KEY

TAKEAWAYS

- Greenback Tree is recovering, however nearing resistance.

- CrowdStrike inventory is at an important pivot forward of earnings.

- Broadcom inventory may very well be prepared for a breakout, however wants a catalyst.

Earnings season could also be winding down, however a couple of standout names might nonetheless make headlines this week. When you’re searching for potential strikes, control these three shares — Greenback Tree, Inc. (DLTR), CrowdStrike Holdings, Inc. (CRWD), and Broadcom, Inc. (AVGO).

Earnings season could also be winding down, however a couple of standout names might nonetheless make headlines this week. When you’re searching for potential strikes, control these three shares — Greenback Tree, Inc. (DLTR), CrowdStrike Holdings, Inc. (CRWD), and Broadcom, Inc. (AVGO).

Every of those names is at a reasonably attention-grabbing inflection level proper now. It is likely to be value ready to see how issues play out earlier than making any massive bets.

Greenback Tree (DLTR): Quiet Comeback with Room to Run?

Greenback Tree (DLTR) broke out of a long-term downtrend and, as of the final quarter, is again above key shifting averages. Most of the beaten-down low cost chains, similar to 5 Beneath (FIVE) and Greenback Common (DG), have began to reverse main downtrends. This week, we are going to see if earnings momentum can preserve going, as DLTR inventory has rallied 21% year-to-date.

Traders shall be searching for perception into how DLTR is navigating the transition after the $1 billion Household Greenback sale (sure, they paid $8.5 billion in 2015) and the way its core shops are performing within the present financial surroundings. The final two quarters have been comparatively calm, as DLTR stabilized with minor positive aspects of three.1% and 1.9%. That stability comes after a three-quarter shedding streak, with common losses of -13.7%.

From a technical standpoint, DLTR made its massive transfer in mid-April because it broke out of a longer-term impartial vary and a long-term downtrend. The inventory value has eclipsed the 50- and 200-day shifting averages and appears to be again heading in the right direction.

The breakout of the oblong backside offers an upside goal of roughly $98 a share, so there’s room for DLTR to run. That transfer would fill the hole created final September and produce shares right into a stronger resistance space round $100. On the draw back, there could also be a possibility to enter DLTR, as we’ve a possible state of affairs the place previous resistance turns into assist, giving an entry stage round $79.50/$80. That will be danger/reward set-up for individuals who could have missed the preliminary breakout.

General, the inventory nonetheless has room to run, however most of this upside transfer could already be within the inventory, as the value approached an overbought situation with a lot overhead resistance forward.

CrowdStrike (CRWD): Heating Up Earlier than Earnings

CrowdStrike (CRWD) has returned from the ashes after final yr’s Delta Air Strains, Inc. (DAL) pc outage that brought on over 7000 cancelled flights. Because it heads into this week’s earnings, shares are buying and selling slightly below all-time highs.

The cybersecurity firm has seen shares decline over the previous two outcomes, however that hasn’t stopped its continued momentum. The inventory averages a one-day transfer of +/- 8.5%, so anticipate volatility.

Technically, CRWD comes into the week at an intriguing pivot level. After breaking out to new highs, the inventory pulled again to its previous resistance areas from which it broke above. Will previous resistance develop into assist, or are we a possible bull lure?

The relative energy index (RSI) signifies there could also be room to run. Now we have seen some excessive overbought situations up to now, and we’re not there but. A strong beat and information might see extra momentum in what continues to be one of many prime shares inside the cybersecurity sector.

Talking of energy, CRWD is shining on a relative foundation. It is up 36.7% year-to-date, outperforming CIBR, the largest cybersecurity ETF in CIBR, which is up 12.8%. That mentioned, draw back danger may very well be steep given the current run. Stepping in entrance of this inventory forward of outcomes may very well be pricey. On weak spot, look forward to a greater danger/reward entry and search for assist simply round $405.

Broadcom (AVGO): Able to Step Out of Nvidia’s Shadow?

Broadcom (AVGO) is Nvidia’s child brother. It’s within the $1 trillion market cap membership, a prime holding in each the Semiconductor ETF (SMH), the Know-how ETF (XLK), and the Nasdaq 100 (QQQ).

AVGO has grown mightily in NVDA’s shadow for years now. Shares have rallied simply over 500% from their 2022 lows, which pales to the 1250+% rally in Nvidia. Nevertheless, over the previous 52 weeks, AVGO shares have risen 82% in comparison with Nvidia’s 23% acquire.

Now that we have seen how value motion settled out with NVDA, what might this imply for AVGO?

