Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

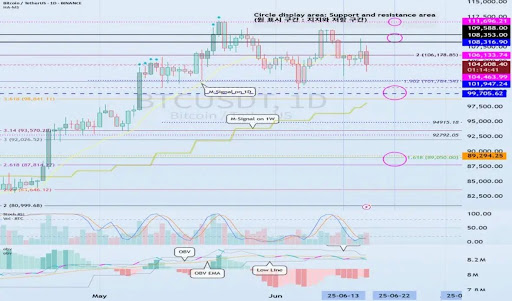

The Bitcoin value motion is at present testing traders’ nerves because it hovers round $100,000. Whereas it flirts with this psychological stage, analysts are highlighting June 22, 2025, as a key date for potential volatility. Backed by each historic volatility patterns and technical indicators, this date is gearing as much as be a vital window for Bitcoin’s subsequent transfer.

Bitcoin Value Braces For Volatility On June 22

Bitcoin is coming into a decisive part because it trades above the $100,000 mark, with technical alerts recognized by TradingView skilled ‘readCrypto’ aligning round a vital timeframe—-June 22. The chart evaluation reveals that June 22 is a vital date, signaling the projected begin of Bitcoin’s subsequent volatility window, with a possible to interrupt out or break down relying on how the flagship cryptocurrency reacts to key help and resistance zones.

Associated Studying

Presently, Bitcoin is buying and selling at $104,731, near a pivotal confluence vary between $104,463 and $106,133—a zone highlighted as a structural mid-point. This space is outlined by the DOM (60) and a Heikin-Ashi excessive level on the value chart, marking the formation of a current higher boundary. Furthermore, the decrease finish of the vary sits round $99,705, which is the HA-Excessive help stage, the place the value has beforehand been examined however not but damaged.

In accordance with the analyst, the June 22 date is essential as a result of it coincides with the confluence of key value ranges with the M-Sign indicator on the weekly chart. This indicator is at present rising and aligning close to the $99,705 HA-high stage. If Bitcoin falls under this stage, it may sign the beginning of a deeper corrective transfer, presumably towards the month-to-month M-Sign line and even the $89,294 area, corresponding with the two.618 Fibonacci.

Conversely, if Bitcoin holds above this stage and breaks out of the $108,316 resistance, momentum may shift again to the upside. The analyst has set higher bullish targets close to $109,598 and $111,696, reflecting the ultimate resistance zone earlier than new highs.

Help Zones And Momentum Point out Tense Standoff

Transferring previous readCrypto’s volatility-driven projection, the TradingView analyst’s Bitcoin chart reveals that the On-Steadiness-Quantity (OBV) oscillator stays under the zero line. This implies that regardless of current features, promoting strain should be dominating the broader market. Nevertheless, the histogram within the chart reveals indicators of waning momentum on the promote facet.

Associated Studying

This divergence aligns with Bitcoin’s weakening Stochastic Relative Power Index (RSI), which signifies momentum could also be cooling. The low OBV readings, mixed with the current bounce from a decrease help vary, additionally underscore an intense standoff throughout the market. If Bitcoin breaks under the Heikin Ashi excessive level at $99,705, a retest of recent lows at $89,294 is greater than doubtless.

Till then, readCrypto’s evaluation reveals that each one eyes are on the $104,000 to $106,000 zone. The world between $99,705 and $108,316 now defines the high-boundary consolidation vary. A confirmed transfer exterior this vary, primarily triggered in the course of the June 21-13 window, may dictate Bitcoin’s subsequent main transfer.

Featured picture from Pixabay, chart from Tradingview.com