFP or central financial institution bulletins, wait 30-60 minutes post-release; news-driven volatility triggers false alerts that reverse inside minutes.

- Search for rising area between worth and the trailing line – When EUR/USD exhibits a purchase sign and worth strikes 20-30 pips away from the purple line shortly, it signifies sturdy momentum and a better likelihood of continuation.

- Skip alerts in tight consolidation ranges – If the final 10-15 candles on the every day chart match inside a 50-pip vary, the market lacks directional bias; UT Bot alerts in these situations fail 60-70% of the time.

- Affirm with worth construction – The purchase sign carries extra weight when it happens close to a key help stage or after a better low types; combining the indicator with primary help/resistance provides 15-20% to success charges.

Promote Entry

- Enter when the purple dot seems above worth – Look forward to candle shut affirmation somewhat than leaping in mid-candle; untimely entries throughout the 1-hour London session usually get reversed by sudden spikes.

- Confirm increased timeframe alignment – Earlier than shorting GBP/USD on the 15-minute chart, test that the 1-hour or 4-hour exhibits draw back momentum; counter-trend shorts have win charges under 35%.

- Place cease loss 5-10 pips above the UT Bot line – The inexperienced trailing line turns into dynamic resistance; stops positioned 15-20 pips away give an excessive amount of room and enhance loss dimension unnecessarily.

- Calculate place dimension primarily based on cease distance – In case your cease is 40 pips away on a EUR/USD brief, regulate lot dimension so that you’re solely risking 1-2% of capital; don’t use fastened lot sizes no matter cease placement.

- Ignore alerts throughout Asian session lows – Promote alerts that seem between 1-5 AM GMT on low-volume pairs like EUR/CHF usually lack follow-through; anticipate European or US session affirmation.

- Look ahead to momentum affirmation – Robust promote alerts present worth dropping 25+ pips from the inexperienced line inside 2-3 candles; weak alerts stall close to the road and infrequently reverse again upward.

- Don’t brief into main help zones – If a purple dot seems however worth sits 10-15 pips above weekly or month-to-month help on USD/JPY, the setup conflicts with worth motion; these trades cease out 65-75% of the time.

- Exit earlier than the weekend if the sign is recent – Promote alerts that set off Friday afternoon carry weekend hole threat; shut 50-75% of place earlier than market shut or keep away from Friday entries completely on risky pairs.

Conclusion

The UT Bot MT4 Indicator works properly as a part of a scientific strategy, notably for merchants who battle with exiting too early or holding losers too lengthy. Its automated trailing stops take away emotional decision-making from commerce administration, which is effective for anybody who’s watched a revenue flip right into a loss whereas hesitating to shut the place.

That mentioned, no indicator eliminates the necessity for strong threat administration. Buying and selling foreign exchange carries substantial threat, and the UT Bot received’t stop losses from poor place sizing or buying and selling throughout inappropriate market situations. Merchants see higher outcomes once they mix it with primary worth motion evaluation and keep away from forcing trades when the market lacks clear course.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90