In algorithmic buying and selling, there’s a persistent fantasy:

the upper the Win Price, the safer and extra dependable the buying and selling system.

In actuality, this is without doubt one of the most harmful misconceptions — particularly in relation to long-term investing and portfolio-based buying and selling.

Most programs with an especially excessive Win Price (80–95%) are scalpers or short-term methods with low and even damaging Threat-Reward, which suggests they’re basically working towards mathematical expectation.

Let’s break down why.

1. Mathematical Expectation Is the Core of Any Buying and selling System

Any buying and selling technique might be lowered to a easy formulation:

Anticipated Worth (EV)

EV = (WinRate × Common Revenue) − (LossRate × Common Loss)

The important thing takeaway is straightforward:

Win Price alone is meaningless if Threat-Reward is under 1.

Instance 1 — A “Stunning” Scalping System

End result:

9 × 1 − 1 × 10 = −1

Regardless of a really excessive Win Price, the system is unprofitable.

Instance 2 — A Development-Following System

End result:

Fewer trades, fewer feelings — considerably higher long-term efficiency.

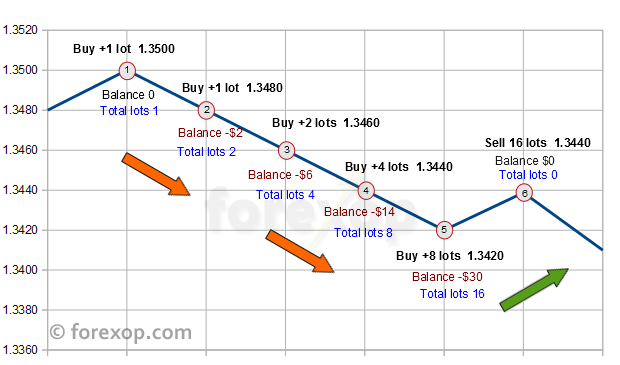

2. Why Excessive Win Price Creates an Phantasm of Stability

Methods with very excessive Win Price often share the identical traits:

Such programs:

-

usually look spectacular over quick intervals

-

fail throughout regime shifts or irregular market situations

-

behave like a time bomb — steady till a single occasion destroys months or years of income

This isn’t investing.

It’s damaging expectancy buying and selling masked by psychological consolation.

3. Why Development and Value Motion Are Structurally Extra Strong

Development-following and Value Motion programs are constructed on a basically totally different logic:

-

losses are accepted rapidly and managed

-

income should not artificially capped

-

the system advantages from value asymmetry and market enlargement phases

Key benefits:

-

constructive mathematical expectancy

-

adaptability to totally different market regimes

-

no dependence on ultra-precise entries

Essential precept:

The market doesn’t owe you a excessive Win Price.

It owes you sufficient motion to cowl your losses and generate asymmetry.

That’s precisely what trend-following programs are designed to seize.

