The brand new setup was launched two weeks in the past and has shortly turn into a favourite amongst customers.

Nonetheless, some merchants accustomed to greater day by day commerce counts might have seen a big discount in buying and selling exercise below the brand new mode. That’s by design – and for security causes.

To offer higher perception, I’ve ready a comparability of the new safety-focused modes versus the customary configurations, based mostly on detailed statistics.

🔍 Understanding the Modes

Earlier than we take a look at the numbers, right here’s a short overview of the accessible buying and selling modes:

🟢 Common Mode

In Common Mode, all technique indicators are executed. If the calculated lot measurement is smaller than the dealer’s minimal lot measurement, will probably be mechanically raised to that minimal.

⚠️ Warning: This could result in huge implied threat. For instance, if the EA calculates 0.000001 heaps however the dealer minimal is 0.01, you’re buying and selling at 10,000× the supposed publicity!

🔒 Advisable just for accounts with $10,000 or extra!

🟡 Small Account Mode

This mode prompts solely methods that meet the minimal dealer lot measurement based mostly in your chosen threat %.

It additionally provides a dynamic threat gate: new methods will solely be opened if the projected most loss (present + pending methods) stays inside your account’s outlined restrict.

This mode considerably reduces publicity whereas sustaining diversification.

🔵 Prop Agency Mode

This behaves equally to Small Account Mode, however consists of Prop Agency Randomization – a function that provides variability to entry factors, decreasing correlation throughout trades.

🧪 Abstract: Small Accounts Can Now Commerce Safely

With Small Account Mode, now you can use Burning Grid ranging from $500 – with no implied threat.

After all, not all methods might be utilized at that measurement, however that’s the purpose: you commerce what your account can safely help, with a long-term sustainability mindset.