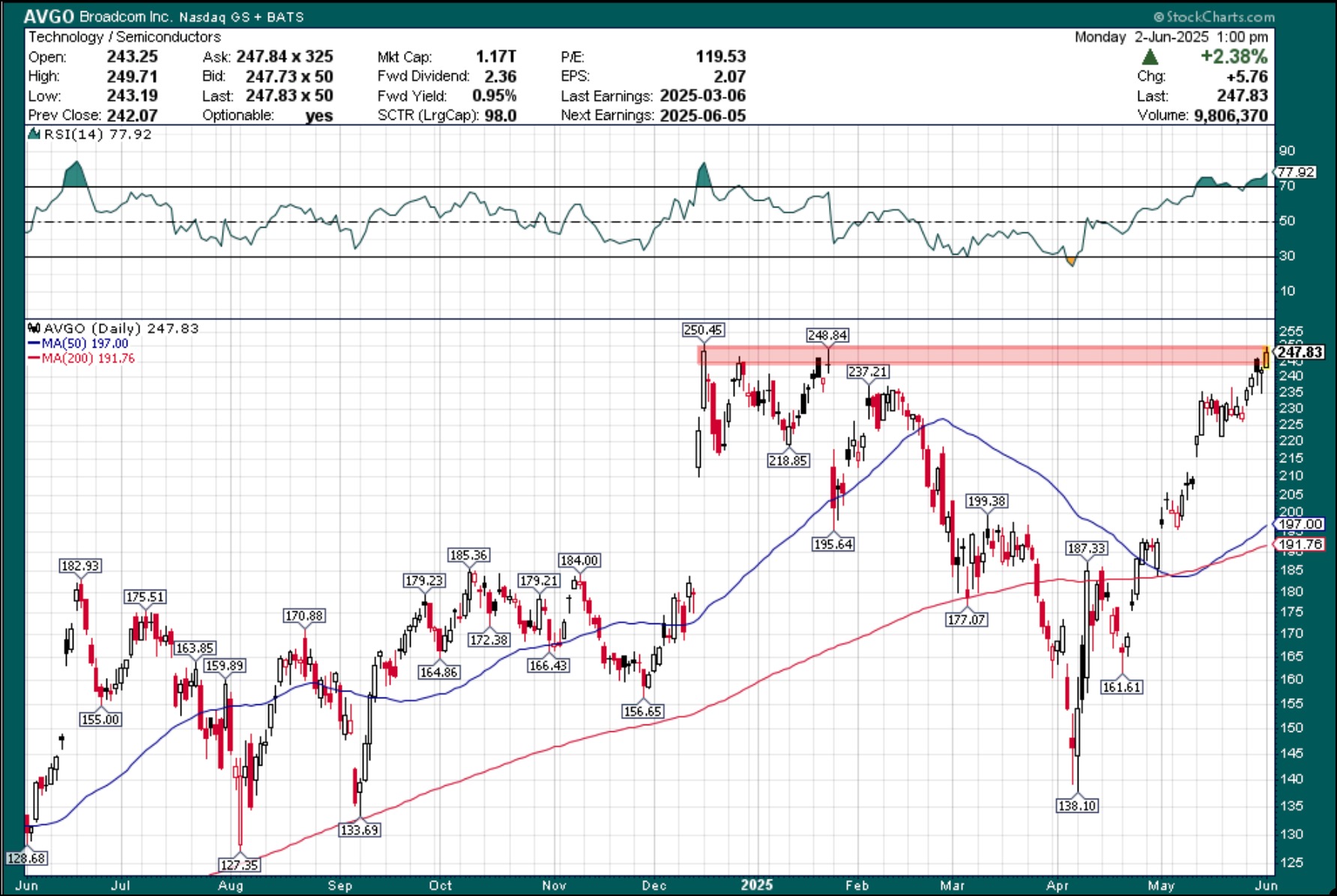

Technically, if AVGO wished to step out of NVDA’s shadows, this might be the possibility to take action and lead the semiconductors increased. Nevertheless, momentum is waning, and we proceed to see massive caps wrestle to make new highs.

The desk is about for a doubtlessly massive breakout. AVGO is at a key resistance space slightly below $250. It could not break by it final week, however might earnings be the catalyst for getting it excessive? Given the overbought situations and hard market surroundings, it ought to be a problem. You might be able to purchase this inventory on a dip and look forward to the remainder of the market to catch up as we search for extra readability on tariff coverage. Search for a pullback to the $220 space so as to add to or enter the identify.

Lengthy-term traders ought to ignore the noise to return. AVGO has suffered by the worst and may escape in due time. It simply will not be this time.

Jay Woods is the Chief World Strategist for Freedom Capital Markets. Previous to becoming a member of Freedom, he was the Chief Market Strategist at DriveWealth Institutional. He additionally served as an Govt Ground Governor on the NYSE, the best elected place on the Change held by solely six NYSE members. Jay spent over 25 years as a Designated Market Maker on the NYSE flooring.

Study Extra