After consolidating for 2 weeks, the Nifty lastly seemed to be flexing its muscular tissues for a possible transfer larger. Over the previous 5 periods, the Nifty traded with an underlying constructive bias and ended close to the week’s excessive level whereas additionally trying to maneuver previous an important sample resistance. The previous week noticed the Index oscillating within the 527-point vary, which was according to the earlier weeks. The volatility additionally cooled off; the India VIX got here off by 9% to 14.63 on a weekly foundation. Whereas staying largely in a variety buying and selling with a constructive bias, the headline Index closed with a web weekly achieve of 252.35 factors (+1.02%).

Over the previous couple of weeks, the Nifty has traded in a well-defined vary created between 24500-25100 ranges. This could imply that the markets would stay devoid of directional bias except they take out 25100 on the upper facet or violate the 24500 degree. Regardless of visibly robust undercurrents, staying reactive to the markets reasonably than getting predictive can be prudent. Though there are heightened prospects of the Nifty taking out the 25100 degree, we should think about it as resistance till it’s taken out convincingly.

The approaching week is ready to see a steady begin; the degrees of 25150 and 25400 are prone to act as resistance factors. The helps are available at 24800 and 24500. The buying and selling vary is anticipated to get wider than traditional.

The weekly RSI is 60.94; it continues to stay impartial and doesn’t present any divergence in opposition to the worth. The weekly MACD is bullish and stays above its sign line. A powerful white candle emerged; this exhibits the bullish development that the markets had in the course of the week.

A sample evaluation of the weekly chart exhibits that the Nifty resisted the upward rising trendline that started from the low of 21350 and joined the following rising bottoms. The Nifty has tried to penetrate it after resisting it for a few weeks.

Total, the approaching week might even see the markets buying and selling with an underlying bullish bias. Nonetheless, for this to culminate in trending transfer, the Index should take out the 25100-25150 zone convincingly on the upside. Till this occurs, the markets might proceed to consolidate in a broad buying and selling vary. Except there’s a robust transfer that surpasses the 25100-25150 zone, one should think about this degree as a direct resistance level. Some pockets have run up too onerous over the previous few days; one should additionally deal with defending positive aspects at present ranges reasonably than chasing the up strikes. Contemporary purchases should be stored restricted in shares with robust technical setups and the presence of relative power. A cautiously constructive method is suggested for the approaching week.

Sector Evaluation for the approaching week

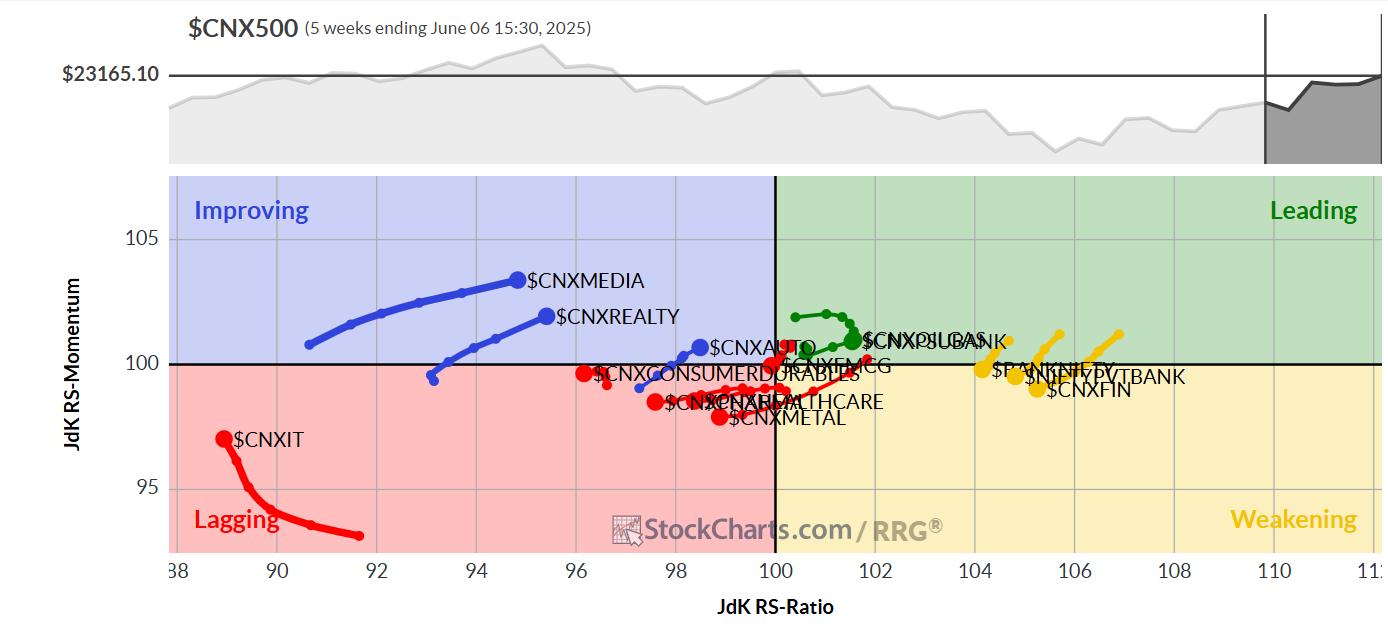

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to the CNX500 (NIFTY 500 Index), representing over 95% of the free-float market cap of all of the listed shares.

Relative Rotation Graphs (RRG) present that the Nifty PSU Financial institution Index continues to construct on its relative momentum whereas staying contained in the main quadrant. It could proceed outperforming the markets comparatively. The Infrastructure, Consumption, and PSE Index are additionally contained in the main quadrant however are seen giving up on their relative momentum.

The Nifty Financial institution Index has rolled contained in the weakening quadrant. The Nifty Providers Sector, Monetary Providers, and Commodity Indice are additionally contained in the weakening quadrant. Particular person efficiency of elements from these teams could also be seen, however total relative efficiency might decelerate over the approaching weeks.

The Nifty FMCG Index has rolled contained in the lagging quadrant. The Nifty Steel and Pharma Indice are languishing on this quadrant. The Nifty IT index can be contained in the lagging quadrant however is seen in a powerful bottoming-out course of whereas enhancing its relative momentum.

The Nifty Power, Media, Realty, and Auto Indices are contained in the enhancing quadrant and should proceed enhancing their relative efficiency in opposition to the broader markets.

Necessary Observe: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly Publication, presently in its 18th 12 months of publication.