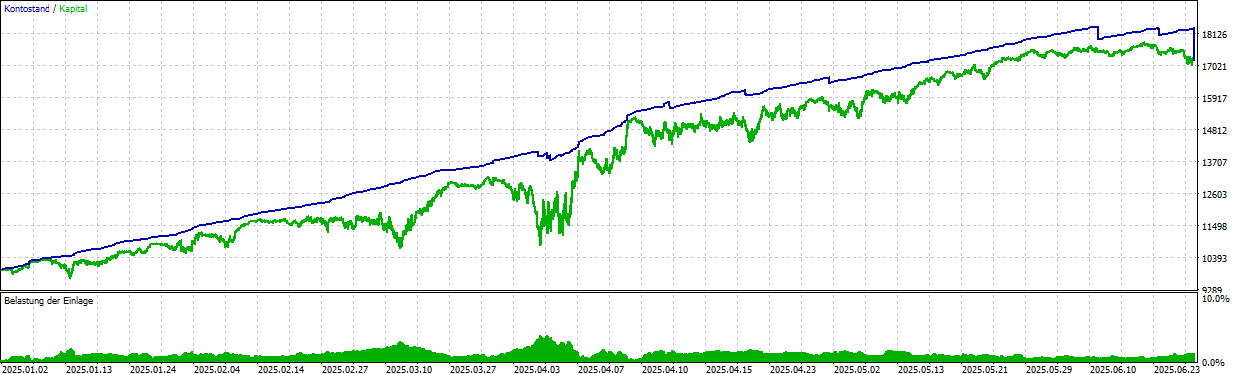

📊 Technique Tester Comparability

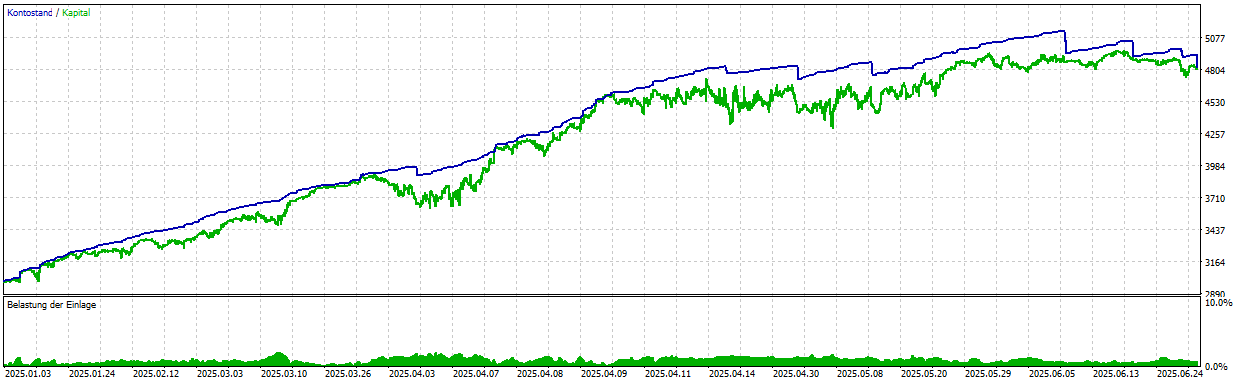

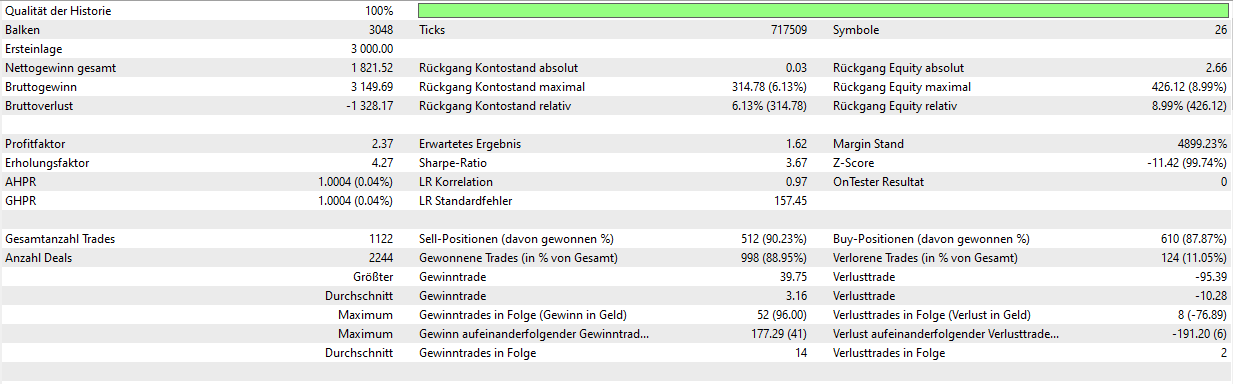

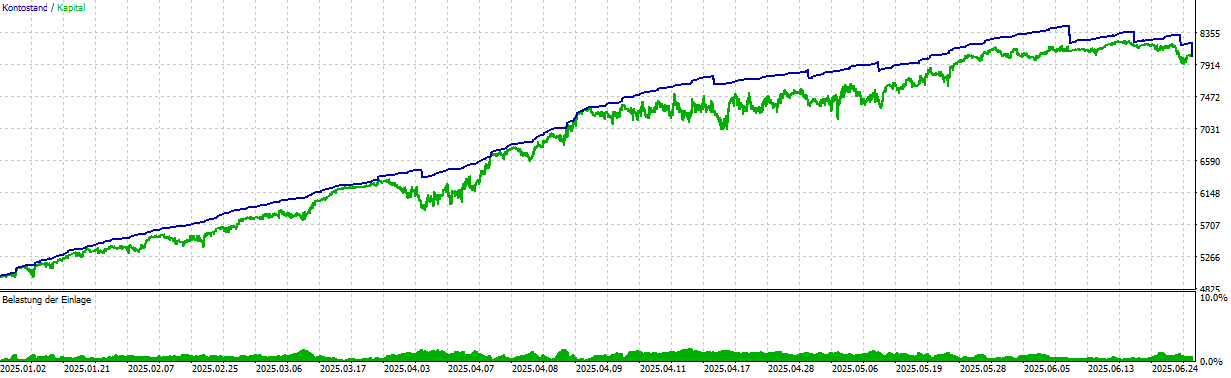

