After a powerful transfer within the week earlier than this one, the Nifty spent the final 5 classes largely consolidating in a really outlined vary. The markets traded with a weak underlying bias and misplaced floor steadily over the previous few days; nevertheless, the drawdown remained fairly measured and throughout the anticipated vary. Because the markets consolidated, the buying and selling vary received narrower. The Nifty moved in a 337-point vary throughout the week. Whereas the Index shaped a near-similar excessive, it marked a a lot larger low. The volatility additionally retraced; the India VIX got here off by 0.59% to 12.31. Whereas displaying no intention to development larger, the headline Index closed with a internet weekly lack of 176.80 factors (-0.69%).

The Nifty has created an intermediate resistance zone between 25600 and 25650. A trending transfer on the upside would occur provided that the Nifty is ready to take out this zone on the upside convincingly. Till that occurs, we are going to see the Nifty persevering with to consolidate with 25100 appearing as help. That is the prior resistance degree, which is predicted to behave as help in case of any corrective retracement. As long as the Nifty is contained in the 25000-25650 zone, it’s unlikely to develop any sustainable directional bias on both facet.

Friday was a buying and selling vacation within the US. Due to this, we won’t have any in a single day cues to cope with on Monday. The Indian markets might even see a secure and quiet begin. The degrees of 25650 and 25800 are prone to act as possible resistance factors. Help ranges are available at 25250 and 25000.

The weekly MACD is bullish and stays above its sign line. The weekly RSI is 62.40; it stays impartial and doesn’t present any divergence towards the worth. No main formation was observed on the candles.

The sample evaluation of the weekly chart reveals that after breaking above the rising trendline resistance and transferring previous the 25000-25150 zone, the Nifty consolidated after trending larger for 4 consecutive days. Over the previous week, it gave up a portion of its features and consolidated at larger ranges. Within the course of, it has dragged its help degree larger to 25000. So long as the Index stays above this level, the breakout and the resumption of the upmove noticed within the previous week stay legitimate and intact.

Total, it’s anticipated that the Nifty will stay throughout the 25000-25650 vary over the approaching week. The markets are unlikely to develop any directional bias except they transfer previous the 25650 degree or violate the 25000 degree. Sector rotation throughout the market could be very a lot seen; it could be crucial to effectively rotate sectors and keep invested in people who present improved relative power and a promising technical setup. We’re prone to see improved efficiency within the Auto, Vitality, IT, and broader markets, amongst different sectors. It’s also strongly beneficial to guard earnings right here, the place the shares have run up arduous. Any aggressive shorting must be averted so long as the Nifty stays above the 25000 degree. A cautiously constructive strategy is suggested for the approaching week.

Sector Evaluation for the approaching week

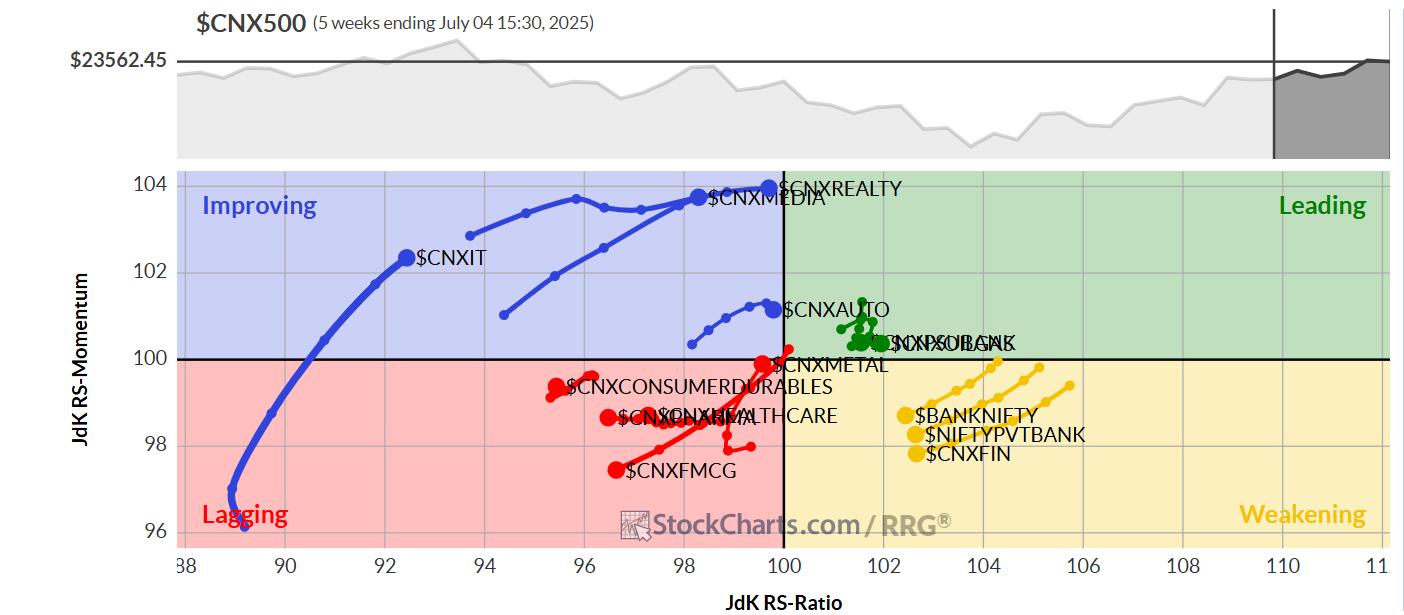

In our take a look at Relative Rotation Graphs®, we in contrast numerous sectors towards the CNX500 (NIFTY 500 Index), representing over 95% of the free-float market cap of all of the listed shares.

Relative Rotation Graphs (RRG) present that the Nifty PSU Financial institution Index and the Midcap 100 Index are the one two teams which might be contained in the main quadrant. They’re prone to outperform the broader markets comparatively.

The Nifty Infrastructure Index is experiencing an enchancment in its relative momentum whereas it stays throughout the weakening quadrant. Moreover, the PSE, Nifty Financial institution, and the Monetary Companies Index are situated throughout the weakening quadrant. Whereas particular person stock-specific efficiency might not be dominated out, the general relative efficiency might take a backseat.

The Commodities Index and the Companies Sector Index have rolled into the lagging quadrant. The Consumption, Pharma, and the FMCG Indices additionally proceed to languish contained in the lagging quadrant. The Steel Index is displaying a pointy enchancment in its relative momentum towards the broader markets, whereas staying throughout the lagging quadrant.

The IT, Vitality, Media, Realty, and Auto Indices are contained in the Enhancing quadrant. They proceed to rotate firmly whereas enhancing their relative efficiency towards the broader Nifty 500 Index.

Vital Observe: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly E-newsletter, at present in its 18th 12 months of publication.