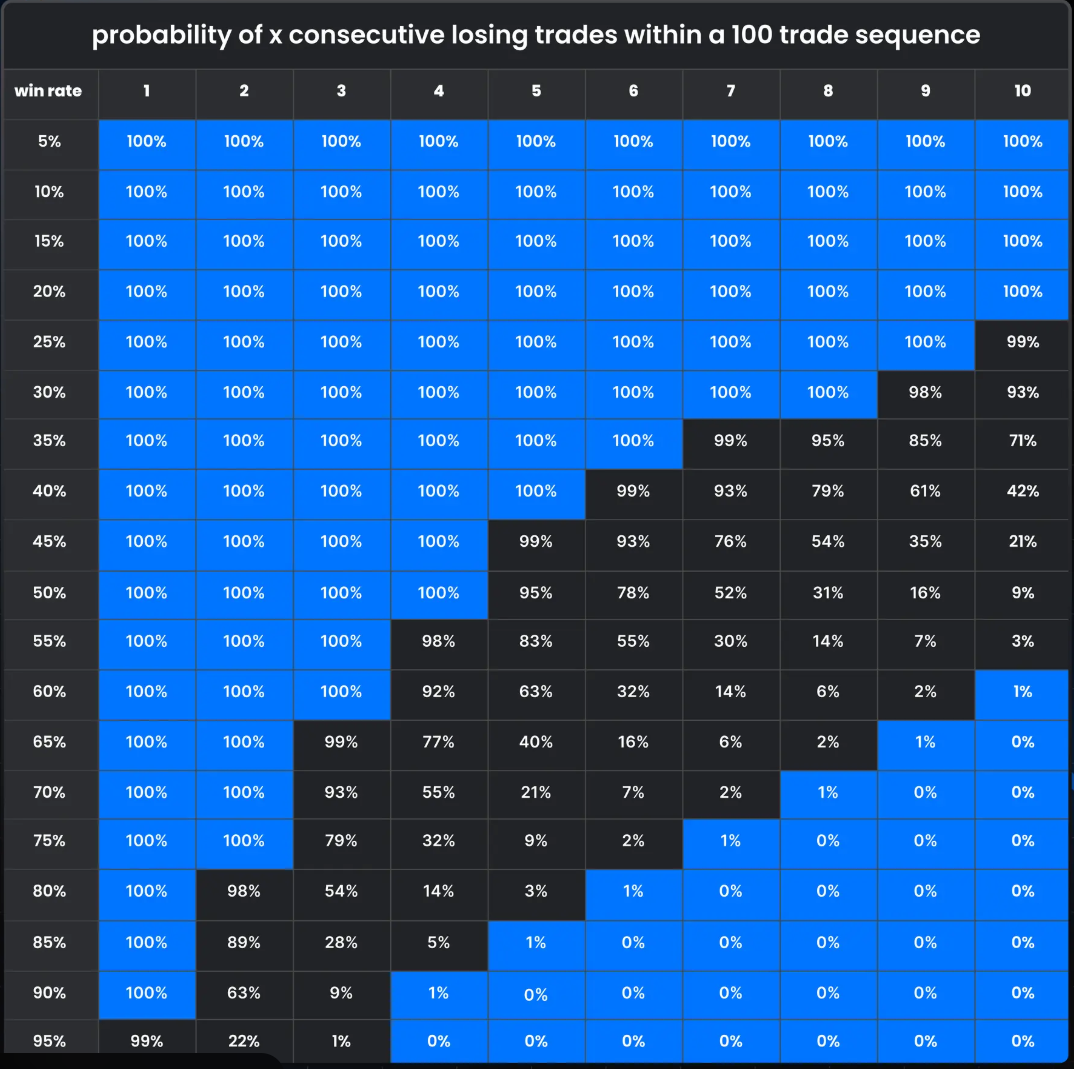

4. Threat-Reward as a High quality Filter

A excessive Threat-Reward ratio mechanically:

-

protects the buying and selling account

-

reduces the impression of dropping streaks

-

improves long-term statistical stability

Structural Comparability

| Parameter | Excessive Win Price Scalper | Development / Value Motion |

|---|---|---|

| Win Price | Very excessive (80–95%) | Reasonable (30–50%) |

| Threat-Reward | < 1 | 2–6 |

| Drawdowns | Uncommon however deep | Managed |

| Market sensitivity | Very excessive | Low |

| Appropriate for investing | ❌ | ✅ |

5. Examples of Excessive Threat-Reward Methods

In follow, this method is applied in programs akin to:

One core logic — a number of asset courses.

Minimal overfitting as a consequence of working with route and construction, not market noise.

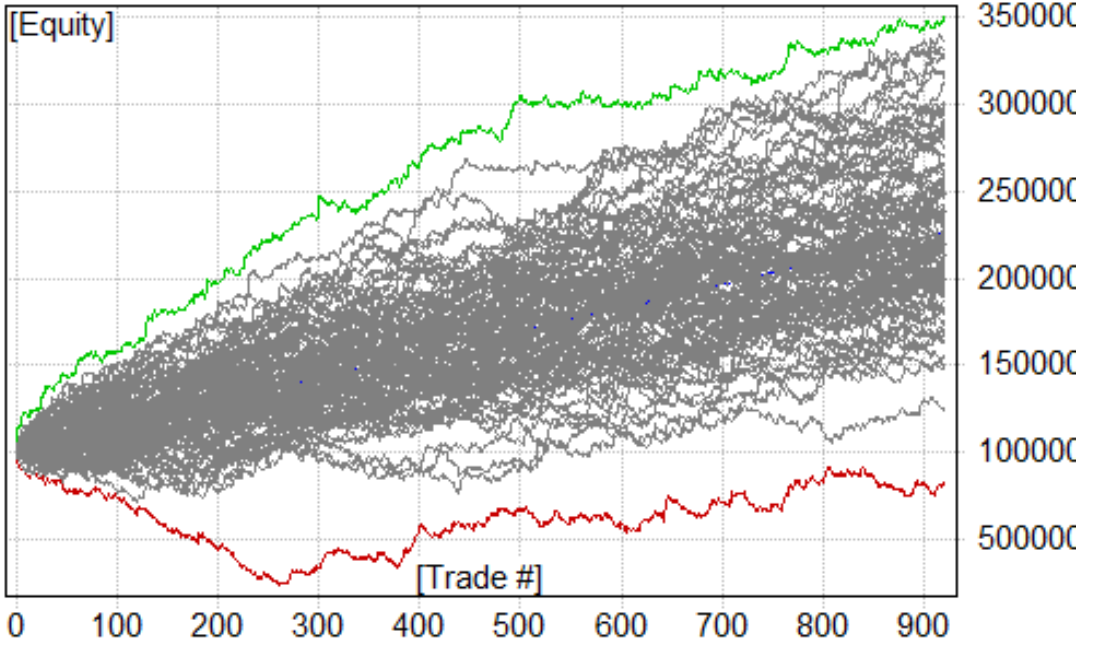

6. Why These Methods Are Higher for Portfolio Buying and selling

Development-following programs with excessive Threat-Reward:

-

mix nicely with one another

-

have low entry correlation

-

produce smoother fairness curves over lengthy horizons

This makes them:

-

appropriate for long-term investing

-

efficient constructing blocks for diversified portfolios

-

relevant on each netting and hedging accounts

Conclusion

In easy phrases:

Excessive Win Price appeals to psychology.

Excessive Threat-Reward satisfies arithmetic.

Markets don’t reward merchants for being proper usually.

They reward merchants who make extra when they’re proper than they lose when they’re fallacious.

That’s the reason trend-following and Value Motion programs stay

one of the sturdy and sustainable approaches for long-term buying and selling and funding.