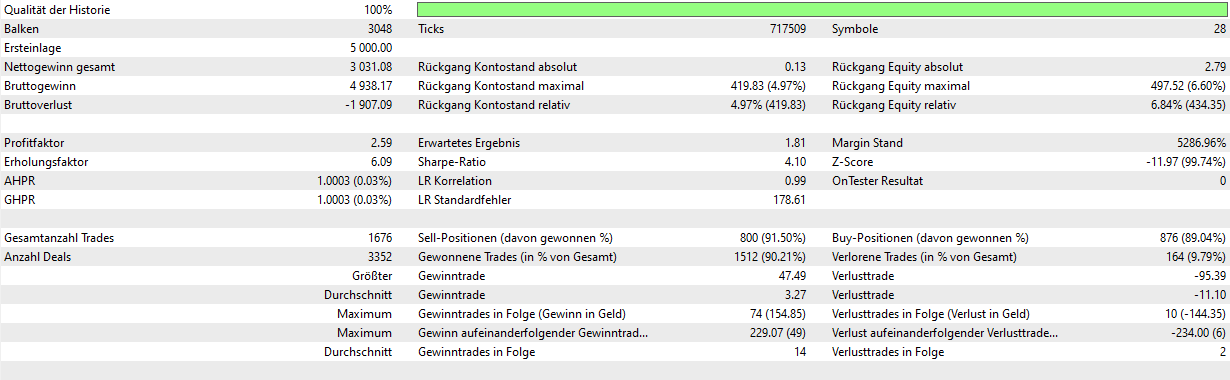

That can assist you perceive how every mode performs, I carried out a check from January 1 to June 30, 2025, evaluating key metrics throughout completely different setups.

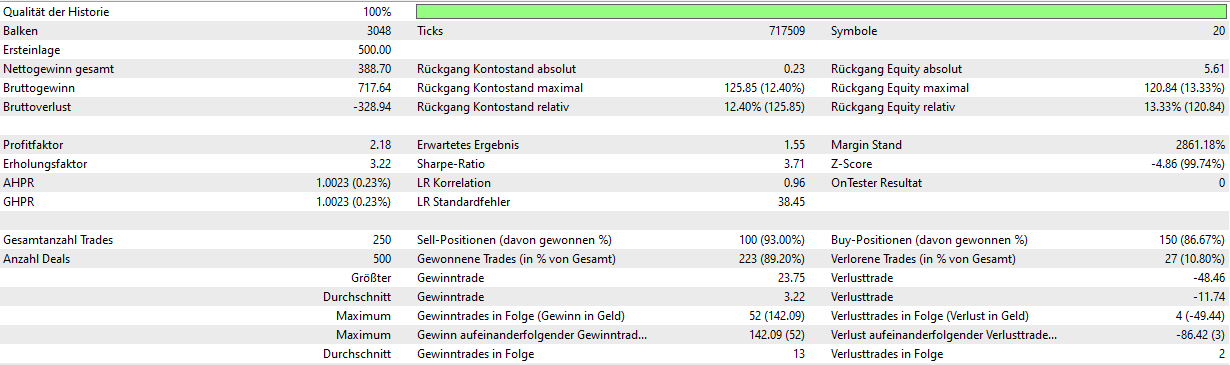

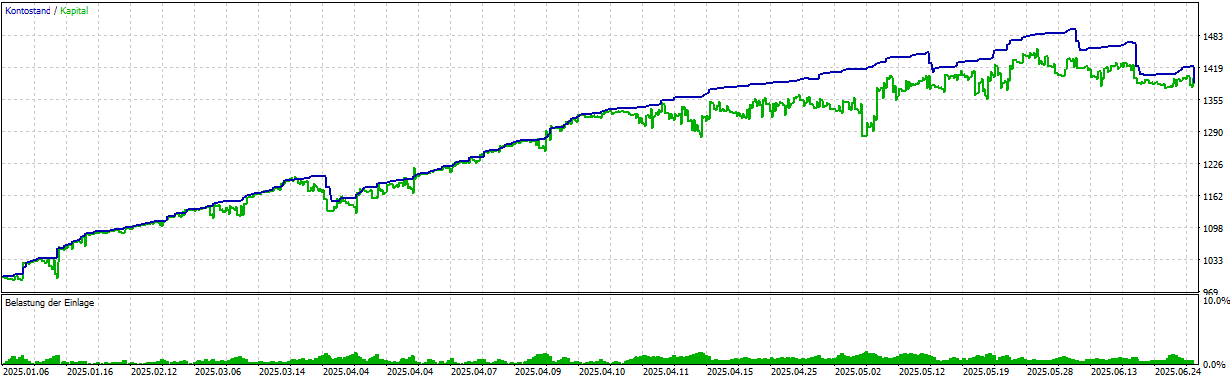

💵 $500 Account

—

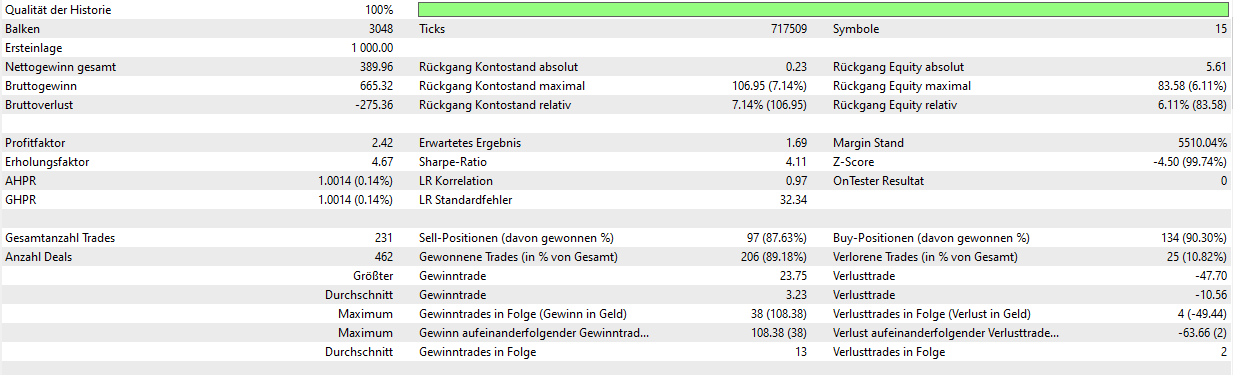

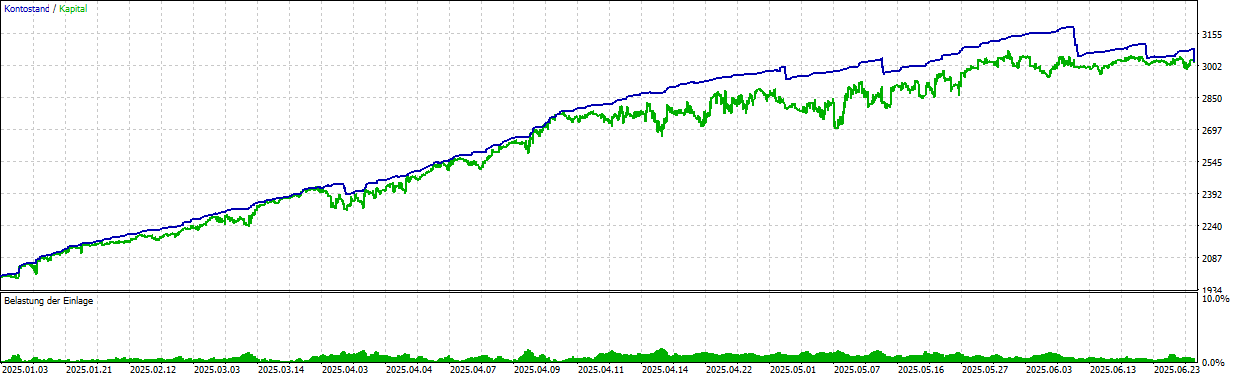

💵 $1,000 Account

-

Trades: 231

-

Methods Run: 24

-

Symbols Traded: 15

💵 $2,000 Account

💵 $3,000 Account

💵 $5,000 Account

-

Trades: 1,676

-

Methods Run: 88

-

Symbols Traded: 28

For comparability, listed here are the commerce statistics ofthe Low, Medium and Excessive Threat Alerts:

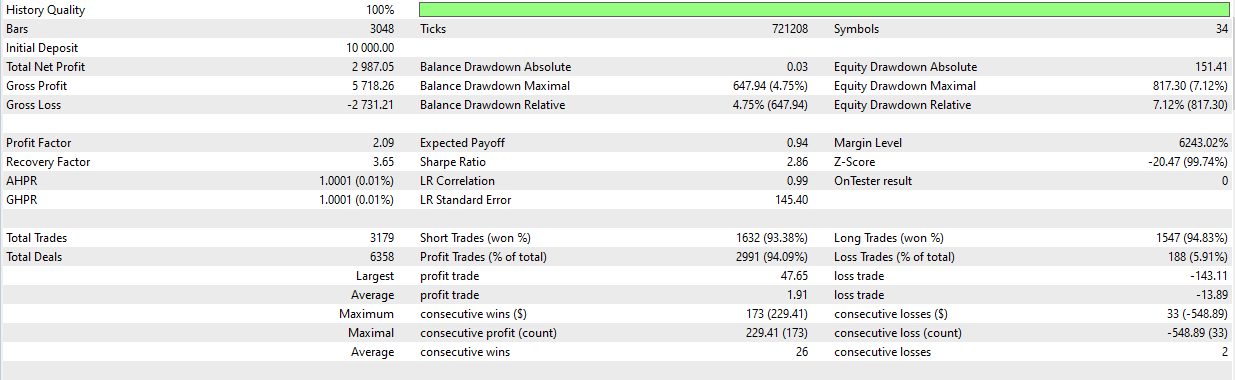

🔹 Low Threat Sign

-

Trades: 3,179

-

Methods Run: 69

-

Symbols: 34

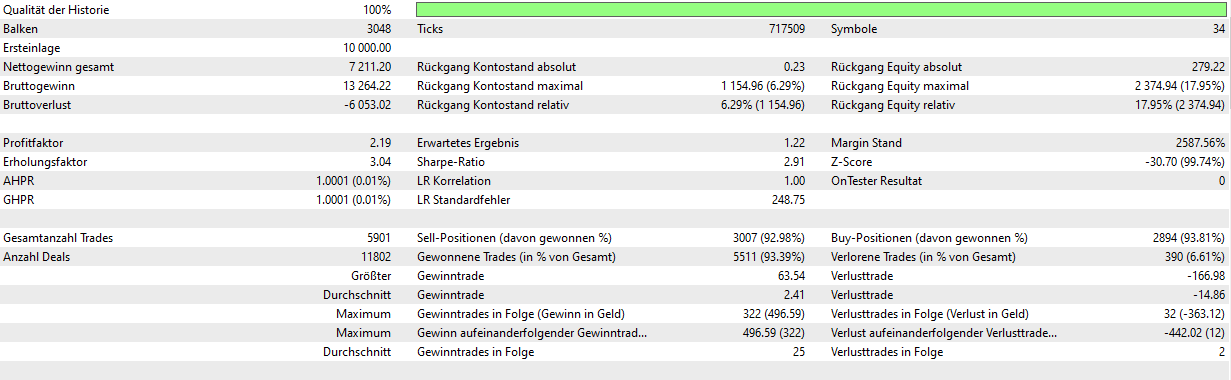

🔸 Medium Threat Sign

-

Trades: 5,901

-

Methods Run: 137

-

Symbols: 34

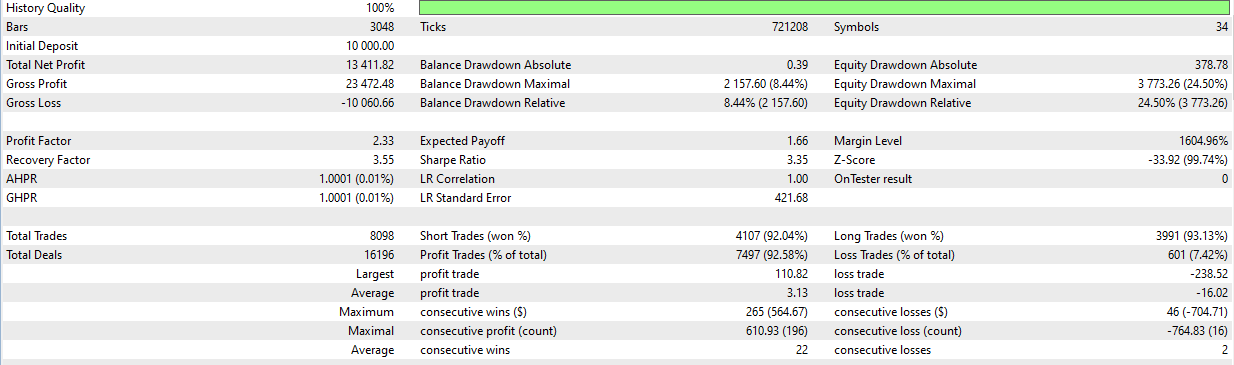

🔺 Excessive Threat Sign

-

Trades: 8,098

-

Methods Run: 205

-

Symbols: 34

📈 Mode Efficiency Abstract Desk

Wenn man das alles in eine Tabelle zusammenfasst ergibt sich folgendes Bild:

| Mode | Trades | Trades per Month | Methods run | traded Symbols | Max DD |

|---|---|---|---|---|---|

| $500 | 250 | 41 | 41 | 20 | 13.33% |

| $1,000 | 231 | 39 | 24 | 15 | 6.11% |

| $2,000 | 564 | 94 | 51 | 21 | 6.59% |

| $3,000 | 1,122 | 187 | 75 | 26 | 8.99% |

| $5,000 | 1,676 | 279 | 88 | 28 | 6.60% |

| Low Threat Sign | 3,179 | 530 | 69 | 34 | 7.12% |

| Medium Threat Sign | 5,901 | 984 | 137 | 34 | 17.95% |

| Excessive Threat Sign | 8,098 | 1,350 | 205 | 34 | 24.50% |

✅ Key Takeaways

Small account modes naturally yield fewer trades in comparison with their high-cap counterparts — however that doesn’t imply they’re inactive.

They merely commerce inside the protected boundaries of what the account can afford, avoiding harmful leverage or unintentional threat publicity.

🔄 Tip: At all times transfer up!

When you cross the edge for a better setup stage (e.g. from $500 → $1,000), swap instantly to the corresponding setfile and cease utilizing the decrease one. This ensures optimum commerce protection.

📌 Necessary word:

Although the $500 account had 41 trades/month, this doesn’t equal two trades per day. Trades can cluster round sure durations, adopted by a number of days with none trades — that’s regular and by design.

🧠 Last Ideas

I hope this publish provides you a greater understanding of how every mode behaves and scales over time. Whether or not you are simply beginning with $500 or managing a funded $10,000+ account, Burning Grid adjusts accordingly — and trades responsibly.

🧯 Burn down the grids – safely!

🔗 Helpful Hyperlinks

🛒 Burning Grid on MQL5 Market – https://www.mql5.com/en/market/product/135273

📖 Learn the Full Weblog Article – https://www.mql5.com/en/blogs/publish/762740

💬 Be a part of the Group & Help Group – https://www.mql5.com/en/messages/0151274c579fdb01